All Topics / General Property / Expert Bust #30 Never sell… really?

When I was a novice property investor, it was drummed into me by the experts of the day, that you buy and never sell because it’s too expensive “trading” property. But I’ve learnt that there are cases where it makes perfect financial sense to sell and invest your dollars elsewhere.

As usual, it all comes down to the numbers: recycle costs vs. opportunity costs. How much will it cost me to sell and buy again are the recycling costs:

- CGT (selling)

- Agent’s commission (selling)

- Legal fees (selling)

- Stamp duty (buying)

- Legal fees (buying)

- Inspections (buying)

How much am I missing out on if I were to own elsewhere are the opportunity costs:

Alternative investment returns minus Current investment returns

If opportunity costs comfortably outweigh recycling costs, then it makes sense to sell and buy the alternative property. But if recycling costs outweigh opportunity costs (or are close enough), then it makes sense to hold. The catch is:

How do you know by how much the alternative property will outperform your current property?

If you have quite literally absolutely no idea, then how do you choose any investment location in the 1st place? Unless you’re rolling dice, you “believe” you have some idea and you believe it enough to allocate half a million dollars somewhere.

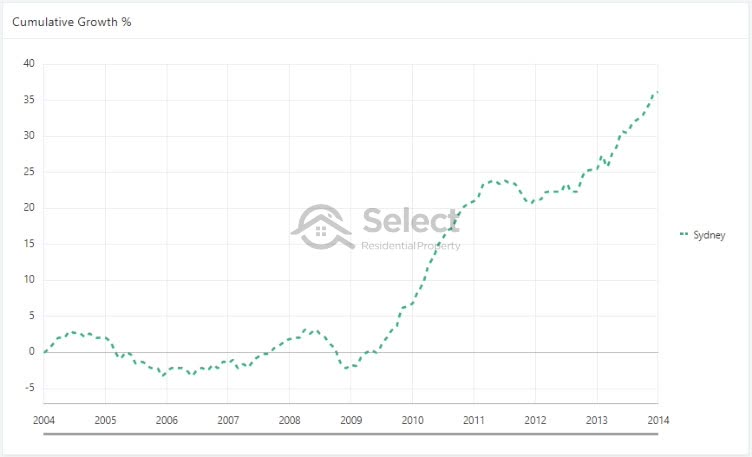

Before going to far with that thought, check out these charts…

Imagine holding a negatively geared property in Sydney for 5 years w/o growth. This period of low growth started just after the end of a period of massive high growth. Here’s Melbourne…

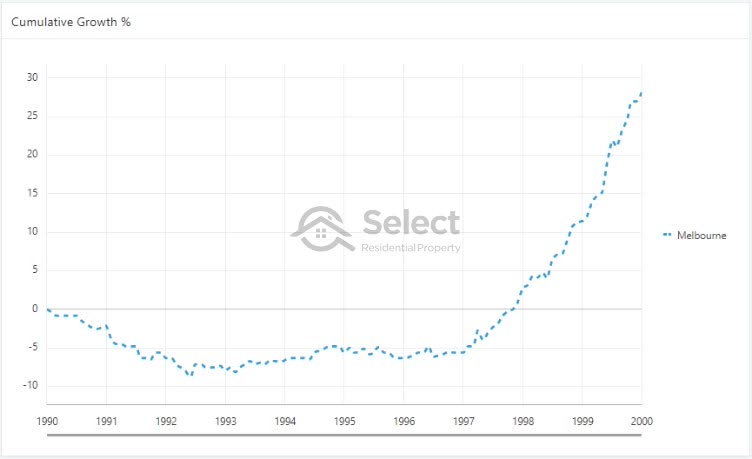

Melbourne had some great growth in the 80s. But the 90s were a long drought.After a really strong growth spurt, comes a growth burst. And it lasts a long time.

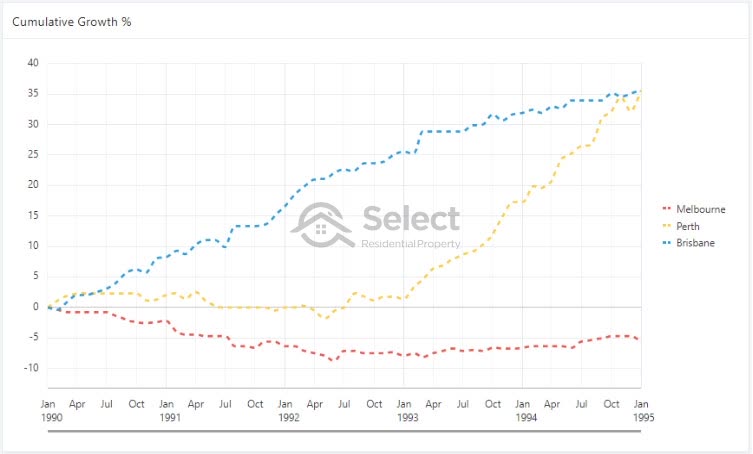

But while one market is floundering, another is flourishing. And the difference between the two can be extreme. That’s the opportunity cost of hanging onto property during those slumps.

I’m not talking about one property delivering 30% growth over the next 4 years while the other delivers only 20%. I’m talking about one delivering 50% while the other is almost flat. Like this…

If there’s more than a 20% difference in forecast performances, then it’s enough to make selling worthwhile.

And it’s not an infrequent or peculiar circumstance either…

There’s definitely a time to sell, even if we don’t know with absolute certainty when it is. Staying open-minded and assessing each case is better than a blanket strategy.

Jeremy Sheppard

https://selectresidentialproperty.com.au/

You must be logged in to reply to this topic. If you don't have an account, you can register here.