All Topics / General Property / Expert Bust #29 Location Location Location

Location is not nearly as important as timing when it comes to achieving above average capital growth.

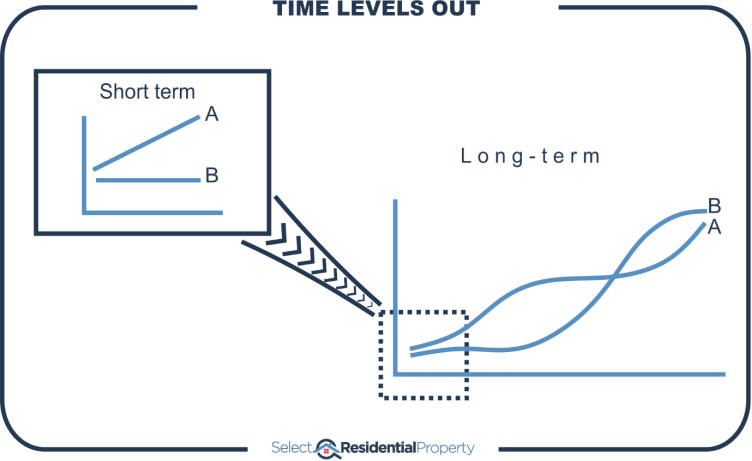

If location really was the 3 most important things to get right about property investing, then over a short time-frame you’d expect to see a superior located property/suburb/city edge ahead of inferior ones. Over a longer time-frame, that edge would start to become more pronounced. Over a long time-frame the clear winner would be obvious.

But that’s not the case. Examination of historical growth patterns comparing thousands of suburbs over decades, shows that long-term there’s a tendency for all properties/suburbs/cities to have the same growth rate.

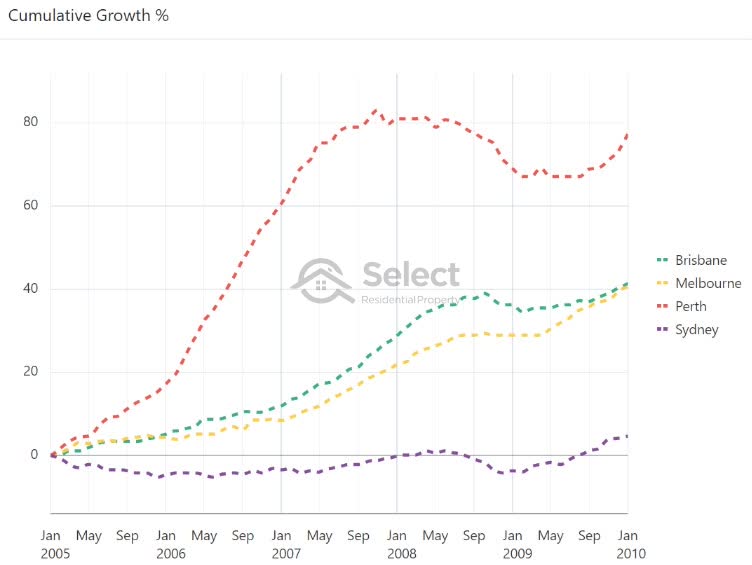

But over the short-term you can see some staggering differences. Here are some examples at the city level…

Across all these 5-year intervals, the average growth difference was 43% between top and bottom cities.

In 4 out of the 5 cases there was at least one city where investors were high-fiving while at the same time in another city, investors were treading water or drowning their sorrows.

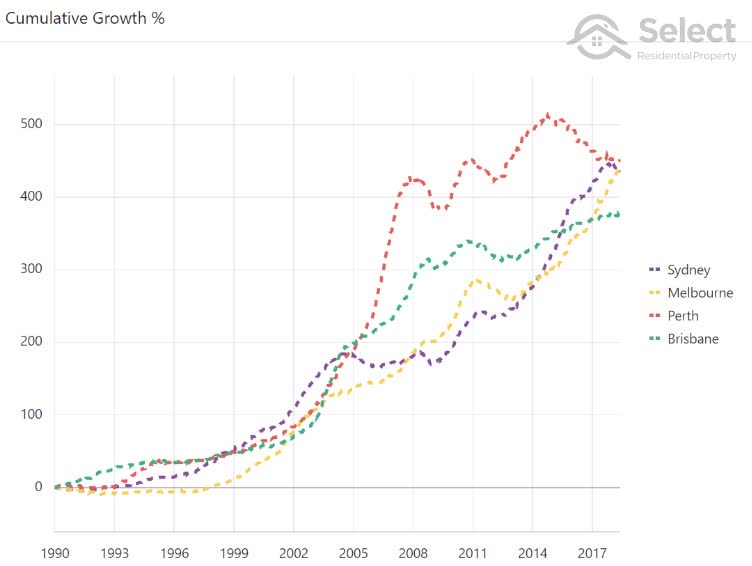

But over the long-term, they end up very similar. Here are the same cities over the last few decades…

Note the number of curve crossovers. This You Tube clip shows it in a cute way…

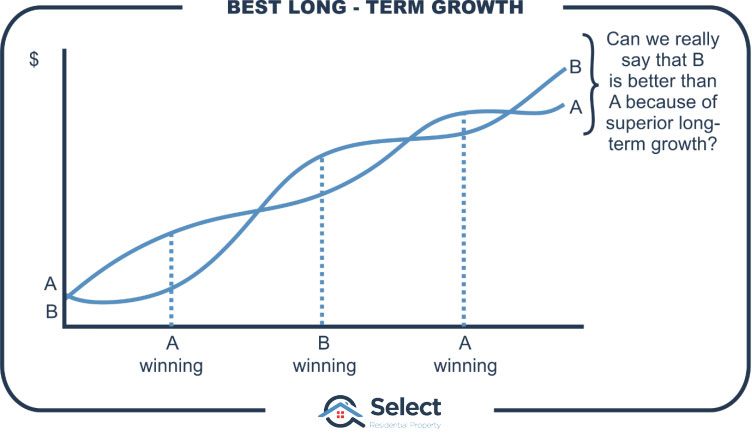

A typical comparison of 2 markets over the long-term looks like this…

When you set the start and finish lines has more influence on determining a winner than location does.

BTW, to understand why there’s this long-term tendency for all markets’ growth rate to balance out, revisit Expert Bust #11 – Apples and Oranges.

Jeremy Sheppard

https://selectresidentialproperty.com.au/

You must be logged in to reply to this topic. If you don't have an account, you can register here.