All Topics / General Property / Expert Bust #24 High Yield

Many experts hype-up yield. But capital growth is the ant’s pants of property investing.

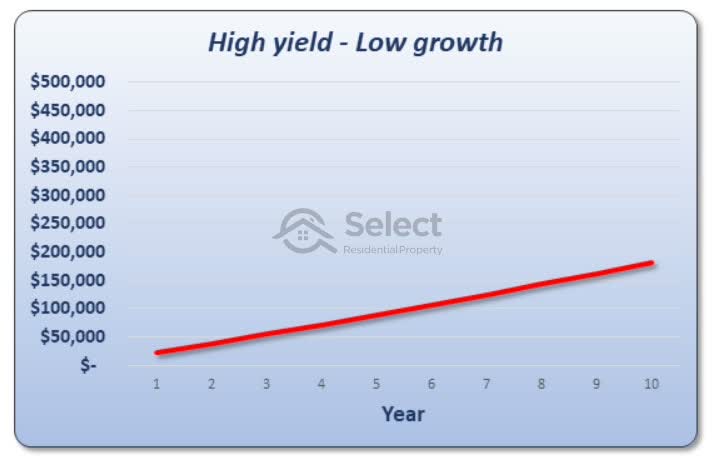

The following chart shows the “total wealth created” for a theoretical $500,000 property over 10 years of constant 7% gross rental yield and 3% constant capital growth per annum.

$180,000 of equity and cash-flow combined.

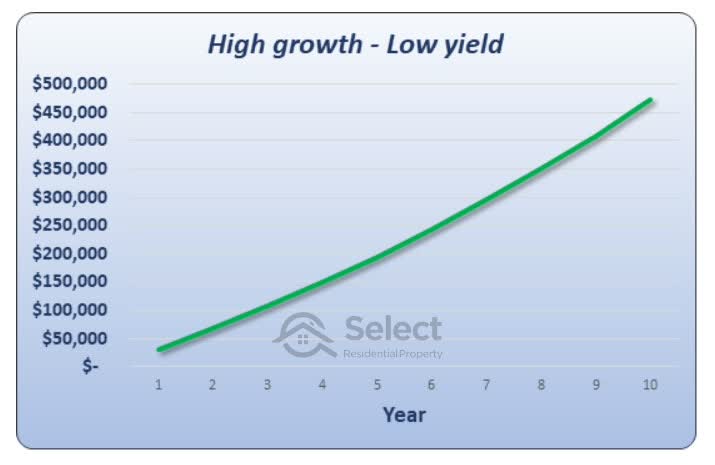

Now swap the yield with the growth: 7% growth and only 3% yield…

$473,000. Staggering difference. There are 2 reasons why:

- More tax is paid for positively geared properties; and more importantly…

- Growth drags up rent too since it’s also influenced by supply & demand

Yield becomes relevant when an investor is on the edge of mortgage serviceability or is nearing retirement.

Jeremy Sheppard

https://selectresidentialproperty.com.au/Both are important.

Without high yield you don’t get serviceability to apply for more borrowing (unless you have an insane amount of cash that you don’t need to borrow)

Without high growth, then you don’t get enough deposit to buy the next one

Instead, it is also important to think which one will break you.

Lack of growth may make things stagnate, but is unlikely to break you.

Lack of cash flow will kill.

Perth is currently experiencing both high growth and high yield returns due to this unique time in history with interest rates at an all-time low, especially fixed rates which can provide a level of comfort to those entering the investment property market.

Cash flow positive and capital growth within a capital city is a rare occurrence indeed.

Colin Rice | CDR Finance

http://cdrfinance.com.au/

Email Me | Phone MePerth Based Mortgage Broker - Investment Property Finance Specialist | E: [email protected]

You must be logged in to reply to this topic. If you don't have an account, you can register here.