All Topics / General Property / Expert Bust #15 – A balanced Vacancy Rate

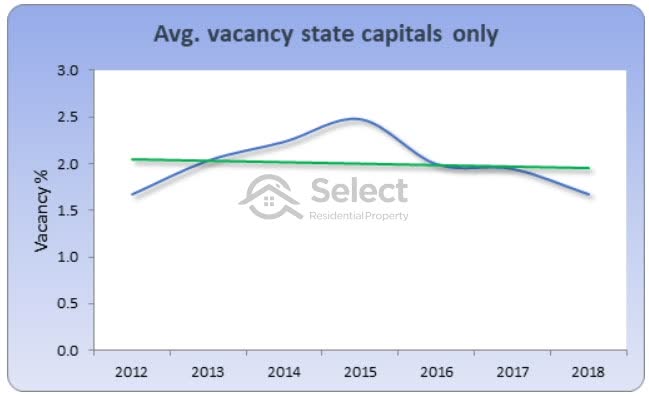

For a long time the belief has been that a vacancy rate of 3% is the sign of a market in balance. But for the last decade the national vacancy rate hasn’t risen above 3%…

2% seems to be a much more accurate round number to quote.

But what if the last 10 years was unusually tight? How do we know the entire country wasn’t out of balance for that period? Another way to estimate balance is when rents start moving in response to vacancies.

How low do vacancies have to be for rents to start climbing? How high do vacancies have to be for rents to start falling? What is the “equilibrium” vacancy rate – the one of a balanced market? Clearly, it would be the vacancy rate in which rents moved in line with inflation, around 2.5%.

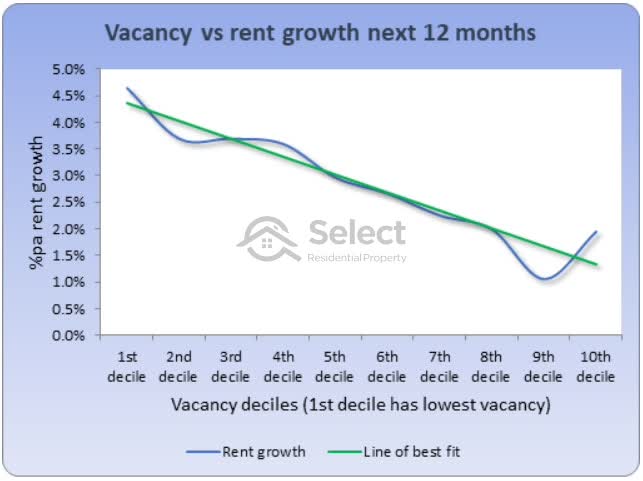

This chart shows the relationship between vacancy and rent growth. The lower the vacancy (left), the higher the rent growth (top).

If we assume an average rate of inflation over the last decade of 2.5%, then we can see that it is the 7th decile that is balanced. The 7th decile had an average vacancy rate of 1.9%.

Looks like 2% vacancy is a good approximation for a market in balance.

Jeremy Sheppard

https://selectresidentialproperty.com.au/

You must be logged in to reply to this topic. If you don't have an account, you can register here.