All Topics / General Property / Expert Bust #13 – Time In the Market

Sooner or later, with the internet of things, we’re gonna have to let go of the old adage about “time in the market”. Timing the market will eventually rule.

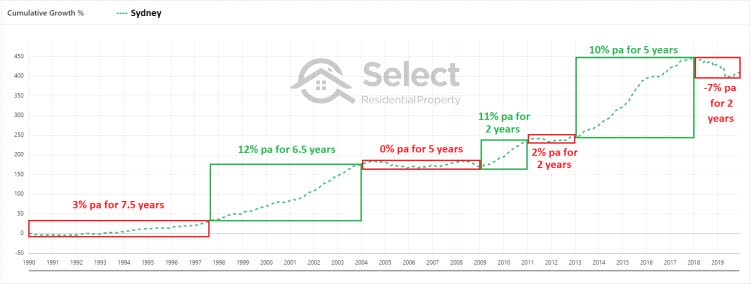

About half the time spent owning an investment property is unprofitable. Here’s a typical example of 30 years of the Sydney median…

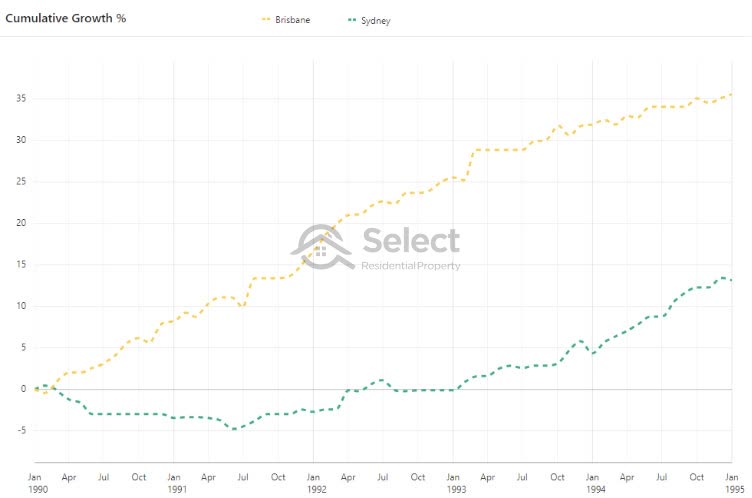

And while Sydney was flat, other cities were booming, like Brisbane…

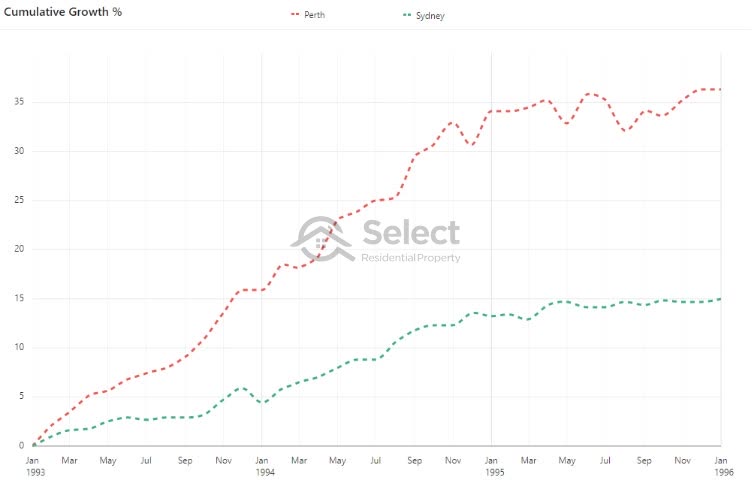

And Perth…

The question is whether the capital growth difference (opportunity cost) is more than the cost to sell and buy again elsewhere (recycling costs).

I created a program to answer that question, to compare holding long-term vs. buying and selling (trading). Then I trialed it with a simple trading algorithm.

I couldn’t use supply and demand metrics like auction clearance rates or selling times since this data wasn’t available 30 years ago. All I used was Long Term Growth (LTG) over the last 10 years.

Buying rules:

1) LTG (10 years) must be between 0% pa and 6% pa preferably 3%.

2) Growth last 9 months of more than 4%Selling Rules:

1) Growth last 12 months less than 6% pa

2) Can’t sell within 3 years

3) Must sell after 5 yearsI started at year January 2000 and picked the best market according to the buying rules. Then each month I applied the selling rules to see if a sell was triggered.

Once a sell was triggered, I calculated all the selling costs like agent’s commission, CGT, etc. I also considered all the buying costs such as stamp duty, legal fees, etc.

The next month I applied the buying rules again with the sale proceeds to buy in the next market. I repeated this until I came to the most recent month.

Then I compared the performance of trading with that of holding the 1st property for the long-term. I also compared the trading performance against the national growth rate and the performance of the best city for that total period of time.

I repeated the whole process again, but picking the 2nd best suburb according to the buying rules. And then the 3rd best and so on until I had trialed the algorithm 20 times over 20 years.

The results:

Trading average 496%

Trading outperformed:

Holding long-term 310%

National average 279%

Sydney, Melbourne & Brisbane average 298%

Syd, Mel & Bris within 10km of CBD average 331%

Best significant urban area (Hobart) 402%

Top SA4 (Mornington Peninsula) 450%This trivial algorithm outperformed pretty much every benchmark.

I repeated this whole process again starting from June 2000 instead of January 2000. The results were even better. I repeated the 20 tests again but this time starting from January 2001 and again from June 2001. The results were all fairly similar.

I tried other algorithms using different metrics than LTG. They showed promise, but not as much as the LTG. Combining them would have been best.

And that’s the thing: we have access to many more metrics now days compared to 30 years ago. And it will only get better in coming years.

Jeremy Sheppard

https://selectresidentialproperty.com.au/Hey Jeremy,

Thanks for making this post. Heck, you might just like staring at stats and spreadsheets more than me!

I agree with your points, especially:

a/ Real estate tends to not perform longer than it performs, but the growth period while performing are impressive.

b/ Transaction costs make it unfeasible to enter and exit the market, so it is extremely difficult to profit from ‘flipping’ in Aus.

c/ The goal should not just be to ‘buy for growth’, but rather ‘strategically buy for growth’ – and hence avoid location boas if possible.

d/ What makes good buying now is not necessarily consistent.

To that end, I came up with a recent study that tracks ‘value’ and ‘timing’ pegging property to trend analysis. It appears to have quite a strong correlation, although I want to do some actual statistical analysis to confirm.

Anyway, happy to have a chat about this if you’d like to meet up. Where are you based?

– Steve

Steve McKnight | PropertyInvesting.com Pty Ltd | CEO

https://www.propertyinvesting.comSuccess comes from doing things differently

Thanks for the kind words Steve. I’d love to chat. I’m Sydney based but in Melbourne till the 19th.

I’ll send you a private message.

Jeremy Sheppard

https://selectresidentialproperty.com.au/

You must be logged in to reply to this topic. If you don't have an account, you can register here.