All Topics / Opinionated! / Beware CBA

Two years ago we borrowed money from CBA to buy IP1. The property was cross collaterised against our PPOR because we didn't know any better at the time.

Shortly thereafter I bought IP2 and went through a Broker. He suggested that whilst the loan for IP2 was being organised it would be a good idea to split the loan on IP1 so that it would become a stand alone loan to make things simpler down the track. ie $60k against our PPOR and another loan for the remaining $220k against the IP. All this was done, I received a letter from CBA stating that the loan was split and securities in place as requested. A few months later we received some money from the sale of a block of land and paid out the $60k portion of the loan.

Today I saw the loans officer at CBA about a possible personal loan and during the conversation he mentioned that IP1 was cross collaterised. I told him that it wasn't, that we'd had the loan split two years ago and the IP loan was stand alone to which he replied that I had it wrong. Was told the only way to remove our PPOR as security was to refinance. Came home, found the letter CBA had sent me at the time they released the security and phoned them.

Long story short – they had never released our PPOR as security against the IP. After looking into it (only after I said I had a letter from them) they came back to me and admitted an "admin error".

Just a word of warning for anyone dealing with CBA. This is the latest of a long list of problems I've had with them.

Cheers,

Di

All banks have these sorts of errors unfortunately. I remember I sold a property and still had a $150k LOC with the CBA for years – it is probably still open if I look into it.

Terryw | Structuring Lawyers Pty Ltd / Loan Structuring Pty Ltd

http://www.Structuring.com.au

Email MeLawyer, Mortgage Broker and Tax Advisor (Sydney based but advising Aust wide) http://www.Structuring.com.au

Yep, I've experienced similar in the past with the same bank too. Not quite the same scenario but something similar.

I must admit though – it's not a single bank thing, they're all guilty of these stuff ups from time to time.

Cheers

Jamie

Jamie Moore | Pass Go Home Loans Pty Ltd

http://www.passgo.com.au

Email Me | Phone MeMortgage Broker assisting clients Australia wide Email: [email protected]

Just received a cheque and apology from ANZ for not linking an offset account to a loan in 2004. probably a direct or indirect result of the recent class action against them which I was not a party to, but a surprised beneficiary of their spring cleaning ( demonstrating an attempt at restitution and duty of care ex post facto as part of their liability minimisation more like it).

We dumped them around 2004 because they didn't want to refinance our motel even though we'd paid the LVR down by about 20% below the level at which they'd first lent, just dumb regional staff I think. Now with CBA who have been mostly helpful.

Cheers

thecrest

thecrest | Tony Neale - Statewide Motel Brokers

http://www.statewidemotelbrokers.com.au

Email Me | Phone Meselling motels in NSW

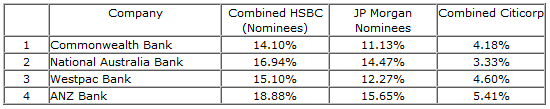

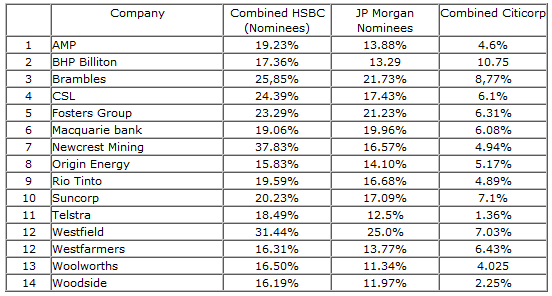

They're all tarred with the same brush and have the same puppeteers namely JPM and HSBC

and who owns corporate Australia and pulls their strings..

You dig deeper into these companies and you find a lot of cross ownership in that most have shares in each other through diverse conduits. On the face of it it looks like JPM and HSBC have around 25%+ in most companies but when you realise some of the other shareholders are also controlled by JPM and HSBC the degree of control is far more extensive and pervasive.

The big four banks for example control through various outlets in the financial industry around 90% of transactions and by default exert enormous influence over the remaining players. Current court cases are merely nuisance value to banks and government has no control over what they do or how they act. The banking sector controls the government not the other way around.

News Corp controls 80% of media in AU and has vast holding internationally that spread the gospel according to Rupert on a global scale. If you look at who the top ten voting shareholders are on that company low behold who do you find;

3.) Invesco – 1.8pc

4.) Bank of New York Mellon – 1.19pc

7.) JP Morgan Chase – 0.41pc

8.) Blackrock Group – 0.35pc

9.) MFC Global Investment management – 0.35pc

10.) Goldman Sachs Group 0.35pc

The money guys control the FIAT and they also control the message. Any wonder the world is full of sheeple.

Bank Incest

Big international banks own both the Australian big banks and the biggest Australian mining firms. They are in control for the financial adjustments and reset. The story is typical of the Western financial super-structures. In the West, Barclays is the banker’s bank that owns a significant portion of almost every important large Western bank. The integrated ownership of these banks reveals a vast incestuous network. The banking system in Australia is controlled by HSBC, JPMorgan, NAB, and Citigroup. The tree below displays the ownership of the largest banks in Australia. In parallel, Americans, British, and Europeans have no idea that Barclays owns a piece of almost every large Western bank. The same shareholder examination for National Australia Bank, JPMorgan, and Citicorp found that the these four companies not only control a vast array of mining and industrial companies, but also pull the strings as banks under a different name. Furthermore, the four financial firms which own Australia’s banks also have substantial holdings in Newcrest Mining Ltd, the largest gold producing company.

The NAB should be in a level between the first and 2nd levels. Go back a post and you can see that JPM HSBC and Citi own the controlling interest in the NAB

So who do you think actually runs the country? The government or the banks? Specifically American banks.

You must be logged in to reply to this topic. If you don't have an account, you can register here.