All Topics / Opinionated! / ARE YOU GETTING THE PICTURE YET?

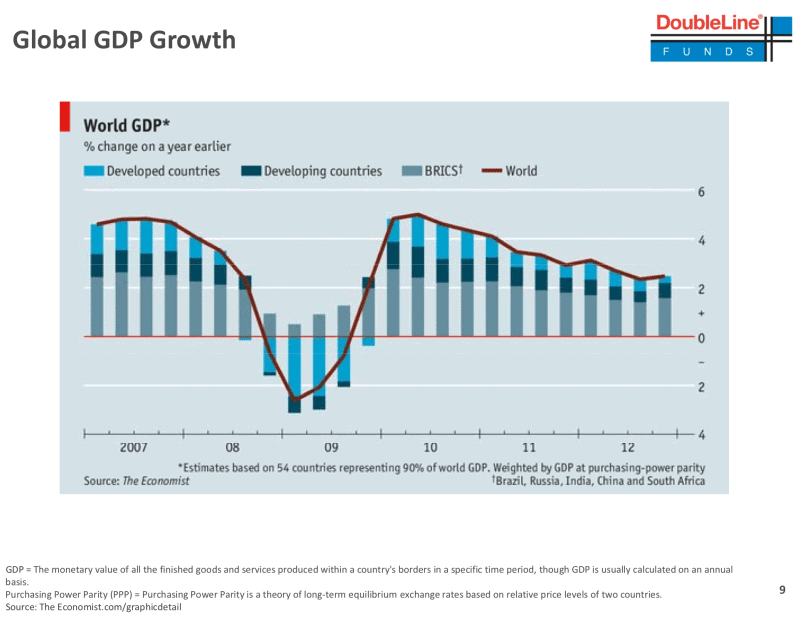

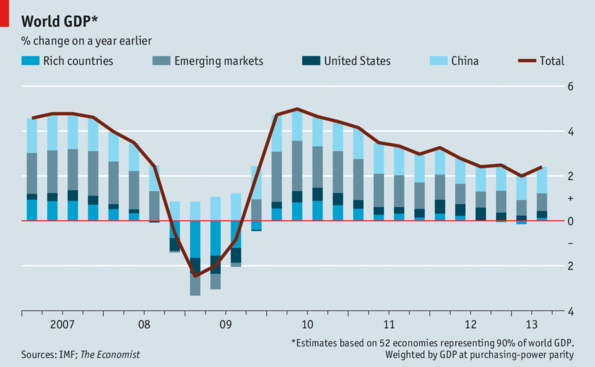

wow. I honestly thought GDP was on the up. is that global figure distorted by China's slump though?

How do you think this will play on the AU housing market? and Interest rates?

Jimmy86 | Future Assist SMSF Specialists - Bris | Melb | Syd

http://www.futureassist.com.au/setupansmsf

Phone MeSelf-managed super specialist administrators and advisers

You have to remember what GDP there is is largely underpinned by debt. The US now spends(QE) $1 to get a $0.10 GDP lift. It used to be 1:1. We are nearing the end of CB's ability to contain this thing. Confidence in CB's is slowly ebbing. At some point it goes critical. When that happens it will be a scramble for the exits.

[image no longer available]

The AU market is considered by almost all measures to be 40% over valued. Banks are lowering mortgage qualifying standards trying to keep this thing spinning. 60% of banks assets are property. A 10% market drop wipes out their collateral. It happened in 08 but they were saved by FED back door operations and government guarantees. Next time we won't be as lucky.

Maybe 2015 will be the year of the collapse.

Our entire economy runs on debt creations, vis-a-vis financialization, since we import $500 billion a year more than we export.

2015 is the year when increasing debt results in ZERO GDP growth. The end of the line. But that won’t stop the Federal Reserve and the criminals in Washington. Enjoy what time we have left before it all collapses.

[image no longer available]

Freckle when the collapse happens next year you won’t have nothing to talk about any more! I guess I’ll see you on the sinking ship, I hope you can swim.

Joe, the "nothingness" is part of "The Neverending Story". I'm sure Freckle will still have plenty to say.

jmsrachel wrote:Freckle when the collapse happens next year you won't have nothing to talk about any more! I guess I'll see you on the sinking ship, I hope you can swim.I found an Island

I could talk about the economic positives and upside opportunity but I'd be lying through my teeth.

Hey Freckle answer this for me.

If the collapse should occur who would be worse off between you and I?

Let’s say I have a handful of IP’s all within 20km to the CBD and approx $1m in debt.

Let’s say you own no property, currently rent, and live week to week comfortably.

I would assume you would say that you would be in a better position to handle the collapse.

But at the end of the day what have I got to lose? It’s so easy to declare bankruptcy in this country it’s not even funny. If I can’t pay my mortgages or values dramatically drop down it’s not my problem – it becomes the banks problem. And once I go bankrupt I will be able to claim benefits that you claim instead of working 7 days a week. It’s out of my control so why sit tight and be cautious and wait for something to happen?

If a collapse should happen it would be a blessing for me.

Freckle if you're not already a part of silverstackers, you should be.

Any thoughts or charts on Purchasing Power Parity? Totally new to me.

jmsrachel wrote:Hey Freckle answer this for me.If the collapse should occur who would be worse off between you and I?

You would have to define worse off.

Quote:Let’s say I have a handful of IP’s all within 20km to the CBD and approx $1m in debt.

Let’s say you own no property, currently rent, and live week to week comfortably.

I would assume you would say that you would be in a better position to handle the collapse.

Possibly. It depends on your strategy in times of crises.

Quote:But at the end of the day what have I got to lose? It’s so easy to declare bankruptcy in this country it’s not even funny. If I can’t pay my mortgages or values dramatically drop down it’s not my problem – it becomes the banks problem.Somewhat over simplified Joe. You loose everything in your or the entities name. It'll depend on how your structured. If you're a company you can literally walk away from the debt with little recourse to you and yours personally in most cases. If your indebted personally they can take everything and leave you with the bare necessities. You may not have enough left over to pay the bond on a basic rental. Your income can be encumbered for several years and if they think you're hiding assets they'll hound you for some time.

Personal bankruptcy is the last thing you ever want to go through. Dying is fun by comparison.

Quote:And once I go bankrupt I will be able to claim benefits that you claim instead of working 7 days a week.AU has one of the lowest SS payments in the world – think below the poverty line.

Quote:It’s out of my control so why sit tight and be cautious and wait for something to happen?I've never suggested you be cautious as in don't invest. Information is power and with it you can avoid or minimise risk/damage and position for opportunity.

The PI's who are at the most risk are those with properties in one city in one class/category type with 70% plus leverage. The objective when a crises is coming is reduce your exposure so you can come out the other side with the ability to recover and carry on. Being philosophical about getting wiped out is not a strategy.

Quote:If a collapse should happen it would be a blessing for me.No it won't. It will be misery like you've never seen before.

Rick sta wrote:Freckle if you're not already a part of silverstackers, you should be.It's part of an overall strategy. PM's are useful as a store of value but little else. PM's are your seed capital to start again when a recovery is in progress. Up to that point toothbrushes and toilet paper have more value. Ask the Venezuelans.

Rick sta wrote:Any thoughts or charts on Purchasing Power Parity? Totally new to me.In what context?

jmsrachel wrote:But at the end of the day what have I got to lose? And once I go bankrupt I will be able to claim benefits that you claim instead of working 7 days a week. It’s out of my control so why sit tight and be cautious and wait for something to happen?

If a collapse should happen it would be a blessing for me.

Living on the street on the pension (which you can't get because you are homeless) is a blessing. hahaha.

If it's such a blessing why not quit work, sell everything and go on the pension (at least you'd have a house to live in).

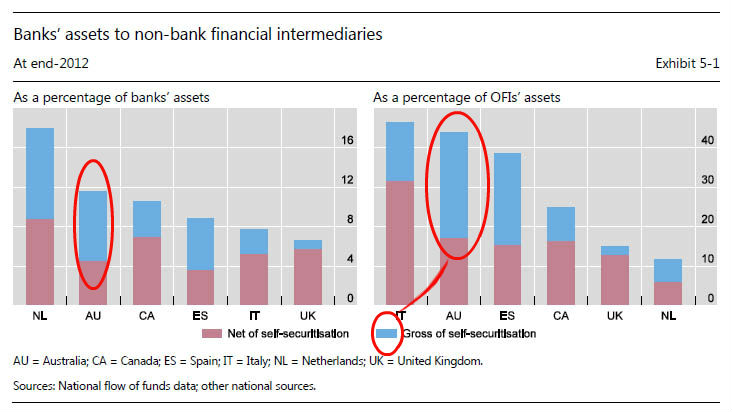

If you think AU banks hold the moral high ground compared to their international bretheren you'll be disappointed. If you you think AU banks are somehow capable of withstanding another GFC event think again.

When you read this article you start to get the picture on how integrated into the international banking ponzi scheme AU banks are. CBA for example is controlled by none other than HSBC and JP Morgan who combined hold around 30-35% of CBA stock. They are the 11th largest bank and 5th most profitable globally. The FED quietly back handed them a few Billion to tide them over last time. I seriously doubt there's a banker in AU that could lie straight in bed.

For those who have difficulty understanding what 'self securitisation' (SS) is – the layman's version;

You take a bunch of mortgages and package them into a security called a Mortgage Backed Security (MBS). You then offer that to the CB as collateral for a loan. Now in normal accounting terms the MBS moves from the banks balance sheet to the CB's balance sheet.

Not when you SS. The MBS stays on your balance sheet and with the loan you can wash rinse and repeat to infinity. Basically a circle jerk.

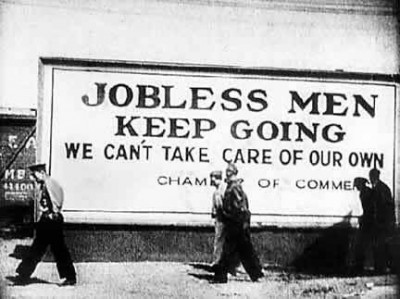

Unemployment rates are so massaged these days as to be totally useless. Labor participation rates are a better indicator of labor market stressors. And we're not looking too sharp. Things have taken a distinct turn for the worse since late 2012. The trend is a concern and not dissimilar to what other countries are facing.

This is a serious problem for young people.

With a high dollar wage growth at this pace will kill competitiveness faster than macro prudential policy can respond. It will invariably decline as growth hits greater resistance. If it declines that could be problematic for rents and market values.

75% of AU's wealth is held by 45 year olds and upwards with a fairly equitable distribution across the ages. AU has one of the better wealth distribution profiles in the world and a GDP per capita ranking that understates this distribution. It makes AU attractive as a middle class paradise that has few equals.

The down side is that an economic crises in all likelihood would substantially debilitate the middle classes for some time. Given the middle classes hold mostly property and stocks(through super funds) a market correction coupled with a property market correction could be devastating to a degree that it would be decades before that lost wealth could be recouped.

This should present food for thought on how a property portfolio might be structured. There is unlikely to be a right or wrong answer but diversification and minimising leverage are obvious tactics that could mitigate any impact.

.

You must be logged in to reply to this topic. If you don't have an account, you can register here.