All Topics / Overseas Deals / Why Japan is Toast

Very interesting barrel of speculation there, with echos of Bass' presentation from a few months back (and another a month or so ago, I believe, which I was already too tired to watch rehashed again).

Aside from the obvious semi-vendetta in “how dare they outmaneuver the mighty US of A in its currency wars, look what they’re doing to our bond market” gripes, some things immediately spring to mind –

1. “people borrow in yen, then invest elsewhere, where the currency will go up”. Really? I wonder where that might be and how these magical clairvoyants that the world seems to be full of predict that. Utter bollocks, as the last five years have shown time and time again.

2. “I’m a big believer in gold”. No, really? You mean like the rest of the panic mongers that fill her ranks? What a surprise. It’s amazing, isn’t it, how the vast majority of doomsday predictors are somehow invested in precious metals and their derivatives (yourself included, on a smaller scale).

3. “Japan doesn’t like immigrants, therefore they’ll never break out of the ageing population trap”. We already discussed this one to death – Japan’s already performing a major overhaul of its immigration laws, and this is one of the best bullets in their arsenal – make that a few truckloads of magazines’ worth – that they haven’t even slightly began to tap – and believe you me, tap it they will.

4. “We will see money fleeing to the safer countries, like the US…” That’s when I pulled the plug – didn’t wait for the end of it.

Give me a break. And pardon me for not continuing to comment on the other thread, too – your last post in that one was so full of speculation and so completely blind to the slight possibility that what happens in the rest of the world may have some effect on your crystalballing, that I didn’t even know how to start addrsesing it.

Ziv Nakajima-Magen | Nippon Tradings International (NTI)

http://www.nippontradings.com

Email Me | Phone MeZiv Nakajima-Magen - Partner & Executive Manager, Asia-Pacific @ NTI - Japan Real-Estate Investment Property

And by the way, if you think Abe will think twice before re-vamping immigration due to some of his supposed "old-fashioned" views – think again – I'm very far from in love with the guy, but his policies are as flexible as they need to be in this day and age – http://www.globalpost.com/dispatch/news/afp/130419/japan-pm-women-key-promote-economic-growth

If someone from Abe’s family line and political affiliation has gone as far as allowing Japanese women to leave their households and sub-servient positions in favour of incorporating them into the marketplace – do you really think he’ll stop at immigrants?

Ziv Nakajima-Magen | Nippon Tradings International (NTI)

http://www.nippontradings.com

Email Me | Phone MeZiv Nakajima-Magen - Partner & Executive Manager, Asia-Pacific @ NTI - Japan Real-Estate Investment Property

zmagen wrote:1. "people borrow in yen, then invest elsewhere, where the currency will go up". Really? I wonder where that might be and how these magical clairvoyants that the world seems to be full of predict that. Utter bollocks, as the last five years have shown time and time again.Ziv you really need to study your carry trade options. The yen borrow rate is has always been cheap as chips. For 20 years its been a textbook FX play. Borrow yen invest somewhere else bank the difference. The yen debasement is just a double bonus.

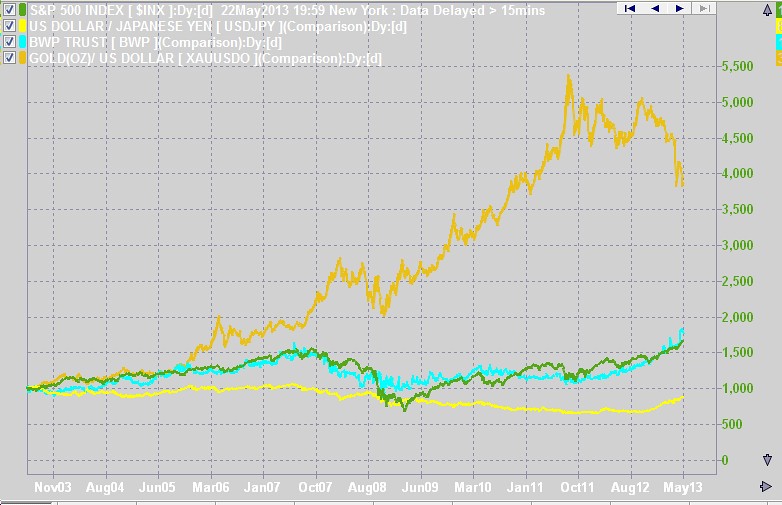

Quote:2. "I'm a big believer in gold". No, really? You mean like the rest of the panic mongers that fill her ranks? What a surprise. It's amazing, isn't it, how the vast majority of doomsday predictors are somehow invested in precious metals and their derivatives (yourself included, on a smaller scale).Yep Gold's a bad bad investment because it has no yield. Jeez Ziv you can be a muppet sometimes. Try Gold verses the S&P500, BWP(AU CRE REIT) and USDJPY

Quote:3. "Japan doesn't like immigrants, therefore they'll never break out of the ageing population trap". We already discussed this one to death – Japan's already performing a major overhaul of its immigration laws, and this is one of the best bullets in their arsenal – make that a few truckloads of magazines' worth – that they haven't even slightly began to tap – and believe you me, tap it they will.

Quote:3. "Japan doesn't like immigrants, therefore they'll never break out of the ageing population trap". We already discussed this one to death – Japan's already performing a major overhaul of its immigration laws, and this is one of the best bullets in their arsenal – make that a few truckloads of magazines' worth – that they haven't even slightly began to tap – and believe you me, tap it they will.Abe can change all the laws he likes. Waffle all the non xenophobic rhetoric he likes but he sure as hell isn't going to induce a wave of migrants who will receive a rapturous welcome to the few miserable jobs on offer. Xenophobia is cultural. They've been anti immigration since the year dot. You won't change that mindset in a hurry. In reality the xenophobia discussion is a diversion to the real issues facing Japan.

Quote:4. "We will see money fleeing to the safer countries, like the US…" That's when I pulled the plug – didn't wait for the end of it. Give me a break. And pardon me for not continuing to comment on the other thread, too – your last post in that one was so full of speculation and so completely blind to the slight possibility that what happens in the rest of the world may have some effect on your crystalballing, that I didn't even know how to start addrsesing it.Mate you really need to catch up on this one. BOJ is displacing current local JGB investors. It's driving them out of bonds and forcing them to look for yield and opportunity somewhere else. The Nikkei and the overseas markets are stated preferences the BOJ wants to see this money flow to. The Nikkei to make them feel rich effect. Replicating the FED's strategy but magnitudes larger and pushing investment to better yielding assets in the international market so that returns can convert back to even more devalued yen and help create inflation.

Those are all straw man arguments anyway. You avoid the thrust of the presentation and seek to dilute the reality of Japan's situation in a mixed bag of nonsense misdirection.

Maths Maths Maths

….Debt increasing exponentially

….Costs increasing exponentially (compound interest working against you)

….Income (taxes) falling on reduced income and shrinking population

= FINANCIAL COLLAPSE

IT IS NOT AN OPINION OR PREDICTION. ………………IT IS A MATHEMATICAL CERTAINTY

The sub theme to that presentation was that the current Abe initiative is simply bringing forward the inevitable at an accelerated rate.

So in your opinion freckle there is good money to be made in FX selling the JPY against USD?

N@than wrote:So in your opinion freckle there is good money to be made in FX selling the against USD?Nope. The money is in borrowing yen @ 0.1% and buying assets, stocks or bonds that pay bucket loads more. If (as) the yen depreciates you get even more of kicker. The yen carry trade as its known is about arbitraging the differences in interest rates. In the past an appreciating yen could neutralise this trade at times but with a depreciating yen it's almost like taking candy from a baby.

Whooaaa!!!

BOJ just threw 2 trillion at the JGB market to support a slide that's been running for a few days now. But this injection it seems is after the Nikkei just took a 7% hit.

Jeez still plunging… ouch!!

This is one wild ride and by all accounts the BOJ is hanging on by the skin of its teeth as it tries to control the market. This will be interesting and educational I'm sure.

Freckle wrote:The yen borrow rate is has always been cheap as chips. For 20 years its been a textbook FX play. Borrow yen invest somewhere else bank the difference.. I'm well aware of how carry trade works, thanks. The lady specifically mentioned "other places, where the currency will go up" – not "other investment vehicles in other countries". She has zero possibility of predicting this, except in the very short term perhaps.

Freckle wrote:Yep Gold's a bad bad investment because it has no yield.Never said that – all I said was that you, like most precious metal traders, have everything to gain when the world panics about anything under the sun – a claim that you're trying to (not so effectively) dodge and drives all of your posts on this forum – not just the Japan related ones. Who's misdirecting and using straw man arguments again?

Freckle wrote:but he sure as hell isn't going to induce a wave of migrants who will receive a rapturous welcome to the few miserable jobs on offer"The few miserable jobs on offer", in the worlds third largest economy with 4.1% unemployment? Are we talking about the same country, or are you completely lost in your own rambling, apocalyptic mind???

Freckle wrote:… In reality the xenophobia discussion is a diversion to the real issues facing JapanI beg to differ, I actually think immigration and equality in the workplace are two of the most significant discussions Japan should be (and is) having in the coming months and years – and that process has already started. Yes, the aversion to foreign intervention in "the old ways" of Japan runs deep – but so has the aversion to increased sales tax, to dropping nuclear reactors, and even to Abe himself. Things change, even in Japan.

Freckle wrote:IT IS NOT AN OPINION OR PREDICTION. ………………IT IS A MATHEMATICAL CERTAINTYNo, it's not, and no amount of shouting will make it so, regardless of who it is shouting it and from which rooftop (particularly when it's shouted by hedge fund opportunists and gold dealers – the people that benefit the most from mongering panic after positioning themselves to benefit from its effects). Furthermore, the term "collapse" is vague, misleading, emotional, and has no measurable effect or result. Every economy has ups and downs, every economy is affected by others around and further from it, and every economy promises opportunities for those who are appropriately hedged and positioned. You're like the kid in the front cart of the roller coaster train, shrieking "we're all gonna die!" at every drop. All of us are aware of what's happening in our respective economies, as well as the ones we're invested in, whether they're the same, or not, or both cases. The only difference is, you're trying to convince everyone that each of these ascents or descents spells fire and brimstone and doom to everyone involved. It doesn't – only to the ones who invest in the hope of a quick buck and in a single investment vehicle. Again, the vast majority of the people on this forum aren't, so your screams are a tad wasted.

Freckle wrote:The sub theme to that presentation was that the current Abe initiative is simply bringing forward the inevitable at an accelerated rate.Yes, that's what she'd like everyone watching to believe, I realise that. On the other hand, she could be wrong, and he could be doing exactly what's needed to put Japan back on the fast track to growth. The reality, as usual, is somewhere in between – no matter what extremists like you want the public to buy.

Ziv Nakajima-Magen | Nippon Tradings International (NTI)

http://www.nippontradings.com

Email Me | Phone MeZiv Nakajima-Magen - Partner & Executive Manager, Asia-Pacific @ NTI - Japan Real-Estate Investment Property

Ziv wrote:I'm well aware of how carry trade works, thanks. The lady specifically mentioned "other places, where the currency will go up" – not "other investment vehicles in other countries". She has zero possibility of predicting this, except in the very short term perhaps.Watch it again. She mentions higher yield products. You don't need a crystal ball for foreign bonds

Quote:all I said was that you, like most precious metal traders, have everything to gain when the world panicsSo lets re-examine what you actually said.

2. "I'm a big believer in gold". No, really? You mean like the rest of the panic mongers that fill her ranks? What a surprise. It's amazing, isn't it, how the vast majority of doomsday predictors are somehow invested in precious metals and their derivatives (yourself included, on a smaller scale).

So does that include China, Russia, Germany and every other major central bank, hedge fund, gold bank, merchant bank etc. They're all "Panic mongers" because they invest in gold. You constantly discredit your argument with this sort comment.

Quote:"The few miserable jobs on offer", in the worlds third largest economy with 4.1% unemployment? Are we talking about the same country, or are you completely lost in your own rambling, apocalyptic mind???So lets see about 127mil people and 1.5% are foreigners. Where are the vast majority of foreign workers employed? That's right – laborers and other low skilled work the locals don't like to do but is appropriate for foreigners. Most of the new jobs will be in elderly care for the aging population wiping bums and chins probably from bog rolls denoted in worthless yen possibly.

Quote:I beg to differ, I actually think immigration and equality in the workplace are two of the most significant discussions Japan should be (and is) having in the coming months and years – and that process has already started. Yes, the aversion to foreign intervention in "the old ways" of Japan runs deep – but so has the aversion to increased sales tax, to dropping nuclear reactors, and even to Abe himself. Things change, even in Japan.Yeah things change but not culturally ingrained behaviors. Cultural values once entrenched are virtually impossible to dislodge in a person. It's the cause of much of the conflict in the world. Prejudices and hatreds are literally impossible to change across a population. it's the least of their worries at the moment anyway.

IT IS NOT AN OPINION OR PREDICTION. ………………IT IS A MATHEMATICAL CERTAINTY

Your response was to waffle around the subject. If you disagree then why is it not a mathematical certainty?

If I looked at any business and saw rising debt, rising costs and a declining revenue base I'd say that it was a mathematical certainty its going to fail. That's Japan. Good luck explaining how Japan overcomes that hurdle.

Quote:she could be wrong, and he could be doing exactly what's needed to put Japan back on the fast track to growth. The reality, as usual, is somewhere in between – no matter what extremists like you want the public to buy.Two guys standing around watching a house burn down. Coming down the road is the fire brigade.

1st bloke: That's lucky fire brigades here. They'll have her out in no time.

2nd bloke: No they won't. Haven't got a show.

1st bloke: Course they will.

2nd bloke: Not a show mate.

1st bloke: Why the hell won't they put her out ya drongo.

2nd bloke: No water.

This is getting tiresome, Freckle, particularly since we've had the exact same discussion in length several months ago.

with your permission, I'll leave you with the following excerpt from "The Independent" which sums up both sides of the argument – because really, we're just rehashing the same old tunes, and i think we both agree there won't be a resolution here –

Quote:Stephen King, the chief economist of HSBC, has argued that Japan is in a structural economic decline that Mr Abe's monetary activism could well fail to reverse. "Offshoring, ageing, the unproductive use of women in the workforce and an acutely cautious attitude towards immigration have all played their part in constraining Japanese growth during its two lost decades," he wrote in the Financial Times. " A wave of the monetary magic wand cannot fix those problems." Yet the economists who know most about deflation and Japan say otherwise. They argue that Abenomics can work provided the programme is followed through and that policymakers do not withdraw the stimulus prematurely, as they have in the past. Richard Koo, the Japanese economist who coined the phrase "balance sheet recession" to describe his country's deflationary malaise, thinks the combined three pillars of Abenomics – fiscal stimulus, monetary stimulus, and supply side reform – "make sense". Adam Posen, a Japan expert who until last summer was a member of the Bank of England's Monetary Policy Committee, also believes the Bank of Japan is finally doing the right thing (although he is sceptical of the wisdom of Mr Abe's fiscal policies).Note how even the staunchest resistance to Abe's policies agree that women in the workforce and immigration reform are key? (I know, you believe a significant rehaul of Japan's attitude towards foreigners is impossible – I don't, however. I've seen the Japanese embrace far more radical trends in the past). And we haven't even touched upon renewable energy in this discussion, a field which Japan is poised to lead the world in these next few decades, nor on service and household robotics, a field which is currently in its infancy, being led by Japan, and predicted to grow by 300% in the next five years, not least due to Japan's very own ageing population problem. As for gold – don't be ridiculous, please. I wasn't referring to anyone hedging their portfolios with gold, as many of us do – but to those, like yourself, to your own testimony, who firmly believe its a "safe haven" against all currency woes and make it a major pillar of their investment strategy. These kind of people profit directly from panic, and you know this as well as I do – you just don't want people to notice, because it drives a spoke in your logic and the reasons for which you apply it. I'll leave you with it, seriously, unless you have something (really) new to say for a change. I'm getting a very annoying feeling of déjà vu here…(https://www.propertyinvesting.com/forums/overseas-deals/4346966)

Ziv Nakajima-Magen | Nippon Tradings International (NTI)

http://www.nippontradings.com

Email Me | Phone MeZiv Nakajima-Magen - Partner & Executive Manager, Asia-Pacific @ NTI - Japan Real-Estate Investment Property

Ziv wrote:This is getting tiresomeIt's getting tiresome because you talk around the subject instead of addressing the issues directly.

I indicated the problem is a mathematical certainty but you continually evade providing a reasoned response on how this could be averted. You allude to micro managed elements and side issues as possible solutions but don't join the dots.

My view is primarily macro and holistic predicated on simple logic. Japan is a country that imports raw materials, value adds and re-exports to fund the majority of its existence. That existence is under threat because the global economies that it relies on are crumbling. The global consumer is largely maxed out on product and debt.

It won't really matter what Japan tries to do. It's customers are broke and global consumer demand is contracting.

You think Japan can make it then give me some hard logically thought out argument backed by empirical evidence otherwise you're just whistling in the wind.

Yes, that existence is under threat (as its been for the last twenty years), yes, there are rocky times ahead, yes, it'll take a lot to pull them out of the fire, and yes, it also depends on how the rest of the world fares (as it does for every country in the globe). All of the above is correct. But to try and portray this as a certainty, or even as the most likely outcome, is speculation, pure and simple – and the reason you're trying to "sell" it as such has far more to do with your view of the world (including your view on the USA, Europe, or any other geographical area you'll have on your sights next year) and with your personal agenda than with anything else. I think that's pretty obvious from reading not only the debate on the subject, but also your own posts on the matter. There are many ways in which this situation may play out – your doom and gloom prophecies are only one of those ways, and the level to which you're alluding, as well as the finality you try to paint it with, are your own wishful thinking – nothing more. In spite of what you'd like us all to think, neither you nor I nor Abe hold all the answers to the Japanese equation – there are far more variables involved, as annoying as this may be to someone who likes to paint the world in black and white as you do.

Ziv Nakajima-Magen | Nippon Tradings International (NTI)

http://www.nippontradings.com

Email Me | Phone MeZiv Nakajima-Magen - Partner & Executive Manager, Asia-Pacific @ NTI - Japan Real-Estate Investment Property

You're still waffling Ziv. You talk in circles but say nothing. You psycho analyse me and seem fixated on my motives and economic position with colorful adjectives to embellish your rhetoric but no persuasive economic argument is forthcoming.

You sound more like a politician wriggling under the spotlight and doing everything they can to avoid answering the question directly.

Not really, freckle, its just that you don't like the answer you've received.

Abe's current fiscal policy CAN kick start reasonable inflation and create growth, the Japanese CAN increase workforce participation and immigration, other countries CAN improve their own economic conditions and resume imports from Japan, and local holders of government debt CAN continue backing up their government until the situation improves, because its in their nature to do so, until improvement overtakes debt.

its just that you don't like the odds, as well as the general optimism and faith in this approach, so you prefer to paint the starker option as a certainty. the reason for this lies, whether you like to admit it or not, in your world view, which states that almost everybody is stupid and will do the wrong thing, and that the path they've chosen will not lead to any positive results. We disagree on all of these points, because we have different views of the world and the Japanese people in particular. Not really that complicated.

Ziv Nakajima-Magen | Nippon Tradings International (NTI)

http://www.nippontradings.com

Email Me | Phone MeZiv Nakajima-Magen - Partner & Executive Manager, Asia-Pacific @ NTI - Japan Real-Estate Investment Property

zmagen wrote:Not really, freckle, its just that you don't like the answer you've received.Abe's current fiscal policy CAN kick start reasonable inflation and create growth, the Japanese CAN increase workforce participation and immigration, other countries CAN improve their own economic conditions and resume imports from Japan, and local holders of government debt CAN continue backing up their government until the situation improves, because its in their nature to do so, until improvement overtakes debt.

ROFL… yeah they've been doing it for 20 years. How's that working out. Japan sat in the midst of the largest credit boom in history yet its fiscal position deteriorated. Must have been just bad luck eh?

Quote:its just that you don't like the odds, as well as the general optimism and faith in this approach, so you prefer to paint the starker option as a certainty. the reason for this lies, whether you like to admit it or not, in your world view, which states that almost everybody is stupid and will do the wrong thing, and that the path they've chosen will not lead to any positive results.20 years of failure. 20 years of doing the same thing with the same result. Einstein's definition of insanity and somehow you're trying to twist that around and paint me as the doomsdayer and economic scaremonger who doesn't like the odds or faith in this approach.

But it's just more rhetoric on your part with little or no economic evidence to support your position.

Quote:We disagree on all of these points, because we have different views of the world and the Japanese people in particular. Not really that complicated.The difference between you and me is that you have blind faith. I don't.

Nikkei is crashing again. Currently down 4% in 40 minutes. Crazy stuff!!

Yo Freckle are you saying we should place some bets on how far the Nikkei will fall and make some cash from it that way?

Jacqui Middleton | Middleton Buyers Advocates

http://www.middletonbuyersadvocates.com.au

Email Me | Phone MeVIC Buyers' Agents for investors, home buyers & SMSFs.

Quote:they've been doing it for 20 years. How's that working out.Depends on your point of view. Some of us (and PLEASE spare me the linking battle again, I'm sure you can find these opinions with ease, same as I can) actually think that, considering the magnitude of the fall they had, they've done spectacularly well – when similar things happened in other countries, all hell broke loose – yet Japan not only retained its global positioning as the worlds 2nd largest economy (surpassed only in 2010, when china took over), but also did it without the total social mayhem and suicidal depression that other nations experienced (ok, just one link, can't help myself – http://www.mindfulmoney.co.uk/economy/economic-impact/japan-s-real-economic-miracle/)

Quote:20 years of failure. 20 years of doing the same thing with the same resultand, once more, this is your simplistic view of things. Others believe they've actually had excellent results – they've remained competitive, avoided a meltdown, and in the interim managed to also keep unemployment down – not to mention the fact that there are those who believe the only reason they haven't re-ascended to their full potential is because they pulled back all monetary interventions before they had a chance to take their full effect. Not an opinion I subscribe too, but neither do I subscribe to yours. I believe reality falls somewhere in between – they could have done better, but boy-oh-boy, they sure as hell could have done worse too.

Quote:The difference between you and me is that you have blind faith. I don't.You're right about that one – I do have faith in Japan, its people and its mentality – a large part of which is thanks to the fact that, in this case as well as in previous years, they don't really give much of a stuff to what freckle, the IMF or Germany thinks, to name but a few. They have their own way of doing things and, although according to your criteria they may have failed, according to their own criteria (which consists of far more than S&P credit ratings and gross national debt, and also includes sociological factors, measures of equality and general approval ratings by their own citizens, etc) they've done just fine, thanks very much.

To implement other people's ideas of "the correct economic measures" regardless of what the Japanese people actually consider to be important to them as a nation is pure idiocy from the Japanese perspective – and I for one completely agree.

Whether that faith is blind or not remains to be seen – but sure as hell won't be measured in the course of a month, or even a single year. Real estate investments, in similar fashion to economic reforms, take a bit longer than that to prove themselves (at least, the less speculative ones among them do). So you keep on screaming and twitching with every jerk and spasm of your graphs – and lets have this discussion again in three or four years time, shall we?

Ziv Nakajima-Magen | Nippon Tradings International (NTI)

http://www.nippontradings.com

Email Me | Phone MeZiv Nakajima-Magen - Partner & Executive Manager, Asia-Pacific @ NTI - Japan Real-Estate Investment Property

JacM wrote:Yo Freckle are you saying we should place some bets on how far the Nikkei will fall and make some cash from it that way?Only if you want part with your hard earned. In this market (Nikkei) at present you'd get better odds on the roulette wheel.

You must be logged in to reply to this topic. If you don't have an account, you can register here.