All Topics / Finance / Can fixed interest rates go any lower?

Hi- I know this is a 'crystal ball' type question however I'm wondering if there is any sense of a downward pattern from those in the game. Some of you have an historical perspective that I don't have. Thank you for any input.

Tough one to call.

ANZ jumped on board the 4.99% 2 year fixed wagon today.

Cheers

Jamie

Jamie Moore | Pass Go Home Loans Pty Ltd

http://www.passgo.com.au

Email Me | Phone MeMortgage Broker assisting clients Australia wide Email: [email protected]

Rates aare goin to go down down!!!

jamie from your point of view when banks lower there rates do u think there lending polices change

Jpcashflow | JP Financial Group

http://www.jpfinancialgroup.com.au

Email Me | Phone MeYour first port of call in finance :)

Policies don't change – servicing for some people improve with some lenders.

Cheers

Jamie

Jamie Moore | Pass Go Home Loans Pty Ltd

http://www.passgo.com.au

Email Me | Phone MeMortgage Broker assisting clients Australia wide Email: [email protected]

Fixing your loan should be about risk management not about trying to 'beat the bank'. Also remember that you don't need to fix your whole loan – you can split your loan into a fixed portion and a variable portion.

Many investors do this so that they have an element of risk management and also can take advantage of the usual variable features like offset facilities, etc.

Regards

Shahin

TheFinanceShop | Elite Property Finance

http://www.elitepropertyfinance.com

Email Me | Phone MeResidential and Commercial Brokerage

I remember standing in the kitchen of the home of a friend of mine in the UK when she opened a letter from the bank notifying her of an interest rate change and that accordingly her monthly repayments were something stupid like 1 penny. The postage stamp notifying her of this cost way more than 1 penny. This letter arrived shortly after the GFC hit. The day after I heard that middle managers at my previous workplace had been made redundant, and that all contractors had been marched into a room, told their minute's notice clause on their contracts was being exercised, and that in front of them were their new contracts, offering 15% less pay. The choice was to sign it, or consider oneself no longer required and to leave immediately. Every single person in the room signed, because they knew there were pretty much no jobs on offer out there.

Maybe we are headed for the same, maybe we are not. If we are, it is important to remember that it will not be all roses. It would mean low interest rates, but it may also mean no capital growth, no rental price growth, job losses and such.

A few months later I was sat next to a lady in a bank in Australia, she had lived through a few of these recession things she said, and "Cash is King" she told me. I've never forgotten it. If you have cash to ride out a storm of say 2 years, one could say you are almost bulletproof.

Jacqui Middleton | Middleton Buyers Advocates

http://www.middletonbuyersadvocates.com.au

Email Me | Phone MeVIC Buyers' Agents for investors, home buyers & SMSFs.

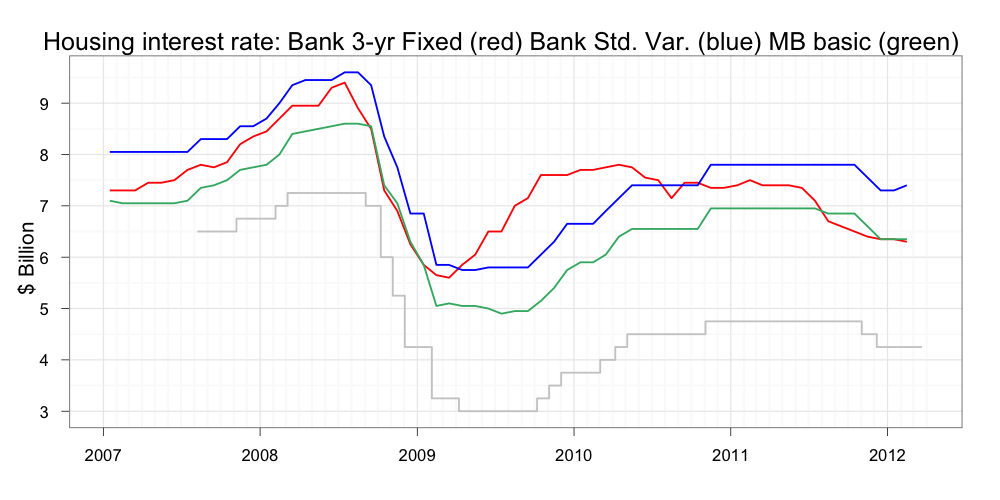

It's interesting to see that graph because it feels very similar to 2009 from where I'm sitting. Rates have dropped to 5%, FHB's seem to be moving back into the market and investors with equity are buying up.

Cheers

Jamie

Jamie Moore | Pass Go Home Loans Pty Ltd

http://www.passgo.com.au

Email Me | Phone MeMortgage Broker assisting clients Australia wide Email: [email protected]

Forgot to mention that Advantedge have dropped their fixed rates further down to 4.79% for 1 and 2 year rates. Half of the loan has to be variable though and LVR needs to be less than 75%

Cheers

Jamie

Jamie Moore | Pass Go Home Loans Pty Ltd

http://www.passgo.com.au

Email Me | Phone MeMortgage Broker assisting clients Australia wide Email: [email protected]

My view is I would be surprised if fixed rates went a lot lower than 4.75% on a fixed rate. This is a good figure if things get worse who knows. However the signs are indicating that things are getting better both in Australia and certainly in the United States.

We have to stop looking at the retail sector because that is changing because of the internet.

Nigel Kibel | Property Know How

http://propertyknowhow.com.au

Email Me | Phone MeWe have just launched a new website join our membership today

I still think rates will get allot lower and I hope things continue to improve but I think the issue is that in employment is steadily increasing.

I know lot of experts say retails is being effected by the Internet but is it really that simple?

PeoePle are buying good online but it's getting to a stage where people are buying from oversease sites.

Also when retails struggle there are many industries that feel the pinch

if shops are quiet landlords reduce the amount of cleaners required, reduce security, shops spend less on renovations and staff get cut off too.

But overall we are still in the best country by far. & I hav to agree with jack cash is king at the nomen

Jpcashflow | JP Financial Group

http://www.jpfinancialgroup.com.au

Email Me | Phone MeYour first port of call in finance :)

It's interesting to speculate on this.

The reason everyone keeps looking at retail is because it is one of the larger employment sectors. It also employs a range of part time, casual and full time. And it is country wide. A lot of commentators look at mining but mining doesn't even come close to employing the people that retail does.

When retail starts trimming jobs (it's been happening for awhile now) then the economy has the flu.

There is a parliamentary enquiry into pricing on electronics at the moment, because we are getting stitched up as a country.

In Australia we don't get global pricing on electronic items, so we pay a higher price. That's why you can buy a laptop online for $500 and here it costs $700. It will be interesting to watch what happens with this, as if we can get better pricing in Australia, retailers will probably be able to become competitive with online shopping. Then more people will shop in Oz, more employees etc etc.

I think if interest rates keep coming down it's going to be a real mixed bag of winners and losers.

Jac I agree, if you can weather the storm why worry about it. It just means that the people who really thought about their financial future survive and that the 'hopers' end up in a not very nice situation.

Be interesting to see the next 12 mths unfold.

D

DWolfe | www.homestagers.com.au

http://www.homestagers.com.au

Email MeHi Jamie,

Just noticed CBA have done the same.

Dan42 wrote:Hi Jamie,Just noticed CBA have done the same.

Yep, it's becoming the norm by the looks of it

Cheers

Jamie

Jamie Moore | Pass Go Home Loans Pty Ltd

http://www.passgo.com.au

Email Me | Phone MeMortgage Broker assisting clients Australia wide Email: [email protected]

Jamie has St George jumped on the 4.99% fixed wagon yet?

Tony Fleming | Triumphant Property Group

http://www.triumphantpropertygroup.com.au

Email MeNSW Buyer's Agent specialising in Western Sydney-Blue Mountains-Orange-Albury

D WOLFE great point!!!!

I always say this, many people struggle when times are good and many people thrive when times are bad.

simple as that…

Jpcashflow | JP Financial Group

http://www.jpfinancialgroup.com.au

Email Me | Phone MeYour first port of call in finance :)

The problem with retail dwolf is that the gap is often a lot wider. Recently I was looking to buy the top of the range Panasonic video camera, not at the new year sales Harvey Norman had this Camera at $1599. Now I can buy the same video camera on line through an Australian supplier for $960 that a huge difference

Nigel Kibel | Property Know How

http://propertyknowhow.com.au

Email Me | Phone MeWe have just launched a new website join our membership today

Yep Nigel,

I got told a story yesterday, about where the same product can be obtained cheaper after passing through several 3rd party distributors, than by coming through the main supplier channel. I think Australian retail has a few extra problems that need work over and above the internet shopping deal.

Once a few retail business work out some streamlining we might see a better 'deal' for shoppers. On the other hand we might also suffer from a lack of choice as ranges get slimmer so retailers can try to make money. Where before we may have been able to buy 10 different cameras we might find that the retailers only stock 4, and they are exclusive models that no one else stocks.

I have to say though going shopping the other day, not many customers out, and plenty of items heavily reduced. Like $80 shirts for $20. It's a pretty dismal outlook for retail, but we might get some new retailers who come into the market with new ideas or the old dogs could learn a few new tricks. You never know.

Sorry everyone, got a bit off topic with this one!!!

D

DWolfe | www.homestagers.com.au

http://www.homestagers.com.au

Email MeI think the problem is that it will be impossible for a retailer in many cases paying high rent and staff wages and commission to compete with someone with an online business.

No matter how far they lower interest rates, this will not change.

Nigel Kibel | Property Know How

http://propertyknowhow.com.au

Email Me | Phone MeWe have just launched a new website join our membership today

Nigel Kibel wrote:My view is I would be surprised if fixed rates went a lot lower than 4.75% on a fixed rate. This is a good figure if things get worse who knows. However the signs are indicating that things are getting better both in Australia and certainly in the United States.We have to stop looking at the retail sector because that is changing because of the internet.

I have no idea where you get this stuff from but whatever you're smokin' I want some.

You must be logged in to reply to this topic. If you don't have an account, you can register here.