All Topics / Help Needed! / Turning PPOR into IP

Hi guys,

I thought I would throw up an idea here before I spend too much time investigating feasibility. Basically I want to explore turning my PPOR into an investment property in the hope that we can rent somewhere close to work and save more per week.

I have done some cashflow calculations and have worked out that our PPOR would be cashflow neutral if we convert our homeloan to IO.

We would look to rent near our place of work and be paying roughly $200 less per week in rent than what our homeloan repayments were.

I would place the $200 per week we were saving in an offset account for our IO loan.

In 4 – 5 years time move back to our original house (to avoid CGT) and sell. Alternatively use the equity toput towards another property.

As far as I can see the biggest risks are:

– the usual risks associated with renting (moving regularly, rising rents, difficulty finding somewhere pet friendly)

– not having a tenant in our IP

– not earning capital returns on our house (although our area has averaged 3.3% capital growth per annum for the last 10 years).

Please discuss!

How did you calculate cash flow neutral? Did you take into account that rates etc are tax deductible? Will you get a depreciation report? that gives more cash in your pocket.

If it is more convenient for your work and costs you nothing (or better still puts money in your pocket) why not? My daughter did this. She had a 2 bedroom and had difficulty paying the mortgage so she rented it out and rented a 1 bedroom herself. She was $150 a week better off after tax deductions.

The capital return doesn't effect whether you live in it or not. look at the other things. How easy is it to get a tenant? How easy is it for you to get a rental in the area you want?

Hi Catalyst,

I used a cash flow calculator on my phone which takes into consideration tax credits.

I have no idea how hard it would be to get a tenant. The vacancy rate for my area is 1.3%.

Regarding capital growth, I understand living in it doesnt affect growth, but I would want to avoid CGT if we sold. If we changed out P&! loan to IO and the house didnt appreciate significantly we would be in a worse off position than if we kept it P&I.

Rentals are plentiful but getting ones that are pet friendly (dog and cat) are a little harder (but not impossible).

Anyone else have any advice?

Can you list all the things you are including in your cashflow analysis?

For starters have you included the following:

1. Building insurance (if its a house)

2. Strata (if its a unit)

3. Landlord Insurance

4. Property Management Fees

5. Loan Interest

6. Water rates (if its a unit)

Regards

Shahin

TheFinanceShop | Elite Property Finance

http://www.elitepropertyfinance.com

Email Me | Phone MeResidential and Commercial Brokerage

Hi Shahin,

I dont have the program handy but it had many expenses covered. Actually, come to think of it, it included conveyance and stamp duty so I would actually be in a better off position than originally thought (as we have already bought the house).

FYI it is a house.

Would anyone go down this path? Freeing up $200 a week is tempting.

This is a very common strategy – make sure you have spoken to an accountant re all the tax implications.

Regards

Shahin

TheFinanceShop | Elite Property Finance

http://www.elitepropertyfinance.com

Email Me | Phone MeResidential and Commercial Brokerage

Probably best to sit down a use an excel spreadsheet. Only use the phone app for rough calcs.

Terryw | Structuring Lawyers Pty Ltd / Loan Structuring Pty Ltd

http://www.Structuring.com.au

Email MeLawyer, Mortgage Broker and Tax Advisor (Sydney based but advising Aust wide) http://www.Structuring.com.au

Thanks guys.

I see it as something that warrants further investigation so ill line up my accountant.

If I am to produce a spread sheet for cashflow, what are the key figures I need to include? Please identify if a figure is usually a rate (eg 2%) or a lump sum to help with my calculations.

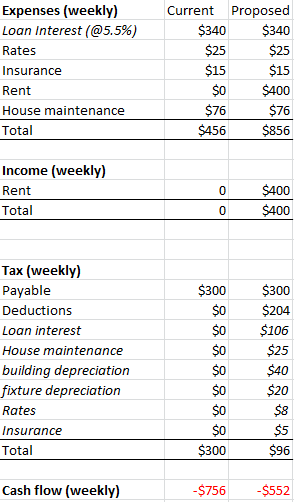

Expenses (weekly) Current Proposed Loan Interest (@5.5%) $340 $340 Rates $25 $25 Insurance $15 $15 Rent $0 $400 House maintenance $76 $76 Total $456 $856 Income (weekly) Rent 0 $400 Total 0 $400 Tax (weekly) Payable $300 $300 Deductions $0 $204 Loan interest $0 $106 House maintenance $0 $25 building depreciation $0 $40 fixture depreciation $0 $20 Rates $0 $8 Insurance $0 $5 Total $300 $96 Cash flow (weekly) -$756 -$552 This is a quick spreadsheet I put together. Basically the difference in cash flow is the result in tax deductions I would receive from using my PPOR as an IP. I have assumed that I would be receiving rent of $400 p/w and renting a place for $400 p/w.

Are there any obvious errors or omissions?

Sorry, table stuffed up.

Will the property be self managed or under a PM? If its a PM then you will need to add it as part of the outgoings.

Also are you basing the loan repayments on the loan itself or the overall cost?

Regards

Shahin

TheFinanceShop | Elite Property Finance

http://www.elitepropertyfinance.com

Email Me | Phone MeResidential and Commercial Brokerage

Hi Shahin,

No I would require a PM – ill add that in. I based the loan repayments on the loan (the interest component) itself. What am I missing? Insurance? This is the existing loan I have out on my PPOR.

Where do the $204 deductions come from?

You need to list all the outgoings for the house then add depreciation etc. The rent you will be paying is not factored into it.

Just take that into account later. Not in your tax benefits.

You mentioned CGT and paying interest only as opposed to P&I. This has nothing to do with CGT. How much you owe on a house is irrelivant to CGT>

Catalyst wrote:Where do the $204 deductions come from?You need to list all the outgoings for the house then add depreciation etc. The rent you will be paying is not factored into it.

Just take that into account later. Not in your tax benefits.

You mentioned CGT and paying interest only as opposed to P&I. This has nothing to do with CGT. How much you owe on a house is irrelivant to CGT>

The deductions are 32.5% (my income tax bracket) of the deductible expenses.

I can take rent payable and rent received out. Wont make a difference to the CF ratio as they are both $400.

Is there a free tool I can use to get a more accurate idea of where I would stand?

This is how I would do it.

List all the cash expenses in rows in excel

strata

rates

insurance

management

total

Then list all the non cash deductions

depreciation builing

depreciation fittings

loan costs (over 5 years).

total

Total costs = Cash costs + Non Cash costs

Income = rent

Taxable income of the property = Income less expenses

= Rent – cash costs – non cash costs.

If this is negative then you can deduct this figure from your other income. This reduces your tax at marginal rates.

If this is positive then it is added and you pay more tax at marginal rates.

That is the tax position.

To work out the cashflow position:

Income = Rent – cash deductions

leave non cash deductions out of the equation because you don't pay for these with cash.

You also get the added benefit of tax back. So this is added in too.

Cashflow = Rent – cash deductions – tax savings.

Terryw | Structuring Lawyers Pty Ltd / Loan Structuring Pty Ltd

http://www.Structuring.com.au

Email MeLawyer, Mortgage Broker and Tax Advisor (Sydney based but advising Aust wide) http://www.Structuring.com.au

Terryw wrote:This is how I would do it.List all the cash expenses in rows in excel

strata

rates

insurance

management

total

Then list all the non cash deductions

depreciation builing

depreciation fittings

loan costs (over 5 years).

total

Total costs = Cash costs + Non Cash costs

Income = rent

Taxable income of the property = Income less expenses

= Rent – cash costs – non cash costs.

If this is negative then you can deduct this figure from your other income. This reduces your tax at marginal rates.

If this is positive then it is added and you pay more tax at marginal rates.

That is the tax position.

To work out the cashflow position:

Income = Rent – cash deductions

leave non cash deductions out of the equation because you don't pay for these with cash.

You also get the added benefit of tax back. So this is added in too.

Cashflow = Rent – cash deductions – tax savings.

Fantastic – thanks Terry. Exactly what I was looking for.

Paul B. wrote:Terryw wrote:This is how I would do it.List all the cash expenses in rows in excel

strata

rates

insurance

management

total

Then list all the non cash deductions

depreciation builing

depreciation fittings

loan costs (over 5 years).

total

Total costs = Cash costs + Non Cash costs

Income = rent

Taxable income of the property = Income less expenses

= Rent – cash costs – non cash costs.

If this is negative then you can deduct this figure from your other income. This reduces your tax at marginal rates.

If this is positive then it is added and you pay more tax at marginal rates.

That is the tax position.

To work out the cashflow position:

Income = Rent – cash deductions

leave non cash deductions out of the equation because you don't pay for these with cash.

You also get the added benefit of tax back. So this is added in too.

Cashflow = Rent – cash deductions – tax savings.

Fantastic – thanks Terry. Exactly what I was looking for.

There is good reason they call me "Australia's leading property coach" !

Terryw | Structuring Lawyers Pty Ltd / Loan Structuring Pty Ltd

http://www.Structuring.com.au

Email MeLawyer, Mortgage Broker and Tax Advisor (Sydney based but advising Aust wide) http://www.Structuring.com.au

Hahaha

BigCubez wrote:HahahaWhat is so funny? I have googled your name and not found anything.

Terryw | Structuring Lawyers Pty Ltd / Loan Structuring Pty Ltd

http://www.Structuring.com.au

Email MeLawyer, Mortgage Broker and Tax Advisor (Sydney based but advising Aust wide) http://www.Structuring.com.au

You must be logged in to reply to this topic. If you don't have an account, you can register here.