All Topics / Overseas Deals / Good time to buy USD ?

Hey Everyone

I own a property in Atlanta and was looking at buying another one when i travel to the states over christmas.

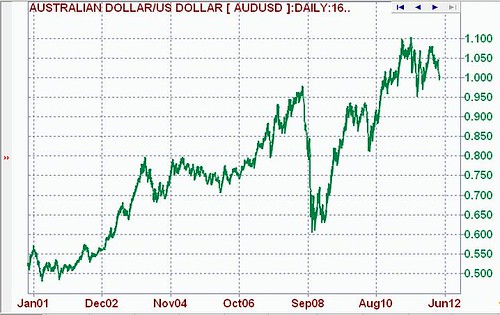

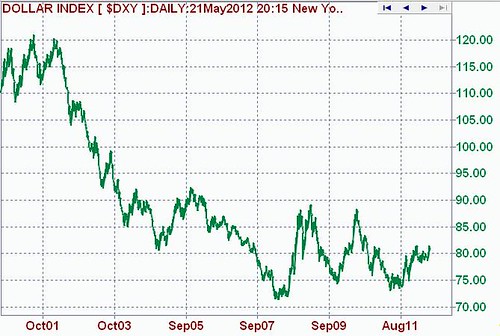

I was thinking about whether the exchange rate is going to drop significantly further throughout the year and whether itd be worth buying some USD now.Lower interest rates, China's demand possibly slowing down, The US possibly starting to recover, The Euro crisis getting worse and investers flooding back to the US currency ? It does seem possible that the doller could drop back down to 90c or so

I know that predicting exchange rates is pretty much like reading tarot cards from the local carnival but id be interested to hear anyones opinion.

Hi Rowan

Anyone's guess, I have watched the Aus $ go from 94 to 1.08 over the last 12 months. However, my gut tells me we are going to see the Aus $ start to decline and remain below US$.

Where was Aus $ when you purchased in Atlanta? Personally I see this could present as a great opportunity to bring funds from US back to Aus.

Do you subscribe to Ozforex, good to get the weekly update.

The latest update belowAustralian Dollar:

It was a familiar story for the Australian dollar overnight with risk being shed across the board. Global stocks slid as did commodities with fears that Greece could leave the Euro-zone gripping markets. With attempts at forming a new government again failing in Greece, continued insecurity and volatilities across global markets have investors braced for the very real chance that proposed austerity measures may fail. After dipping briefly below the parity level against its US Counterpart during local trade, the Australian dollar failed to hold such levels dropping to an overnight low of 0.9956 against the Greenback. Opening this morning below parity for the first time this year the Reserve Bank are set to release the minutes from their most recent meeting today with any further hints at future rate cuts likely to lead to further downside movements in the Australian Dollar.WI

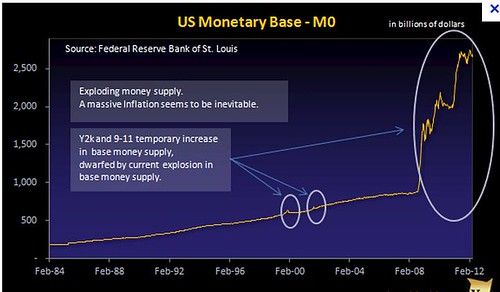

Rowan, it’s likely you’ll see the AU$ continue to drop until Benny launches another QE operation. The markets are suggesting Sep at this point.

Simple hedge, go 50/50. You get half the benefit either way.

I have just transferred funds into my US account. Long term I think the greenback will recover.

EngeloRumora | Ohio Cashflow

http://ohiocashflow.com/

Email Me | Phone MeF@#$ THE REST WORK WITH OHIO CASHFLOW TO INVEST

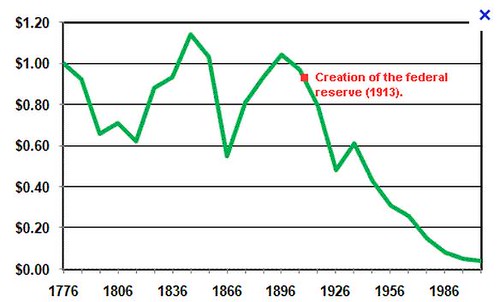

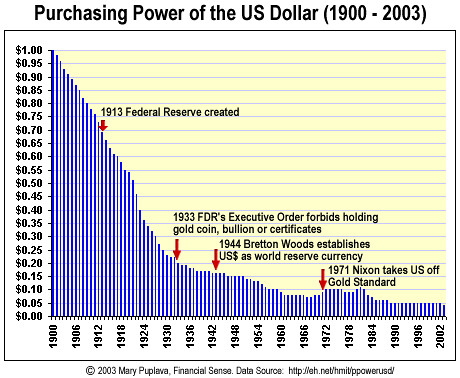

engelo10 wrote:Long term I think the greenback will recover.FIAT currencies do not appreciate when you inflate the currency. Economics 101 Engelo.

It would reverse in a crash as we saw in 07/08 but to a lesser extent as other options for safe haven emerge. AU$ is now considered to offer some safe haven potential and that trend/theory/hypothesis is gaining traction in markets. That could see a substantial appreciation against the US$ during and after another crash as the Fed would almost certainly hit the ‘print’ button.

Your long bet for a weaker AUD vs stronger USD would be a big bet amigo. You’re betting against a historic trend to depreciate the dollar and helicopter Bens’ penchant for expanding the money supply at all costs.

Consequences of the M1 Money Supply

http://ncrenegade.com/editorial/consequences-of-the-m1-money-supply/

The expansion of money, given an increase in the monetary base, is inevitable, and will ultimately result in higher inflation and interest rates. In shorter time frames, the expansion of money can also result in higher stock prices, a weaker currency, and increases in commodity prices such as oil and gold.

engelo10 wrote:I have just transferred funds into my US account.

engelo10 wrote:I have just transferred funds into my US account.Your timing might not be too bad I’m thinking. The next crunch is just around the corner. Word on the street suggests Spain may have about a month before it goes over the cliff. Then we’ll see the EU go into hysterics. I’d expect to see the € slide against the $ as events unfold.

The AU$ is likely to slide against the US$ for the time being but if Ben prints expect to see that reverse.

Commodities are falling at the moment. Iron ore is down along with coal. The resource boom is over in my book. Our ToT will take another big hit in volumes but a currency slide may help overall prices. Small Cap miners are getting smashed at the moment including PM’s which is kinda weird.

My gut tells me we’re on the verge of the next GFC. It’ll be interesting to see what central banks will do to pre-empt the next bust. Bucket loads of printing me thinks although BoE have said no more easing. Wonder how long they can hold their nerve for.

Interesting times ahead.

Does any one beleive the outcome of the presidential elections will have impact on where the USD moves in the next year or so ?

I havn't been following too closely, but ive heard reports about Ron Paul believing he can help America's debt through his foreign policy and elimination of the internal revenue service but Mitt Romney believes they should keep their soldiers stationed all over the world which costs billions of dollars they don't have.

More debt = more printing = lower USD ?

Even in the short term before any new policy changes have come into effect, surely there will be alot of premptive trading of US currency straight after the elections based on who ever won ?

Probly wont change a thing for me on what i decide to do. Buts its still really interesting

Rowan MCcole wrote:Does any one beleive the outcome of the presidential election swill have impact on where the USD moves in the next year or so ?Not in a macro way I’m thinking. Too many large forces pushing things around at the moment. Most of the major central banks are manipulating their currencies to try and keep their economies competitive. That appears to be the main driver at this point not politics.

There is plenty of new evidence to suggest that the USD is making a comeback.. but not yet. The US housing market is finally starting to bottom out.

Historically, the currency value of the US follows its real estate market. BUT, there is a lag time between the recovery. So, if the U.S housing makret is just starting to bottom out, it will be some time before prices return to normal. Afterwards, it could be years before the USD catches up. <moderator: delete advertising>

avest50 wrote:There is plenty of new evidence to suggest that the USD is making a comeback..Where?

but not yet.

Oh you were just kidding!!!

The US housing market is finally starting to bottom out.

You mean the sub prime market is almost but not quite bottoming.

Historically, the currency value of the US follows its real estate market.

I have no idea how you figure that. So the RE market has been falling all this time??

BUT, there is a lag time between the recovery. So, if the U.S housing makret is just starting to bottom out, it will be some time before prices return to normal. Afterwards, it could be years before the USD catches up.

The USD isn't catching up to anything tangible like housing. Fed policy is to devalue it and keep devaluing it. It's bee smashed down over the last decade and that practice continues.

<moderator: delete advertising>

It's not a blog. It's a promo article for US Invest. Much of what he writes is either rubbish or simply promo blurb

Obviously nobody can predict the future when it comes to how the AUD USD exchange rate will be in the future. The best way I can suggest is to factor a bad exchange rate in your investment calculations, a worst case scenario sort of thing so you can see how your investments turn out if everything goes wrong.

Also in my personal opinion, I believe AUD reaching parity with USD is only a temporary thing. When I was looking at purchasing US dollars for our US house, we were aiming to just be happy with anything above the long term average. Looking at historical data, the average appeared to be around 1 AUD = 0.75 USD (I am sure the exact number is up there). So the way I figure it is, anything above 0.75 USD should be a good exchange rate.

I agree that anything above 0.75 USD is a good buy. The USD has regained strength in the past few monthly both with the USD being used as a safe haven currency tied with the RBA lowering rates making the Aussie a less attractive currency. The AUD's weakness in my opinion is greatly tied to the slowdown in China and therefore there will be more opportunity to get into the property market in Australia with lower mortgage rates and potentially lower prices.

From my previous evaluations of cashflow properties in Australia, the potential properties were quite few. The continued declining trend of interest rates should change this an create new opportunities.

You must be logged in to reply to this topic. If you don't have an account, you can register here.