All Topics / Overseas Deals / US market still trending down…. where’s the bottom?

I personally don’t have a lot of confidence in the US market even though there are many areas still open to PI exploitation. Talking to/with Alex, Jay, Kyler and others through this forum I get the distinct impression this is becoming more and more of an expert market to deal successfully in.

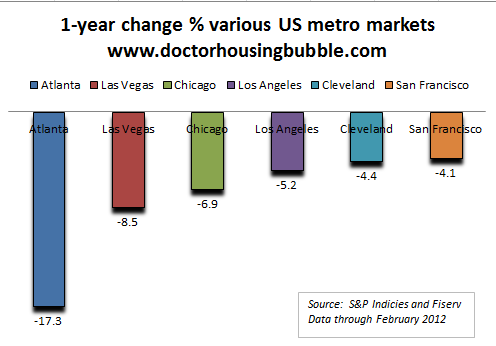

The following tables tend to suggest that areas once considered reasonably safe to invest in (more economically secure geographically and demographically) are starting to feel the affects of tough economic conditions seeping in to the middle income classes. I also get the feeling that the size of the viable investment market is contracting faster than most think.

Over the short to med term (3-5yrs) I see the US market continuing to contract before it settles into a slow but steady downtrend similar to Japan. That’s if the poly’s and banksters don’t blow things up along the way.

Notable is the apparent crash in Atlanta, 3%+ growth in Phoenix and a 1.5% rebound in Detroit.

http://www.housingviews.com/wp-content/uploads/2012/04/SPCase-Shiller-Home-Price-Indices-April-2012-Release1.pdf

The problem as I see it, Freckle, is the difficulty in compiling figures (which by default will be history) with a market that is so vast and so local.

A lot of the cities in the figures you quote are bigger than Australia in population. Yet individual streets have their own characteristics. You can walk 200m and go from ‘nice’ to ‘nasty’ on some streets – these micro communities on a massive scale will distort figures dramatically and the ‘smart’ guys on the ground like Kyler, Alex, Emma etc can arbitrage this with great success. Jay deals on a level above these guys (he uses these guys to help him pick the eyes out) so he gets a ‘national’ picture and they are all saying the same thing – the bottom has past.

From my own experience, my rentals in a mid scale beachside area of LA are getting busier, but to counter that I would also point out that peak subprime also was very busy – people renting because they were out of their houses elsewhere. My little area was not sub prime affected to any real degree, so I immediately see these ‘US figures’ as a nonsense – like many in the US, it didn’t affect me really, so not my problem:)

Freckle

I can see where your coming from because your just reading stats.

What reality is,,,, is vastly different.

The reason things are trending down is the bottom feeders are buying everything they can get… So you have an inordiate amount of sales on the low end of the mean.. which push's the medium down….

Take that and the super high end which is still very vulnerable in the US… IE the 3 million dollar home in florida that cooks off for 750k… and that skews the market..

The fact is the bottom end of the wholesale market has reached its bottom in most is not all markets.

for the past 2 years in Atlanta lets say I just bought right off the MLS> no worries. Now there is 10 offers on one house… No Aussie is going to get that house because most of the reselling companies do not have the capital to just buy basically site unseen…

so for the first time since 07 I bought 3 props in Atl.. at the court house steps… Made my margins… Had not had to do that in years.

Still there are other areas that the herd has not gone to that we can pick things. off.

And we will succeed because we are here and can react real time… Our partners that buy do not need permission..

Out side investors want due diligence etc.. hard to compete when I make an offer with no due diligence close in 10 days etc etc.

Best,

JLH

And one last thing Freckle

The property and area that Lawys has invested is so far and above what is bandied about on this site its just not apples to oranges he owns mercedes and everyone else is dealing with Ugo's…

South bay and the good parts of LA are as good as anything in OZ hands down.

Only thing better is SF pennisula down to Los Gatos,,, Cupertino, Palo Alto,, Meno Park,,, Woodside,,,Atherton,,,

For LA it would be PV,,, Beverly hills and 100 other great addresses there,,, nothing that 95% of the people on this site would even know of or consider for an investment… Lawys is light years ahead of the group in quality of properties.. That I can assure you.

JLH

Pretty much agree with everything you guys say except that we’re at a bottom. I still think this thing has a long way to run yet.

A lot of what I read concurs on the oasis like patches in the markets. The theme coming through this is that where incomes support markets you have little if any reductions and in many affluent areas ( think Silicon Valley types) prices are rising.

The potential risks I see is how do middle class markets handle the current economic difficulties. The data is suggesting seepage into these areas that where buffered because the initial problem was low income subprime focused.

It’ll be interesting to see how the facebook IPO affects RE in Ca over the next year.

lawsjs wrote:A lot of the cities in the figures you quote are bigger than Australia in population. Yet individual streets have their own characteristics. You can walk 200m and go from ‘nice’ to ‘nasty’ on some streetsI can take you too Auckland, Wellington and Christchurch and show you the same thing. I only know Sydney in Aus but the same applies.

The thing is a 20million pop city isn’t going to profile much differently at all than a 5million pop city. It’s still going to have it’s rich areas, poor areas, industrial, retail, suburban, old, new, ethnic, quirky etc etc. We still need data and stats to give us a structure to base decisions on and to further develop more in depth info.

I don’t ignore the guy on the grounds opinion but there’s always more dimensions to information that is worth a look.

A tale of 5 cities.

What I see here is that Denver, Dallas and to a lesser extent Charlotte are clawing back losses (on average). I suspect that these cities and states offer a better business environment (Especially Texas.. top dog for 5 years I think) and could be the places the US eventually launches a recovery from. While not every county or suburb will get equal benefit the data at least gives clues to investors where to start looking.

Charlotte’s in that middle ground it appears. It’s getting business and jobs growth but RE Agencies are aware banks are sitting on shadow inventory. Distressed sales still represent a significant part of market inventory (50%). Provided Charlotte can continue to grow business and jobs it will eventually see a return to positive RE growth albeit small annualised.

How fast banks feed REO inventory into the system will have an impact for some time to come I suspect. Mean while it sits and deteriorates affecting surrounding suburbs.

http://www.inman.com/news/2011/04/28/charlotte-job-market-improves-shadow-inventory-looms

http://www.inman.com/news/2011/05/6/foreclosures-drag-down-atlanta-real-estate-prices

.

.Click the map and then click on individual zip codes for RE data

Site actually provides in depth data

this is a Vegas take..

Having just gone through the usual mind numbing continuing education for RE … What I can say is that for Vegas, in a room with 56 agents, one lobbyist and the president of GLVAR (our R/E realtor association), there are entire classes on post AB284 … And I read some of the Internet posts from October 2011 and just find it humorous with all the 20/20 you can with hindsight….

Fickle Freckle… What is the expression? Lies , damned lies and statistics?

2 days ago I rushed to the first vaguely viable potential in Vegas in gosh, um, I don’t know.. A month? 7055 sawtooth drive… List price 68k, COMPS over 90 so obviously agent ploy but still…I was reticent either way as I HATE pools… HATE them. Assume $1100. – $1150 in rents done up, taxes not much and insurance usual $450 etc…

I have no idea what it will go for but there were 8 cars sitting outside it as though there was a block party… All the usual folks and international reps there…Israeli contingent, Chinese, Brits and yep, even one bonafide Aussie (yay me)… I took photos it was that hysterical…

I love and always invested in Vegas as it is tight and boom bust (mobile homes worth $250k in ’06… On OPTIONS lol) but I am miserly…

By the time I waited (now for giggles, there were 6 sight unseen offers already 10k over list if rumors that we all spread were accurate), this was more as a lesson to my guys than anything else.. This house was trashed,again, had a swimming pool (aka vegetable patch as Americans rarely swim in the middle of the desert), and anything that might have resembled electrical was gone… Think 12k repairs…. That bad.., new a/c, pool pump, all plumbing, all carpet, every door… Just a lot…

I actually agree with you Freck… Buying ANYTHING for the sake of the gold frenzy that is going on is litlerally laughable and dangerous but what these stats aren’t showing you are the 25 international and local buyers representing consortiums with new cash pockets in excess of 5 mill a piece and when the WHOLE Vegas market has 4500 active properties on it and psycho buyers willing to pay ????

Couple that with government supply constructions and I will show you a real time bubble that has no legs but 2004-2006 never stopped anyone..

These are not home buyers….it is fascinating. I used to think the 30k discrepancy in prices was a financed deal versus cash (still is sometimes), but check titles and geojet … A large percentage are gold fever..and genius title hiding (helllooooooo LLC buyers!!!)

Is there shadow inventory?? In Vegas they say there are at least 30,000 GASP homes in shadow inventory….. Oh, but wait, I was sitting next to one agent bundling Fannie and freddie homes into 5 mill parcels and another with two 10 mill consortiums….

Prices go up, incomes remain the same, rents can’t increase until the jobs/economy turns……..although LOADS of construction now!!

Stick to your own personal investment goals. I can’t, nor can Freckle say what will happen tomorrow so go with what you KNOW… What will it rent for TODAY, what are repairs, TODAY and what are you willing to spend all up, including everything…..? There is a finite point and a finite amount. Stick to them and don’t get gold fever… In Vegas especially, the house always win…make it your house though that wins….If you want to play futures… Be my guest I go with today’s variables and if it makes sense it makes sense.

The whole world is pouncing…. Don’t just pounce for the sake of it.

Frekle,

I know Aussie's are basking in their high priced real estate.. However being born and raised in Cupertino, lived in Palo Alto 10 years then the Napa "valley for 10…. High priced Real Estate became the norm in these areas 27 years ago.. 1985 to be exact.

What was the price of a home in Brisbane or Sydney then…. I can tell you in 1987,, I personally paid 750k for a tear down home in Palo Alto on a 7k sq ft lot…. Now that lot is worth probably double, and the home I built and sold in 1990 for 1.2 is probably close to 3 mil… I designed it and built it 2700 sq ft nothing super special at all…

yes you talk about Facebook.. Google etc….. Just remember Apple which is headquartered in Cupertino,,, Just look at your I phone and see the red dot on the google map thats hwy 280 and hwy 9… thats their headquarters.. I was raised right there.

Steve Jobs was my neighbor in Palo Alto… did I get into software or computers no,,, and thats why I am still working.

You think just because Facebook will come and go… Fact is there is no more room for houses on the pennensulia…And its ground zero for high tech if its not facebook… It is where all the new internet inventions happen… Will prices go to 5 mil for average house probably not anytime soon… but you have multiple offer bid up situations happening again.

house 3bd 2 ba 1500 sq ft 50 years old nothing special listed at 1.2 and 30 offers come in on one day and it sells for 1.350.000

Is your market in Oz that strong and expensive???? I know you talk alot about 300 to 500k houses but what about 1mil plus??

do you have 100,000 plus homes over 1 million in 20 square miles??? just curious.

So frekle I just do not think you can really grasp anymore than what you read on Caseshiller ( which unfortunalty for the US re professional) its a joke,,, data is outdated and not germain to the real worlds other than bean counters.

emma171 wrote:.The whole world is pouncing…. Don’t just pounce for the sake of it.

Absolutely!!!. I get the impression there’s a feeding frenzy kinda thing happening over there. I can understand why. There’s literally trucks loads of dollero’s leaving countries looking for somewhere to park that’s perceived as safe (inflation protection) and has the potential to run higher if you think you’ve got in at the bottom.

Germany’s PI market is starting to fiz I believe. Billions escaping Greece and Spain ($65B/mth) insane.

I can see mini bubbles popping up all over the place. Global, National, State and local economies are full of distortions with hot money flows and govt interference.

This would have to be one of the toughest times (and dangerous) to be a PI. I can see a lot of ppl getting cleaned out over the next few years.

Freckle wrote:Pretty much agree with everything you guys say except that we're at a bottom. I still think this thing has a long way to run yet. A lot of what I read concurs on the oasis like patches in the markets. The theme coming through this is that where incomes support markets you have little if any reductions and in many affluent areas ( think Silicon Valley types) prices are rising. The potential risks I see is how do middle class markets handle the current economic difficulties. The data is suggesting seepage into these areas that where buffered because the initial problem was low income subprime focused. It'll be interesting to see how the facebook IPO affects RE in Ca over the next year.Freckle,

How much lower can the bottom be, in markets were the wholesale prices are bouncing at 20k per house and rents are 700 to 900… now that does not mean the average Oz investor will see these prices they won't unless they live here and can out work us US guys for the deals… And with profitering that goes on in the industry.. with the US guys and the OZ resellers these houses will come to the OZ buyers at double to triple that.

And because they are off market transacitons they are not reported to MLS… So they do not show up as comps many times.

I can assure you ( for whatever its worth) the wholesale market has bottomed in 90% of the US markets that foriegn investors like to buy.

And again the price index from Case shiller paints a lower price point than reality, for sure on the retail side… So many wholesale deals are happening, which include houses that need total reno's the numbers just are not realiable accross the board.

jayhinrichs wrote:[How much lower can the bottom be, in markets were the wholesale prices are bouncing at 20k per house and rents are 700 to 900…Here’s how I interpret a falling market. I don’t just look at prices. There are multiple market segments and there are population socioeconomic markets.

In a market you may have variations in decline in market segments and not all will bottom out simultaneously. The first to the bottom will be the sub prime sector which generally means the cheapest in the market. They probably have bottomed. I don’t see a bottom in the middle class bracket yet.

The sub prime sector where buggered from the get go and is still washing through the system. What I see next is economic dislocation through loss of job or reduction in income pushing home (and renters) over the edge and into default. I see that as a still developing story.

The other aspect of a bottom is when does the size of the problem stop expanding. So while prices might bottom (sub prime) the size or volumes of foreclosures has to start declining in order for a true bottom to appear.

Freckle,

I give you that…..

however in reality most of the sub prime has come to roost.

What your not aware of and what is a little dirty secret in the US.. is that in the mid west, south east, upper mid west. the majority fo the foreclosures has nothing to do with sub prime.

These are from investors that are under water walking away.. What the OZ investor is going to find out the hard way is rentals in the US are not rentals in Oz…. The US investor found that out and they just got tired of pouring good money after bad and have walked away from their rentals…

Freckle since your a research guru, please research and find out how many foreclosures happening now are owner occ and how many or non owner occ… I think this will surprise you.

Fact is in the mid west markets… Memphis in particalur , 50% plus of all SFRs are non owner occuppied… So it goes to reason at least half of the foreclosures are from investors walking away… then one has to ask themselves why..

Once they ask themselves why then the answers start to come out… Rentals on your own in the US are highly risky.

This is why you have REITS and other partnerships.. because they can and will do it better than the individual trying to manage a rental… One rental going sour even if your in the states will cost you 3 to 5k just to try to go there and figure it out.

Take a trip from Oz and what does that cost.

JLH

jayhinrichs wrote:I know Aussie's are basking in their high priced real estate.. However being born and raised in Cupertino, lived in Palo Alto 10 years then the Napa "valley for 10…. High priced Real Estate became the norm in these areas 27 years ago.. 1985 to be exact.

Hmmmm.. 1985 just out of the army. Born and raised Redwood Christchurch. The high priced stuff was down the road a bitWhat was the price of a home in Brisbane or Sydney then…. I can tell you in 1987,, I personally paid 750k for a tear down home in Palo Alto on a 7k sq ft lot…. Now that lot is worth probably double, and the home I built and sold in 1990 for 1.2 is probably close to 3 mil… I designed it and built it 2700 sq ft nothing super special at all…

Not sure was still living in NZ. Paid bugger all for a block 900m2 (9680sqft). Designed and built a 4000sqft double story Miami Vice style house. US TV for you …go figure. Sold for bugger all. Bit of a crash going on at the time.

yes you talk about Facebook.. Google etc….. Just remember Apple which is headquartered in Cupertino,,, Just look at your I phone and see the red dot on the google map thats hwy 280 and hwy 9… thats their headquarters.. I was raised right there.

Steve Jobs was my neighbor in Palo Alto…

Sorry dude no iPhone. That’s what you get for growing up in the wrong neighborhood I guess

did I get into software or computers no,,, and thats why I am still working.

Me neither. We’re a sorry couple of sods eh?

You think just because Facebook will come and go… Fact is there is no more room for houses on the pennensulia…And its ground zero for high tech if its not facebook… It is where all the new internet inventions happen… Will prices go to 5 mil for average house probably not anytime soon… but you have multiple offer bid up situations happening again.

Okidoky

house 3bd 2 ba 1500 sq ft 50 years old nothing special listed at 1.2 and 30 offers come in on one day and it sells for 1.350.000

Is your market in Oz that strong and expensive????

Mate we have some pretty expensive stuff here. Where else can you go and buy an old fibro shack for a Mil+

I know you talk alot about 300 to 500k houses but what about 1mil plus??

do you have 100,000 plus homes over 1 million in 20 square miles??? just curious.

We’ve got heaps last time I counted. Sydney.. like fleas on a dogs back

So frekle I just do not think you can really grasp anymore than what you read on Caseshiller ( which unfortunalty for the US re professional) its a joke,,, data is outdated and not germain to the real worlds other than bean counters.

You’re being a bit hard on us bean counters mate. We may look and talk a bit funny but we’re not that bad really

What can I say? Listen to Jay?

If you own a 1 mill house in th states, you aren’t likely to be on this forum or renting it. If you are renting and buying these deals you need to get away from statistics. You need to eyeball your tenant, eyeball your house and know exactly why you bought that house and chose that tenant.

NOW THAT is where the stats come in… Become a demographer…. Be your tenant… Work out who they are or will be. Mine will probably be casino workers, retired or Hispanic families. Draw from that what you will… My retirees don’t say boo to a cow and I barely remember they live here… Must take shoes off and refer to them as Mr and Mrs… 3 years and not a peep. My casino workers ditto and my hard working hispanic families just feed me.

My problem children??? Lol… Oh they exist …. Never buy a home with a pool! When a layoff happens, be ruthless… Get on top of it in the first month…

Oh and yes, every client I have bought 10times better than when I did which was when those in the US pounced and it was a feeding frenzy on the way down….Vegas will probably end up showing Jan – August 2011 as bottom….I was “bought out” by then but we were the only bidders and lowballs were poss.

WAAAY, and now the feeding frenzy is back.. You HAVE to expect 30 multiple offers… HAVE. If you are buying through someone who needs to factor in hyper inflated repairs???. You would be better off finding your OWN agent and bidding directly…..a private retail buyer will always be able to bid more… Just pick a house that is move in ready!

I went to the auction for giggles… Omg h prices are STUPID high… Ha, funny to see the pros of snakes prices…still better taking your chances on an REO as trustees are putting more faith back into the open market and raising opening bids.

I have my own stats… One zip, 3 streets in 89142… From 58k back in 2011 to now 80k….cash buys in both instances.

I look forward to thinking there is a double/triple dip but as you said yourself….the world is flocking and I don’t see that stopping and when I hear that by the time people are “done and dusted” at 20 – 30k over real prices with bogus repairs and fees etc????

In Atlanta I tell everyone budget 2-3k in repairs per annum…. Double, triple what you are told and then add 10% for good measure. Outside jay I don’t hear many people being concerned on hyper inflated repair costs down the line…you should be… We all are… My brother, myself, my clients… Everyone needs to understand what thousands of foreigners with rental repairs means to property management and contracting companies…… Kerching kerching

Every agent I know in Vegas is after inventory “by any means”…again…. Think even just 10 agents with standing orders for 200pkus properties a piece…. Or the wholesalers who KNOW they have 20k orders split 5 countries…..

It is FASCINATING to watch ..

Oh, if you do invest in Texas…. Just hope to god you never end up as a defendant….justice does tend to lean on the “don’t mess with Texas” rule.., NOT overly friendly to non Texans….and snail pace…. Although that was from a friend in Dallas and living through it.

San Antonio of course is fab… Just crazy prices… Ditto with Austin.. I was in there in 2002..

There is a lot to be said for lower yields and ” safer,” slower cap rates … But if your entry price is below 100k, you are going to be back to basics, tenants and location and who is lookg after your investment.

emma171 wrote:Every agent I know in Vegas is after inventory “by any means”…again…. Think even just 10 agents with standing orders for 200pkus properties a piece…. Or the wholesalers who KNOW they have 20k orders split 5 countries…..It is FASCINATING to watch ..

Oh, if you do invest in Texas…. Just hope to god you never end up as a defendant….justice does tend to lean on the “don’t mess with Texas” rule.., NOT overly friendly to non Texans….and snail pace…. Although that was from a friend in Dallas and living through it.

San Antonio of course is fab… Just crazy prices… Ditto with Austin.. I was in there in 2002..

There is a lot to be said for lower yields and ” safer,” slower cap rates … But if your entry price is below 100k, you are going to be back to basics, tenants and location and who is lookg after your investment.

Luv your style girl… frenetic!! I almost get a sweat up reading your posts.

The new get fit regime….! ; )

lawsjs wrote:BTW there is a very interesting Bloomberg article today suggesting housing has bottomed in th US – I can’t get the link right now, but it kind of backed up what Jay, Alex, Cheeves, Kyler the dress wearer and Emma have been saying.Seeing a surge in these articles as well. Not convinced by a long shot actually. The surge in articles rely on a mix of industry generated opinion and cherry picking data (often inaccurate – govt massaged) to support those opinions. What I see though is exactly the opposite. The fundamentals don’t support a recovery hypothesis.

What I think is happening is a surge of hot PI money flowing into the market from overseas investors looking to possibly buffer their wealth. I get the feeling many internationals see the US as at or near bottom so if things do go pear shaped any fall would be minor if at all.

You must be logged in to reply to this topic. If you don't have an account, you can register here.