All Topics / General Property / Interest rates in perspective

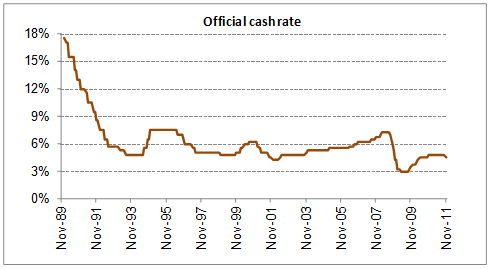

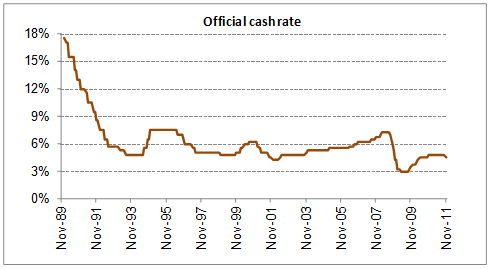

A longer term chart of rates from the 1990's to place things in perspective. Rates will go up and down what remains is how you take action and advantage of the market that exists at the moment!

on average it looks like 6%

Andrew_A wrote:A longer term chart of rates from the 1990's to place things in perspective. Rates will go up and down what remains is how you take action and advantage of the market that exists at the moment!

Yea, until they go up again:)

Last 20 years the av has been around 6%.

Long term, it's around 8%.

keiko wrote:on average it looks like 6%Not too far off that mark I suspect.

I'm reminded of the saying 'never cross a river that's on average 4 feet deep' however! The constant has been change, investors were making money in the 90's recession and when interest rates were very high, investors have been making money in the present market, adapt your strategies to what the market is presenting at the moment and take calculated action!

Hi Guys, I am looking at fixing my rate on 4 properties totalling 1.3 million of borrowing.

I am currently at 6.41 variable and am looking at fixing at 5.99% for 2 years.

No one has a crystal ball and I am fine going with a gut feeling. I am looking for a few different views on what will happen with interest rates taking into account that banks are making it clear that interest rate cuts are not necessarily going to past on.

What do you think will happen with rates this year and would you fix them at 5.99 now?

Fixed rates are normally based on different markets than variable rates and this sometimes means than aren't really effected by any reserve bank changes (not that seem in control of rates anymore anyway)

I guess it means that if you fix loans on a rate, and that rate will work for your investment scenario into the future,

then your strategy is successful, and it doesn’t matter where interest rates go for you.However, changes in interest rates affect the economy in various ways and those changes in the economy may

in turn affect an investment, so if you have debt, it’s not easy to be completely insulated.cheers

thecrestthecrest | Tony Neale - Statewide Motel Brokers

http://www.statewidemotelbrokers.com.au

Email Me | Phone Meselling motels in NSW

Fixing your rate gives you a fixed cost, and in business (which is what you are in, the business of Investment properties) this is a good thing. You can budget better and weather any interest rate change.

The down side is your locked in, so if you need to sell or refinance for some reason, it can be costly to get out.

You must be logged in to reply to this topic. If you don't have an account, you can register here.