All Topics / General Property / Property bust not here yet … worse to come

- Freckle wrote:Bardon, ran across these comments at MB. Even though they’re anecdotal they add weight to the real world events happening out there as opposed to the data and statistics.

The Freckle

Freckle one thing that you need to grasp in your debate, which is significant, is that the average housing investor is far less fickle than your average freckle. Agony aunt columns and what the weather is doing don’t really figure in the normal investors mindset.

The waters may be choppy at the moment but the tide is doing its usual, Yes those that you refer to that were well outside the bell curve and done radical things may have got their fingeers burned, so what, happens all the time and means nothing. If you could only post things about mister and missus average I might be inclined to notice it but right now you haven’t.

Lets face it most investors bough a property with a known cash flow. This cash flow is improving and will get better. The buy and and holds just need to enjoy their improved lifestyle and reduced holding costs and savour how lucky the are in this very much sought after country.

bardon wrote:Lets face it most investors bough a property with a known cash flow. This cash flow is improving and will get better. The buy and and holds just need to enjoy their improved lifestyle and reduced holding costs and savour how lucky the are in this very much sought after country.Bardon I’m not sure if you’re willingly delusional or simply don’t know.

Total Housing Debt $1.2T

Owner Occupier Debt $840B

PI Debt $400B

In the last 10 years we’ve seen a surge in PI activity unseen previously. 80% are Joe Average (earn less than $80k/yr)

– According to the ATO, there were 1,751,679 property investors declared to the ATO in 2009-10 – representing one in seven taxpayers – an increase of 59,235 from the 2008-09 financial year.

– Of the 1,751,679 property investors recorded by the ATO in 2009-10, 63% or 1,110,922 were “negatively geared”

– Of these negatively geared investors, nearly three-quarters earned less than $80,000 in 2009-10, and the average loss was $9132 per negatively geared investor, or $176 per week.

– According to the 2009-10 Australian Bureau of Statistics (ABS) Household Wealth and Wealth Distribution, nearly three-quarters of Australia’s investment properties by value were held by individuals aged 45 and over, with Australia’s Baby Boomer generation (45 to 64 years-old in 2009-10) holding just over 55 per cent of these homes.

The idea that cash flow is getting better is a furfy. The problem with the majority of investors is that they are poorly skilled at investing. You have a large chunk of investors in the middle aged sub $80k/yr bracket. They tend to be skittish.

My guess is (and its only a guess – no data to back it up) is that a fair chunk of current selling pressure is investor driven. It won’t take much more pressure to push more into selling as they; fear for their retirement, struggle with delinquent tenants who loose jobs, run into income pressures of their own, worry about declining asset values etc.

If just 1/10 (170 000) PI’s start to panic she’s all over red rover. And if they start to go more will follow.

The Freckle

This is how it works, you buy a place and rent it out. The rent increases, that is all. No delusion, no spin, just the facts.

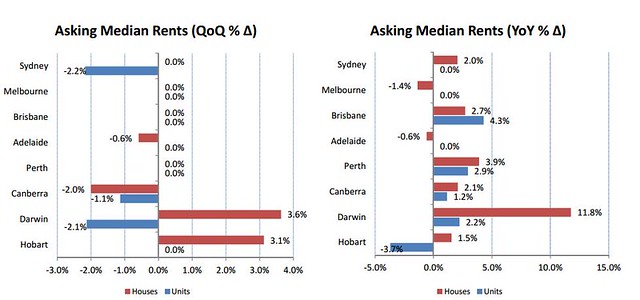

bardon wrote:This is how it works, you buy a place and rent it out. The rent increases, that is all. No delusion, no spin, just the facts.Rents rise while home values fall by 2.7 per cent in 2011</font

http://www.rpdata.com/research/rents_rise_while_home_values_fall_by_2.7_per_cent_in_2011.html

Can’t see a winner here.

………”No delusion, no spin, just the facts.”

The Freckle

Baron,

Rent per area can only go up so muchJpcashflow | JP Financial Group

http://www.jpfinancialgroup.com.au

Email Me | Phone MeYour first port of call in finance :)

The market isn't picking up without another cash injection.

Freckle wrote:Rents riseThe Freckle

Yes that’s it, thanks for confirming.

And if rents rise then your cash flow improves.

Jpcashflow wrote:Baron,

Rent per area can only go up so muchSorry mate, I hate to be the one that tells you this, but they always go up.

Freckle wrote:Bardon are you a successful PI or is it just blind luck.–

Freckle I would rather not get involved with a measure of PI success pissing competition with you.But when it comes to rent growth or not, I would like to engage your well honed chartist skills further. Rather than posting a chart with the last quarter rent, hows about you inject some meaning into the debate and do one for say the last 25 years, then also project it out for the next 25 years,

If you could then borrow a child’s protractor and measure the angle of rent increases over time and report your findings that would be a good discussion point. You are welcome to try and fart around with the origin or both the axis to suit your spin, even make it a log scale if that helps, but I think I could predict the gradient of your trend line once you are finished.

I could be wrong and I am sure you will advise me either way.

bardon wrote:–

Freckle I would rather not get involved with a measure of PI success pissing competition with you.Bardon you make wild claims with nothing to back them up other than we should take your word or something.

It’s patently clear to the dottiest of people that rents go both up and down. Rents in fact don’t track inflation they track income specific to their area on average.

During the 30’s rent dropped 40% to come into line with incomes – fact of life. You can’t rent something to anybody unless they have the capacity to pay for it. So if we see a decline in living standards and an increase in competition for renters expect to see rents drift down. Sydney on average is experiencing that now.

I expect to see a growing demand for rentals as investors exit the market in growing numbers. While rental vacancy rates may be squeezed I don’t necessarily expect rents to rise. In fact if unemployment trends up I expect to see rents decrease as PI’s try to hold onto their tenants. Remember 63% are negatively geared and (PI’s) over 45.

What will change is yields. As property values decline provided rents remain about the same yields will increase for new entrants. Something akin to the current US market.

http://www.smh.com.au/business/property/nation-of-lossmaking-landlords-20120430-1xuh4.html

been saying it for years – you can't NG when you don't have an income. It's going to get worse on bad without someone throwing money at it and, here's the kicker, no-one has any money left to throw.

Wether Australia has had the luckiest or unluckiest housing boom in modern history is immaterial – breaking point has been reached.

Freckle wrote:Bardon you make wild claims with nothing to back them up other than we should take your word or something.I think that you will find that when it comes to rent reviews then the outcome is that they rise which is hardly a wild claim. Happens all the time and I doubt there would be many investors that are keeping up their maintenance that would not be seeing continual rises and I would be gobbsmacked if they were dropping their rents.

So as I said, you can do your sums on cash flow before buying, if it works for you then you buy and then watch the cahsflow improve.

bardon wrote:I think that you will find that when it comes to rent reviews then the outcome is that they rise which is hardly a wild claim.You make the claim they always rise which is patently untrue. I’ve rented for the last 13 years, 2 for 5 yr periods each. Not one rent rise in all that time. I pay less today than I did 10 years ago.

My guess it that over the next few years many (but not all) areas will see downward pressure on rents as this next round of recession bites.

Yes I am sure that you have bucked the trend with the prevalent rent increases over the last ten years mainly because you are smarter than the average bear. As for future drops, dream on.

bardon wrote:As for future drops, dream on.Quote from a thread you posted on;

April 21, 2012

There is an interesting article on mining towns and the recent Dysart situation on the link below. According to that article it aint so bad after all.Mine closure expected to bring down rents and prices in Dysart, Queensland: Agents

http://www.propertyobserver.com.au/queensland/mine-closure-expected-to-bring-down-rents-and-prices-in-dysart-queensland-agents/2012041854299One minute your highlighting the fact the next you’re claiming the opposite. Make up your mind.

Freckle wrote:bardon wrote:I think that you will find that when it comes to rent reviews then the outcome is that they rise which is hardly a wild claim.I've rented for the last 13 years, 2 for 5 yr periods each. Not one rent rise in all that time. I pay less today than I did 10 years ago.

Hmm, I think that may have more to do with either a naive PI who feels they are doing the right thing as you were such a great long term tennant, or they are receiving poor advice from the PM.

I asked my dad why his rent was so low, was renting to tenant for 3 years and rent went from $300 to $330 in that time. A quick look at rentals in the area, he realised rent for that house should have been $400. Fired agent on the spot, their explanation "they were such nice people". Now renting for $420 (went from negative to positive geared).

Incomes are increased by inflation rates every other year, I read somewhere, average house rent can be up to 30-35% or the persons average income. So if incomes are increasing, then so are rents.

Thoughts?Freckle wrote:One minute your highlighting the fact the next you're claiming the opposite. Make up your mind.Hey Freckle once you get to know me you will fond me to be boringly consistent. That article that I quoted has stuff all to do with the mainstream rent story. Surely even you could see that?

NHG wrote:Thoughts?NGH. You have to remember that the majority of landlords are as the ATO infers around the middle age and older. The property I rented in Artarmon in the early 00’s was owned by an elderly lady who was interested more in stability. Another $20/wk was less important than lost rent and additional agent costs to get a new tenant who would be an unknown quantity. The next place we rented in Willoughby North. Same thing. We dealt direct with the owner who has a tool servicing business just around the corner. We paid around $100/wk less than ppl across the road who had a smaller place.

Prior to moving to Artarmon we lived at Umina on the Central NSW Coast. We moved back to the North Shore because rents dropped around $50/wk after the Olympic frenzy. Without that drop we wouldn’t have moved.

I ran a removals business on the North Shore for 8 yrs. Areas went up areas went down.

You need high demand and competition to push rents up. When there’s a swing up it’s not uncommon for rents to overshoot the market. You then get a correction. Sydney is seeing a mean drop in unit rentals of 2.2%. That suggests there is increasing competition between suburbs for renters. If the mean drop is 2.2% then if only 10% of the market is adjusting then rents in those areas could be dropping by 10% or more.

I’ve been a renter for years and will be for many more. Even though I make a truck load of money in resources that hasn’t always been the case. I still see anything over $300/wk as expensive. There are lots of people like me who see no value in paying top dollar for places simply to live in something flash. We accept less (quality, location etc) to spend our doa on more interesting things.

There’s a fine line between how much you can get for a place and how efficient that rental is. The majority of landlords are conservative and tend to undershoot maximum rental potential to ensure regular tenants.

You must be logged in to reply to this topic. If you don't have an account, you can register here.