Forum Replies Created

This structuring of finance stuff is addictive! Thanks for the help.

I apologise for my ignorance but why wouldn't you just use the money straight from your offset account?

Thanks for your input guys. Will be keeping them!

Great point BigCubez. Our area is dominated by young families so I guess the robes will stay.

Thanks for the advice Nigel. As a newbie to property investment I am reluctant to increase my scope to beyond my local region. I feel that growing up in the Hunter Region gives me considerable advantage to an outsider looking to invest in the Region. Its almost like a sixth sense of knowing the desirable suburbs and areas poised for significant capital investment. I think this would be extremely hard to match by looking at statistics, suburb profiles etc

How did you overcome the uncertainty of buying in a foreign town/state/country? What are the indicators you look for in an area you are unfamiliar with?

Terryw wrote:This is how I would do it.List all the cash expenses in rows in excel

strata

rates

insurance

management

total

Then list all the non cash deductions

depreciation builing

depreciation fittings

loan costs (over 5 years).

total

Total costs = Cash costs + Non Cash costs

Income = rent

Taxable income of the property = Income less expenses

= Rent – cash costs – non cash costs.

If this is negative then you can deduct this figure from your other income. This reduces your tax at marginal rates.

If this is positive then it is added and you pay more tax at marginal rates.

That is the tax position.

To work out the cashflow position:

Income = Rent – cash deductions

leave non cash deductions out of the equation because you don't pay for these with cash.

You also get the added benefit of tax back. So this is added in too.

Cashflow = Rent – cash deductions – tax savings.

Fantastic – thanks Terry. Exactly what I was looking for.

Catalyst wrote:Where do the $204 deductions come from?You need to list all the outgoings for the house then add depreciation etc. The rent you will be paying is not factored into it.

Just take that into account later. Not in your tax benefits.

You mentioned CGT and paying interest only as opposed to P&I. This has nothing to do with CGT. How much you owe on a house is irrelivant to CGT>

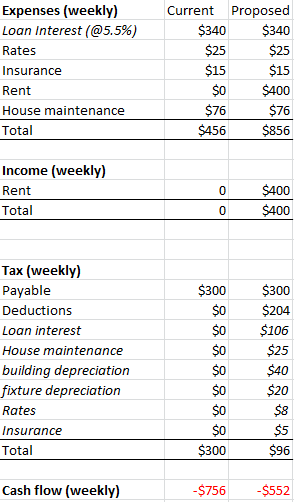

The deductions are 32.5% (my income tax bracket) of the deductible expenses.

I can take rent payable and rent received out. Wont make a difference to the CF ratio as they are both $400.

Is there a free tool I can use to get a more accurate idea of where I would stand?

Hi Shahin,

No I would require a PM – ill add that in. I based the loan repayments on the loan (the interest component) itself. What am I missing? Insurance? This is the existing loan I have out on my PPOR.

I personally would look to set myself up with a PPOR first. This will provide some stability for you and your children and can always become an IP later on.

Sorry, table stuffed up.

Expenses (weekly) Current Proposed Loan Interest (@5.5%) $340 $340 Rates $25 $25 Insurance $15 $15 Rent $0 $400 House maintenance $76 $76 Total $456 $856 Income (weekly) Rent 0 $400 Total 0 $400 Tax (weekly) Payable $300 $300 Deductions $0 $204 Loan interest $0 $106 House maintenance $0 $25 building depreciation $0 $40 fixture depreciation $0 $20 Rates $0 $8 Insurance $0 $5 Total $300 $96 Cash flow (weekly) -$756 -$552 This is a quick spreadsheet I put together. Basically the difference in cash flow is the result in tax deductions I would receive from using my PPOR as an IP. I have assumed that I would be receiving rent of $400 p/w and renting a place for $400 p/w.

Are there any obvious errors or omissions?

Thanks guys.

I see it as something that warrants further investigation so ill line up my accountant.

If I am to produce a spread sheet for cashflow, what are the key figures I need to include? Please identify if a figure is usually a rate (eg 2%) or a lump sum to help with my calculations.

Hi Shahin,

I dont have the program handy but it had many expenses covered. Actually, come to think of it, it included conveyance and stamp duty so I would actually be in a better off position than originally thought (as we have already bought the house).

FYI it is a house.

Would anyone go down this path? Freeing up $200 a week is tempting.

Hi Catalyst,

I used a cash flow calculator on my phone which takes into consideration tax credits.

I have no idea how hard it would be to get a tenant. The vacancy rate for my area is 1.3%.

Regarding capital growth, I understand living in it doesnt affect growth, but I would want to avoid CGT if we sold. If we changed out P&! loan to IO and the house didnt appreciate significantly we would be in a worse off position than if we kept it P&I.

Rentals are plentiful but getting ones that are pet friendly (dog and cat) are a little harder (but not impossible).

Anyone else have any advice?

Oh bugger. This is why I thought to get on here first before heading down to the bank. Will have to wait.

The NAB home equity calculator is very misleading. (http://www.nab.com.au/wps/wcm/connect/nab/nab/home/Personal_Finance/1/4/101/7/)

Thanks Jamie, Cubez and Shahin for your help.

Hi Jamie,

Property is worth $375,000 and $325,000 is outstanding.

Does this mean that I essentially have no useable equity? i.e. 80% of value is $300,000.

Hi Jamie,

Thanks for the welcome. I am with NAB.

Hi Shahin,

No you guys are the first port of call in this instance. Once my partner is 100% on board then we will take it to the lender. I will look into getting a valuation.

Cheers.

TheFinanceShop wrote:Yes that is correct but you will not have any issues with either resale or renting it out due to the demographic in Hornsby and Kuring Gai (im from Gordon). The benefit of the Sepp is that you are following State Development Guidelines rather than the outdated and backward council DCP.Do you due diligence on both and see which one looks better. Michael said it took him 5 months – I think you should count yourself lucky it took you that long.

Regards

Shahin

Hi Shahin,

I may be wrong but wouldn't the LEP and DCP still apply given that the development would be assessed under Part 4 of the EP&A Act? The SEPP would prevail to the extent of any inconsistencies but would it be worth it?

Plus Stamp Duty? Are any of these expenses deductible?

The outstanding amount on the loan is $325,000. The house was purchased for $371,000.