Jeremy Sheppard‘s profile was updated 4 years, 12 months ago

Jeremy Sheppard started the topic Expert Bust #9 – Knockout Bids in the forum General Property 4 years, 12 months ago

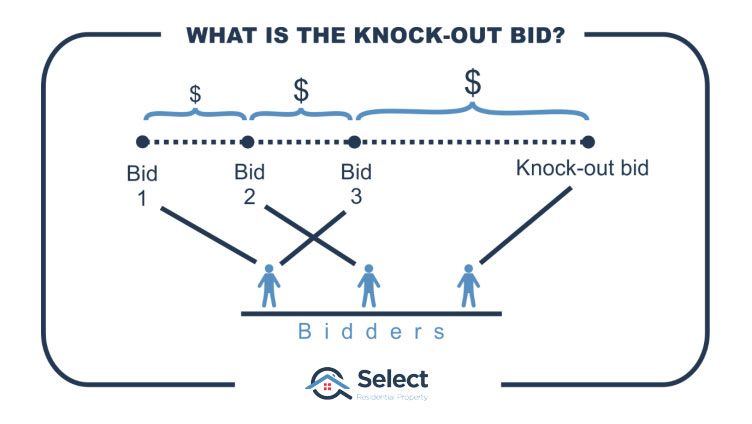

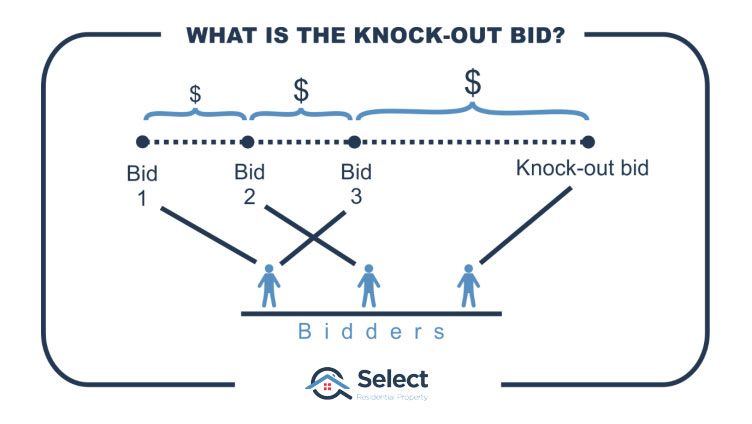

Buyers Agents have told me they’ve seen proof of it working for them. But all they say is they won the auction with a knock-out bid – not proof. A small incremental bidding approach might also have worked.

The only way you can know that it worked is if the other bidder tells you after the auction what their highest bid was GOING TO BE. If you…[Read more]

Jeremy Sheppard started the topic Expert Bust #9 – Knockout Bids in the forum General Property 4 years, 12 months ago

Buyers Agents have told me they’ve seen proof of it working for them. But all they say is they won the auction with a knock-out bid – not proof. A small incremental bidding approach might also have worked.

The only way you can know that it worked is if the other bidder tells you after the auction what their highest bid was GOING TO BE. If you…[Read more]

Jeremy Sheppard started the topic Expert Bust #8 You lose money when you buy in the forum General Property 5 years ago

You don’t make money when you buy, you lose it and lots of it…

Most investors make money when they hold – assuming they’re holding the right asset.

If the focus is on making money at the time of purchase, what’s the point of holding then? If the focus is on holding then, the purchase price will become irrelevant within a few years of decent…[Read more]

Jeremy Sheppard started the topic Expert Bust #8 You lose money when you buy in the forum General Property 5 years ago

You don’t make money when you buy, you lose it and lots of it…

Most investors make money when they hold – assuming they’re holding the right asset.

If the focus is on making money at the time of purchase, what’s the point of holding then? If the focus is on holding then, the purchase price will become irrelevant within a few years of decent…[Read more]

Jeremy Sheppard started the topic Expert Bust #7 – Avoid High Depreciation Props in the forum General Property 5 years ago

There’s no such thing as depreciation “benefits”. Depreciation is the opposite of appreciation. Properties with the highest rates of depreciation are fighting against capital growth.

If you can claim $10k in depreciation for a financial year and you’re paying 40c in the dollar in tax, then you’d pay $4k less tax. Nothing wrong with doing that,…[Read more]

Jeremy Sheppard started the topic Expert Bust #7 – Avoid High Depreciation Props in the forum General Property 5 years ago

There’s no such thing as depreciation “benefits”. Depreciation is the opposite of appreciation. Properties with the highest rates of depreciation are fighting against capital growth.

If you can claim $10k in depreciation for a financial year and you’re paying 40c in the dollar in tax, then you’d pay $4k less tax. Nothing wrong with doing that,…[Read more]

Jeremy Sheppard replied to the topic Expert Bust #3 – Old is better than new in the forum General Property 5 years ago

Hi mnapier,

I get a lot of strong opposition on this topic. Mostly from those who derive revenue from selling new. No apology necessary.

The statement about it being mathematically impossible to outperform is on the assumption that all other things are equal. This wasn’t clear early on in the article. So, I take that criticism on the chin.

The…[Read more]

Jeremy Sheppard started the topic Expert Bust #6 – Wage Growth Doesn't Equal Capital Growth in the forum General Property 5 years ago

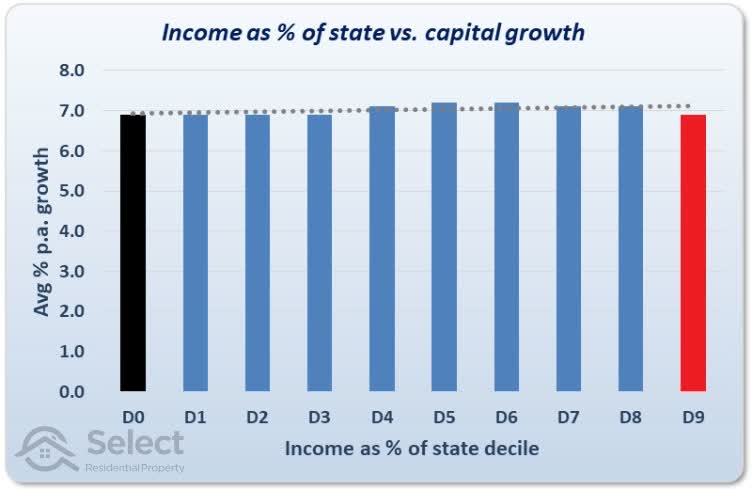

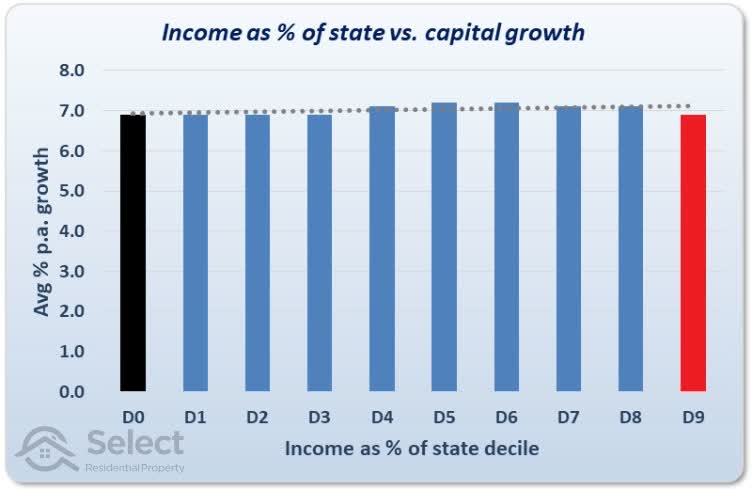

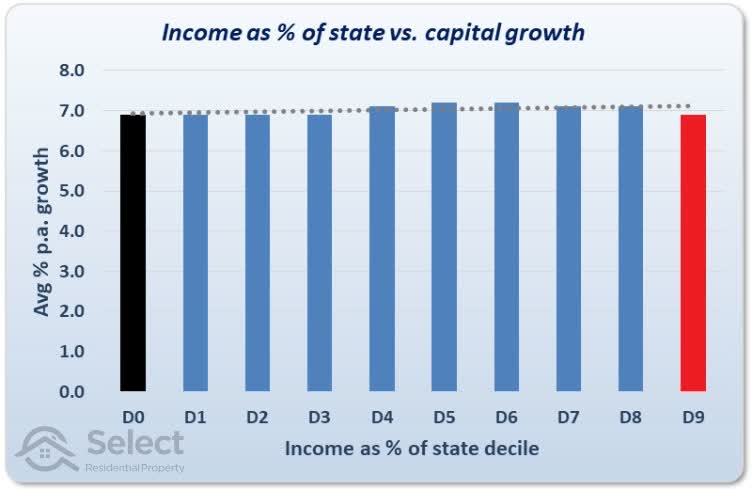

There’s a significant amount of historical evidence to suggest that wage growth isn’t the big driver of capital growth that investors have assumed for so many decades. At the suburb level, it simply doesn’t correlate to capital growth as the following chart shows…

The left black bar represents the per annum growth rate of suburbs with the…[Read more]

Jeremy Sheppard started the topic Expert Bust #6 – Wage Growth Doesn't Equal Capital Growth in the forum General Property 5 years ago

There’s a significant amount of historical evidence to suggest that wage growth isn’t the big driver of capital growth that investors have assumed for so many decades. At the suburb level, it simply doesn’t correlate to capital growth as the following chart shows…

The left black bar represents the per annum growth rate of suburbs with the…[Read more]

Jeremy Sheppard started the topic Expert Bust #5 – Wage Growth Doesn't Equal Capital Growth in the forum General Property 5 years ago

There’s a significant amount of historical evidence to suggest that wage growth isn’t the big driver of capital growth that investors have assumed for so many decades. At the suburb level, it simply doesn’t correlate to capital growth as the following chart shows…

The left black bar represents the per annum growth rate of suburbs with the…[Read more]

Jeremy Sheppard replied to the topic Expert Bust #3 – Old is better than new in the forum General Property 5 years ago

Hi Jaxon, we could have two differently priced properties and compare their growth rates as opposed to the dollar difference.

The point is that the rate of growth is dependent on the appreciation rate of the land and the depreciation rate of the dwelling.

Here’s a cool chart that only takes a few minutes to get the gist, but took me literally…[Read more]

Jeremy Sheppard started the topic Expert Bust #5 – No need to buy near CBD in the forum General Property 5 years ago

I’ve done some research into distance from CBD and capital growth. The popular belief is that: the closer, the better. But the data suggests there’s not much really in it, not enough to get excited about this as a winning strategy…

I calculated growth over the last 40 years for the 5 major CBDs. I categorised each suburb into one of 10…[Read more]

Jeremy Sheppard started the topic Expert Bust #5 – No need to buy near CBD in the forum General Property 5 years ago

I’ve done some research into distance from CBD and capital growth. The popular belief is that: the closer, the better. But the data suggests there’s not much really in it, not enough to get excited about this as a winning strategy…

I calculated growth over the last 40 years for the 5 major CBDs. I categorised each suburb into one of 10…[Read more]

Jeremy Sheppard started the topic Expert Bust #4 – Amenity Proximity Overrated in the forum General Property 5 years, 1 month ago

Proximity to amenities is of little help achieving higher capital growth. Investors think they need to avoid main roads and buy close to schools, shops, transport nodes, etc. But historical research shows there’s no real benefit, except in one case – when the amenity is new.

If an amenity has been around for years, the benefit has already been…[Read more]

Jeremy Sheppard started the topic Expert Bust #4 – Amenity Proximity Overrated in the forum General Property 5 years, 1 month ago

Proximity to amenities is of little help achieving higher capital growth. Investors think they need to avoid main roads and buy close to schools, shops, transport nodes, etc. But historical research shows there’s no real benefit, except in one case – when the amenity is new.

If an amenity has been around for years, the benefit has already been…[Read more]

Jeremy Sheppard started the topic Expert Bust #3 – Old is better than new in the forum General Property 5 years, 1 month ago

If you have 2 properties side-by-side with identical blocks of land, but the dwelling on one property is new and the other is old, the old will have better capital growth. It’s a mathematical certainty – all other things being equal.

Investors have been duped by developers and those pushing new. Historical data, maths & logic confirm that old…[Read more]

Jeremy Sheppard started the topic Expert Bust #2 – Under Mkt Value in the forum General Property 5 years, 1 month ago

Trying to buy under market value may not be a good idea. Those suburbs where bargains can be found are not hot. The hottest suburbs for capital growth are the ones where sellers treat buyers with contempt. There’s a great discussion of it in this article, “Aiming to buy under market value is bad”.

Jeremy Sheppard started the topic Expert Bust #2 – Under Mkt Value in the forum General Property 5 years, 1 month ago

Trying to buy under market value may not be a good idea. Those suburbs where bargains can be found are not hot. The hottest suburbs for capital growth are the ones where sellers treat buyers with contempt. There’s a great discussion of it in this article, “Aiming to buy under market value is bad“.

Jeremy Sheppard changed their profile picture 5 years, 2 months ago

- Load More