Jeremy Sheppard replied to the topic Expert Bust #8 You lose money when you buy in the forum General Property 4 years, 3 months ago

So you had $150k more in your bank account the day you bought? The same week then? Same month?

The day after you bought, your property’s new value was precisely the amount you paid for it.

But given time and other sales (hopefully higher valued comparable sales) then your property might have been valued $150k higher … later. But not when you…[Read more]

Jeremy Sheppard replied to the topic Expert Bust #8 You lose money when you buy in the forum General Property 4 years, 3 months ago

My point is that even if you invest wisely, it takes time for that wisdom to play out and recover the expense of buying. At the instant of buying, you have already lost money whether it was an astute decision or not.

Jeremy Sheppard started the topic Expert Bust #36 – Cheap suburb, low growth? in the forum General Property 4 years, 3 months ago

Do cheap suburbs under-perform?

I split Australia into 2 groups based on whether a suburb is below or above the national median. Then I compared the performance of the cheaper half vs. the more expensive half over 3 years, 4 years, 5, 10 and 20 years.

For each growth period, the cheaper group outperformed the more expensive. And they…[Read more]

Jeremy Sheppard started the topic Expert Bust #35 Over-rating Expenses in the forum General Property 4 years, 4 months ago

There’s nothing wrong with trying to reduce expenses, but when an “expert” is focused on them, it makes me wonder if they have any other tricks.

I’ve had a number of people contact me over the years wondering whether they should sell their investment property. Many are apartments that have high body corporate fees. They feel they made a mistake…[Read more]

Jeremy Sheppard started the topic Expert Bust #34 My Worst Mistakes in the forum General Property 4 years, 4 months ago

Learning from my mistakes:

Never say “never sell”, there may be a time when you’ll be better off

Pick a loan you can easily replace if your lender turns ugly

Good finance doesn’t make for a good investment, it’s only a lever

Research the tenant if the property you’re buying comes with one already fitted

If buying O/S, re-learn ev…[Read more]Jeremy Sheppard started the topic Expert Bust #33 How Many Open Homes in the forum General Property 4 years, 5 months ago

I’ve heard more than one educator/expert/spruiker say you should inspect 100 properties before making a decision. I guess their idea is that you become familiar with what’s out there and how much it sells for.

It sounds like good advice, an extreme dedication to research. But it actually telegraphs inexperience.

A good market is one in which…[Read more]

Jeremy Sheppard started the topic Expert Bust #32 Ideal Tenant/Owner Mix in the forum General Property 4 years, 5 months ago

Each census we get asked whether we rent or own the property we’re in. Based on the answers published about a year later by the ABS, we can calculate the proportion of renters to owner-occupiers in a suburb.

I’ve heard some professionals in the industry suggest that investors want a high proportion of renters since it reflects demand. That is…[Read more]

Jeremy Sheppard started the topic Expert Bust #31 Information Overload in the forum General Property 4 years, 6 months ago

I don’t believe in Information Overload. I want more data, not less. But I accept some investors may get confused with the massive range available.

I focus my attention on supply & demand. It’s a well-established law of price growth that’s been around for 400 years.

I’ll admit there are some metrics that can be difficult to classify (e.g. expert…[Read more]

Jeremy Sheppard started the topic Expert Bust #30 Never sell… really? in the forum General Property 4 years, 6 months ago

When I was a novice property investor, it was drummed into me by the experts of the day, that you buy and never sell because it’s too expensive “trading” property. But I’ve learnt that there are cases where it makes perfect financial sense to sell and invest your dollars elsewhere.

As usual, it all comes down to the numbers: recycle…[Read more]

Jeremy Sheppard started the topic Expert Bust #29 Location Location Location in the forum General Property 4 years, 7 months ago

Location is not nearly as important as timing when it comes to achieving above average capital growth.

If location really was the 3 most important things to get right about property investing, then over a short time-frame you’d expect to see a superior located property/suburb/city edge ahead of inferior ones. Over a longer time-frame, that edge…[Read more]

Jeremy Sheppard started the topic Expert Bust #28 Be greedy when others are fearful? in the forum General Property 4 years, 7 months ago

I can’t count the number of “experts” in Aussie real estate I’ve heard mis-use Buffet’s quote. It might work well in the share market, the context Buffet intended for it, but historical data suggests applying it to property investing is a clear mistake.

Why, because investors make their decisions to buy or to sell for financial reasons, but…[Read more]

Jeremy Sheppard started the topic Expert Bust #26 Investment Grade in the forum General Property 4 years, 7 months ago

A few qualities I’ve heard over the years for an “investment grade” property (or suburb):

Lifestyle location

Safe & friendly

Special

Appeals to a wide range

Affluent owners

Short walk to amenities

Cafes, parks

Street appeal

Views

Natural light

Privacy

Attractive style

Sound structure

Above avg. historical growthI b…[Read more]

Jeremy Sheppard started the topic Expert Bust #25 Buy prop for demog in the forum General Property 4 years, 8 months ago

Here’s a great example of how to misinterpret data like an expert…

Let’s say 80% of the properties in a suburb are houses. Some experts would recommend investors buy a house not a unit, since that’s what tenants in the suburb obviously demand.

But the properties in the suburb are those that have been supplied to that suburb – not demanded by…[Read more]

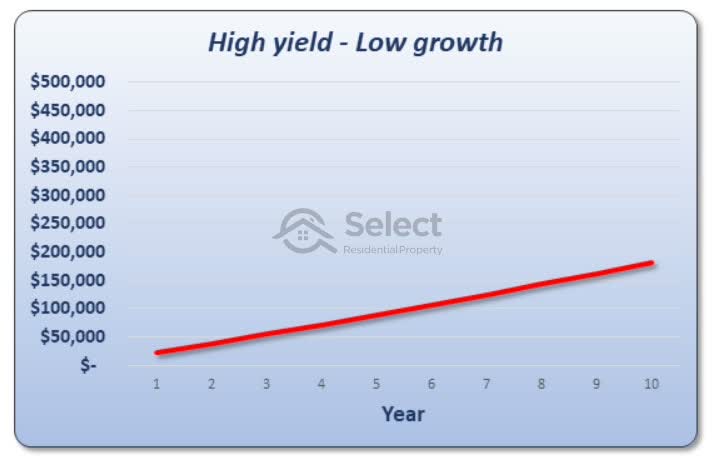

Jeremy Sheppard started the topic Expert Bust #24 High Yield in the forum General Property 4 years, 8 months ago

Many experts hype-up yield. But capital growth is the ant’s pants of property investing.

The following chart shows the “total wealth created” for a theoretical $500,000 property over 10 years of constant 7% gross rental yield and 3% constant capital growth per annum.

$180,000 of equity and cash-flow combined.

Now swap the yield with the g…[Read more]

Jeremy Sheppard started the topic Expert Bust #23 rent money – dead money in the forum General Property 4 years, 8 months ago

For decades it’s been said that “rent money is dead money”. The “follow-on” has always been that you should aim to own your home rather than pay the landlord.

But it could be argued that paying home mortgage interest could be more “dead money” than rent money.

What are the chances that the place you want to live (or need to) also happens to be…[Read more]

Jeremy Sheppard started the topic Expert Bust #22 Adapt to new phase in the forum General Property 4 years, 9 months ago

Every few years I hear marketing from investment experts along the lines of:

“You need to adapt to the new phase in the cycle. What worked in the past won’t work now.”

I’m yet to find a case in the last 40 years where capital growth hasn’t “worked” for property investors.

But imagine you’re a professional operating in a very specific patch…[Read more]

Jeremy Sheppard replied to the topic Expert Bust #18 No benefit buying under median value in the forum General Property 4 years, 9 months ago

Well, buying under-valued props is a whole ‘nother topic.

This topic is about buying under the median. You can buy under the median and still pay too much. Conversely, you can buy over the median and nab a bargain.

But a nice case study. Assuming you pay an agent $7k to sell it and your base profit was $75k, then prior to tax you’ve made…[Read more]

Jeremy Sheppard replied to the topic Expert Bust #2 – Under Mkt Value in the forum General Property 4 years, 9 months ago

There’s no such thing as the discount-flip like there is for the reno-flip…

You can’t buy an under-valued property and then sell it for market value next month. If that’s the strategy, you won’t make much money. So, what is a useful strategy then?

If you buy under market value AND get capital growth, that would work – but over time…[Read more]

Jeremy Sheppard replied to the topic Expert Bust #18 No benefit buying under median value in the forum General Property 4 years, 9 months ago

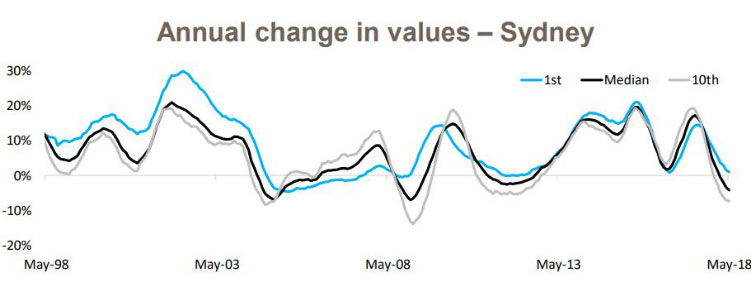

Yes, good point about the relative risk associated with price point. Core Logic have published a fair bit of data along those lines. Like this chart…

Although it’s deciles within a city, there’s no reason to believe the same concept doesn’t apply to properties within a suburb.

But I dunno about rent. If the market goes pear-shaped, la…[Read more]

Jeremy Sheppard started the topic Expert Bust #21 Lots of Land Misses the Pt in the forum General Property 4 years, 9 months ago

Everyone knows that land appreciates while buildings depreciate. So, how can investors best apply that intel?

Some buy houses instead of units. Some buy houses on big blocks. Some professionals suggest you should aim for a larger than average block size.

I’ve even read one blog, where the apparent expert claimed to have discovered the ideal r…[Read more]

- Load More