Forum Replies Created

Lived at Umina for a year or so back in1999/2000. It was supposed to be all go then but it never really got any momentum going. The big killer was the F3 and trains. After a year we were over it. It was cheaper for us to move to Artarmon and pay twice the rent ($220 to $410) than it was to live on the CC. The big bonus was 4hrs less travel every day. Priceless!!

The Freckle

simple wrote:A norm on the street for mam/dad investor is to LOOSE money in RE now.That probably fits with 90% of PI’s Over the last few decades many made a dollar not through any particular property related skill. I have a good friend who buys properties on sentiment alone and he’s an extremely smart guy who has made a bundle on property along the way.

At a purely anecdotal opinion based level I believe as many as 60% of PI’s actually make no money on investments. They’ll tell you I bought such and such for 300k 10 years ago and now its worth 500k blah blah. What they don’t tell you is how poorly structured the deal is, they paid top dollar, the loose 6 weeks a year rent, the tenants have trashed the place twice in that time and so on and so on.

If you actually sit down and crunch the numbers they’re well out the door.

If you look at how many active users here, in one of the more popular forums, you get the idea that of the 1000’s of PI’s out there very few are proactively engaging with expertise and knowledge available here. That leaves RE agents, brokers, accountants etc as their likely expert advisor. That’s scary.

The Freckle

kylermrice wrote:All this talk about financing, has me thinking i should start offering it for my investors. Not going to offer it to my tenants, lol.Just make sure its OPM

The Freckle

lawsjs wrote:Money is not being printed, it is being sold to banks at low rates to stimulate borrowing. It is a subtle but very important difference.Money IS created and then SOLD to the banks. The initial plan was to maintain liquidity but no one knows how deep in the hole the next guy is so banks literally refuse to lend to each other creating a liquidity crises. To overcome that Central banks every where have become lenders of last resort. Banks take the freshly printed money and reinvest it back into treasuries which enable them to comply with reserve requirements and underpins their insolvent balance sheets because of property losses (If they marked to market they’d be bust tomorrow)

The US housing market has been (as far as it is possible to be) ‘cleaned’ of almost every derivative it created. For that reason I see it as insulated (again as far as possible and certainly compared to almost anything else I can think of) and therefore ‘safe’ – or at least ‘safer’ than any other market you could name – assuming you can buy something without being ripped off and actually manage the thing properly.

Rubbish. There’s currently $9 trillion in mortgages. Of which 600 billion is in default. There’s all sorts of property related derivative instruments available on the market. If you want to hedge property then inverse ultrashort ETF’s are an effective tool if you know how to use them.

Money was thrown at banks to hopefully get it into the system. They basically paid it all back to keep the Feds out of their pockets.

Rubbish again. The bail out monies you think have been paid back is all smoke and mirrors. Banks underpin the property market and central Banks underpin banks. The too big to fail banks have even more bloated balance sheets than prior to the GFC. To get your head around how this fiasco is manipulated behind the scenes read the following;

http://www.ritholtz.com/blog/2012/03/open-ended-bailouts-are-continuing/

Sovereign debt is a very big issue, surely there is a finite amount of money that is possible to be created, but if anything is ‘safe’ I would think it it is the stuff that is being discussed here.

Theoretically there’s no finite amount of money creation/QE/money printing call it what you will. Once they get on a roll it’s much like a drug addict. They go till it all goes boom!. If you think property is safe then you’re simply deluding yourself.

The name of the game in a GFC event is capital preservation. I think the graph below illustrates spectacularly how property responds to financial crises

The Freckle

streamlineinvesting wrote:I just hope it does not get too out of control because we still hope to have a couple years to be able to build a great property portfolio in the US.Eventually it will end, and we will have to come to a new strategy that matches the current economic climate.

A buy and hope strategy. If the market is hotting up it may offer opportunities to bank gains. The market is being driven by hot money looking for a home because the returns are lousy every where else. Buy and hope isn’t an effective way to invest nor is simply looking to grow a portfolio simply to have a truck load of properties even if it is to garnish regular returns. That was ok 20 years ago but there’s way too much volatility around at the moment to hang on to old strategies.

In the current market, and I think for the foreseeable, future strategies are going to require constant reappraisal. I see advantages and benefits to aligning strategies with “day trader ‘ type qualities albeit on proportionally longer time scales given the type of market property is.

The Freckle

moxi10 wrote:The explanation by the company that the mine has been loseing money for several months seems a bit thin under the circumstances.Not really. Management at BHP aren’t rocket scientists by any stretch of the imagination. Having worked as subby within their systems they’re their own worst enemy. Their break even price for commodities just keeps on rising. Add to that external cost pressures and many mines let alone proposed projects are being reassessed.

BHP is under mounting pressure to get it’s profit margin up and return better profits to shareholders/investors. There’s a big rethink going on within BHP as shareholders/investors pressure for shorter time frames for ROI instead of their customary long view when planning future acquisitions and expansions.

My gut feeling is that mining town investors are in for a bumpy ride over the next few years with more than a few loosing their shirts on the process.

The Freckle

lawsjs wrote:See my post under Foreclosure… To add to a litany of US banking dramas, up to and including foreclosure (not BofA) through the banks error – proven and retracted after 12 months. Accept they are all totally incompetent, do not believe anything they say and get everything you can in writing. Check that the addresses you give them actually print out legibly from their computer system. Get a PERSONS card and make sure they understand you WILL call THEM when there is a problem. Make sure everyone has your email address. If you assume as a matter of course everything will go wrong (and believe me you cannot anticipate what will go wrong, they never cease to surprise me) you will minimise your annoyance when disasters happen.I think US banking has a half life. You may get through a year without something going wrong, but another 6 months will exponentially increase the opportunity for bastardry in any number of forms to occur:)

Jeez!!!… and I thought Aussie banks were retarded when I moved over here. When I arrived here in 98 I thought I’d landed in some sort of time warp.

I go home (NZ) at least every 18 months to catch up with family and friends. It always amazes me how far behind Aussie still is in the retail and banking space. Crazy thing is it’s Aussie bank who own most of the NZ banks.

The Freckle

Jay you have what I call Titanic Syndrom.

When the Titanic hit no one really panicked after all it was unsinkable right! Even as it settled into the water still people were reluctant to get in life boats. The first launch of boats were only half full. People still believed all was well until almost an hour before the end.

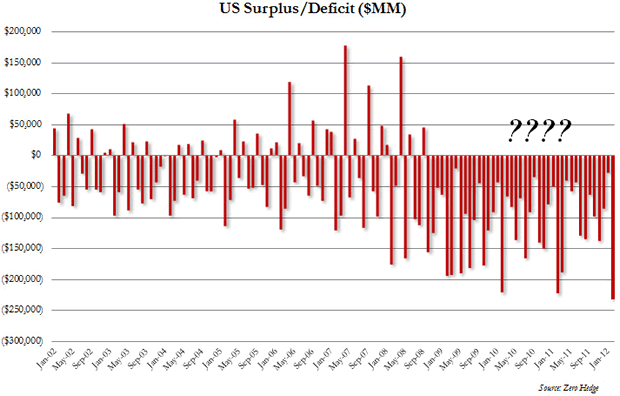

Debt’s going stratosperic. How do you manage debt being accumulated at exponential rates

No trade surpluses at all!!

The core of the problem. Spending more than one earns.

Have a look at the 2007/08 periods in those graphs. You could almost say the economy was relatively normal (if that’s the right word).

We fell in a hole then and that was bad enough. Look at the economic picture now.

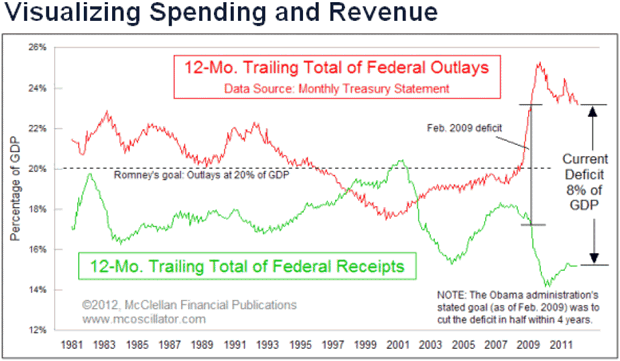

And everyones in on the QE party

If QE was a pathway to wealth we would have done it millennia ago but we all know that sustained QE to solve a debt problem is economic suicide.

Weimar Germany, Zimbabwe are prime examples of what happens when you try this. QE is a delaying tactic for politicians. It’s not a solution.

If you think it’ll be business as usual after the next GFC you’re in for a big shock.

The Freckle

And I notice from the next graph that every indicator is heading south again

Couple that info with the following article and included data it’s hard to see any positive info that might drive the market up this year. On the contrary.

http://www.macrobusiness.com.au/2012/04/nsw-kills-housing-finance-recovery-by-leith-van-onselen/

Add to that problems in nearly all parts of the national economy let alone international pressures and 2012 simply may be a precursor to further down turns.

Canberra doesn’t get me excited either with the planned govt layoffs. The initial figure is 1500 I believe with more to follow. The govt has a (recently) stated aim to reduce govt over head and red tape. That doesn’t bode well for a market heavily reliant on govt sector employees.

The Freckle

.xdrew wrote:the developer (who watches the street demand like a hawk to prevent himself losing money)Known a few over the years. At least half went broke eventually and 2 hung themselves. I have about as much regard for your run of the mill investor, RE agent or developer as I have for the local village idiot. They’ll send you up the garden path as well as anyone

The Freckle

Texas Cash Cow Investments Australia wrote:Remember…amateurs built the Arc….Professionals built the Titanic !!Then I’ll go with the amateurs. The Arc never sunk and saved the world if you believe religious folklore.

The Freckle

worldinvestor wrote:" I am not an economist by any stretch, an investor and a builder"

Yep, keep it simple Jay, just get those deals over the line. By the way how your purchases in Atlanta going??I think this article pretty much sums up my feelings on this stuff.

http://danerwin.typepad.com/my_weblog/2011/02/ten-reasons-why-economists-get-it-wrong.html

Cheers

WI

http://www.wheredopuppiescomefrom.com.au/australian-puppy-mills/The article makes some valid points about the difficulties and complexities of financial predictions especially when in the context of defining time frames. He is however, patently wrong when he states that

They did not foresee the financial crash of the west, or the collapse of Western property values.

There where several notable financial experts and economists shouting from the roof tops about the impending crash. MSM ridiculed them along with pure lies from politicians and central banks.

Economics 101 is pretty easy WI. Spend more than you earn you go broke. Borrow more than you can afford to repay you go broke.

The global sovereign debt crises unfolding now is a result of those two principles. The only thing we can’t predict accurately is when they will go bust. It could unravel tomorrow or 5 years from now but my money is on sooner rather than later.

The Freckle

jayhinrichs wrote:I guess I just look at how my business is going from a macro level then micro level.You got burned last time because you didn’t see it coming. No excuses this time amigo.

And things are just Soooo much better now than 2 years ago…

I disagree. I think that’s an illusion supported by massive QE. 90% of sheeple think things are fixable and all will be well because gubermint says so.

housing is a big driver in the US economy,, 2 years ago in the Portland Market that had been building 12,000 housing units a year, in 09 we built 700…. Total crash, I would say 90% of builders and small subcontractors went BK.. I might be exaggerating a little but it was a melt down. 2010 saw 2400 permits pulled… 2011 3800… and 2012 will top 5,000, I personally have 7 Presold homes going right now for clients… I had not had a pre sold new construction home in almost 5 years.

Housing is a huge driver in all modern economies but unfortunately it’s a highly manipulated market that attracts too much mal-investment hence the regular boom bust cycles.

US citizens with money in their IRAs and there are trillions residing there have access to it on demand either through loans and or cashing them out,,, however there is a penatly if you take it out early. In our TWH model 8 out of 10 of our sales are US IRAs.

We have similar programs here called self managed super. I believe they can invest in RE with fairly strict limitations however I’m no expert in that area.

I am not an economist by any stretch just an investor and builder, who has lived through 3 of these cycles since 1980… the GFC of course was the worse.

It’s the point I’m trying to make. There’s this blasé attitude to the GFC as if it’s over and contained when in reality nothing got fixed and if anything they simply delayed the inevitable collapse along with making it magnitudes worse. If you thought the GFC was bad you ain’t seen nothing yet.

I’m actually fascinated to see how $707 trillion in derivatives unwinds. That’s a mega disaster in itself!

Ones that are picking up the better properties.. They are buying them for 30 to 50% less than replacement costs. And even if rents went down 30% they will still be positive cash flow,,,

This is a major flaw in investment thinking. Most people can’t get their head around a worse case scenario. It’s simply too bad to contemplate. People rationalise to make things emotionally and psychologically manageable. This rationalisation is almost always in favour of a positive outcome or at least survival.

The problem I see is that you already have an incredibly stressed (financially) population with a significant percentage too near tipping point if another down turn comes. Even if we only had a GFC event comparable to the last its effect would be significantly worse given we haven’t recovered one iota from the last. If I was looking at worse case scenarios 30% rent declines wouldn’t cut it. I would be contingency planning for 80% or worse 0.

So as I saw my Real Estate portfolio that I amassed before the crash, come tumbling down in value,,, I set out to buy 100’s of these properties so I could income average out my portfolio… So far so good.

Snap!! I’ve done the same with silver investments 24% down so far ouch!!

I suppose if we have total devaluation and social melt down then, it will be about food and water… And I have that covered. I will simply move out to my 500 acre Tree farm in Rural Oregon which has no debt, and live off the land I have a nice 3bd caretakers cabin on it with a big shop….. Set up a little portable saw mill, trade lumber for goods, grow my own food,,, Take Venison or the occasional Elk when I need meat that sort of thing, Salmon and Steelhead run in the rivers that I can ride a bike too as well…

Samo here. I’ll head back to NZ and do a little gold panning. An oz should be worth an arm and a leg by then.

The Freckle

ITS Called foreclosure clusters….70% or more of the problem housing debt is in 6 markets.

Only something like 4% of homes at the worst point in the crisis in the US were in foreclosure.

I tend to think we look at this problem from quite different perspectives. You guys seem to assess the situation from a housing market perspective while I look at it from an overall economic perspective.

The US housing correction started from dubious sub prime loans packaged as AAA mortgage backed securities. It was a toxic problem that crashed the banking system. Foreclosure stocks working their way through the system are the result of that implosion.

The GFC of 2007/08 has morphed from a banking collapse to a sovereign debt collapse which is being prevented by vast amounts of money printing from every large central bank in the world.

What I am trying to articulate to you guys is that the sub prime debacle was just the beginning, the tip of the iceberg. What’s coming is magnitudes bigger. It’s so big I struggle to get my head around it at times.

The Freckle

kylermrice wrote:Its not going to happen. If we go do down everybody goes down.It will happen of that I have no doubt and yes everyone goes down.

Current estimates suggest globally we need to get rid of $70T in debt just to get debt levels back to a managable level.

The US share of that is approx $25-30T

Unless you know of a way an economy can spend more than it earns and print its way to prosperity we are goners big time.

Its going to hit at a global, national and local level

Globally almost all major economic regions are contracting, are printing money to support an insolvent banking system and have passed the point of being able to support debt serviceability in a sustainable way.

Nationally countries are engaged in currency manipulation, market manipulation, data manipulation, QE/money printing, trade protectionism etc in a vain attempt to prevent their economies imploding.

At a local level States, Provinces and Municipalities are struggling to contain exploding liabilities (wages, pensions, bureaucracy) as income plunges on consumer debt deleveraging and faltering housing markets.

32 of 52 US States are bankrupt

States Continue to Feel Recession’s Impact – March 21, 2012

I don’t buy the upbeat future projections in this report. Treasury projections are almost always over confident. Fed Govt is pulling back on assistance and austerity actions by States will invariably impact their bottom lines. I expect to see their positions deteriorate rather than improve in most cases. The exception will be the progressive states that are pro business. I’m afraid there are too few of these.If I were you guys I wouldn’t necessarily look at this situation negatively but more as an opportunity, however, everything has a sting in the tail and this one has a beauty. Fore warned is fore armed as they say. Any good investor will take seriously the deteriorating economic situation and plan for the worst with exit and hedging strategies.

The Freckle

lawsjs wrote:like won’t let me sign in on computer (or a country!) that their system doesn’t recognise!! Same laptop, different country – sign in (in my very best Thai) CANNOT!Get this software

It’ll solve that problem.

The Freckle

Although the US is not that cash strapped per say… there are trillions of dollars in cash sitting in Mum’s and Pops accounts earning exactly zero or 1% those investors are starting to jump in

Jay you need to look a lot deeper. $0.43 in every dollar the Federal Govt spends is either printed or borrowed money. 50% of Americans can’t scape $2000 together with 2 weeks. The average punter is worth less than $6000. The trillions you assume are sitting around in various funds and accounts aren’t as accessible as you think.

The US is more Spain like than you think. The US actually has higher youth unemployment (54%) than Spain (48%). Unemployment is not falling in the US nor is the US in any sort of recovery despite what the MSM, government and Fed tell you.The figures are heavily manipulated. For real world explanations and analysis see;

http://globaleconomicanalysis.blogspot.com.au/2012/04/nonfarm-payroll-120000-unemployment.html

http://www.shadowstats.com/alternate_data/unemployment-chartsCal generates 1/3 of US GDP so a significant player in the US economy however it’s broke and insolvent. Last year it had to arrange an emergency $5B bridging finance in case the Fed debt limit didn’t pass. It’s a welfare beneficiary on the way to bankruptcy. Municipalities pose a significant problem/risk in the near future. Bankruptcies are rising.

http://www.familysecuritymatters.org/publications/id.11682/pub_detail.asp

The next crash will be different. In the past crashes where isolated events and could be covered by state or federal assistance. The problem now is that both States and Federal Government are drowning in debt they can’t pay back. The next crash will be a total system failure affecting everyone and everything within the system.

You may not think this is possible but your government sure does. It’s imposing new laws (and even breaking its own laws) and positioning/developing resources to better control the populace once things start to go bang.

The Freckle

You guys need to learn how to hedge.

The Freckle

Jay my understanding of the market is this. Growth states tend be proactive pro business environments. For example CA is the opposite and loosing out big time to TX. The building demand is being fed by businesses moving to business friendly states and consequently drawing personell along with them. This in turn feeds into the unemployed space as a better place to live and chase jobs. The problem I see with this is a concentration of efficient parts of the economy along with a concentration in the less efficient parts. This has negative connotations for states slow to react to this type of economic atrophy.

In reality things aren’t getting better overall just better in places at the expense of others.

I think banks holding defaulted stock and handing it over to management companies might be a short run thing. Banks do not like to hold onto assets and then manage them to get a return. It’s not what banks do nor know much about. They may however use this option as a stop gap until they can liquidate.

I.m not sure there’s trillions sitting around in personal bank accounts doing bugger all. The average value of an American is $6000. So my guess is that accounts for 70% of the population. If there’s anything sitting around it’s corporate stashes like Apples little hoard.

I’d be wary of loading up on anything at the moment. Share investors would call this a bear rally at this stage. I don’t think the US property market is anywhere near the bottom yet.

The two following links point to worrying concerns within the US economy;

http://www.zerohedge.com/news/consumer-credit-decelerates-most-feb-2011

http://www.zerohedge.com/news/51-months-after-start-recession-here-report-cardItaly and Spain are now entering into the default cycle phase

We’re closing in on the End Game, the real crash. Everything up until now is just a warm up.

The Freckle

Back of knapkin calc.

Currently the property would gross around $140/wk … $7200/yr. Doesn’t appear to be any chance of capital gain and possibly a loss in value over coming years.

If you sold you would net around $200k. Invested at current fixed rates of 6% that would put $12k/yr in your pocket.

A $450k property that returns around 4.8%pa and no CG is a loss making situation. You need to be getting around 8%pa CG every year just for your dollars to hold their value after entry/hold/exit/taxes/inflation.

Net rental return of $140/wk on net invested monies of $270k is only 2.7%

Seems pretty simple to me. It’s a dog of an investment option. My gut feeling is that in 5 years you would have less dollers than you have now and they would have less spending power through inflation.

The Freckle