Forum Replies Created

- lawsjs wrote:A lot of the cities in the figures you quote are bigger than Australia in population. Yet individual streets have their own characteristics. You can walk 200m and go from ‘nice’ to ‘nasty’ on some streets

I can take you too Auckland, Wellington and Christchurch and show you the same thing. I only know Sydney in Aus but the same applies.

The thing is a 20million pop city isn’t going to profile much differently at all than a 5million pop city. It’s still going to have it’s rich areas, poor areas, industrial, retail, suburban, old, new, ethnic, quirky etc etc. We still need data and stats to give us a structure to base decisions on and to further develop more in depth info.

I don’t ignore the guy on the grounds opinion but there’s always more dimensions to information that is worth a look.

Pretty much agree with everything you guys say except that we’re at a bottom. I still think this thing has a long way to run yet.

A lot of what I read concurs on the oasis like patches in the markets. The theme coming through this is that where incomes support markets you have little if any reductions and in many affluent areas ( think Silicon Valley types) prices are rising.

The potential risks I see is how do middle class markets handle the current economic difficulties. The data is suggesting seepage into these areas that where buffered because the initial problem was low income subprime focused.

It’ll be interesting to see how the facebook IPO affects RE in Ca over the next year.

Dubstep wrote:Hi Freckle,

I love your comments and input on this site ! !

I'm just curious as to why some of the other site members are so argumentative with you ?

What's all that about ? ?

I’m contrarian.. goes with the neighborhood, however most of the guys here are great to debate with. Funny thing is most of us don’t really disagree with each other in a general sense.

But PI’s are sensitive to negative publicity. I hurt their feelings every now and then

Japan’s now firmly wedged itself between a rock and a hard place. Energy wise it’s barely meeting it’s day to day needs. That effectively hamstrings industry for the next decade or two if they start now with replacement energy production systems.

Japan’s GDP growth has gone negative again, however, its growth over the last 2 decades has been anemic to say the least.

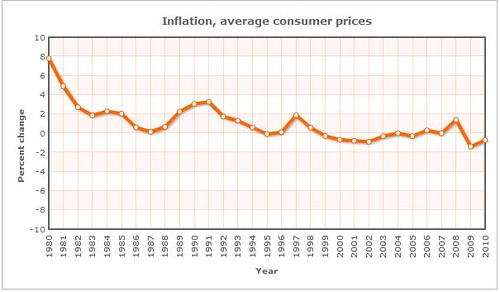

Japan has kept inflation low for decades but with insane printing to keep the Yen competitive one has to ask how long they can hold this together.

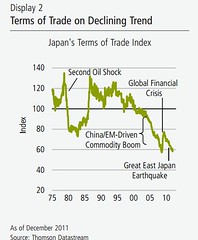

Japans ToT have been on the decline for years. A sigh their economy is burdened with too much debt. They’ve now started to run trade deficits which is a bad sign.

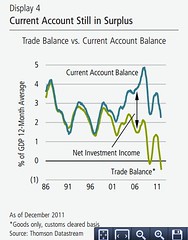

The saving grace to trade deficits is their Current Account is still in surplus.

>

Japan is considered to be one of the more fragile sovereigns struggling with astronomical debt loads far in excess of the PIIGS. Last count govt debt was around 200% GDP and total debt 512%. Mind boggling. So if you throw the nuclear power issue into the mix along with a GFC v2 just down the road things don’t look too rosey for the Land of the Rising Sun

bardon wrote:This is how it works, you buy a place and rent it out. The rent increases, that is all. No delusion, no spin, just the facts.

bardon wrote:This is how it works, you buy a place and rent it out. The rent increases, that is all. No delusion, no spin, just the facts.Rents rise while home values fall by 2.7 per cent in 2011</font

http://www.rpdata.com/research/rents_rise_while_home_values_fall_by_2.7_per_cent_in_2011.html

Can’t see a winner here.

………”No delusion, no spin, just the facts.”

The Freckle

bardon wrote:Lets face it most investors bough a property with a known cash flow. This cash flow is improving and will get better. The buy and and holds just need to enjoy their improved lifestyle and reduced holding costs and savour how lucky the are in this very much sought after country.Bardon I’m not sure if you’re willingly delusional or simply don’t know.

Total Housing Debt $1.2T

Owner Occupier Debt $840B

PI Debt $400B

In the last 10 years we’ve seen a surge in PI activity unseen previously. 80% are Joe Average (earn less than $80k/yr)

– According to the ATO, there were 1,751,679 property investors declared to the ATO in 2009-10 – representing one in seven taxpayers – an increase of 59,235 from the 2008-09 financial year.

– Of the 1,751,679 property investors recorded by the ATO in 2009-10, 63% or 1,110,922 were “negatively geared”

– Of these negatively geared investors, nearly three-quarters earned less than $80,000 in 2009-10, and the average loss was $9132 per negatively geared investor, or $176 per week.

– According to the 2009-10 Australian Bureau of Statistics (ABS) Household Wealth and Wealth Distribution, nearly three-quarters of Australia’s investment properties by value were held by individuals aged 45 and over, with Australia’s Baby Boomer generation (45 to 64 years-old in 2009-10) holding just over 55 per cent of these homes.

The idea that cash flow is getting better is a furfy. The problem with the majority of investors is that they are poorly skilled at investing. You have a large chunk of investors in the middle aged sub $80k/yr bracket. They tend to be skittish.

My guess is (and its only a guess – no data to back it up) is that a fair chunk of current selling pressure is investor driven. It won’t take much more pressure to push more into selling as they; fear for their retirement, struggle with delinquent tenants who loose jobs, run into income pressures of their own, worry about declining asset values etc.

If just 1/10 (170 000) PI’s start to panic she’s all over red rover. And if they start to go more will follow.

The Freckle

Bardon, ran across these comments at MB. Even though they’re anecdotal they add weight to the real world events happening out there as opposed to the data and statistics.

SMc….In my opinion its already started.. I live in Sydney and have the fortune or perhaps financial misfortune to live in Mosman.. take one look at military road and count the for lease signs… even the rich mosmanites are not buying in their little boutique stores.. probably need the cash for the Mercedes finance repayments.

BotRot….SMc, I live in Cremorne. Oh boy what a scene it is here indeed. Military Road is full of empty/for lease/for sale/for auction commercial premises. Even my favourite Barber, Mr. Milano has been tossed and the premises is up for auction. This happened within a month.

The Solicitor’s office above him is booming in business, in orbit. Not from divorce, litigation, nor from compensation cases, no, but from people selling their houses not being able to afford their mortgages any longer. I understand the details, they can get some protection from some law that stops them from being immediately tossed or something like that.

Also from about November 2010, I noticed and kept mental notes of the amount of times I saw people having more than 2 cards rejected at either, Neutral Bay Wollies, Mosman Harris Farm, and the BP Servo in Mosman near the Vet.

One that sticks in mind is at Neutral Bay Wollies, a woman had 6 credit cards and one EFTPOS card rejected, all for $43 buck worth of shopping, she calls her father (this woman looked late 40s) to come pay the bill, they both walk out, she then steps into her brand new dark gray Audi. Amazing!

Tarriic…I’ve seen similar things many times. Do they really need to pay for Milk and Bread, all of $4 on their credit cards. Living on the Northern Beaches I very rarely see anyone pay for anything with cash its always a card. I always hear from people around here that they are struggling financially. You tell them to stop dining out 3-4 nights a week and buying a new car every 2-3 years and they act like you have committed a heinous act of blasphemy against their beliefs.

The Freckle

bardon wrote:But anyone buying into the Sydney market at market price are not shitting themselves right now about negative equity, debt serving or how much their joint is worth, that ‘s for sure.Not sure I’d agree with that. Our high net worth clients where time and cash poor. There’s a keep up with the Jones’ mentality in the upper markets of Sydney. People seem to live maxed out on credit. $200k cars in the drive but couldn’t pay us in cash. I doubt that the top of the market is doing all that well but Syd’s a large and diverse market. Something for everyone.

The underwater places tend to be out west. I recall the mad dash for McMansions by the FHOG’s. Thought they were getting a better deal but didn’t really factor in the cost to commute back into the city where they worked in. The mortgage saving just got eaten up in commute costs. A few years later we were moving some of them back after they either sold or rented their PPOR’s

The Freckle

bardon wrote:Steady on their Freckle, any fecker that bought a joint in Sydney 98/99 didn’t see a crash, wont see a crash on what they bought in at and as far as wage growth is concerned have blown their debt out the water in the thirteen years since.No we didn’t see a crash obviously and I was way ahead of the game so to speak. What constantly amazed me was the YoY increases without corresponding leaps in wage growth. A few lost their shirts but more because they were novices and didn’t get their leverage right.

Moved this young guy into a major high rise upgrade on Lavender St Milsons Pt. This is back around 02. He was young and single and just bought a one bedder looking north for some insane amount. I think at the time it was costing him slightly more than he was earning in interest only repayments. He was desperately looking for a girlfriend to shack up with and share expenses. Not sure he’s blown the debt out the door just yet. $420k takes a few years to erode away. These figures where quite common for investors chasing the Sydney North Shore market. $400 – 600k was pretty standard.

Those who will feel a crash the most are those who run into debt servicing issues and are forced to liquidate assets at a bottomed out market. That might occur if we run into high inflation and central banks try to suppress it with higher interest rates. In the late 80’s early 90’s we saw interest rates get to 16% on average and 22% for high risk borrowers. That was on inflation in the 8 -10% range. Given the way the muts overseas are carrying on anything’s possible.

The Freckle

From MB today

Something Just Snapped in the Economy (Link)

In short, this report is suggesting that we are headed into recession. Add in the R.P.Data Index of a resumption of house price falls in April and I’m getting the distinct impression that we’re going through some kind of freeze in aggregate demand.

If I had to pick a cause, I’d say that the bank’s shift to unilateral interest rate moves has dramatically undermined confidence in the RBA insurance policy. Folks are headed into their shells.

We might also speculate that this is why the RBA pushed the panic button, it may have picked this up in its industry liaison or one of its other proprietary data sources.… Houses and Holes

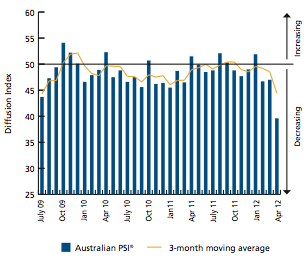

My gut feeling is we’re starting to see downward pressures starting to consolidate. Negative economic pressures are relatively small but are multiplying. This is sooner than I thought. I didn’t expect to see PSI pull back this fast nor to these levels until later in the year.

The hairs are starting to tingle on the back of my neck. I’m hoping I’m wrong because I was hoping to get at least another two years out of this economy before it starts to go pear shaped. I think that’s still possible as most of the pull back was in sales and orders and the most affected sector was finance and insurance (services).

The Freckle

grantos_champos wrote:The Freckle,Are you a former member by the name of JackFlash? Your posts seem very similar and both from Port Hedland. Excuse me if I'm wrong.

Know him well he sends his regards

The freckle

Ian you’re a little ray of sunshine.

You’re on the money mostly for my part. As they say; hope for the best plan for the worst.

Where I would disagree is

Time to stop trying to figure out the world’s woes here

this is exactly the right place to discuss issues like this. Forums (and Blogs) are some of the best information and learning tools around. The diversity and depth of opinion is fascinating to me anyway.

One of the big conundrums for PI’s is how would any down turn affect me. For that you need to understand the problem and relate that to your local situation. So for example would a resource sector driven market like Perth be better than a govt driven sector like Canberra.

Does your demographic area offer protection or is it a potential threat.

I would suggest a full S.W.O.T. analysis of a portfolio to understand its potential to withstand global/national shocks.

http://rapidbi.com/swotanalysis/A SWOT analysis may also reveal opportunities within a portfolio and opportunities on the recovery side of downturns.

It’s not all doom and gloom. Downturns and crashes are all part of market cycles even though I think this one will be a doozy. You don’t have to slash and burn but you need to understand the problem and figure out a way of dealing with it.

The Freckle

scha9799 wrote:Hi Freckle,I really appreciated your research, stat. and opinion?

I am here just wondering where do you live ? what kind of car do you have? how many properties do you have ?

also if OZ property market collapse what will you do ? ( what will you invest in ? or where will park your money ?)

more, in next 3 years which asset class will you invest in ?

Described all that about 4 posts back.

I’ve lived in Oz for about 13 years starting out in Sydney in 98. Been in Port Hedland WA for the last 4 yrs.

I’ll be moving to Mandurah in about 2-3 weeks to set up a new business in labour hire and recruiting. A potentially more lucrative position than transport logistics. It’ll service the resource sector initially and diversify once we get that leg going. I tend to think resources will start to unravel in about 18 months as China slows and major resource projects near completion hence the need to diversify fairly quickly.

I don’t think resources will drop dead over night but it will increasingly become overly competitive as resources return to a steady state sector over the next 5 years.

I’ve been out of property a long time but I was always more interested in building and developing when I was involved. The buy hold wait strategy of recent years didn’t motivate my need for quick returns. When I arrived in 98 the Oz market, especially Sydney was cooking. I just saw warning signs everywhere for the investor. You really needed to know what you where doing and having no knowledge of the Oz market I stayed clear. I saw ppl making crazy money and doing crazy things in those days. It was like a frenzy to me. I saw a lot of ppl ripped off during those years.

I’ve been tempted over the years to chase property from time to time but the hackles always go up on the back of my neck. The fundamentals in Oz property never stack up in my book. Over priced, over leveraged, over taxed and manipulated market(s). When I looked in 98/99 I saw crash written all over the property market. Prices couldn’t ramp up at magnitudes greater than wage growth without correcting. The longer it went on the greater the chance and the bigger the falls.

If I’m going to invest I choose business. I have some simple rules. ROI potential must be in the 300%+/yr for low capital investment, Less than $50k. On a weekly basis I don’t want to work more than 30hrs as an average (currently 27). I’m not soley after money. To me wealth is money plus time. I’m not interested in being cash rich time poor. If I have to choose I’ll take time over money any day.

I’m a minimalist. I own a car a truck a microlight and personal affects.. that’s it. I like being mobile and the ability to pack up in hrs and move if I have to. I’m not interested in being rich. I’ve watched many ppl , mostly friends, chase the money. What I learnt was that money has a personal price. The more you earn the more personal the price extracted. Usually in quality time and personal relationships.

The Freckle

This Is the First Time In History that All Central Banks Have Printed Money at the Same Time … And They’re Failing Miserably 01/05/2012

Four of the world’s largest central banks have gone absolutely berserk, running the money printing presses like never before in history:

Is this what the end game looks like? Print till we bust!

The Freckle

bandwagon wrote:If you do have IPs, I’m stumped as to where you have invested?I saw the writing on the wall years ago but like many others thought the great correction would have happened much sooner. What we didn’t realise was the lengths governments and central banks would go to in propping up a failing system. I have absolutely no intention of owning property at this point in time. Too much capital with too much risk for such a piddly return.

I’m 55, had one heart attack and have every intention of dieing in debt because I sure as hell can’t take it with me.

I invest directly into business and a little in PM’s through shares and ETF’s. My business investments have a ROI of around 500% annually. The PM’s are being hammered at the moment down around 30% but they’re a hedge and as insurance it’s relatively cheap. PM’s will recover their losses over time and if everything turns to custard like I suspect then we could see a several hundred percent return.

the Freckle

For Luke and other non believers with cognitive dissonance.

The exponential growth in debt and declining GDP is accelerating as the massive debt loads drag on growth. Debt loads are being managed by artificially (market manipulation) suppressing interest rates. A 1% rise in US treasuries would literally cripple The US overnight.

Govt figures are massaged and manipulated to give the sheeple the idea that their governments have things under control, however, the staggering rise in unemployment (and these are suppressed official figures – real world figures are magnitudes worse again) over the last 5 years is starting to manifest itself as social unrest (OWS movement)

Spain now the 12th nation in Europe to fall into recession – the dramatically bad changes in unemployment and GDP since the crisis began (especially among the youth) suggest more angst is to come as the political compact is pushed to its limits.

Debt Overhangs: Past and Present

Carmen M. Reinhart, Vincent R. Reinhart, Kenneth S. Rogoff

NBER Working Paper No. 18015

Issued in April 2012We identify the major public debt overhang episodes in the advanced economies since the early 1800s, characterized by public debt to GDP levels exceeding 90% for at least five years. Consistent with Reinhart and Rogoff (2010) and other more recent research, we find that public debt overhang episodes are associated with growth over one percent lower than during other periods. Perhaps the most striking new finding here is the duration of the average debt overhang episode. Among the 26 episodes we identify, 20 lasted more than a decade. Five of the six shorter episodes were immediately after World Wars I and II. Across all 26 cases, the average duration in years is about 23 years. The long duration belies the view that the correlation is caused mainly by debt buildups during business cycle recessions. The long duration also implies that cumulative shortfall in output from debt overhang is potentially massive. We find that growth effects are significant even in the many episodes where debtor countries were able to secure continual access to capital markets at relatively low real interest rates. That is, growth-reducing effects of high public debt are apparently not transmitted exclusively through high real interest rates.

Presenting Bridgewater’s Weimar Hyperinflationary Case Study

http://www.zerohedge.com/news/presenting-bridgewaters-weimar-hyperinflationary-case-study

Eurozone debt web: Who owes what to whom?

http://www.bbc.co.uk/news/business-15748696

An interactive debt graphic that reveals the interdependence of the financial system. All for one and one for all. Check out the USA and UK.. staggering.Worse Than 2008

http://www.zerohedge.com/news/guest-post-worse-2008The Freckle

bardon wrote:I am in awe of your economic knowledge and readings.On average I would read 1 – 3hrs of material a day. Compared to many what I know wouldn’t fill the back of a postage stamp.

The Freckle

scha9799 wrote:wow I am really interested in what you guys saying now !!I think end of the day if you scared of the big crush, then sell all your properties ….. then end of the stories.

Not necessarily. There are arguments that support holding property in such a crises. The arguments do not centre around whether or not you loose your shirt but will property offer the opportunity of reduced losses compared to other asset classes including cash.

if you want to be in the property game then stay on !

Serious investing in any class isn’t generally considered a game. ‘Staying on’ in any investment during a crash would be foolish I would think. The smart guys move from asset class to asset class. They all have their day in the sun as well as in the shadows. Chase the sun in investment classes and your returns over 40 years would make property alone look like beer money.

always have boom and burst, it's just part of the property cycle : ) i just enjoy the roller-coaster ride : )

Yep. Always fun till someone looses an eye.

The Freckle

bardon wrote:Well if the price of that house and its rents are higher now than they were way back when, then they have conformed to the general rule, no ?“No time in history” is a very long time for you to have a comprehensive economic knowledge of.

You talk as if rents and asset prices increase in a linear fashion when they don’t. At times they’ve been up and other times they’ve been down. It’s all timing.

Don’t claim to have ‘comprehensive’ knowledge and history books cover from the year dot until now. You just have to read them.

The Freckle

luke86 wrote:Freckle- The sky will not fall in and the sun will rise tomorrow.True but for how long.

Some countries have a debt prioblem but most do not.

Luke do you live in an information vacuum or something

I strongly disagree with your statement that every major economy is near collapse.

Then you don’t appreciate the interconnected nature of the financial system. The EU doesn’t have the funds to save Spain and now Italy is teetering. If you stick your head up for a minute and listen to some of the more credible analysts you start to see what a disaster the EU is. There is no way out other than to print or go bust. Problem is going bust is inevitable.

Reality is slowly setting in in Europe that they can’t beat this collapse. They’re now starting to plan how they can manage the worst of it and mitigate their loses. In other words shifting the losses to the tax payer.

Once Europe starts to unravel then the US can’t help but follow. It controls 95% (through 5 of the biggest banks) of the $706T derivative market which is largely CDS insuring loan defaults of Euro banks along with sovereigns. Another AIG but x5

I am guessing that you consider yourself as a notable investor on teh world stage judging by how you speak?

The notable ones are those who manage billions in investment funds.

Having said that, I am not privvy to the information that major institutions and governments have. And I strongly suspect nor do you- We are all generally poorly informed and only know a fraction of the full global enonomic picture.

Then you’re not looking very hard. Economic analysis and reporting is not soley a goverment function. Universities, think tanks, private analysts, investment houses, banks…. the resources for good quality verifiable data are massive and freely available. Much more than I can get through.

IMF World Economic Outlook

January 24, 2012

http://www.imf.org/external/pubs/ft/weo/2012/update/01/pdf/0112.pdfThe updated WEO projections see global activity

decelerating but not collapsing. Most advanced

economies avoid falling back into a recession,

while activity in emerging and developing

economies slows from a high pace.However, this

is predicated on the assumption that in the euro

area, policymakers intensify efforts to address the

crisis.The plonkers in the EU have been trying to stabilise this crises for well over two years now. We now have Greece, Portugal and Spain not in a recession but a depression. ECB debt through shonky back door money printing to support insolvent banks has ballooned to over a trillion Euro with more printing to come. Germany and to a lesser degree France are on the hook for this debt. Ireland is lining up to have it’s debt forgiven as they struggle under austerity.

Go and do some digging on China, Russia and India. You’ll find things aren’t as rosey as they’re made out to be there either.

The smart guys accept the fact that a GFC of significant proportions is on the way. What they and we don’t know is when and where or how bad it’ll actually get. But they’re positioning themselves to take a hit and hopefully come out the other side stronger than the next guy. That might just give them an advantage to increase their wealth in leaps and bounds.

The cheer leader types who only see positive things and ignore anything remotely construed as negative (doesn’t fit the personality or peer group image) will wake up one morning and wonder how they lost everything.

The Freckle