Forum Replies Created

- xdrew wrote:the very real possiblity of CONFISCATION OF LAND ASSETS is on the table until normality is restored

That could be a kindness. Put the poor buggers out of their misery. I don’t actually see it happening but property value based on the Drachma may equate to confiscation any way.

Has Greece ever been normal? Default is a way of life for those bludgers.

zmagen wrote:Hey, Freckle – have you seen Bulgaria's 2011 numbers, just released? Lalaland may be coming…Haven’t seen theirs but I think there’s a trend towards fantasy future growth and revenue figures in many places. California is another example but hey they have Hollywood, land of dreams.

Bulgaria I think you’ll find is benefiting from German manufacturing. The Germans have moved quite a lot of sub assembly and manufacturing to the smaller low labour cost ex Eastern Bloc countries.

simple wrote:Freckle, to me it sounds like one looong depression event with dead cat bounce along the way

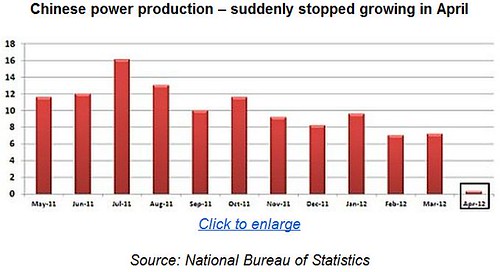

China just hit the brakes big time. Lending just crashed and deleveraging is accelerating from what I can see so far. Early days but I think the Chinese growth story just ended.

Iron Ore’s dropping like a stone ($133 today) and China’s energy consumption fell of a cliff in Apr

The coal price ($98.35) is another commodity that has slumped.

Aus ToT are going to look pretty sick next quarter. I can see all this becoming a death spiral trapped in a negative feedback loop.

Just a mirage Ziv.

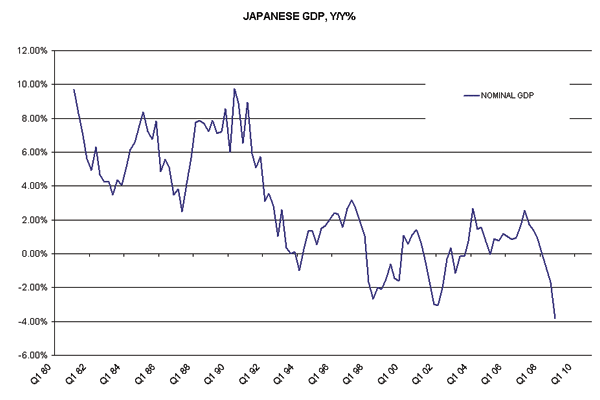

I always look at these things in context with what’s happening globally and it just doesn’t tally. Japan’s export markets are in one hell of mess and sinking fast. A few reactors going online won’t be nearly enough. It’ll be interesting to see how the others fair after inspections and maintenance are complete.

I expect to see industry continue to migrate offshore because of long term energy uncertainty. Along with it’s huge debt energy security will remain Japans’ biggest headache for the next two decades. Going long Japans’ aging population will ensure a growing drag on growth (estimated at 1% of GDP annually).

Japans’ electronics industry will struggle for some time I think. Much of what they produce is about what people want as opposed to what the need. As the world deleverages things can only get tougher for Japan. If there was a way out you’d think they would have found after 3 decades of massive credit growth but Japan with actually little growth over that time.

http://www.jeita.or.jp/english/stat/pdf/20111215.pdf

Domestic production by the Japanese electronics industry in 2011 is estimated to drop

10% from the 2010 result, to ¥13.8 trillion, the first year-on-year decrease in two years.

Although tremendous efforts were made to restore supply chains and production lost after

the Great East Japan Earthquake, the continuing high yen and economic sluggishness in

many overseas markets impacted exports from Japan. In 2012, domestic production by the

industries is expected to remain flat at ¥13.7 trillion, as the operating environment for

Japanese manufacturers remains severe.

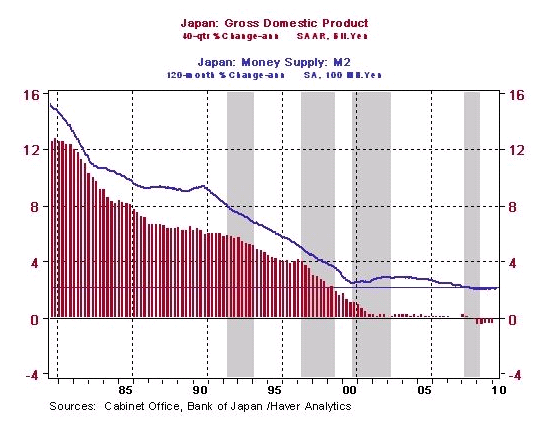

The contraction in money supply is scary.

Well it’s been 6 years and I think the next GFC crash is on our doorstep. We’ll know for sure I think within the next few months. The outlook for property would logically take a hit with this coming crash. Mining towns may be the first to start contracting along with mining states if the Chinese contraction is anything to go by.

I’m wondering if we’re going to see a rise in available property for sale over the next month. My bet is yes and the size of the rise may well be a measure of any panic in the market.

Interesting days ahead.

Very hard to fill a room let alone a house. People are picky. Even when you can let a room TO is high.

its a logistic s nightmare buying this volume of homes.. its not like buy 100 apartments units and having to redo them all.

You’d definitely have to make sure you have all your ducks in a row but I actually think it’s doable

thats why I only buy about 5 to 7 homes a month in any market it keeps me on top of whats happening.

Certainly much more controllable and less stressful but I reckon you could leverage yours and your teams expertise. Couple that with a few out of work RE agents/PM’s and you could definitely build teams to do the grunt work. Use the intellectual capital within your biz to QA the deals and with management oversight systems and I think you could run with it in relatively quick time.

It’s like the theory the NZ Army runs on. We’re way too small economically to afford large defense force establishments so we run a highly trained core army unit that can expand exponentially if needed. The skill and knowledge is maintained in that core component. I think you have to strategise it like that.

these hedge funds are going to come… will be intersting to see how they make out.

MY guess is they can’t do it without guys like you. For any chance of success they have to tap into credible industry players to have any hope. I think they’re dead in the water otherwise.

jayhinrichs wrote:Had a conference call today with yet another hedge fund that is jumping into the SFR game. Colony Capital has already jumped in. as well as Columbia endowments in Phoneix. And we saw what happened there when they bought 500 houses for 8% net yield. Turned the market.One the single investor would have to be careful buying into. With such big inventory you now have the prospect of a manipulated market both at the asset value level and rental yield level. Competition for tenants??

this company bought 180 homes at foreclosure auctions last 60 days in SoCAL.. And are looking at Atlanta and a few other cash flow markets.

Interesting. Cal is an economic disaster on a similar scale to Greece. $15B deficits, 1/3 of all US welfare recipients and a heap of them loosing their benefits shortly. Businesses leaving in droves and my bet is Faceplant will be a dud within months of its IPO.

Their target return is 4 to 7% Net Yields… they have 1 billion committed,,

Better than treasuries for sure. You’ve got around 8 mil in the SFR pipeline. The creams in the top 25% maybe 2mil homes. You would probably have to do some more filtering to weed out the low prospect regions I would think to come up with potential targets. At say 80 – 150k average that’s $160 – 300B total market value. With currently available inventory you probably looking at closer to $500B of value there. That figure will ramp up maybe 5%-10%/yr if HF’s start chasing hard. The problem is where is the price turning point when asset value outstrips a viable yield because I just don’t see rents rising in the current or foreseeable future. In fact they could turn down. Then what? How will the HF’s play it. Repackage into property backed securities. I can see this getting messy.

I think they took Warren Buffets advice.

What do they say “Do as he does not what he says”.

couple of young Harvard Grads as in young mid 30’s live in Silicon Valley,,, Both worked at Starwood Capital and Lehman brothers.

The sort that wouldn’t know their arse from their elbow when it comes to property

Going to be interesting to see how they handle the PM issues that are unique to SFR’s…..

And that’s where I see a whole heap of problems if renters don’t get serviced. Opportunity Jay??

They will hit CA hard… We are looking at providing them with Atlanta inventory,,, with the prices of Atlanta inventory they could dominate the Foreclosure market

To dominate I would imagine you would need a large and experienced team to acquire and process that many deals especially in short period of time. To dominate you would also have to corner the market in some way and I’m not convinced they have the people resources and expertise to do that.

…and with their net Yield requirement they will drive prices up no doubt..

Temporarily probably but not on their own. 200 properties is just a regular if not small development in the scale of things. They would have to be chasing 1000’s I would think to have that sort of impact. And we are only talking SFR inventory are we not? I also imagine they would try to diversify their market or are they not that smart?

In the 14 major Atlanta counties 200 homes a month is not out of the question especially at purchase prices under 100k… they won’t be trolling for the 10k homes so those who like that market have no fear…

Here’s where things could get a bit chaotic. If several players are chasing inventory then the personell and expertise to process volumes just wouldn’t exist and that presents a portfolio quality issue. That then degrades investment return if PM gets out of hand or challenging.

I have them looking at some other markets as well.

They won’t do my TWH model but I certainly would not mind being in front of this freight train and just wholesale inventory to them…

My thoughts are to set up a new company to handle this as a buyers agent and PM business. Possibly spin it off later for a dollar or two

Be interesting to see how this affects the turn key companies that need to represent 15% plus yields to attract investors….

A percentage of investors will adjust by shifting to a mix of yield and asset appreciation as opposed to yield only

I wonder if an OZ investor will jump into US real Estate on the guise of appreciation only and very small net returns….???

There will be some but they would have to be a little sharper to play in this market if HF’s become a dominant player

Hedge fund hot money with no where to go. Another bubble, albeit small, in the making.

I would make sure I covered my positions with rock solid agreements and secure payment arrangements. I can see this thing blowing up in very short time with these guys.

They’ll drive the market at break neck speed as others pile in also trying to catch the ride up. This is your perfect boom bust model.

Have fun while it lasts. Just don’t get caught holding the bag.

Rowan MCcole wrote:Does any one beleive the outcome of the presidential election swill have impact on where the USD moves in the next year or so ?Not in a macro way I’m thinking. Too many large forces pushing things around at the moment. Most of the major central banks are manipulating their currencies to try and keep their economies competitive. That appears to be the main driver at this point not politics.

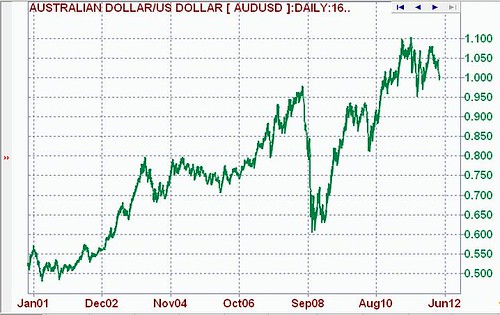

engelo10 wrote:I have just transferred funds into my US account.Your timing might not be too bad I’m thinking. The next crunch is just around the corner. Word on the street suggests Spain may have about a month before it goes over the cliff. Then we’ll see the EU go into hysterics. I’d expect to see the € slide against the $ as events unfold.

The AU$ is likely to slide against the US$ for the time being but if Ben prints expect to see that reverse.

Commodities are falling at the moment. Iron ore is down along with coal. The resource boom is over in my book. Our ToT will take another big hit in volumes but a currency slide may help overall prices. Small Cap miners are getting smashed at the moment including PM’s which is kinda weird.

My gut tells me we’re on the verge of the next GFC. It’ll be interesting to see what central banks will do to pre-empt the next bust. Bucket loads of printing me thinks although BoE have said no more easing. Wonder how long they can hold their nerve for.

Interesting times ahead.

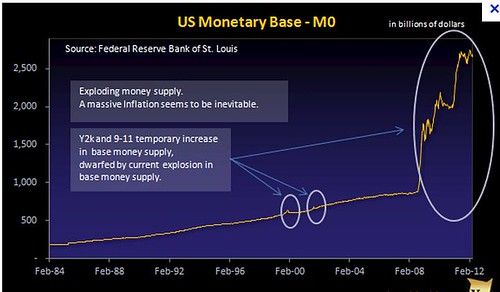

engelo10 wrote:Long term I think the greenback will recover.FIAT currencies do not appreciate when you inflate the currency. Economics 101 Engelo.

It would reverse in a crash as we saw in 07/08 but to a lesser extent as other options for safe haven emerge. AU$ is now considered to offer some safe haven potential and that trend/theory/hypothesis is gaining traction in markets. That could see a substantial appreciation against the US$ during and after another crash as the Fed would almost certainly hit the ‘print’ button.

Your long bet for a weaker AUD vs stronger USD would be a big bet amigo. You’re betting against a historic trend to depreciate the dollar and helicopter Bens’ penchant for expanding the money supply at all costs.

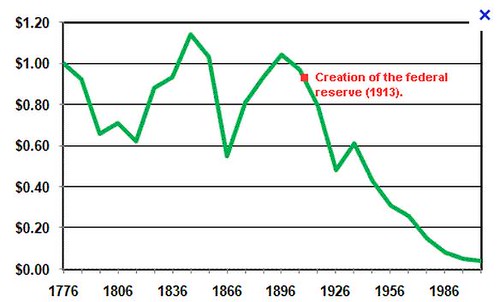

Consequences of the M1 Money Supply

http://ncrenegade.com/editorial/consequences-of-the-m1-money-supply/

The expansion of money, given an increase in the monetary base, is inevitable, and will ultimately result in higher inflation and interest rates. In shorter time frames, the expansion of money can also result in higher stock prices, a weaker currency, and increases in commodity prices such as oil and gold.

I bet my back teeth my bones’ill be dust before they build another airport. Not too worry. We’ll be out of oil by then and flying around in Zepplins

Rowan, it’s likely you’ll see the AU$ continue to drop until Benny launches another QE operation. The markets are suggesting Sep at this point.

Simple hedge, go 50/50. You get half the benefit either way.

zmagen wrote:Yes, being flogged that deal myself by some brits. As Freckle puts it, and as their guarantees promise, no one knows what happens after 4-5 years. Kinda like Aussie mining towns really…You have to actually have assets when booms come along to kill the pig on these deals. By the time the spruikers hit their straps you know there’s a good chance you’ve missed the boat and any deal now carries 1000% more risk and a compressed time frame to make your buck before it all heads south again.

Alright if your a light on your feet small margin player but most are not.

Interesting. Estimated to have around 900 billion barrels of oil of which 4% (36B) is considered recoverable with current technologies. That’ll run the world for about 157 days. Kinda puts its size in perspective eh?

It would be interesting to know how long the field will last for. The set up takes a lot of manpower but once its been built out (pumps infrastructure etc) you need bugger all people to run these things.

5 years??

The Freckle

Been trying to tell PI’s in mining towns for almost 2 years that the booms over. We’re near or entering the bust phase. Given the length of property cycles you can’t get in and out and still expect to have a shirt on your back.

But then PI’s luv to keep listening to property industry spruiking and self interested parties in stead of looking at the wider picture and underlying fundamentals.

The world is deleveraging which means lower consumption lower demand.

Governments are dealing with debt problems by transferring wealth from the housing sector to recapitalise bank balance sheets. That’s killing growth.

China has massive financial problems few understand and less even know about. Restructuring means growth models of 3% or possibly less. That means huge downward pressure on commodities.

All the info’s out there you just have to put the pieces together.

Derek wrote:Can't see anything positive for Roebourne out of this.Has about as much appeal as living at the local tip. There’s a small subdivision almost finished now I think. Not sure what the block values are or whose bought/owns them.

Town has a high percentage of indigenous residents with few problems if I recall correctly. Unlike South Hedland with it’s indigenous youth problems and high crime.

Pt Sampson, Wickham will do alright out of it initially.

lawsjs wrote:BTW there is a very interesting Bloomberg article today suggesting housing has bottomed in th US – I can’t get the link right now, but it kind of backed up what Jay, Alex, Cheeves, Kyler the dress wearer and Emma have been saying.Seeing a surge in these articles as well. Not convinced by a long shot actually. The surge in articles rely on a mix of industry generated opinion and cherry picking data (often inaccurate – govt massaged) to support those opinions. What I see though is exactly the opposite. The fundamentals don’t support a recovery hypothesis.

What I think is happening is a surge of hot PI money flowing into the market from overseas investors looking to possibly buffer their wealth. I get the feeling many internationals see the US as at or near bottom so if things do go pear shaped any fall would be minor if at all.

jayhinrichs wrote:.. I had a bad chest exray that my doc wanted checked out on a ct scan… not an emergency but the type of thing that gets you nervous… by the end of the next day I was in and out of the hospital with the procedure done and will have results tomorrow.It’s the age group we’re in mate!! I’ve got a few bits that aren’t working as well as they should but the old girl still thinks I’m a legend. Thank God for pills

Hey had a heart attack 3 years ago. Didn’t even know I was having one. I thought I had food poisoning or something. Started off with an ache between the shoulder blades that morphed into a full blown ache from jaw to my gut. I was lucky. It was early morning (6.30am) when it started. I was scheduled for a site induction in town at one of the big miners. I’m usually 100’s of km’s out in the bush. BY the time I realised I was crook I was on my last legs. Managed to get myself around to emergency at the hospital a block away. By the time I got there I was vomiting, had the sweats and was struggling to stay upright.

They knew straight away what was up and fortunately I got this ancient old South African guy who nailed it (type of heart attack) and had me stabilised 30 min’s after pumping drugs into me. By 11am I was on a Royal Flying Doctor flight down to Perth. 3pm I was all tucked up in Royal Perth Hospital with a drop dead gorgeous Doc

Next morning they did an angiogram followed by an angioplasty (2 stents). 3rd day they kicked me out. Service was tops. They flew the old girl down and put her up in a hotel, gave her taxi chits to get around and did the same thing for both of us to fly back home.

That’s my 4th stay in Aussy hospitals, meningitis, 2 food poisonings and a heart attack. Has never cost me a cent and I have to say the service and care couldn’t be faulted.

Jay I see your a bit of flyer… I play around with microlights