Forum Replies Created

Kong your problem at this time is your lack of knowledge and experience. The current market is really one for PI experts and I expect to see them have great difficulty as well. The PI landscape is changing rapidly and mainstream methodologies and approaches will need reshaping to capture value in the property market.

Your current proposal is a recipe for disaster. 5 – 10 yrs ago yes (a rising market) but not today (a falling market).

We are likely to experience over the coming years one of the greatest financial calamities of our lifetime. GFC v2 will make GFC v1 look like a practice run. It will present opportunities to the patient and the well informed but crucify those who rush in and only do cursory DD.

The new generation of PI’s will need to take a more holistic view of the market and incorporate national and international economic drivers into their investment planning.

There are some very switched on and experienced cookies within this forum. Leverage this knowledge base to up skill yourself over the next 12 months while you watch and learn to see how the PI landscape evolves as this current GFC unfolds.

kong71286 wrote:I feel a bit nervous as well, since I have never purchased a property before, and market sentiment doesn’t seem that great, but I’m thinking that in terms of exit strategy for worst case scenario I could always discount my property by up to $26,500, and many real estate agents have stated that if I were to do so, it would sell relatively quickly. Also if the property is neutrally/positively geared market swings over the next 5 years shouldn’t be too big of a deal.worst case scenario I could always discount my property by up to $26,500

Are you serious!!! That’s not even close to worst case scenario and if things go bad I can tell you from experience it will not sell quickly.

Keep your money in your pocket and watch and wait. The fireworks are about to start any day soon.

Can’t go the tablet thing. Wife has one (Android) that keeps her out of my hair (most of the time anyway). Droid OS has a long way to go in my opinion especially on tablets. But no matter how problematic they are I definitely won’t buy anything starting with “i”. I’d much rather have a netbook.

bardon wrote:This does not result in a step change and the transitions happen over many years and is more of a gradual process whereby the new entrant takes up market share and then a point is reached where it overtakes the previous energy source in terms of usage..

Shale gas is the fly in the ointment so to speak. Since the mad dash to uncover shale gas deposits in the US the industry has gone ballistic. The sheer quantity of gas being bought on stream is literally displacing coal and oil (heating, generating etc) at never before seen rates. The price crash in gas is making coal even less competitive

The downward pressure in coal prices is almost totally blamed on displaced coal markets in the US seeking new customers in China. in India’s case transport infrastructure is limiting their coal distribution capability (most mining is in the north). Even at higher prices it easier to import coal and deliver it to ports near their markets. The flip side to that is that lack of infrastructure invites building a gas infrastructure as a priority over a coal infrastructure if you’re going to reduce dependence on coal anyway.

Coal isn’t going anywhere soon. I think there’s something like 300 yrs supply of the stuff at current rates of consumption. What I can see in the future though is different processing practices to turn coal into other products like gas and liquid fuels.

I think you’ll find that gas will displace coal faster than most think. If you look around investment markets shale gas is seen as the hot play of the day to be involved with even with a relatively low price compared to a few years ago. It is more likely to attract investment capital than coal.

Australia has some potentially large shale gas fields located in the outback. It’ll be interesting to see how those develop over the coming years. Maybe the new mining towns of the future.

This just in from MB

Chinese Defaulting on Bulk Contracts

http://www.macrobusiness.com.au/2012/05/chinese-defaulting-on-bulk-contracts/I can see this getting really ugly very fast. I’ve argued for well over 18 months locally that expansion of mine capacity in the Pilbara region alone would exceed all of China’s seaborne demand by at least 100mtpa. Add to that supply from other regions of Australia and supply coming on stream from international sources and I couldn’t see anything but a recipe for disaster.

China’s going to try and bring forward infrastructure projects because their economy isn’t just heading for a hard landing it’s actually stalling big time.

http://www.macrobusiness.com.au/2012/05/here-comes-the-chinese-stimulus/You know when you hit the brakes and then miss a gear to get moving again… to me that’s China but they’ve picked too low a gear and slowed down even more to stalling speed. I think they’ve just snapped an axle trying.

This has the makings of one big balls up.

mattsta wrote:the chinese cancelling coal orders will not be good for the various mining economies – and could have negative impacts for investment properties in those areas too. i will keep an eye out for what's happening in china regarding demand for australia's resourcesBoth India and China are developing energy policies that reduce their dependence on coal

Milne said China and India were openly discussing moving away from coal.

http://articles.economictimes.indiatimes.com/2012-03-19/news/31210665_1_coking-coal-iron-ore-indian-steelGas is taking center stage as the energy source of choice given its eco profile (compared to coal) and it’s cost. If anything I expect to see pressure exerted by green groups and government to grow the gas industry at the expense of the coal industry over the coming decades.

Some coal stats

Exports

Black coal is Australia’s second-highest export commodity and Australia is the world’s leading coal exporter.Over the past 10 years black coal exports have increased by more than 50%.

Japan takes 39.3% of Australia’s black coal exports – the largest share, with a total of 115.3 million tonnes exported last financial year.

China is our second largest market with 42.4 million tonnes in 2009-2010, almost double the previous year.

The Republic of Korea accounts for 40.7 million tonnes, India for 31.92 million tonnes and Taiwan for 26.53 million tonnes, rounding out the top five destinations for coal from Australia.

Together these five countries accounted for 88% of all black coal exports with a further 28 countries taking the remaining 12%.

Demand for coal in China and India is expected to increase dramatically over the next decade in line with these countries’ projected need for coal for energy and manufacturing.

Australia was the only one of the world’s 33 advanced economies to grow in 2009 during the worst global recession since the Great Depression.

The principal reason for this was our continued coal exports. The importance of coal in the economy is also evident in its growing share of Gross Domestic Product.

This share has more than doubled, from 1.7 % in 2006-07 to 3.5 % in 2008-09, making it the largest contributor to the mining sector.

http://www.australiancoal.com.au/exports.htmlIt’s early days yet bit it appears Chinese mills are delaying or cancelling orders for coal and ore.

http://www.cnbc.com/id/47498211

I notice that LME stockpiles are rising.. nicker for example

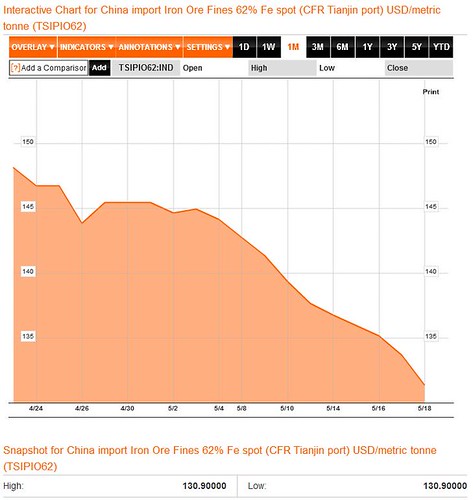

Fe @ 62% was US$145/dmt on 1 May. It’s slumped to US$130/dmt

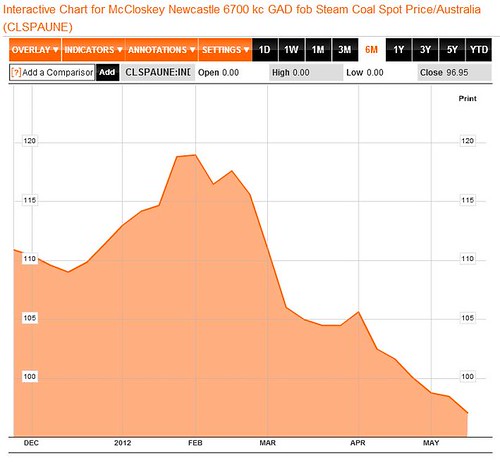

Coal is looking decidedly shaky. That has implications for the East Coast especially QLD

The monthly volume volatility is concerning.

Even more concerning is the massive percentage of export earnings these commodities represent

China, which now receives around 30% (or $7 billion per month worth) of Australia’s total merchandise exports, up from only 5% in 2000:

The question I ask myself is; are commodities returning to trend given global growth is seriously impaired and likely to be for the foreseeable future?

avest50 wrote:There is plenty of new evidence to suggest that the USD is making a comeback..Where?

but not yet.

Oh you were just kidding!!!

The US housing market is finally starting to bottom out.

You mean the sub prime market is almost but not quite bottoming.

Historically, the currency value of the US follows its real estate market.

I have no idea how you figure that. So the RE market has been falling all this time??

BUT, there is a lag time between the recovery. So, if the U.S housing makret is just starting to bottom out, it will be some time before prices return to normal. Afterwards, it could be years before the USD catches up.

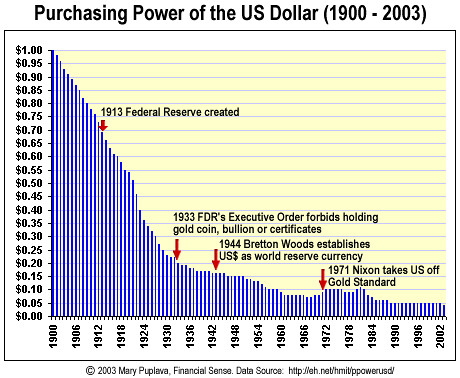

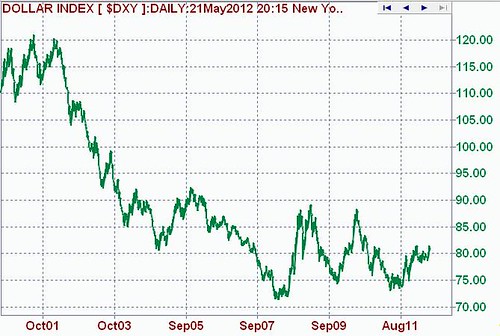

The USD isn't catching up to anything tangible like housing. Fed policy is to devalue it and keep devaluing it. It's bee smashed down over the last decade and that practice continues.

<moderator: delete advertising>

It's not a blog. It's a promo article for US Invest. Much of what he writes is either rubbish or simply promo blurb

bigfirerichie wrote:Had the same problem…solved with xetrade.com, let’s you transfer from us bank accountInteresting. I’ve been using if for a while now to move money to NZ accounts and Malta. Didn’t realise you could swing it back the other way.

JT this (see below) may inspire some confidence but I think it’s overly optimistic. Many of the current projects are scheduled to be in operation by 2014 with some running out to 2016. Whats not clear is how quickly the scale of the projects will wind down as they near completion and what might be behind them to fill the vacuum so to speak.

http://www.theresourcechannel.com.au/blog/2012-australian-oil-gas-project-summary

I like what I’m reading because I intend to set up a labour hire biz out of Perth initially. The idea that we need to ramp up from 75k jobs to 250k by 2014 gives me hope but again I still think that’s way too optimistic. Another report I was reading though indicates staff TO (churn rate) is in the vicinity of 20%/YR. A stat I like given my job will be to supply replacements. I can here the cash register going flat out when I see these numbers.

JT7 wrote:China is an interesting one. I don’t agree it is at a stand still although it has through self regulation slowed and there is an argument that if Europe sinks into a recession it will be able to stimulate it’s economy similar to 2008.China’s easing policy and size are widely considered to have complicated China’s ability to cope with economic shock. China did what everyone else did and the outcome as we know today was/is a bigger mess to clean up.

China’s ability to stimulate now is also considered to be severely limited if at all and the last massive stimulation program has actually exacerbated the current crises emerging in their financial system. To many China is an enigma. Comment by MSM over the last 2 years consistently over estimates China’s ability to drive global growth and under estimates its financial problems often citing trillions in foreign reserve as evidence of this.

The following link is a presentation given by Mike Pettis on China’s situation. He expands on the theory of where it needs to go if it is to survive this GFC and continue to grow into the future in a sustainable way.

Patrick Chovanec gives a detailed an interesting account of China’s property market and the part it’s playing in driving down growth.

http://chovanec.wordpress.com/2012/05/16/china-real-estate-unravels/

An interesting article by Nomura on metal consumption based on method of analysis and then compared to western countries.

http://www.alsosprachanalyst.com/economy/the-china-driven-commodities-super-cycle-debate-nomura-edition.htmlI don’t agree with everything he says especially hard or soft landing scenarios for China but this comment struck me as profligate waste in the Chinese construction industry;

Significantly more steel to generate the same USD1mn of GDP as other countries

Significantly more copper to generate the same USD1mn of GDP

Significantly more aluminium to generate the same USD1mn of GDP

and

Miners and mining-related companies have been among the largest beneficiaries of China’s rapid growth since 2001, and if China’s growth model is in the process of changing, even in a small way, then the negative consequences of such change are likely to be felt disproportionately by those who have benefitted the most from the previous trend, especially given current production expansion plans are designed to meet continued and rapid demand growth from China

and then there’s this analysis from Zarathustra that is just plain scary. He provides ample evidence via several scenarios that predict growth from -6% to +4% not the 7+% the world needs China to come up with to keep us in the style we’re accustomed to.

http://www.alsosprachanalyst.com/economy/crash-chinese-economy.html

You owe me girl

Definition of ‘Millage Rate’

The amount per $1,000 that is used to calculate taxes on property. Millage rates are most often found in personal property taxes, where the expressed millage rate is multiplied by the total taxable value of the property to arrive at the property taxes due. Millage rates are also used by school boards to calculate local school taxes to be collected, based on a derivation of the total property value within school district boundaries.Investopedia explains ‘Millage Rate’

The term is derived from the root word mill, which means “thousand”. Millage rates are often expressed mathematically with the symbol %o, as in 1%o, which is one part per thousand, or 0.1%. Millage rates for individual properties are usually found on the property deed itself.Read more: http://www.investopedia.com/terms/m/millagerate.asp#ixzz1vHFh9Qzy

JT7 wrote:It appears Vale doesn’t agree with some views expressed here.A plan that’s been on the drawing board for some time and makes sense to continue with even though global uncertainty is the theme of the day.

Mining will not stop. Construction of new mines will not stop.

What will change is the price of commodities and the volumes. Both will reduce and some commodities like coal and iron ore I expect to see a substantial drop in price and volume.

China’s virtually come to a grinding halt. Given that it takes 60% of seaborne ore that’s going to literally plunge in price and volume. Added to that is higher quality and a cheaper source being developed in Africa over the next few years. Competitiveness here will have to improve if AU is to retain it’s share.

Both India and China have stated aims to improve energy production outcomes in terms of efficiency and pollution. That’s morphing into a move towards gas as a progressive replacement (not totally) for coal. So coal prices and volumes will come under pressure going forward.

The upshot of all this is that given GFC v2 is just around the corner then the most likely scenario is a retracement back to early 00 prices and volumes.

I would expect to see resource based construction drop off by at least 80% over the next 3 years.

Boom over in my book.

A great management and marketing strategy John. I’m impressed.

I believe you can fax cheques too. Their version of netbanking

triptizehd wrote:such as taking a photo of a check / cheque with your iPhone as a way of depositing it..

triptizehd wrote:such as taking a photo of a check / cheque with your iPhone as a way of depositing it..Reminds me of DeCaprio in ‘Catch Me If You Can”. His character ‘Frank Abagnale Jr’ would have just luved that!!

triptizehd wrote:Wow incredible, on the other hand their horse and carriage logo says it all… .Apparently cheques are quite common over there as well. Couldn’t tell you the last time I saw one let alone wrote one out.

Tell a lie. A buddy of mine is still analogue. Hasn’t really progressed from wind up watches. I tried to bring him into the age of LCD screens and battery operated devices but to no avail. The little netbook I set up for him found a resting place on top of a pile of papers. Trying to teach him even basic computer skills was like teaching advanced math to my wife. Luv her to bits but as thick as 2 short planks when it comes to ‘rithmatic

Amazing isn’t it. We live in some of the most technologically advanced countries in the world and yet a simple money transaction is still one of the hardest things to do.

Might as well live in Tajikistan for all the good it does.

Videographic for Japan. Nicely summarises the problems Japan faces.

Rebalancing the Economy: Japan

http://www.economist.com/multimedia?bclid=1154831493001&bctid=1250962214001