Forum Replies Created

Bought another $10k into a silver miner. Of course Murphy was watching and it immediately went down.

Dad why aren't we paying our mortgage.

Well son we owe more than we own..

That's not good eh dad…

It sucks son but we're definitely not the only ones…

Dad…

Yes Son….

Why is everyone going to the US to buy property?

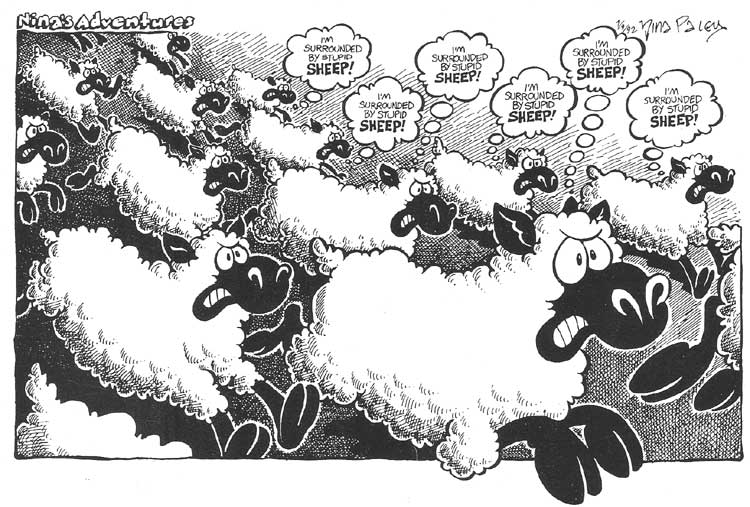

You know how sheep like to follow each each other??

Yes Dad…

Oh!…

And of course the exchange rate will revert back to the mean. You betcha!!!

USD currency over 10 years

JYN/USD

EUR/USD

AUD/USD

But Dad it reverted during the GFC

Yes son.. and so did property.

Ohh….. Does that mean they're screwed Dad

'fraid so son…

You also need to come with your buy-in costs as well.

An agreement is a contract and therefore falls under tort law. Contract law is not written in stone instead disputes are about what is fair and reasonable. Consequently one can include almost anything in a legally binding agreement subject to the fairness proviso. Agreements cannot contravene or side step legislative law. For example certain rights cannot be negotiated away simply because 2 parties agree.

Common english contracts are becoming more popular especially with the advent of the internet and better access to legal opinion. So don't be afraid to be a little more wordy in your agreements. That doesn't mean you have to use a legalese style simply that you can include explanatory notes to make your meaning clear. Get a community law center to give it the once over if you're not sure. They're usually free,

Bardon you would make the consummate politician. Whenever we have our little chats I'm reminded of interviews in the past with John Howard and many an interviewer. He was the master at obfuscation and talking around the subject without ever addressing the points raised.

John would be proud of you.

I also doubt the opportunity cost of owning is factored in either.

bardon wrote:There is a saying that "hydrocarbons beget more hydrocarbons" (unless your a Peak Oiler god bless them) cheaper and more available energy is the very thing that will power the economy along and also produce even more cheaper and abundant energy. We are seeing the natural progression of energy sources from wood to coal to oil to gas towards the natural conclusion of an ultra efficient hydrogen based economy.

I was kinda with ya up until about here. I know you luv your straw man arguments but this one definitely gets you a Master of the Universe badge.

bardon wrote:As time goes by there is a lesser chance of a property bust.How do you figure that? The economies in every major market are in a worse state now than they were before. Underlying fundamentals haven't improved they've gotten worse.

Quote:Now we have affordability back the same level as ten years ago.Affordability has never driven markets. Affordability is still at all time lows but it never stopped the boom cycle of the last 20 years. If affordability had ever been an issue your property would be worth half it is today. Credit and the ability to leverage has been the driver over the last few decades. Credit has tightened and there is very little leverage available today. The market is now heavily inclined to deleverage and reduce risk as economies struggle

Quote:The bears are all giving each other high fives on commodities but that is merely a blip.Depends on which commodities you're talking about. Base metals like iron, alluminium, copper and their respective minor metals are for the chop big time and it's no blip. The idea that these resources will bounce back are a pipe dream to say the least. PM's will go higher as this story unfolds. Food especially cereals are set to skyrocket this season and continue an average upward trend as demand and production costs continue to rise. Energy (oil & gas) could go ballistic if the Iran thing turns to soup. If that happens a property crash would be the least of your worries. Energy simply isn't going to get any cheaper and that's going to crush some economies over the next 20 years. Coal especially steam coal is in for a hard time. Shale gas is crushing coal prices and that trend isn't going to end anytime soon. It'll be interesting to see if we get a price cut from coal powered generators. I somehow doubt it.

Quote:Nope cant see any sings of a bust this month.It's already happening. Your asleep at the wheel Bardon. Not every part of a market collapses at once. The top end of property has been smashed. Some regions are struggling others are on the cusp of a major down turn (resource areas). States like WA and Qld could take a serious hit if China doesn't stabilise its markets over the next 6 months. Darwin's seen a hefty jump this year but everywhere else has either gone sideways (if it's lucky) or down.

But like any market there will be areas and regions that will hold their own and if you're really lucky you might even see some growth.

http://mileslewis.net/australian-building/pdf/07-cement-concrete/7.09-additives.pdf

p 7.09.12

By 1910, however, the idea of applying a cement stucco to chicken wire on a timber

frame had been adopted by the local architect Harry Marks at Toowoomba,

Queensland, and this, while not important in its own right, was a harbinger of

'Gunite' and other such methods used at later dates. In Tasmania Bernard Walker's

house 'Wylam' at Sandy Bay, Hobart, of 1916, was followed by a number of houses

after World War I in using stucco over either wooden lathing or chickenwire. By

the 1920s this stucco on chickenwire was widely used in rural Victoria, and cement

over wire netting, is said similarly, to have been used for Spanish bungalows in New

Zealand in the 1930s.

In Australia generally the technique was known as 'Conite', an American name which

may or may not have been used at the outset. In 1947 the Victorian Housing

Commission reported that Conite on 'a special wire mesh', and finished in white

cement, was proving very successful, especially in northern areas, and had been used

at housing estates at Wangaratta, Dimboola, Shepparton and Mildura. Clifford

Lloyd described Conite on the basis of United States practice: first of all wires were

stapled horizontally across the studs at nine inch (225 mm) intervals, then stout

building paper was laid over these, then wire netting was fixed over that, presumably

also by stapling. The cement render was placed over this, and the sand required by

the American specification was translated into Melbourne terms by Lloyd as two

parts of Frankston to five parts of Cardinia Creek or Kooweerup sand, passed through

a 1/8th inch (3 mm) sieve. Some architects, according to Lloyd, sought to improve the

system by using expanded metal rather than netting, but this was not as good because

it required more joints, and the extra stiffness was unnecessary. In America,

according to Lloyd, 'many of the film stars' palatial homes are built of this …'

In New Zealand a similar effect was produced by the use of 'Steeltex', an imported

reinforcing mesh with a kraft paper backing, used as a base for stucco finishes.

Some of you guys need to back the horse up, take a deep breath and go for a walk around the block. The kinds of comments here do not jive with intelligent investing.

If you had invested in the States 5 years ago you would have done your doe. FX movements would have wiped out your gains and you may even be looking at an over all loss. It has come off a bottom of 0.60 to around 1.05. There are good reasons for that dramatic shift and anyone who thinks it will revert to the mean sometime soon should really get to know and understand what is driving currency values now and likely to drive them in the future. There is a very real chance that the AU$ will go higher yet and that any investor who thinks that FX exposure to the downside is a sure bet should think again

You need to sit down with a pencil and calc and start crunching some real numbers including modeling some what-if scenarios.

Steve's example of a $12k house plus $12k reno does not mention the FX movement against that investment and where it stands today. DO YOUR OWN SUMS!!!!

You also need to talk to impartial advisors to get a balanced view of this investment. Stu Silvers examples where not property investments. They were business buy outs. BIG difference.

There is nothing wrong with the investment model, vehicles or over all strategy. However I get the distinct impression many are simply ignoring the risk elements and have not thought through how this investment dovetails into their overall investment strategy.

The economic risks and FX risks are real and substantial. Given all the costs and fees that funds like this attract the real net return to an investor will most likely run in the 5% – 7% region. Your initial fee and FX currency Tx fees will take 2 – 4% off the first year. In the first year it's unlikely the fund will make any return at all. It's establishment costs will take time to remediate. I would not expect a fund like this to start to perform for at least three years and that's assuming the US economy and FX rates do not move against you.

Texas, Florida and Georgia all have substantial economic risk. These risks are easily assessed by looking at their individual state analysis. All are considered to be fragile economies struggling with current economic difficulties. Their frailty makes them vulnerable to external shocks and investors need to understand this to get a better picture of the risk profile they face.

Do your DD like you would with any property investment. You have time. The 1.98% discount on fees is simply a pressure selling tactic to get you to commit earlier. It represents $198/$10k invested …. peanuts when assessing an investment. You pay more to DD a property so don't get all wound up about missing the pre $20m discount window. In the scheme of things it's absolutely nothing (and its tax deductible)

Get your overall investment strategy clear in your head or on paper. Assess the risk and allocate financial resources accordingly. Investment 101… do not put all your eggs in one basket. High risk investments should not encapsulate the majority of your investable funds.

When you make a claim on an insurance policy the policy may terminate at the completion of the claim. You then start afresh under new conditions. My guess is this or something like this will happen and your premium will be higher.

Ask for a post claim quote.

Failing that if your tenant has vehicle insurance she should have 3rd party/public liability as part of the policy. This sometimes applies to contents policies as well. Get her to claim on her policy or at least get clarification.

If you go with your company they will invariably want her details anyway. If she's insured they will do nothing regarding her. Insurance companies do not as a rule claim from each other. If however she has no insurance they can pursue her personally for the damages. This is common practice in vehicle accidents.

Pictures would help. As an ex builder expansion joints in a house sound a but weird.

NZ doesn't have a CGT. You pay tax on property bought for resale at your marginal tax rate in the country you reside. If you buy an investment property rent it and then sell it some years later there is NO tax on the CG.

There's a great new tool called google and NZ have had the internet for a few years now. Their tax agency is even on the internet. It's called the I n l a n d R e v e n u e S e r v i c e

Hey Jay!! Good of you to drop buy.

Pretty much agree with what you say. It meshes with much of what I read.

Steve's fund per se is OK by me. That's not the issue I see as problematic. Their economic and FX assumptions just don't gel with reality for me. The CRE report is up there with the worst I've seen. It was simply a restatement of generalised publically available data by and large with a nothing summary capped off with the usual 'but and if' statement to cover their backsides.

They have focused on Texas, Georgia and Florida as regions worthy of CommRE investing. I can kind of go with Tx but Ga and Fl don't rock my socks by a long shot.

The CRE report says everything should be honky dory provided employment and the economy pickup.

Well lets see then..

Texas

Comptroller says strong Texas economy may slow in 2013

Georgia

Florida

South Florida one of nation's most financially distressed areas

UNF economist says Northeast Florida economy stagnant in July

Florida economy faces long road to recovery, report says

A common theme with all these states if you read their economic outlooks is that they are all highly dependent on the Euro zone for their economic survival. Up to 22% of GSP in some cases. Europe falls over they fall over. Really simply stuff.

So everyone put their hands up who think the idiots in Europe can solve their economic problems without crashing the world economy or at the very least do substantial damage to it.

Both countries have a Double Tax Agreement. You are taxed by the country you live or reside in.

SteveMcKnight wrote:Freckle,Thank you for the chance to flesh out a beneficial conversation.

I think it is important that you disclose your name, your qualifications, and your investing experience as these are important considerations for those reading your posts.

- Names are unimportant and my personal privacy policy is to protect my confidentiality as much as is possible given I make comments in other areas (other sites) that are of a political nature and do not always support the powers that be or their actions. Given the nature of governments and other authorities one may construe that as somewhat Orwellian however I prefer to be safe not sorry.

- I have a Dip Bus Stud, and 35 years in business. I invest in business and some shares.

- Do I feel qualified to comment? Based on the feedback I get it seems many out there see my opinion as a fresh view. I do not claim to be an expert in anything. I try offer opinion as opposed to advice but interpretation may differ.

For my part I am a chartered accountant, with a Bach Business in Accounting and a Diploma of Financial Services. Aside from my formal qualifications, I have bought over 500 properties, with more than 200 in the US. I have been investing in property for 13 years. I am regularly asked for my opinion by various media outlets, making me one of Australia's foremost property experts.

I don't say this to big note myself, or to put you down, rather just to put it on the record so readers can see the substance behind my answers.

- I don't evaluate people based on their qualifications as a rule. Too many out there with letters after their names that are dumber than my dog. For the record I consider you to be, highly motivated, knowledgeable, experienced and for the most part an ethical business person.

I would also caution you about whether you need an AFSL to make some of the comments you are. I will actually seek legal advice about this forum thread on Monday, and whether or not it needs to be taken down as PropertyInvesting.com does not have an AFSL.

- I doubt it. I have no pecuniary interest in RE at any level nor am I a responsible entity as defined by the Managed Investments Act 1998

In the meantime though, you raised 10 issues that you have concerns with in respect to the Fund which I would like to reply to. They are:

1. It's international

It's important to understand that this managed fund is created, managed and regulated within Australia.

However, it is true to say that the assets it will hold will be primarily in the US (some money will be retained in Aus).

Other than cash, the assets of the Fund will be loans to, and units in, a US real estate investment trust (REIT). In turn the US REIT will acquire US commercial property.

This is not a new model. It is used by a number of listed managed funds and Australian companies.

The distributions from the US REIT flow to the Aus Managed Fund, and from the Aus managed fund back to investors (every six months).

Capital appreciation occurs as follows: as the value of the US commercial property increases, so too does the value of the units in the US REIT (held by the Aus managed fund), and therefore the units in the Aus managed fund too (held by unit holders) [Note: assuming FX rates remain constant]

- being international presents problems should things go wrong. It would be virtually impossible for any investor to legally challenge a US based REIT. This is simply a consideration an investor should consider in their DD deliberations

2. It requires a more complex investment vehicle to apply funds

In my opinion this is a factually inaccurate statement.

The US REIT is quite a simple investing vehicle, and considerably so compared to trying to acquire the property directly by an Aus managed fund, or as an Aus individual.

- the funds themselves are straight forward entities however once you increase the layers you increase the complexity. This requires greater DD and a broader understanding of both entities and how their commercial relationship functions across international boarders.

3. Other than the principle (sic) the team is largely unknown and as far as I can tell has either no or limited commercial experience

This is completely incorrect. The other board members have significant commercial experience, both in managed funds, investment banking and real estate.

- i was referring to commercial realestate not commerce. The PDS CV's are fairly typical of corporate disclosures of this nature. I personally wouldn't back anyone with these fairly vague types of personal histories. They lack substance and specifics.

We will also be supported by expert advisers in areas such as currency risk management.

- they don't exist unless you know someone who can read crystal balls and that's the point. The markets have been volatile and literally impossible to call over the last few years. At no time in history have currencies been as manipulated as they are now. The idea that markets set the rate has now become ludicrous as algo's and HFT bots fight out complex strategies within the cyber trading markets.

4. No experience or track record in managing REIT fund investments (that I'm aware of)

This is true specifically in regards to US REITs.

However there is considerable Board experience with various managed funds models. We are also being advised by US and Aus attorneys about the requirements, governance, etc of the US REIT.

In short, what we lack in experience specific US REIT experience we are gaining via consultants.

- I don't have a problem with day to day management or managements ability to meet statuatory requirements.

5. The US REIT side is an off market non tradable REIT

This is true, however just because an investment is listed does not mean there is a market (buyers) or volume to provide liquidity.

- no but it does mean in an off market Vs on market world that market REITs have way more liquidity and flexibility for investors than the alternative

We have deliberately chosen not to list the investment due to the additional costs associated with listing and ongoing compliance.

- that kind of concerns me. That suggest limitations within management to deal with the complexities of compliance which goes to experience coupled with penny pinching. Market research I've conducted indicates some nREITs are going public to increase liquidity. That however may be more an indication of difficulties managing the downturn over the last 5 years. I'm not saying this is good or bad but for me it throws up a red flag

Some may argue being redeemed by the Fund at a published unit price provides greater certainty about knowing there is a buyer and at a transparent pre-known price.

6. Little to no liquidity for long periods

Liquidity (ie. not being able to cash out of the investment as and when you would like to) is a real and siginficant risk, which has been disclosed in detail in the Product Disclosure Statement.

Remember, real estate is not a liquid investment (like cash), so this means investors need to be compensated (for the lack of liquidity) by higher rates of return.

- I'm not with you here??? Every investment strives for the best return. Investors do not get compensated for going with a particular fund structure. Compliance cost for a market REIT is literally tiny fractions of 1% in additional cost over large funds.

If this is not possible or achievable then the risk-to-return is not sufficient to justify the investment.

I agree that investors who need liquidity are unlikely to find this fund attractive.

7. Almost impossible to exit in a downshift market

I don't believe 'almost impossible' to be true. The Board has strategies to create liquidity events other than having to sell properties (capital management, finance options, etc).

- Disclosure 7 states this quite categorically. Depending on liquidity at any point in time an investor may face delays in withdrawing funds. If a market inverts investors may panic. If you faced a run on funds it would almost certainly be impossible for investors to extract their funds in a timely manner to prevent or contain losses.

Furthermore, our purchase strategy will see us diversify the investments by location, type and use meaning that although there is a risk of price decline then it is unlikely (albeit still possible) all assets in the portfolio will fall in value.

- You are in one market sector (commercial RE) and predominantly one class (B Class comm assets) in one country. In reality you are only diversified by region. Given sovereign economic risk that to me is a relatively weak diversification strategy.

8. FX risk is extreme (no hedging offered)

'Extreme' is an emotive word which again I disagree with.

The Board has chosen not to hedge because the research we have points to the Aussie being overpriced.

- an economic theory I have a lot of problems with. Henry suggested some months ago that the AU$ may become a safe haven currency even with a deteriorating ToT and resource sector decline. The AU$ has for many years been considered a resource currency. Funny how resources declined and as difficulties globally saw capital looking for safety and return headed in our direction. We are considered to be the MOST stable of economies with an HONEST market and economy hence a currently strong currency.

- I'm not sure if your board has had a good look around yet but every major economy is in difficulty and central banks are in a currency war trying to make their currencies competitive to uphold declining exports.

- Given currency volatility and uncertain times ahead I would think any board would take prudent steps to hedge currency fluctuations as a matter of course.

The research we have points to the Aussie being over valued. Similar comments have been made by the RBA, and many CEOs (most recently BHP's CEO).

- Would that be the same CEO's that kept telling us alls well in the resource world and China will boom forever. Albenese and Kloppers are skating on thin ice after some disastrous investment calls.

That said, our AFSL allows us to hedge, and we will receive periodic expert currency strategy advice.

Individual investors who are particularly worried about exchange risk can:

a) manage the risk themselves (if they feel the Aussie will go higher)

b) not invest

Interestingly, a currency strategist recently told me the nature of this investment contains a natural hedge.

That is, if US property prices do well then it is likely the USD will under perform. Alternatively, if US property prices decline, then the USD will strengthen.

- I think you need to talk to another advisor because he doesnt know what he's talking about. Heres the DJ REIT graphed alongside the AUDUSD over the last 10 yrs. Note how they track each other'. They go up and down together

9. Economic risk is extreme

Again, I disagree.

While there is a mountain of economic data for and against economic recovery, my own observations are that the US economy is less risky than the Aussie economy and the Aussie property market.

- this is where you and I diverge big time. A simple question is if the US was a corporation would you buy shares in it

Investors need to make up their own minds though.

Remember, the US economy remains the most politically stable, and the largest in the World.

- I've have doubts about stability but that's another story. When you hold $16T in debt $200T+ in unfunded liabilities and $700T in questionable derivatives I suppose you are the biggest. The trouble with being big is you're not very light on your feet and when you fall over it hurts more.

10. Investment is a 5 – 10 year play – that puts this gamble fair smack in the middle of one of the most economically challenging events in history

I don't agree in any way, shape or form that an investment in the Fund is a 'gamble'.

It is a matter of strategically identifying an advantage, and then leveraging the management team's skill and expertise to outperform to maximise the opportunity.

- corporate speak for a gamble. Definition – a. To bet on an uncertain outcome. b. To play a game of chance for stakes. 2. To take a risk in the hope of gaining an advantage or a benefit.

Thanks again for the chance to answer your questions, and by doing so provide more information about the Fund.

– Steve

- Not a problem.

P.S. I also note than many of the links you have referenced relate to questionable REIT disclosure. As this is an Aus managed fund, it must comply with the recently revised ASIC RG146 which addresses many of the issues those articles refer to.

- Yep. The fund may be 'stralian but the REIT is all 'merikan

General advice warning: Past performance is not a guarantee of future performance. No earnings estimates are made. This information is of a general nature only and does not take into account your objectives, financial situation or needs. You should consider the Product Disclosure Statement issued by Plantation Capital Limited ACN 133 678 029 AFSL 339481 in deciding whether to acquire an interest in the Passive Income (USA Commercial Property) Fund. You can download a copy at the following website http://www.passiveincomefund.com. PropertyInvesting.com Pty Ltd is an authorised representative of Plantation Capital Limited ABN 98 096 059 353, AFSL 339481. PropertyInvesting.com Pty Ltd's authorised representative number is 423856.

I've seen all of your presentation videos and read your Disclosures page on your site prior to previous comments. I've since compared those to your PDS and they cover something close to 90% of the PDS but in less detail.

I don't see that the PDS is materially important to this discussion at this point but may do so in future posts.

Problems I have with this proposal.

- It's international,

- requires a more complex investment vehicle to apply funds,

- other than the principle the team is largely unkown and as far as I can tell has either no or limited commercial experience,

- no experience or track record in managing REIT fund investments (that I'm aware of)

- the US REIT side is an off market non tradable REIT

- little to no liquidity for long periods

- almost impossible to exit in a downshift market

- FX risk is extreme (no hedging offered)

- economic risk is extreme

- investment is a 5 – 10 year play – that puts this gamble fair smack in the middle of one of the most economically challenging events in history

The MSCI US REIT INDEX paints a quite different picture to a snapshot over the last 3 years

And what the 33% over 3 years crowd neglect to tell you is that it still hasn't recovered its losses from barely 5 years ago.

What punters also need to to understand is that value dynamics are different in market tradable REITs compared to off market non tradable REITs proposed here.

In essence this is a bet on Steve McKnight's belief that he's picked a winner on commercial property.

Trouble ahead for high-yielding stocks, REITs

June 5, 2012

Mag Black-Scott, president of Beverly Hills Wealth Management, said that investors have to stop being drawn into high-yielding stocks – particularly real estate investment trusts — where the underlying numbers and the financial markets suggest that there is significant trouble ahead.The Trouble with Non-Publically Traded REITs

I don’t like non-publically traded REITs. At all. And I’ve said as much countless times.Non-publically traded REITs are what they sound like: real estate investment trusts (which own income-producing real estate) that are not traded publically. Non-publically traded REITs are littered with problems for investors, and those problems were the subject of a recent FINRA investor alert.

Are Non-Traded REITs Finally Headed Toward Transparency For Investors?

December 12, 2011

If history is any indication, it will be imperative for firms to go above and beyond what they have done previously in performing due diligence on the non-traded REITs they are offering. Just about the time the market for non-traded REITs was expanding, the real estate market across the country began to struggle mightily and this resulted in significant problems for many non-traded REITs. The difficult real estate market forced many non-traded REITs to adjust distributions and suspend the “buy-back” of shares from investors (often called the redemption program). One non-traded REIT, Desert Capital REIT, even went bankrupt (filing for Chapter 11 bankruptcy earlier this year). President of MTS Research Advisors, Michael Stubben, was recently quoted on investmentnews.com regarding the impact of the rough condition of the real estate market on non-traded REITs. He said, “As a result, the market values of their assets have declined, and these nREITs have experienced declines in occupancies and rents.”