Forum Replies Created

Pretty straight forward. I've highlighted the areas that would most concern this claim.

http://www.fairtrading.qld.gov.au/guarantees-warranties-refunds.htm

As a consumer, the law automatically provides you with guarantees on certain goods and services. These are called consumer guarantees.

You are guaranteed that the goods you buy:

- are of acceptable quality

- match the description, sample or demonstration model you were shown

- are fit for their intended purpose

- have clear title, unless otherwise stated

- do not have any undisclosed securities (money owing on them)

- come with a right to undisturbed possession

- will have spare parts and repairs available for a reasonable amount of time after you buy them

- will have express warranties honoured.

You are guaranteed that the services you buy are:

- provided with due care and skill

- fit for purpose

- completed within a reasonable time.

If a good or service fails to meet a guarantee, you have rights against the business you purchased them from and, in some cases, the manufacturer. They will have to provide a 'remedy' – an attempt to put right the fault, deficiency or failure.

APerry wrote:The US Gov creates money by selling IOU's to the Federal Reserve as bonds and receives money in return, which it spends, the Fed can either keep these or on sell them.

I pretty much agree with everything you've said although the above sentence is a bit fury.

Treasury flogs bills, bonds and notes to just about anyone who'll buy them. The Fed intercedes to manipulate price or in a worse case scenario becomes the buyer of last resort. Fed monetisis that debt (gives money to treasury to pay for government services) and holds the bonds on it's balance sheet.

Quote:You are correct that a lot of the QE is this money being used to buy various securities (ie its not going into general circulation as I stated), but you are forgetting that there is another side to the ledger, the bond holders. These bonds have to be redeemed at some stage by real money and if the Fed can't on sell the bonds then they have no real value and their price will plunge making the money paid to redeem the bonds worth less and so the currency generally worth less.That's not quite true. The Fed has been expanding its balance sheet exponentially since the GFC. It bought bucket loads of MBS and other toxic debt from TBTF institutions in an attempt to provide liquidity and bolster balance sheets. Today it buys $85B/mth of these things in an attempt to kick start the building and housing industries. It buys something like 70% of of all T bills, bonds and notes. Treasury simply issue new and bigger bonds to roll over maturing ones (to fund govt deficits).

Fed balance sheet issues are or will be almost impossible to resolve if not already. Any attempt to sell this stuff would crush the US economy (via rising interest rates).

What's also interesting is their $9T or so in secret off-balance-sheet transactions that no one wants to talk about.

jbelmore wrote:The RBA has an inflation target of 2-3 % not zero. Enough said.You might have to elaborate JB. On some things I'm as dumb as a chook and reading between the lines was never my forte.

Stop taking things personally. The same type of behavior is evident throughout the world. NZ's and Australians seem to have particular issues with Indian students and immigrants. Aborigines cop a flogging from everyone. Some deserved but much of it not. I don't deny it exists nor do I get offended when someone points it out.

Interestingly your reaction is reflected in international opinion of Japanese culture. Japanese have no problem criticising others but have difficulty accepting criticism directed at them. They don't like to have their shortcoming pointed out.

I/we had Japanese students for several years. Some of the best guests I've ever had in my house. Always found them to be lovely people. The only thing that ticked me off was when they left. Had a habit of balling their eyes out as if they were being ripped from their mothers breast. I didn't think I was that loveable.

zmagen wrote:Incidentally, here are a few of the things the Japanese people, as opposed to government and BOJ, will most likely do, ………….just a few more of the "bullets" in the Japanese arsenal for bad times, if and when they hit – there ARE alternatives to the "mad max" scenarios.

Japan isn't unique in its ability to cope with hard times. There's interesting stuff going on in Greece, Spain and Portugal as their economies turn to dust.

What's with the mad max, apocalypse, Armageddon descriptors? How economies cope and the people within them will vary from country to country. Some will experience total ruin and the worst things that that brings. At the other end the smart cookies will make a killing. The thick end of the wedge will be at the bust end unfortunately. Whether countries descend into civil strife even war remains to be seen. I don't see things going well for middle eastern and African countries. Europe's problematic. Plenty of civil unrest there and we aren't even near the end game yet. The US will be interesting. South America – hope we don't go back to the old days of military dictatorships. By and large I would expect that most western countries will stay relatively stable while they work through this.

Unfortunately history shows us that economic collapses are often followed by war. Here's hoping we don't go down that path.

You've made a lot of points so I'll deal with them linearly.

Quote:It’s far more likely that the Japanese Yen will depreciate strongly for a while – as it has done in the past – without any major implications for the economy as a whole long-term – only to rise again when appropriate corrections or global market forces allow it to.The Yen will not depreciate strongly because competing CB's won't let it least of all the FED. The BOJ has repeatedly tried to devalue its currency over the last 5 year with little to no success. We're in a currency war so scrap that idea.

Quote:The same links also claim that yen depreciation, for instance, is exactly what's needed now to re-ignite export (something that Australia, for all its merits, hasn't worked out yet, btw), with which I completely agree.Insanity: doing the same thing over and over again and expecting different results.

Albert Einstein.

It's been a few years now. When are you guys going to figure out this strategy isn't working only making things worse.

Points you make about Abe's policies;

Re-engage with China. Obviously sensible but it'll take decades to mend that fence and restore business activity to anything like past levels. The Island ownership debacle was a catastrophic error in diplomatic relations.

Public works programs. The fall back/old faithful policy of struggling administrations trying to stimulate local economies. The problem with these initiatives is that exacerbate the debt problem not alleviate it.

"printing money till the cows come home", which you wrongly suggest japan has been doing" I can come up with about a million links from the BOJ and related sources explaining this to you if you wish but I'll leave you with just one.

BOJ's money printing is offset by households' cash hoarding

Renewable energy initiatives. These things always sound great on paper but rarely pan out as expected. The Japanese energy sector is considered highly corrupt. The competing forces within this sector will ensure things don't go as planned. To top it off the government needs to pump bucket loads of subsidies into this initiative just to keep it afloat. I expect to see the same problems there as experienced here in Australia.

Quote:the approach you try to perpetrate, as if there is a singular "magic wand" that someone can wave to make things better, and Japan just hasn't found one yet,or has tried all magic wands to find that they don't work, is a very black and white oriented view of economyIt's pretty simple Ziv. If you spend more than you earn you'll go bust. If you borrow till the cows come home and manipulate the books with fuzzy accounting you can extend and pretend for a while but at the end of the day your creditors want their money back.

Quote:You say you don't believe xenophobic Japan will allow more immigration – fortunately you're plain wrong.Am I. Here's the reality regarding immigration in Japan. Thirty years ago they were calling for the relaxing of immigration restrictions. Over that time their immigrant population has grown to a little under 2 million or less than 1% of the population. the lowest in the world. Immigrants are 90% un or low skilled people doing jobs the Japanese won't. In 2009 they were paying immigrants to go home with a big 'don't comer back' stamped on their visa.

Nationality/Number/Percentage

China (PRC) / Taiwan (ROC) 655,377 29.6%

South Korea / North Korea 589,239 26.6%

Brazil 312,582 14.1%

Philippines 310,617 14.0%

Peru 59,723 2.7%

United States 52,683 2.4%

Thailand 42,609 1.9%

Vietnam 41,136 1.9%

Indonesia 27,250 1.2%

India 22,335 1.0%

United Kingdom 17,011 0.8%

Nepal 12,286 0.6%

Bangladesh 11,414 0.5%

Canada 11,016 0.5%

Malaysia 7,910 0.4%

Others 141,440 6.4%

Total (as of 2008) 2,217,426 100%

Most immigrants are work visas. Loose your job = go home. Some estimates suggest immigrant numbers have declined post GFC and more recently Fukushima.

While Japan may modify its immigration policy, immigration is unlikely to change significantly while a culturally xenophobic prejudice is allowed to go unchallenged. Their constitution declares all are equal but in practice their laws don't. The idea that a few tax breaks and relaxed immigration will somehow fill the void left by a dwindling population is almost laughable if it wasn't so serious. How do you attract foreign business to your country when your own companies are leaving. There are simply way too many better opportunities for foreign businesses than Japan. The reality of the situation is that a relaxed immigration policy isn't the solution for an exodus of Japanese companies.

Some other points about more bullets to fire;

Robotics. Read this http://www.ifr.org/industrial-robots/statistics/

Nothing extraordinary there. Predicted growth rates of around 5%pa for the next few years

Electric cars. ??? Electric car start ups are going bust left right and center. They need massive subsidies to survive

Ziv I understand that governments and politicians are creating/developing initiatives that the public see as attempts to correct the economic mess they find themselves in. But in all reality it's little more than window dressing. The fact remains that until sovereigns address the overspending issue you can raise taxes, print money do what ever you like but the problem will always remain, an increasing debt burden will bust you in the end.

The solution is to spend less than you earn and eliminate debt by righting it off. Painful as that may be it will happen anyway. The longer they leave it the more painful will be the cure.

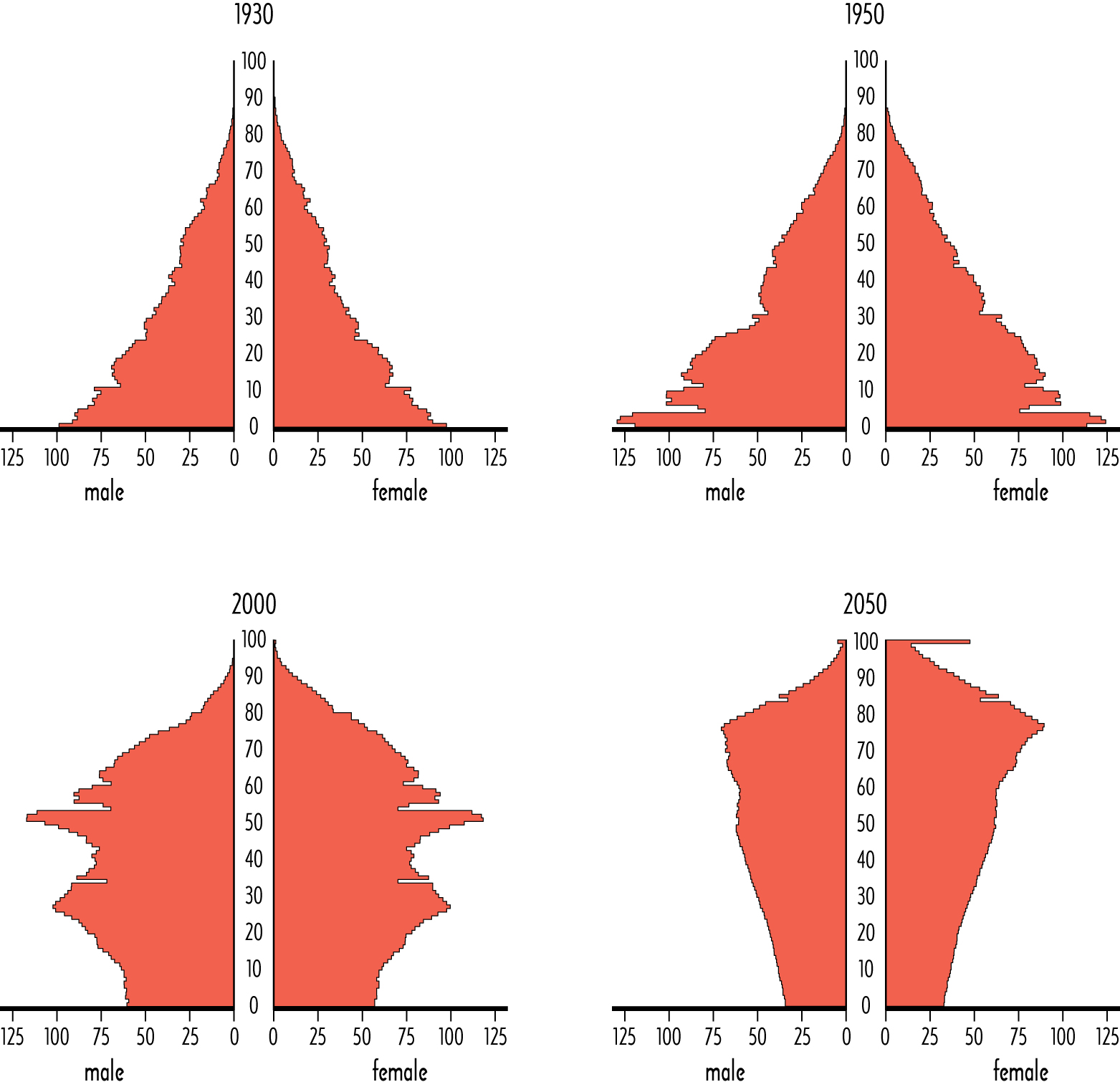

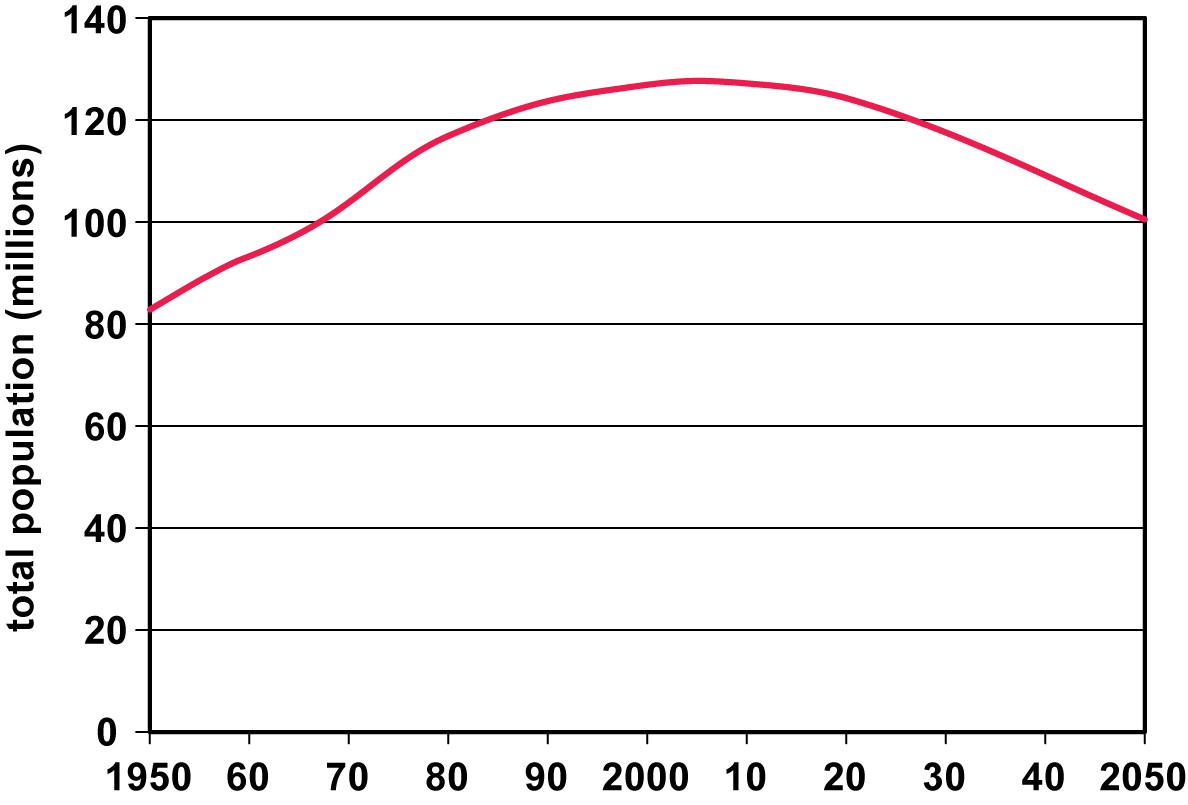

The above graphs throw up another interesting aspect of interest. How does this affect debt/wealth on a per capita basis. in other words what will be the populations ability to spend be going forward.

The following graphic suggests individual spending power could be overcome by huge debt loads.

This doesn't imply that massive amounts of debt will be taken on but that the population base servicing current debt loads will decrease significantly. This adds weight to the argument that the Japanese tax payer will face crushing debt servicing loads unless the Japanese government can find a way to restructure its debt liabilities.

This illustrates why simply increasing sales tax rates will not work. They're going to have find other ways to increase revenue from an ever declining tax payer base which suggests increasing taxes on tax payers will be self defeating. Taxing businesses is also a no win situation as Japans competitiveness continues to decline. The BOJ's attempts at currencie devaluation to help exports is generating unintended consequences such as capital flight.

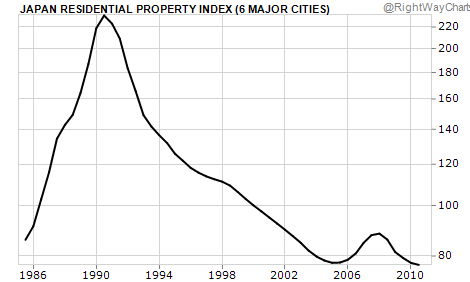

All that kinda puts the next graphic into perspective.

The income to expenditure gap just keeps getting wider. I wonder how far you can stretch a rubber band before it snaps?

Ignoring Japans immediate financial problems for the moment one has to wonder where the RE market will get its demand from given two significant population issues are deteriorating at an accelerating rate namely a declining population coupled with an aging population.

A possible solution to Japan's problems by Jared Diamond, a professor of geography at the University of California, Los Angeles

Three Reasons Japan’s Economic Pain Is Getting Worse

Diamond alludes to the problems causing their current predicament and potential solutions, however, I think things would have to get much worse before the Japanese government acted along these lines particularly immigration. Japanese are one of the most xenophobic cultures out there so I have no idea how you would get that initiative across the line in a way acceptable to their wider community.

PS: this bloggers personal testimony questions Japans ability to support immigration as part of an overall economic recovery strategy. I found his story quite reveling regarding Japanese culture.

Rent now 130.

It's an obvious trend

For sale has locked in at 223 it appears. To be expected over the Xmas period??

TheFinanceShop wrote:I have a lot of Japanese (and other nationalities that happen to have worsening economies) investors purchasing in high end areas of Sydney. Does that have anything to do with the state of Japan? Not sure but a lot of them are saying we want to be earning aussie dollar (they may be referring to dollar's strength, stability or both)?Regards

Shahin

And that presents a few problems for us here. If the AU$ continues to garner support as a safe haven currency then that is likely to attract more capital seeking refuge than is good for us. The RBA's attempts to lessen that attractiveness may well backfire on them if RE is perceived to be cheap and a safe store of value. Make interest rates cheap attracts more RE money creates bubble creates bust conditions etc etc.

I expect to see more RBA and government intervention in this area. Neither of which will be able to deal with the currency appreciation problem effectively. Iron Ore is breaking $150 so watch out for a strengthening dollar if that price holds for a while. We might even see a budget surplus if ore holds but that puts future rate cuts into question.

There are warning signs that ore could collapse though. Prices appear to be driven by budgetary expectations in China. The spread between the spot and 12m swap price is as wide as its ever been and that usually indicates a price correction is likely.

As a side note it's estimated that the unit market in Sydney is fueled by $2B and Melbourne $1B of Chinese capital.

zmagen wrote:In your favorite style and spirit of linking to graphs, articles and presentations that support your theories, here are a few of our own, that we've been collating for new and existing clients over the past year –http://www.nippontradings.com/japan-real-estate/busting-japans-impending-debt-crisis-myth/ ("business insider")

http://www.nippontradings.com/japan-real-estate/japans-miraculous-economy/ ("mindful money")

http://www.nippontradings.com/japan-real-estate/japan-economy-set-to-soar/ ("Reuters")

Interesting articles from the point of view they almost always ignore the elephant in the room.

You have a debt problem. Up until now you've been able to fund that debt to maintain the country with savings (and ZIRP) and the ability to maintain an export surplus. The export surplus has gone as trading partners around the world grapple with their own debt problems after 30 years of a credit fueled spending spree. The cheap money is or has come to an end. The next generation of borrowing (to fuel a system that requires 40% of it's budget go to just servicing cheap debt) will be considerably more expensive than in the past.

The immediate challenges facing Japan are how does it cope with an export and subsequent income decline, remediate the Fukushima and associated nuclear power problems, maintain the status quo in a declining/aging population as pension demand accelerates and deal with a mounting debt problem that threatens to swamp them.

Quote:there are more, of course, but the main point is, as others have pointed out above, that Japan has quite a few other ways of dealing with the current state of affairsGreat! What are they because as Kyle Bass points out quite clearly the discussions he's had with the leaders of Japanese financial institutions have all but admitted they have no idea how to solve this problem. They're out of bullets

Quote:– and the "hasn't made a difference for the last two decades" is really a double-edged sword – according to this rationale, Japan should have dived nose-first into currency collapse and become India or myanmar a decade or two ago, rather than go into a mild recession and come out of it as resilient as ever – yet somehow, miraculously, they're quite far from it.Enron looked great just before it collapsed

Quote:yes, I'm biased, in the sense that I'm a firm believer in the Japanese people and their resiliency, creativity and hard-working, sincere mentality, and believe that they'll find a way to persevere (even without adopting IMF policies, imagine that).Societies almost always do, however, many experience considerable pain and dislocation during this coping period.

Quote:What this actually is, i love to read assumptions about, but leave to wiser folk than myself (the links above point to a few options, as have the comments on this thread).The links above do not point to options or solutions that haven't been tried before a hundred times with no affect. In fact most of the so called solutions involve fudging the figures and CB balance sheet expansion. In every case the situation has deteriorated a degree further.

So here's a challenge for you Ziv. Find the readers an example of Japanese government and or BOJ intervention that has or will turn this impending debt crises around.

Quote:as for me, I deal in real-estate, and advise my clients to always be positioned with ample reserves and minimal leverage, so that they're able to take advantage of current conditions, and not play with money they'll need back in a hurry (unpopular concept for property investments, I know, considering so many folk out there try to liquidate all their belongings at the first sign of price drops and lose their pants in the process, or leverage themselves to kingdom come and lose everything when the **** hits the fan). Incidentally, this happens in any country at some point in time over every decade or two – I'd rather be in Japan when this happens than any other place in the world, any day of the week. They know how to deal with crisis without resorting to doomsday and Armageddon scenarios far better than us whiners and selfish "save yourself, screw all others" in the west

Sound advice and the last place I'd want to be on earth if things go south is the US or Europe.

Quote:As a side note, I hardly believe that someone who, according to their own testimony firmly believes in hoarding precious metals and their related stocks and industry assets (which someone less polite might label "dealing in fear and paranoia") has any interest in making any other investment seem attractive, and would most likely do their best to continuously convince anyone who'll listen that "the worst is yet to come, beware the impending global meltdown, it's only just begun", etc etc.Ziv it's standard strategy in Investing 101 – hedge your bets. There isn't a market that isn't rising and falling like a yo yo anywhere that I'm aware of. It has to be one of the craziest and least predictable times to be an investor in anything. That in itself tells a story.

Quote:but we already had the pessimistic vs optimistic vs realist discussion, maybe we can save ourselves the trouble this time, since we're both not likely to change our tune in this regard.It's no fun debating with someone who agrees with you. Where would I be with out you.

"Soooooo many reasons why Japan will not just "collapse".

And I, like many I'm sure, are interested in hearing what they are.

Interesting. The Canucks are the single largest investor group in the US RE market.

The more and more I see of the these foreign RE markets the more I think punters should start learning the 'speculators' mindset as opposed to the 'investor' mindset. The global financial landscape is becoming more fluid by the month and I suspect those that have traditionally approached these opportunities as long term investors will over time loose their lunch on these deals.

My gut tells me that those playing foreign RE markets with long term strategies will eventually get done like a dogs dinner.

APerry wrote:Whether real estate prices will rise or not is another argument.

So your original statement should have read;

"potential exchange rate losses will only be offset if asset values rise"

Quote:If you can better describe what is happening in the US with regard to QE and its potential implications in 2 lines, please do.There's no limit to posts sizes as far as I know. Is that simply an excuse for a poor description of events.

Perry you're in finance. I would expect a higher level of understanding and a better ability to express yourself in understandable terms for the lay person.

"US is printing money to fund debt. This is a recipe for inflation"

No it's not. Japan has used easing policy for decades and still has inflation below 1%. Inflation is more complicated than just printing money.

"the only reason it hasn't happened already is because the money being printed is not going into circulation,"

I don't know where you get this from. There's billions going into the system weekly through a variety of entry points.

"At some stage all this cash will come come into circulation and there will be massive inflation and potentially a currency crisis in the US."

QE/money printing is a symptom of a failing system not the cause of it. It usually signals the final stage if left unchecked. Massive inflation if it turns into hyperinflation (usually defined as inflation above 50%/pa) is a signal there is no longer any confidence in the monetary system or the controlling authority.

Much of this so called printed money (it's actually not printed simply created by computers on balance sheets all over) is in the form of securities, bonds and shares. There isn't going to be a torrent of money entering the system to cause widespread inflation. If (when) things snap securities, bonds and shares are likely to plunge in value expunging much of the wealth created by QE. Increased inflation is likely to occur because of shortages and currency devaluation raising import prices not more printing.

If the powers that be can't contain the next collapse then you're looking at widespread systemic failure and a liquidity crises which can then lead to a hyperinflationary event (loss of confidence in the system by key sectors and players) and currency collapse.

The idea that somehow huge amounts of cash which don't exist will suddenly find their way into the money supply and cause massive inflation is a stretch to say the least.

kong71286 wrote:I believe the concept many need to grasp is that all fiat currencies are designed to lose purchasing power over time,

No they're not. Quite the contrary.

APerry wrote:There seems relatively little chance of the US$ improving much against the A$ while the US is printing money to fund debt. This is a recipe for inflation, the only reason it hasn't happened already is because the money being printed is not going into circulation, it is being hoarded. At some stage all this cash will come come into circulation and there will be massive inflation and potentially a currency crisis in the US. If you are leveraging into that market then your potential exchange rate losses will be offset by rising asset prices, in fact if you lock in at low rates now you may do very well in terms of capital growth but i would be very wary of making an investment over there as a play on a relaltive drop in the value of the A$, even if it happens in the short term i doubt there will be a long term swing back to anywhere near where it has been in the past.Much of what you have written is either misleading or simply inaccurate.

"potential exchange rate losses will be offset by rising asset prices"

It mystifies me as to how you can come to this conclusion.

"money being printed is not going into circulation, it is being hoarded. At some stage all this cash will come come into circulation and there will be massive inflation"

A poor description of what's actually occurring and it's implications.

alfrescodining wrote:I wouldn't write off Japan.They can always just print money.

Have for 20 years… next suggestion.

Quote:They can pay people to breed. Or finally let some immigrants in.Explain to me again how that helps an export led economy with declining export markets

Quote:The sales tax can work...and what do you think the rate should be? Keep in mind that at 1000% they still can't raise enough to solve their debt problems.

Quote:Third biggest economy in the world – unlikely to just collapse…Aagh yes.. the Too Big To Fail theory

JacM wrote:Ipeople don't like to buy shoes that have been on someone else's skanky feet.

ROFL… this girl was far from shanky. All I could do to stop my boys drooling down their shirts all day. They kept going missing in action through out the move(s) we did for this client. Of course being married I was hardened to this type of distraction.

PS: Shoes were still in their boxes.

Jpcashflow wrote:My mentor admitted that the economy is in trouble in Japan and he has had to slash a high number of employees hours from Full time to Part time, Thankfully being such a large company he gets great support from the Japanese government.

But he made a good point, Should fear stop him? Nope he is always looking at ways at improving his business and on the other hand his real estate business remains pretty steady.

Couple of points Jo.

- The primary focus of the thread is; how do foreigners with Japanese assets play this market through this particular time frame? Your mentors situation is interesting and certainly reinforces the deteriorating situation in Japan from an insiders viewpoint but he won't be exposed to FX risk.

- Should fear stop him? In real terms he has little choice but to continue to manage the situation. Fear shouldn't be allowed to play a part in one's decision making. The objective should always be to take an honest and open appraisal of any situation whether it be improving or deteriorating and make plans accordingly.

There are 2 major concerns with investing in Japanese RE namely;

- deteriorating economics which eventually begin to tell on property values if it isn't already and,

- a public policy of substantially devaluing the Yen.

This new govt headed by Abe was a disaster last time and given their nationalistic leanings I have little doubt things will flow along the same lines as the last debacle especially where China is concerned.

Commentators see Japan as "a bug looking for a windscreen" and "a slow motion train wreck". Can't argue with either of those assessments.

A couple of graphs to enlighten the readers:

The problem with the following graphic is not that Jpn is top of the pops but that the rate of debt accumulation by other economies has jammed those countries into a corner meaning their ability to support global growth and assist Japan to somehow survive a little longer is fast running out of steam. The reality is that if you have a huge debt load serviced by an export led economy then you absolutely need a healthy global economy to support you. That's no longer the case.

… and as things continue to go south the ability of punters to buy into the property market has taken somewhat of a battering over the years.

Given that property is usually considered a long term play I can't for the life of me see how the Japanese RE market could be considered a sound investment. I have problems even considering it viable as a speculators market