Forum Replies Created

Not to worry Darryl I expect that to all change over the next few years. You'll have surveyors coming out your ears.

The first signs of austerity…

Japan To Slash Welfare Benefits In Attempt To Root Out "Comfortably Poor

- ..welfare benefits will be slashed by ¥74 billion over a three-year period starting from fiscal 2013, after a government panel found that some people are making more on the dole than the average low-income person who is not spends on living costs..

Terry expanding on why things will get bad for the average Jp citizen.

Abe's printing until the cows come home to try and achieve several things;

- inflate (2% target) away debt. The problem with this is the average Joe is the primary supplier of the loans to the JPG. When your lending money at virtually 0% deflation works for you but inflation kills you.

- Pump the stock market so people feel richer. Problem is (see graphics below) the japanese have very little in the stock market so gains are minimal

- Devalue the currency. As mentioned collateral damage will be via imports especially fuel and energy

I'd definitely feel dudded if I was an agent or someone selling. Great if this came up just before an auction and having to pay auction costs upfront. I think I'd be looking for damages.

You're a newbie… get the experience. When you've bought 20 or 30 so properties no worries

…….is it wise to buy without inspection first?

Ever played russian roulette

Nigel Kibel wrote:I think the problem is that it will be impossible for a retailer in many cases paying high rent and staff wages and commission to compete with someone with an online business.No matter how far they lower interest rates, this will not change.

Now that I completely agree with.

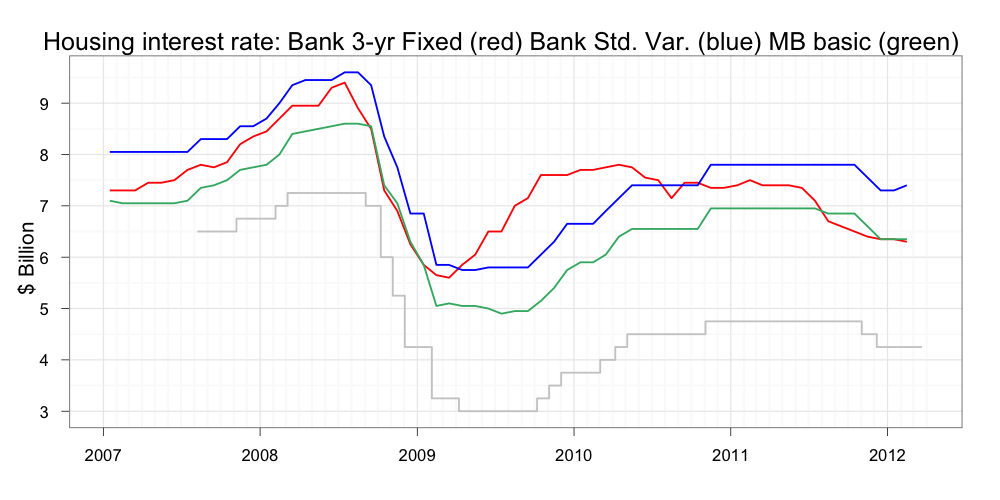

Fixed rates are popular in NZ for some reason. Never been a fan of fixed rates. I like my pain slow and steady.

Nigel Kibel wrote:My view is I would be surprised if fixed rates went a lot lower than 4.75% on a fixed rate. This is a good figure if things get worse who knows. However the signs are indicating that things are getting better both in Australia and certainly in the United States.We have to stop looking at the retail sector because that is changing because of the internet.

I have no idea where you get this stuff from but whatever you're smokin' I want some.

Yep. This one in particular throws up a few questions about the next super cycle (60-70yrs)

Have you seen this?

Stockland follows Mirvac with warning

Big guys are leaving town. Might be up beat for the small developer though… less competition.

Oil is currently rising in US$ terms while JPY vs USD is literally collapsing. Implied target is $1.04 ($0.9317 today)

It's not just oil but everything else Japan imports. Everything will have to go up eventually. Abe's after 2% inflation but it's likely he'll get more than he bargained for.

I see a disaster in the making for Japan unfortunately. It may be the first of the major economies to implode.

Purelle wrote:Oh what does how's mean, I was also thinking about roller shutters to help keep the heat out. Any thoughts on that? There is also no pergola or shaded area, is this important do you think?

Purelle wrote:Oh what does how's mean, I was also thinking about roller shutters to help keep the heat out. Any thoughts on that? There is also no pergola or shaded area, is this important do you think?Roller shutters can turn into hot plates that make the situation worse. Depends on design. Personally I'd just DIY solar tint the windows. Cheaper and easier and very effective at deflecting radiant heat.

DWolfe wrote:it was on the market for 3 days and is now under offer.Listings show it was on the market at least as far back as 26 Sep 12. Staging then looked average especially the lounge area (showhome pics perhaps). I like yours much better.

No white goods…?

http://www.thehomepage.com.au/property/residential/3-48-lyons-road-croydon-north/502048

A little OT but look out for inflation.

The charts below show recent movements in international benchmark prices relevant to the price of petrol and diesel in Australia. These market prices include the Singapore price of petrol (MOPS95 Petrol) and diesel (Gasoil 10ppm sulfur) and the market prices for Tapis and Dated Brent Crude Oil.

grimnar wrote:

grimnar wrote:Again though, value at the end of the mayhem purely depends on whether or not your currency still holds a value. Market crash resulting from currency collapse would be a total reset!

I can't get my head around a total currency collapse model at the moment. CB's are largely acting in concert albeit trying to work around their respective political masters who in Japan's case want to actually hold the reins (heaven forbid) The political muppets scare me more than the banksters.

My instincts tell me that currencies will be destroyed after a reset. I tend to think it will look like an immediate post GFC08 kinda environment but without the stability fixes they employed then (or nothing that works for any length of time). Sovereign defaults could look ugly and I think the bogeyman is going to be derivatives but a 1000 x worse than last time.

Japanese Bonds… they're a gonna fursure.

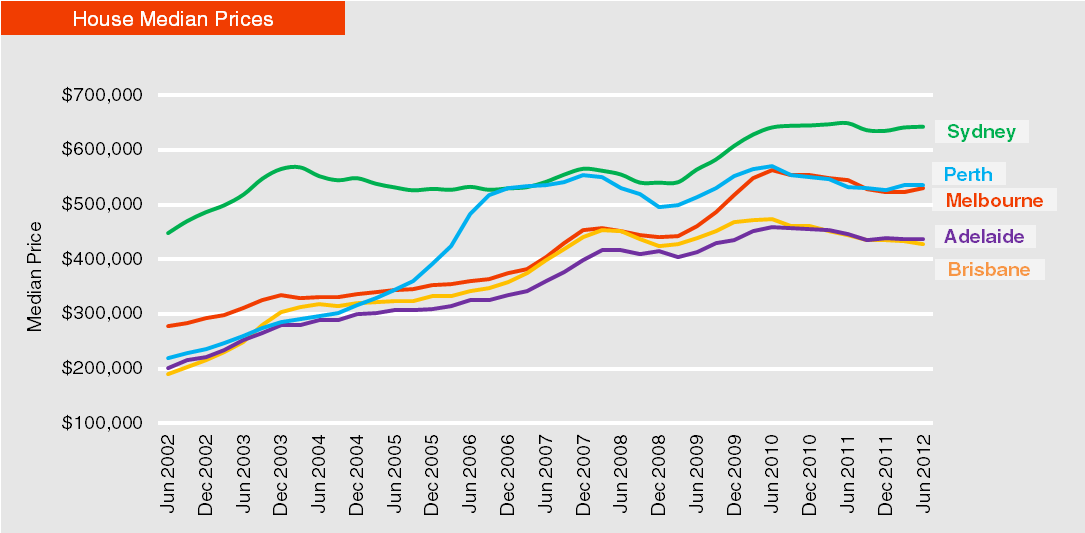

vagirl2012 wrote:In uncertain times like this I'd say property all the way…The property investor sector could be decimated given that the vast majority are leveraged to the gills. A 20% move in property could push 60% or more into negative equity.

A property correction accompanied by a AU$ fall would see a massive rise in inflation. RBA would have little option but to raise interest rates.

Double wammy..

Nigel Kibel wrote:Some of the experts believe there will be a big correction. That's why I believe property is a better and safer investment.Only if you're not leveraged.

Quote:If shares do fall people may put more money into property again.The vast majority of potential buyers are middle class and above. They got smashed in the last GFC.

-

Half of $1m plus investors report GFC losses of up to 30%.

Australia’s wealthy have endured significant losses following the GFC with around half reporting a loss in assets of up to 30%, pushing nearly one quarter of investors out of the $1m + asset bracket.

- there has been significant growth in the number of high net worth individuals leaning towards ultra-conservative investment decisions with around 43% registering as risk averse in 2009 compared with 11.5% in 2007.

- Currently more than half (51.3%) of HNW individuals see cash and cash-like assets as the best investment option, with property, Australian shares and International shares ranking behind

Property prices have been mostly flat since Dec09. There's no real evidence money fled to property for safety. The GFC property price reaction (muted) may lead to a false sense of security for those looking at property as a safe haven investment if the share market corrects significantly. If the markets correct there is no resource boom to back-stop the Australian economy this time around. I would expect to see serious problems evolve within the Australian property market on all fronts.