Forum Replies Created

What are we talking about here? 1m…2m…3m high? Does it border the front/public property or is it a garden rear type wall. Need specs to understand what you're talking about

….Getting 2 or 3 phone enquires a week and they have turned into inspections, midweek

You need to understand why these aren't turning into sales. The agent needs to do a follow up on these enquiries once they go dead to get a reason why they didn't commit.

Without this info you're flying blind. Time to give the agent a kick up the proverbial.

India and China are the most populace countries in the world. India has the worst poverty in the world. China has 100's of millions that live on a few hundred dollars a year.

Your point? Population growth is not a sign of an investment opportunity on its own.

Give me some hard data that supports your contention that Florida is worth a long term investment in property.

I might have this arse backwards but back of the napkin suggests $5-8K net or around 2-2.5% return on capital invested before tax.

Where's the risk premium? Assuming $150k initial investment (inheritance) would generate on term deposit (4.7%) around $7k for no effort or risk.

It looks like she hasn't yet recovered costs (incl potential exit costs) and won't for another few years as well.

Given the current state of economies and the inherent risk that brings to a CG position there appears little if anything to warrant leveraging up to the neck for such a small return. Worse if adjusted for inflation.

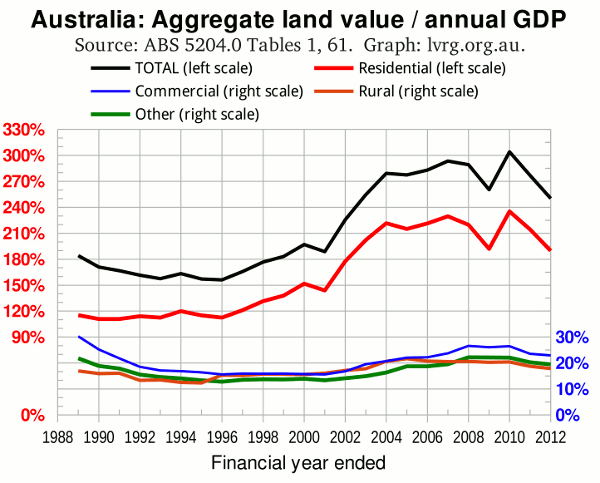

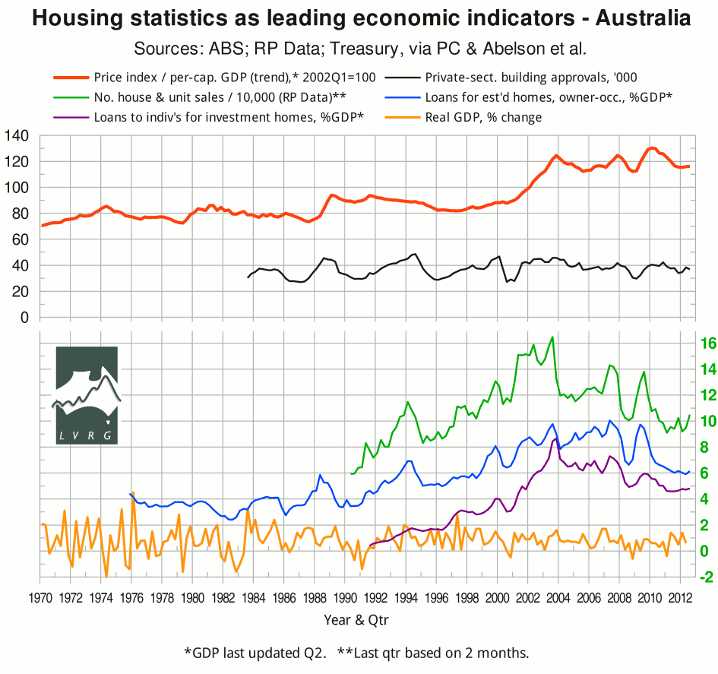

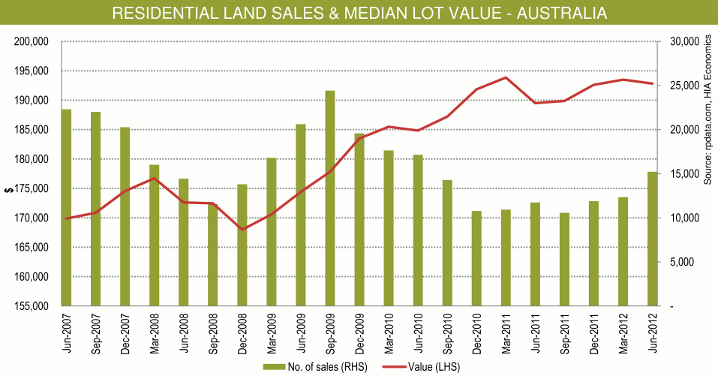

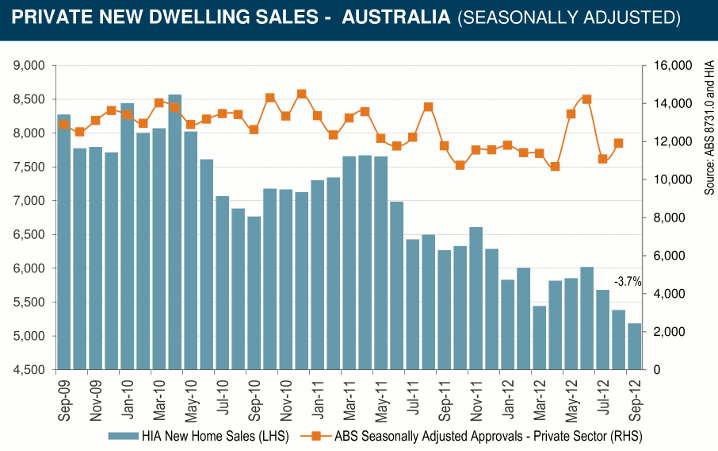

The Land Values Research Group have the odd bit of interesting data

(click the image or image icons if they don't show for graphic and article)

Quote:You have to look at the strengths and weaknesses of markets and make decisions accordingly.

Quote:You have to look at the strengths and weaknesses of markets and make decisions accordingly.Show me some tangible real strengths that would indicate sustainable CG and rental growth. To date I can't recall you ever coming up with any real hard data that supports a real world sustainable opportunity.

Quote:Unfortunately, they are still on the market and not one has sold.The agents agree that it is priced right

How long have they been sitting? I would want to see activity stats from the agents; enquiries, inspections, offers etc. They need to be mapped to current market trends to get a guideline idea of where you're at.

Enquiries suggest you have market presence, inspection suggest market interest and offers suggest accurate pricing.

If you're not getting enquiries you have a marketing problem (and possibly price). If you're getting inspections but no offers then something's wrong somewhere and that is most likely price if there's nothing else that's obvious.

Big John wrote:3. Economic fundamental is place that indicate the US economic recovery has commenced

And what would they be then??

Best Performing Cities 2012

http://www.milkeninstitute.org/pdf/Best-Performing-Cities-Report-2012.pdf

Guess what Orlando ain't on it like the rest of Florida except in the biggest looser categories.

That jobs growth you're talking about (courtesy of the Orlando Sentinel)

"So 80 percent of the net increase," he said, "were in two relatively low-paying sectors."

And the government massaged unemployment rate (benefit terms are linked to official unemployment rates – the rate drops so does the benefit term) to keep benefit costs down

Beginning this month the state is reducing unemployment benefits from 23 weeks to 19 weeks.

Florida is an oversold story. As soon as you kick the tyres and look under the hood you soon discover she's a rusty old banger that needs a lot of TLC and rework to get her back on the road.

Read. It should solve most if not all of your problems

http://www.woohoogroup.com/latest-news/who-is-carly-crutchfield

All you ever wanted to know about this mob and more.

Les I think you might have to go to Gehl's workshop on how to flog free stuff.

callmeles wrote:I'M WITH freckle on this one.Your supporters tickets are in the mail.

Renting – The American Dream

The next housing bubble?

The Second Housing Bubble Ends With A Bang, Not A Whimper,

- David Stockman WarnsStockman further contends, "It's happening in the most speculative sub-prime markets, where massive amounts of 'fast money' is rolling in to buy, to rent, on a speculative basis for a quick trade. And as soon as they conclude prices have moved enough, they’ll be gone as fast as they came." Critically, he points out we live in a world of boomers looking to be trade-down sellers, not one of trade-up buyers, as "the fast money will sell as quickly as they can and the bubble will pop almost as rapidly as it’s appeared.

- as he explained there is "no real organic sustainable recovery."

More surveyors because of less work.

Watch coal and gas resource expansions literally go full stop over the next few years. I'm betting you'll see an increase in mine closures within 18 months. If India builds a proposed rail link for its 3 largest coal deposits scheduled for the next 5 years coal in QLD will crash and China's talking up a cap on coal use due to pollution. Another major problem.

I'm watching things slow up here in WA and it's happening way faster than even an old doomer and gloomer like me thought it would.

The guys a dud in my book. Others think so too.

http://somersoft.com/forums/showthread.php?t=76099

I hate to say it (not into development/coaching cses) but Steve's Apprenticeship Cse would be far better value for your buck

Some of the broker experts can confirm but all RE lending here is full recourse. The only way to simulate non recourse is to have your assets locked in under another entity and the use of bankruptcy if they're hell bent on taking every last cent. You'll find the wealthy use this ploy or tactic without hesitation.

jmsrachel wrote:I'm going to make myself look pretty stupid and ask what is non recourse lending and when would you need it?In case of a default the lender can only seize the collateral nothing else.