Forum Replies Created

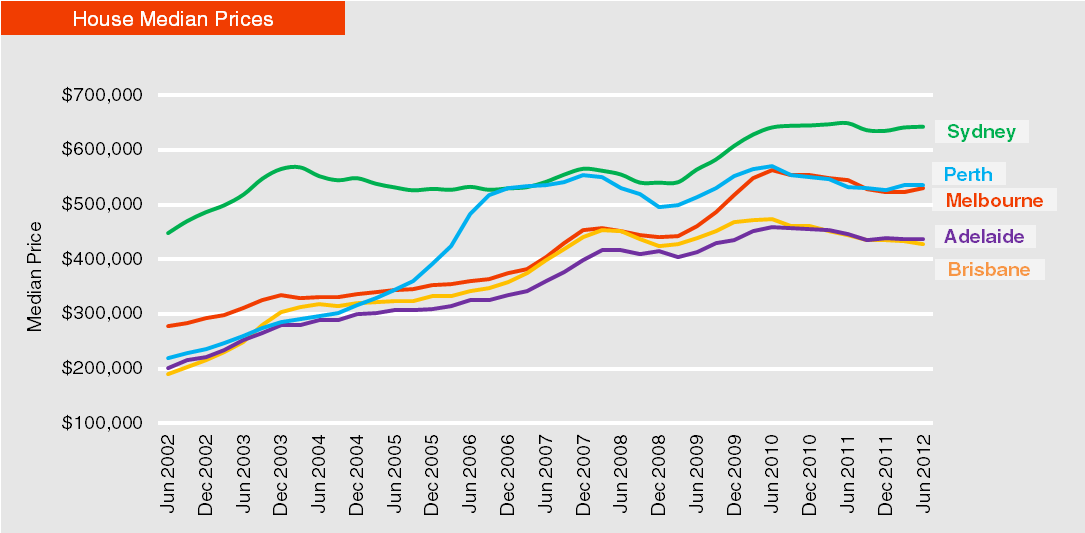

The following graph illustrates how much CG has been the contributing factor to wealth generation. If CG is a thing of the past at least in terms of being able to beat inflation and holding costs etc then one has to question how returns could be seen as reasonable given the trend in rental increases has not matched the level of funds in vested.

This illustrates the difficulty in finding cash flow positive properties when high gearing is employed. When return on capital invested is calculated it obvious that the returns are extremely poor.

While this looks at the traditional buy and hold investor its fairly obvious that investors are going to have to become considerably more sophisticated to scratch a return out of property for the foreseeable future.

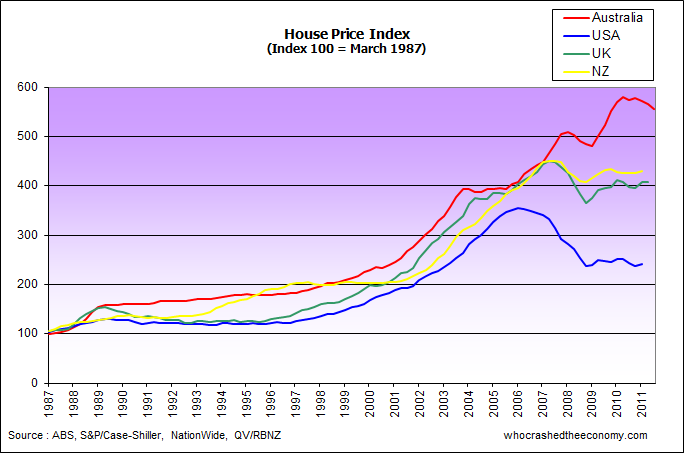

And here's another reason I think Aus property markets provide challenges the average investor would find insurmountable.

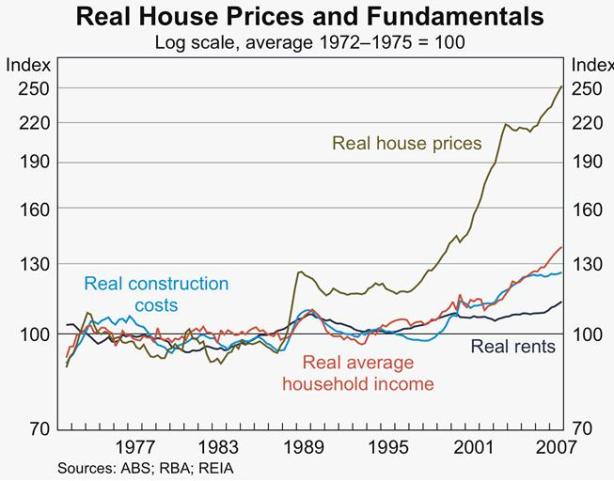

A graphic like this screams bubble to me. Simply because the Australian market hasn't corrected significantly yet doesn't mean it won't.

The concerning thing about this graph is that it points to a market that is overvalued by a factor of 2 and that any correction to the mean would see values halve. That's a huge amount of wealth that could be vapourised.

alfrescodining wrote:I'm not sure what areas you're looking at Freckle but in Sydney where I am the property market is doing quite well, particularly the lower end of the market. Darwin is doing well, Perth is doing well, Melbourne is ok.You could go to any city and find spots that are "doing well" as you say. You can also find spots that are doing the opposite. This is generally not useful information because by the time a suburb is doing well there's a good chance you've missed the boat and trying to front run hotspots is literally impossible.

The problem with this view is that it is time sensitive. It's all about now or what has just been. It doesn't help you figure out the likelihood of positions in say 5 years. Trends are also rearward looking and are at best a guide.

So to me it's impractical to look at a suburb now that is appreciating and extrapolate from that the market in general is doing well and is likely to continue in this light. Unless there is a broad appreciation in the market of values greater than 5%pa I would have to surmise the market is experiencing some difficulty though albeit some suburbs are seeing reasonable growth.

Quote:I take your point that the property market has risen through times of high interest rates, but the 2004-2007 era saw unprecedented wealth which supported the property market.That wealth was the equity increase due to price rises.

Quote:However, how many times have we seen interest rates this low and the market NOT boom? None. How many times have we seen interest rates this low and the market DID boom? One. I know the same outcome this time is not guaranteed, but I think it's more likely than not.I think you're drawing the wrong conclusion here. While rates have been low on occasion they have not remained low for any great length of time. They may have been part of the over all trigger mechanism but they appear to have played no part in sustaining property price increases.

DWolfe wrote:So, Freckle, are you discounting manufacturing and food?

I found a website (I too have access to Google) http://www.tradingeconomics.com/australia/exports I won't cut and paste the graph, people can look at it there. According to this site, manufacturing and food exports make up 33% of the total. with coal and oil 18% and 9%. So who's to say that after the horse meat lasagna thing our beef exports don't start heading up? Whose to say that in a few years Australia replaces the falling demand in the mining market with food exportation?

Definitely not but both those sectors are problematic as well. Manufacturing has been contracting on a steady basis for some time and that trend seems set to continue for some time at least.

Food will be challenging as we move forward. Right now we're up against the water barrier and right after that is energy and right behind that are fertilisers. Given all our smarts, all our new beaut technology we still haven't managed to push food production up over the last 20 years. In fact we're loosing the battle some would say. Globally we need to double food production by 2050. That's only 40 years away!!

It's likely we'll have problems just trying to maintain production levels as our own population increases. We currently export something like half our production. Those export levels aren't like to increase.

Quote:China is a large market at (once again according to this site) 27% of our export market. So what about the other 73% of countries buying our product?They wouldn't be the ones going broke would they. The price of iron ore alone shifted our Terms of Trade (ToT) from positive negative. That's without anything else

Quote:Also do you think that tomorrow no one will buy they gold we are digging up? Really?There's no problems there. Where the problem lies is in the manipulation of the price of PM's to keep them down (long story). What that does is suppress mining and consequently, jobs, capex, exploration, investment etc

The problem with resources is they make up such a large portion of our export market.

This is how it works; Over the last 20 years the world has gone ballistic on a credit frenzy unparalleled in history. That enabled countries like China to climb of the floor and fairly quickly become the worlds manufacturing center for cheap mass produced goods. That in turn meant increased wealth for the Chinese and consequently a spending spree on infrastructure to bring themselves out of the dark ages so to speak and be able to foot it with the rest of the world. That in turn saw a massive increase in demand for our raw materials. that made us kinda rich. Well so we thought. Trouble is our debt levels after this boom don't look too crash hot either.

Now the problems is that the global economy is running off a cliff so what happens to China. It slows down we slow down. To date its been pumping massive amounts of stimulus into its economy to stop it from tanking. That's led them to a debt situation as bad as the US and a few others. In fact it's probably worse.

Resources only have to pull back 10% and we're in trouble.

DWolfe wrote:Freckle, u workin for Macro Business?D

MB is the only MAB (multi author blog) of any worth in Aus. Certainly anything to do with economics. These guys are either ex treasury or ex analysts. You get relatively objective comment/analysis I've found and they always have a fairly good overview on property. The commentators are fairly switched on bunch too so for me it makes interesting reading and a reference point for comment.

These guys control up to 30+ years of supply. The bitching is about these large development companies monopolising supply and consequently manipulating land values by withholding supply from the market. There's been a lot of crying over the years about state govts not releasing enough land but that's been shown to be a furphy time again.

Mirvac has just audited its land bank as I'm sure others are doing. It's looking at selling back land it sees as uneconomic to develop over the next 10 – 20 years. They're being squeezed by lack of demand so all this is about adjusting balance sheets and keeping shareholders happy.

The upside is it reduces competition for the smaller developers.

I'd recommend you get your teeth into something like this but I tend to think it might be throwing you in the deep end at the moment.

http://www.macrobusiness.com.au/2013/03/prosper-responds-to-land-banking-developers/

Blimey more mind numbing industry gibberish.

I notice you lead with positive sentiment when in fact 80%+ don't see property actually keeping pace with inflation over the next 5 years.

In other words the great majority of people see property as a looser but somehow this has been twisted into a boner for property spruikers.

alfrescodining wrote:This will be a good year for Sydney's outer suburbs.

Sydney has a lot of outer suburbs from the dirt poor to the filthy rich. It's a bit like saying it'll rain next year.

alfrescodining wrote:Look from 1990 onwards.Interest rates plummeted and stabilised from 18% to between 3% and 8%. Property prices soared. Unless interest rates skyrocket, people will keep borrowing, and prices will not fall.

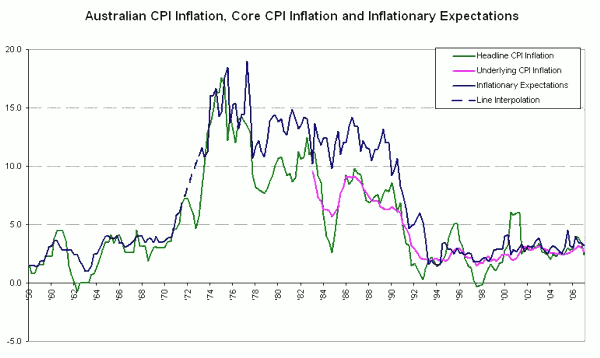

I've never considered interest rates as a driver of boom cycles. That can be seen in previous boom cycles where values still lifted above trend even though the cost of credit was exorbitant by historical standards. I've always considered rates as enablers not drivers. Globally govts relaxed fiscal policy and gave the banksters the green light to lend more. As property prices rose the trend became to access equity and leverage in order to gear up on property. The driver became a loop of equity access + equity increases rinse and repeat. Feeding the frenzy where spruikers that were thicker than fleas on a dogs back.

The primary reason for McKnight's success was this loop. Without this his ability to acquire properties would have been severely limited.

The party never really got going until the late 90's. The big problem is that the 98 – 08 ramp in property prices was too high too fast. It simply out stripped the consumers ability to keep up. Since 10 the markets been flat and will stay so until credit capacity returns to the consumer.

Credit volume (access limitations) and availability (price/rates) are no longer supporting property prices. The consumer has exhausted his/her credit capacity. What little capacity remains is being conserved while they figure out which way national and global economies will trend.

Australia has remained stable and continued to grow albeit much more slowly however that growth came on the back of China's spending binge. Their capacity is now considerably limited. The next decade or so will more than likely see a reversion to the mean on average. Until a new driver of growth materialises economies aren't going to enjoy the boom conditions of the last 2 decades.

alfresco wrote:That's obvious. People have access to money and credit – much more than they need. Nothing will change that in the immediate foreseeable future. The massive boom from the late 1980s to now coincides with A TRIPLING in people's borrowing capacities, due to structurally lower interest rates, caused by the adoption of sound monetary policy including inflation targets and the RBA charter, as well as deregulation of the economy. The massive price increases are justified.I had to laugh at the sound money quip. I don't think we've seen sound money since 71

Since we went off the gold standard and CB's got the all clear to print markets have become increasing unstable. Post GFC08 they're as unstable as they've ever been and continuing to deteriorate.

Private debt has been channeled into housing as a matter of Govt policy to give the public the impression of prosperity without the govt having to do the hard lifting through fiscal policy. Govt has deleveraged giving the impression of sound fiscal prudence while allowing the private sector to go on a debt binge.

Post 71 govt's lost control. Inflation went parabolic.

Govt's countered with equally parabolic interest rates.

Property boomed and bust cycles continued

The booms preceeding GFC08 match the high spikes of inflation and interest rates. The cost of money (interest rates) does not appear to have affected the property booms of past.

alfresco wrote:Were you asleep in 2009? Or when rates were cut after 9/11? What happened last time interest rates were this low? The market boomed. And its happening again. Are you asleep now? Wake up pal. While you're sitting on the sidelines afraid, rational people are making money.

Not really seeing a boom here. For the last 10 years the average compounded return has been around 7% annual. Sydney is half that. By Jun 2010 the market had topped and has been in a sideways to down movement, basically drifting. The funning thing is we have the lowest RBA rates ever 3%. As this continues that 7% growth aggregates downwards.

So why isn't this market booming as you claim?

Was I asleep in 2009. Don't think so. In 2009 I was banking $250k /yr what were you doing?

If you bought property on the rise in 2009 you sure as hell weren't banking $250k/yr. My guess is that given purchase costs, hold costs, probably a good chance the value has drifted sideways or even slipped plus exit costs there's a good chance you're sitting on a paper loss right now.

I don't really sit on the sideline unless I've made a bucket load of cash and I'm looking around for something to invest in. Actually that's what I'm doing right now.

I'm down 40k on silver resources stocks at the moment. I've got a 5k bet with a buddy I'll be up 100k by the end of the year. So if you think I'm a doom and gloomer who sits around fretting about the world and is too scared to get his hands dirty you haven't understood a word I've been saying and your understanding of investment has some way to go yet before it matures.

I did the property thing years ago and I do other stuff now. I'm not after penny ante 8% annual returns anymore. I start at 100% and work up.

My philosophy works like this. If you want to earn $500/wk then you'll probably earn about that. If you want to earn $2000/wk it might take you a little longer but eventually you'll earn that. If you think $10k/wk is possible and you set your mind to it you'll earn that.

alfrescodining wrote:Household creation drives the property market.No it doesn't. You can only create a new household if you can meet and access the conditions below.

Quote:We have a healthy birth rate (compared to other OECD countries) and people are literally dying to get here from other countries.Demand is greater than supply currently.

You have a poor understanding of demand/supply dynamics.

Quote:The post-1950's property boom coincides with both massive annual increases in population, and the normalisation of banks lending money for people to buy houses, whereas previously this was not the case.You're getting closer but the population meme is a red herring. The answer is in the second part… banks lending money.

You can have all the demand you like but with out the ability to access credit the demand driver can not be engaged.

Here's an example for you. Arguably there's a high demand for Ferraris amongst males 18 – 40. So why don't we see hundreds on the street. Because only a small percentage can afford to buy one. Provide a viable method for the average worker to buy one and sales will go up.

Pricing, credit and the cost of credit are the primary drivers of property markets. Second to that is credit capacity.

At this point in time we have relatively easy credit criteria and low cost of credit so why isn't the market booming given Australia has a relatively stabile and high population growth? New construction is crashing.

Answer: pricing and credit capacity.

PS:

Terry might be able to confirm this but I believe that as long as you're paying something towards settling an account on a regular basis they can't have a judgment awarded against you.

Wilko while I understand your angst I don't think the price is too far off the mark.

Labour rate is actually pretty reasonable. Charge out rates for tradies have been around $90/hr for the last 10 years or more. Plumbers are the most expensive trade next to sparkies. The hours worked are about right. I notice there's no machine time listed. Generally a digger will go out around $300 – 500/day.

Sure they've over charged on materials – who doesn't.

The problem as I see it is that they've balls'd up the quote and the final price has exceeded your expectations leading to an I want to kill some body moment.

The other problem I see is that as I read it you were given an estimate not a fixed price quote. Biiiig difference me ol' mate.

I'd ask for a discount which is the best I think you could get. Maybe $200 at most. Take it on the chin, lesson learned which is GET FIXED PRICE QUOTES.

So if they're unwilling to be friendly you can claw a little satisfaction back by dragging out payment for ever as a reminder to these guys that financial pain can be a 2 way street.

Best I ever did was 5 years.

There's an old joke that goes like this (clean version)

An old bull and a young bull were standing on a hill looking down on a valley full of cows. “Hey”, says the young bull. “Let’s run down and enjoy one of those cows…”

“No”, says the old bull. “Let’s walk down and enjoy the lot.”

So the moral of the story is slow down young fella. In 12 months you'll have $40k and that puts you in a much stronger position and will improve your economic outlook substantially.

The property market isn't going anywhere for some time. Its been drifting for a while now and there's a better than even chance it will drift downwards. That'll give you time to actually learn a lot more because right now your cumulative knowledge wouldn't fill the back of a postage stamp.

Patience… the most important and effective investment skill you'll ever learn.

DIY.. its dead easy. Either rent or buy some cheap new furniture.

We used to move stuff for a guy in Sydney who bought reno'd and sold apt's on the North Shore. He had a simple formula when it came to selling. After the reno we'd bring in 2 dbl beds, a chaise lounge, lounge chair, glass coffee table, glass side table and a tall modern lamp. A vase for table and two mid sized modern pictures – one for the lounge the other for the main bdrm. A cpl of things on the kitchen bench like a kettle & toaster set. Colored scented water for the loo and soft oil/perfume fragrance box or something to give the place a nice fresh pleasant smell.

Don't under estimate the value of smell when selling stuff especially property.

Only used to takes us about 1.5 hrs to pick the stuff up and set it for him. He'd hang the pics and make the beds etc.

He had his own stuff but you can rent furniture for this purpose. There's a few in Canberra. They usually deliver for a small fee too.

I'm sure Dwolfe can give you more tips.

3m Scotch Blue masking tapes are the best. Have a good edge seal for line work and don't leave residue.

The scary thing is it's not just the US. Everywhere is the same. I've lost track of them now but there was a good white paper put out by one of the large global institutions, IMF I think, about how wealth distribution can mute or drive an economy. The overwhelming evidence suggested wealth accumulation at the very top could predispose a country to revolution if the size of the group within the poverty class became too large as percentage of the whole. French and Russian revolutions where classic examples of this.

In the US your talking 50% of the population is either in poverty or borderline poverty and the next 20% are at risk should something go seriously wrong. In the last decade you have an increase in food stamp use from 15 – 47million. That's a staggering figure. 50% of Americans can't put $2000 together with 2 weeks, 40% have CC debt larger than savings and so it goes.

They now waffle on about things they call "Growth corridors". What they should be focusing on is how to prevent or restore the economic wastelands that continue to spread throughout the US.

You should read this book;

Days of Destruction, Days of Revolt (a review by By PHILIPP MEYER NYT)

and if you think the US won't go the way of the French or Russians then your betting against history.

Spanish military are openly discussing a coup d'état while Catalonia seems hell bent on secession. Here it comes. The last war was preceded by the Spanish Civil war.

Déjà vu?

Sorry dude but if I have to read another inane property blog I'll seriously consider self harm as an option. It wouldn't be so bad if you guys could differentiate yourselves but you are more like weeds on the side of the road. Prolific, untidy and of no real use.