Forum Replies Created

Granny Hulk

News Headlines from LA

Body Builders Flock to West Coast.

Steroid Sales Decline in Favor of Cesium 137

Olympic Committee Bans Cesium 137: Japanese Olympic Team decimated by new ruling

Tourist who stayed too long in Caly

You turn into the Hulk

Rentals just jumped 5 in one week

Rentals now 172 up from 167 7 days ago…

I thought the drop in the rate of change of rentals was optimistic. It seems I was premature. The increase in rentals seems to still be hovering around an average of 0.5/day

4sale has risen as well

231 up 7 from 224

SebastianJefferyJones wrote:I hadn't thought of attending inspections, good thinking! Cheers, mate.

Seb.

And auctions. Watch people. Follow the body language. Look for patterns in behavior especially from RE agents and spruikers. Learn selling techniques so that you know when and how they're trying to manipulate you.

Rob I could go along with what you say if you could articulate something.. anything.. that would enlighten us as to Florida's situation.

Meanwhile Florida's state of distress appears to be escalating in spite of all the hopium. For the life of me I can't see how anyone could recommend Florida as an opportunity to an inexperienced overseas investor with concomitant exchange risk and still sleep at night.

From Zillow

This is an interactive map. Go to their site and mouse over each county for foreclosure detail

Florida Defies Housing Rebound as Foreclosures Soar

By Dan Levy – Jan 18, 2013 12:53 AM GMT+0800

Florida’s foreclosure crisis just won’t end. More than six years after subprime lending and overbuilding led to the worst U.S. real estate slump, the state had the biggest increase in home seizures last year, and the highest foreclosure rate, RealtyTrac Inc. said.

One in every 32 Florida households received a notice of default, auction or repossession in 2012, more than double the average U.S. rate of one in 72, the Irvine, California-based data seller said today in a report. Home repossessions increased by 16,276 during the year to 84,456, the biggest gain nationwide. Adding to the state’s woes is a backlog of foreclosures caused by a required court review of each case.

January 28, 2013

By RealtyTrac Staff

Foreclosure Activity Down in 12 of 20 Largest Metros, Led by Phoenix, San Francisco, Detroit

Stockton Posts Highest Metro Rate, But Florida Cities Account for 8 of Top 20 Rates

Now if you think all these hedge funds and companies entering the market and driving up prices is good and that it mops up excess capacity.. well think again.

Is the “Buy to Rent” Party Over?

- Rents for single-family homes are rising slower than property prices as firms such as Blackstone Group LP (BX) flood the market with homes for lease, posing risks to investors betting billions on the burgeoning market.

- In Atlanta, asking prices climbed 14 percent as single family rents gained 0.5 percent, and in Las Vegas rents dropped 1.7 percent even as asking prices soared 18 percent.

- “Investors are buying homes, in part, to rent them out, and that has added a lot of rental supply, and that’s preventing rents from rising,”

- Tina Africk, a Las Vegas broker who manages 60 single- family home rentals, said houses that might have rented in 30 days in the past can now take 60 to 90 days to fill, while rents have dropped about $100 a month from a year ago.

- “One of the risks is prices run up and therefore the rental economics don’t justify the business model,” Rahmani, who has an outperform rating on Silver Bay and Colony, Rahmani said in a telephone interview from New York. “The problem could be that you would have assets that are up a lot in value, which isn’t the worst thing in the world. The risk would be that everybody goes to sell at the same time.”

The major risk aspect of these markets are that they are bubbles fueled by Fed money via corporate/hedge funds looking for yield. As the price rises yield evaporates. Once that nexus is reached you'll start to see sell offs as funds look for better yield. First to sell will make money after that everyone's a potential looser. This will be driven by declining rents as more and more properties enter the market looking for tenants. Hedge fund investors are currently struggling with occupancy rates of 54% on average.

Most small investors will have paid too much and become caught in the rent squeeze. The small investor will have to compete for management services as the big guys monopolise resources. When the selling starts prices will revert if not outright crash. The foreclosure cycle will start all over again.

You're going to have to be a very astute, agile investor with your finger glued to the pulse to have any hope of making a buck out of this market over the long haul. In normal times returns are in the 6-8% bracket for low to no risk. In this market risk is everywhere. You will need 3 – 4 times that return as reasonable compensation. If you can't get 20%+ net yield it's just not worth being there.

John-USA-CommercialRE wrote:You make yourself out to be such an authority on everywhere in the world..If there's anything that you find in my comments to be inaccurate as it relates to fact please let me know and I'll duly correct it(them). If you disagree with my opinion please persuade me otherwise. If you disagree with my assumptions or conclusions please provide supporting evidence or logical argument and I will take it on board for consideration.

John-USA-CommercialRE wrote:Hey Freckle; where do suggest to invest? You make yourself out to be such an authority on everywhere in the world..I would love to see your personal track record to verify what you can do.Since I live and work and assist thousands of people with commercial investments I qualify to be a far better speaker to this market than you my friend. I personally have closed $13 million in commercial sales alone the 1rst quarter of 2013. As an agent, broker, and soon to be real estate instructor I will take my chances with NOT listening to people like you. You must have tons of time on your hands; is this your real job?

The difference between myself and you is that you express an industry biased opinion and look to minimise the risk while extrapolating the benefits.The problem is that with a pecuniary interest in the outcome the information you look to promote has to be viewed with a critical eye. It wouldn't be so bad if you could actually display some examples of in-depth understanding of underlying fundamentals but to date your response has been to attack the messenger not the message.

My posts look to expose the risks and challenge the assumptions many pro US property spruikers publish in support of the notion that the US market is a sort of once in a lifetime opportunity and one should jump in boots and all before it dries up.

There are opportunities to invest in any asset class in any market at any time. To do that successfully requires understanding the risks not ignoring them while focusing on the potential upside.

Your the upside guy and I'm the downside guy on this thread. I try to keep opinion to a minimum and concentrate on providing fact. Feel free to challenge either. I'm always up for a good intelligent discussion. If you want to throw stones or get into mines-bigger-than-yours then I've got better things to do.

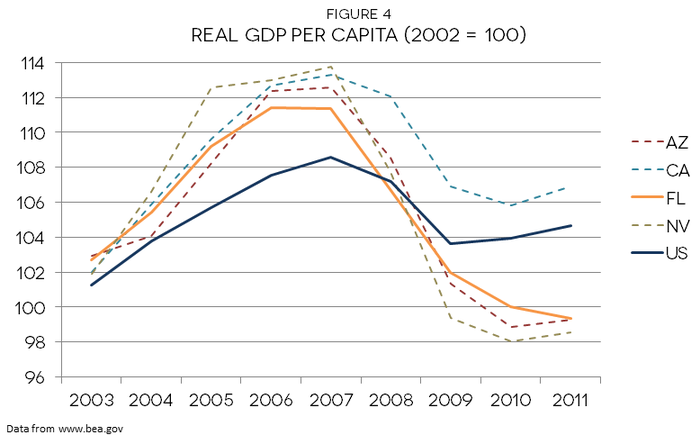

Florida’s Long Term Economic Trajectory Emerging from the Great Recession

Bureau of Economic and Business Research

College of Liberal Arts and Sciences

University of Florida

- the housing boom temporarily masked what has otherwise been a two decade long downward trend in the underlying determinants of Florida’s relative income and GDP per capita.

The following illustrates another dimension that highlights Florida's vulnerability to economic shock.

Poverty in Florida

*Supplemental Poverty Measure (SPM)

In Florida, there are 2,055,778 families, with 3,885,132 children.

Poor Children: 21% (809,655) of children live in poor families (National: 21%), defined as income below 100% of the federal poverty level.

April 1, 2011

Top 10 Reasons for Central Florida’s Need

Author: Dave Krepcho

1. Food Hardship

A recently released study showed the hardest hit markets for families not being able to afford adequate food. The Orlando area ranked #10 in the nation for food hardship with 23.6% of the population struggling — higher than the State and national averages.

2. Childhood Hunger

Orlando has a higher percentage of children in poverty that are of school age than the rest of Florida or the overall United States. One in six children lives on the brink of hunger in Florida. The number is closer to one in four for Central Florida. Orlando: 23.3% vs. overall U.S.: 17%

3. The Meal Gap

A study released March 2011 shows that Central Florida ranks higher than the national average for a measurement of what percentage of the population is in need of food. This study also measured the Gap in terms of dollars needed to provide missing meals over the course of one year. For Central Florida the gap is $84,548,545.00.

4. Poverty Rate

For Central Florida, there are approximately 400,000 people living in poverty, almost 20% of the population. Just over 100,000 of that population are children.

5. Hunger Study

The Hunger Study for Central Florida measures several indicators every four years on the hunger landscape. One key measurement is the number of different people receiving help through our feeding programs. In 2004 the number of people was 298,000. When measured in 2009, it grew to 732,000 people….a 152% increase. This increase outpaces most parts of the country. Florida ranks #1 in Nation for increase in households struggling with hunger . Increase from 2004-2006 period of 8.9% to 14.2 % for 2007-2009.

6. 211 Calls

The number of 211 calls for help in Central Florida increased by 43% from 2009 to 2010. The increase continues in 2011. Food assistance is one of the top three requests.

7. Food Stamp (SNAP) Usage

SNAP usage has increased in Central Florida by 32.8% vs. the State average of 20.8% from 2009 – 2010. One in six Floridians use Food Stamps. There was a 113% increase in Florida from 2007 -2009 in the number of people who lived in households that had no other cash income other than Food Stamps.

8. Unemployment

U.S = 8.9% rate vs. Metro Orlando = 10.8%. Surrounding Counties in Central Florida have a rate as high as 12%.

9. Under- Employment

Florida ranks fifth in the nation as a percentage of people that are considered under-employed…. ranging from 21% – 24.9% . While we do not have Central Florida data, we believe this range fits or may be understated due to the heavy tourism base and the tens of thousands of low paying jobs related to that industry.

10. The Perfect Storm

All of the previous nine key indicators add up to a perfect storm of a dire situation. This data paints the picture of Central Florida’s dubious distinction as a geographic area in great need. When compared to other markets across the country, Central Florida, unfortunately, stands out as an area of higher need.

The house has options the units virtually none at all. You need to talk to the money guys here about how you might finance development down the track. Also the planning guys. It's not my field of expertise but this type of property is what many investors kill for.

Lets say for example you did a development that cost say $200k. You would probably add $400k to the overall value. So you've spent $600k all up and have a conservative rental return of around $700k. A smart reno and redevelopment might see a rental return of $800+/wk (maybe more) if you execute properly.

The upshot is you can build equity fairly quickly and efficiently and get the cash flow up as well. That could set you up to leverage further with the increased equity and serviceability. Like I said earlier these are the types of deals every investor is looking for.

It's fairly rough back of the napkin stuff but definitely worth exploring.

You guys still don't understand the population dynamics of Florida. You just parrot MSM headlines as if they convey the real story.

The problem with Florida is really America. The US is a disaster zone economically and given the scale of corruption and malfeasance since the GFC it rides within a hairs breath of a repeat of the GFC x 10 at almost any time. As every day passes we edge closer to the cliff as the powers that be try every trick in the book to wriggle out of this financial tar pit they find themselves in.

Florida is a state that ticks along alright in relatively good times but is one of the first to burn when things go wrong. It also tends to burn more than any other state under those circumstances.

- Florida's rate of growth has been declining for decades

- during the GFC people couldn't get out of Florida fast enough

- population inflows tend be low socioeconomic and retirees

- jobs growth is predominantly low paid

For a more comprehensive understanding read the following;

An Analysis of Annual Migration Flows in Florida, 1980 – 2008

Florida has been one of the most

rapidly growing states in the United

States for many years, but growth rates

have fluctuated considerably from one

year to the next. Most of these

fluctuations were caused by changes in

the number of people moving into and

out of the state. I

Percentage growth rates, however, have

been declining steadily, from 44% in the

1970s to 33% in the 1980s, 24% in the

1990s, and a projected 18% between

2000 and 2010

Low, Declining, Polarizing: Job Skill in Florida

ABSTRACT

After removing the effects of local amenities, prices, and local labor supply and demand

shocks, on a wage based measure of skill Florida’s average job just before the Great Recession

was 3% below the nation’s, down from 2% at the beginning of the last decade. Florida mimics

the national pattern of wage and job polarization—the hollowing of the middle of the skill

distribution coupled with strongly rising relative pay for high-skill jobs, slightly rising relative

pay for low-skill jobs, and falling relative pay for mid-skill jobs. In addition, labor force

participation fell more in Florida than in the U.S. over the past 30 years, and this was more

pronounced at low education levels. Simultaneously, real earnings for those with low education

levels fell, but less than in the rest of the nation. Florida is in the midst of a pronounced emptying

of the middle of its job skill distribution in which increasing demand for workers in low-skill

manual non-routine jobs is apparently outpacing increasing demand for high-skill analytical

workers. The agglomeration economies exhibited by high-skill jobs and expected baby boom

retirements are likely to accelerate this process absent aggressive and urgent public investment in

education and infrastructure, which seems unlikely.

This graphic suggests that Florida's high end job market is not performing very well in comparison to other regions. The data suggests that Florida is in fact seeing a decline in the sector. Jacksonville hits a high but only because of a high 12 year average. Overall the trend is in decline. The next best city, Tampa, comes in at 22nd and the remainder are well down.

This is only a part graphic – click to see full version

When the next correction comes holding property in Florida could well cost one their shirt. Florida is the leading edge of the new property bubble.

It's not unusual to see quite large spreads when there's a lack of quality data. You might look at getting a few RE firms to give you a workup on this property and take an average to see where you sit. They should be able to help you narrow the market price down to something a little more accurate than a $100k spread anyway. If they can get to within $30k of each other then you probably have a fairly accurate market price.

House looks interesting. 40 steps down could mean (subject to height restrictions) could you build another level on top? Trees??? Just get an arborist in to prune the living daylights out of them.

Wouldn't touch anything that subsides or is subsiding and it's even less attractive because theres a unit on top to consider.

streamlineinvesting wrote:Toowoomba would also provide a lot of the maintenance resources required for the mining sites, as you can imagine the maintenance of the mines is going to last a lot longer than the actual construction. This is in regards to coal seam gas anyway.This is an important distinction when looking at regional economies dominated by resources. Qld faces some significant challenges over the next decade or two with both coal and gas. Both are under substantial downwards price pressure which is only set to increase. Coal is being displaced by gas at every opportunity and gas has become abundant over the last decade with some huge finds coupled with CSG and shale gas. Resources won't disappear but a 20% reduction in production makes most ventures borderline at best. So things like royalties and resource expenditure declines significantly.

The other problems with resources is that they have distorted regional economies. So even though other industries exist they haven't changed to any great extent over the last decade. Virtually all change is resource driven either way. This make regional investment in places like Qld difficult to say the least. The most stable places long term will be resource hubs for logistics and maintenance. Newman is an example of this in the WA Pilbara region.

Investors need to be wary of the CSG/shale gas story as well. These are generally small, highly mobile and very temporary (<2yrs) projects.

You are already showing some of the traits required to achieve success. Goal seeking requires a certain amount of extrovertedness, aggression in pursuing objectives and resilience to failures. Life rarely progresses in a straight line. Others here won't drag you along. You have to push yourself along to get to where you want to go. There are many members here who sign up but do or say nothing. The lurkers.

Getting involved in threads and discussions has to be a proactive pursuit by you. You can't catch fish if you don't throw your line in the water.There are no monsters here. Everyone here has been where you are and understands where you're coming from and the difficulties you face. If you choose to proactively tap into the knowledge base that exists here (and other forums) you will build relationships with professionals who will invariably become your investment team. They by default will mentor you in their areas of expertise.

Individual mentorship is a high risk proposition in this game. I have a landlady whose journey into PI via an experienced friend has been nothing short of a disaster. Less than 1% of 1% of investors have a clue about property. I know several people who own in excess of $5mil in property but have got there through good luck not good management. Then there's professional mentorship programs. Many are designed to separate you from your hard earned dollar.

Forums like this offer you the opportunity to express your ideas and strategies. Elaborating here enables others to critique your ideas from a variety of perspectives and offer solutions. You can think of forums as a lot like a nursery if your prepared to exploit it along those lines. That's what they're designed for.

Two things you need to get your head around in the early stages are behavioral not knowledge base. Patience and objectivity. Newby's are usually busting their britches to get in the game and consequently are prone to acting in haste. They tend to see an opportunity as something that should not be passed up. When you let an opportunity slide without feeling like you've just missed out on winning the lottery you'll have started to mature as an investor. Opportunities are endless so patience will always reward those who wait for the right opportunity.

Objectivity can be hard to maintain in the early days. There'll be times when certain properties appeal to you at the emotional level. That's often a sign to give that one a miss. Emotional decisions in this game are rarely good ones. You need to be able to assess deals on the cold hard facts not because you think the fixtures and fittings are cool.

E Wolfe wrote:to me it seemed quite amazing for the price bracket – outside not much, but inside is gorgeous

It's your run of the mill portable. Nothing special. By the time you've seen a 100 or so the wow factor disappears and the practical side of your assessments will have kicked in.

Quote:we have road construction for at least the next 4 years, which is why I didn't think there would be a shortage of tenants happy to pay a relatively high rent- at least short term- I would have thrown in house cleaning service for an extra $50 p.Property investment is a long term game in the main. Temporary surges in demand are just blips in the time line nothing else. You need to look at long term drivers of value in long term investments. It's no good if cash flow is great for 4 years then lousy for the next ten and the value slides.

Quote:Is there not also a market for retirees wanting to buy into relocatable villages?Buyers in this market are socio-economically disadvantaged for one reason or another. Without land tenure there's nothing to support the price let alone CG growth.

Quote:The first agent I spoke to said that within the last week or so about 4-5 people had all of a sudden been asking about them.Anecdotal information from agents that purports to support the viability of a purchase where they have a biased interest should be treated with skepticism to say the least.