Forum Replies Created

What a lot of you new investors are struggling with is understanding that you're no longer investing in growth times like the 00's but are operating in markets that for the most part are tracking sideways to down. Those few markets where growth still exists on average are precarious at best as conditions tighten.

Unless you have lots of wiggle room then investing in these times requires a more stringent appraisal of strategies. In your case Joey you are leveraging to the max on a CF- property in a sideways to down market with a high probability of negative CG growth as global economic challenges put pressure on Australian economic conditions.

Your financial profile, experience and investing approach is about as high risk as it comes. Your choice of the Illawara probably goes to lack of experience. This region is showing signs of rising unemployment and a transition away from resources to services. The only real driver in that economy is the Uni and given global challenges its impact may be constrained going forward. I don't see anything on the horizon that presents any compelling reason to invest in the region.

I tend to think you need to focus on building a stronger position for the time being. There's not a lot of point jumping into a market that is in all likely hood going to cost you wealth not increase it. You need to ensure your first property is CF+ and doesn't leave you overly exposed to market movements. With your current plan a 5% move against you would invariably see you in negative equity territory. In this climate it could take years for that position to correct while in the meantime it cripples you financially.

Some basic tips;

- don't risk your grubstake (equity in PPOR) on high risk low margin plays

- avoid -CF like the plague or figure out how to make it CF+

- look for opportunities to build at least some equity in a new acquisition

- CG is 50% of the game – invest where there is potential for it

Sold an aircraft engine to a guy over that way who builds horse stables. 2 years work ahead of him. Go figure.

Here's what your slightly smarter than my pet rock commentator fails to grasp. A slide in JGB's impoverishes the 91% of Japanese institutions including the biggest pension fund in the world and may well make a few dollars for the foreigners who have derivative insurance backing any losses. If the BOJ looses control of the bond market it's game over. I've seen estimates that suggest super funds could loose 30 – 50% nominal and much higher in real terms as the Y sinks faster. The implied target is USDJPY 120. Loosing control could see a run to 150+. At that point it would be game over. Some are speculating the Y could go to 200 and beyond.

The general consensus is to get out of Y and Japanese assets and buy foreign currency or foreign productive assets. There are already indications of capital flight that are further pressuring the Y.

Throwing fuel on the fire is China's and S Korea's somewhat negative reaction to put it mildly. SK has to go in all guns blazing because it can't afford to be snookered by Japan when 60% of its GDP is exports. China's kinda hamstrung with food inflation issues so can't realistically devalue. That suggests other forms of punishment in retaliation.

This is absolutely not going to end well for Japan.

zmagen wrote:From a web commenter – "…The BOJ and the Finance Ministry would love a panic. That way they could buy the bonds back cheap. It is a shakedown of foreign investors and I think it is hilarious…" Interesting times.

Are you suggesting he/she actually knows what they're talking about or are they just another dumber than my dog blog commentator who probably wouldn't know a wooden dollar from a real one and you've posted it to add humor to the day.

Qlds007 wrote:Tell me where you can invest and pay a lesser rate than inside a SMSF and i will stop my contributions tomorrow.

Qlds007 wrote:Tell me where you can invest and pay a lesser rate than inside a SMSF and i will stop my contributions tomorrow.For me it's the opportunity cost. When I can literally get returns in the 300%+ on capital invested and pay bugger all tax the opportunity cost far outweighs the few tax dollars saved. I have a natural antipathy towards super. Governments have a tendency to keep moving the goal posts to suit their own interests.

haven you read this thread?

https://www.propertyinvesting.com/forums/property-investing/commercial-property/4328825

thecrest is the resident expert in this field.

Be careful what you wish for. The Libs will do you no favors. In fact you may well be worse off if they go with their proposed austerity measures to pull the the budget deficits back into surplus at virtually any cost.

The moves on super are attempts at accessing sources of income the govt currently relinquishes in the form of tax breaks. They're narrowing the field in terms of tax deductibility like the 15% on super. It is widely abused by the 1% who receive massive advantages compared to the 99%.

The tightening of property in SMSF was to be expected. Too much room for speculation which is not what super is about given that the vast majority of PI's are less than successful at building real wealth.

I wouldn't have enough coin in super to keep the dog in biscuits for 12 months. To me its always been a place money goes to die.

Builders don't do it in general and there's no licensing requirement other than electrical safety prior to installation that I'm aware of.

You' re better to use experienced insulation companies. They are familiar with the safety issues to staff and hazards of material located around down lights, electrical fittings and flues.

Ask to see a copy of their workers comp and public liability insurances also warranties etc.

Your insulation supplier should be able to recommend a competent installer.

http://www.deir.qld.gov.au/workplace/publications/alerts/insulation_install/index.htm

I think Darryl (RPI) has the goods on duel occupancy issues as they pertain to Qld as well. Not my area of expertise at all but I think DO's are a no go in good old Qld of late. Darryl might be able to overcome that if at all possible.

Well things just went bust in the Japanese bond market resulting in a temporary halt while they pulled things back from the brink.

From DB

Deutsche Bank On Central Bank Intervention: "We Are Flying Blind"

- the halting of the Japanese Government Bond complex due to excessive volatility. Now, this is not some zero-liquidity penny stock or an algo fat binary finger: at last check there is one quadrillion yen in Japanese debt, which makes it the second biggest sovereign bond market in the world.

- You'll be able to read chapter and verse from strategists trying to explain what's likely to result from such moves but the honest truth is that we are flying blind in terms of historical evidence even if we go back centuries.

zmagen wrote:You've truly digressed there, Freckle.

zmagen wrote:You've truly digressed there, Freckle.

Who me? Never! Every serious subject should have a little humor or we'd all have to slash our wrists.

Quote:sorry to have been away for so long, can't really take an awful lot of time to comment, as we've been quite busy.You've been letting the side down mate..

Quote:For better or worse (I know which side of the assumption you're banked on, don't answer that one), equity money is moving to real estate for lack of dividends, and Asia real estate money is moving to Japan for fear of more cooling measures (and a few other places – see here – http://www.pwc.com/us/en/asset-management/real-estate/publications/emerging-trends-in-real-estate-2013.jhtml), and we're happily copping it.I can understand a pullback from the Fukushima region as a whole shunting some pressure on other areas but foreign investment begs the question.. Why would anyone in their right mind invest in depreciating assets (historically) in a currency with quite clear intentions of devaluation? Insanity or just plain stupidity. Somebody's getting sucked in here that's for sure. Even the questionable appreciation in property prices does not outweigh currency risk by a long shot.

Quote:rents in Tokyo are on the up, vacancies on the drop, and Fukuoka city, where we and our clients have been purchasing extensively since 2011, is one of the first cities in the country to experience land prices on the rise again finally. Not sure where that rise will end up on the two-decade scale, but on the short term, five year scale it's the best we've seen.So you've seen a small claw back of an asset (land) at this point in time. Are we back to break even yet or even close to break even? While an increase in rental income is always welcome given the inflation in living costs (food, fuel, energy) is this adequate compensation or will rents be suppressed eventually as inflation of basic living costs bite with devaluation?

Quote:Abe's attempt to kick-start growth through inflation, with fanfare and printing machines at full steam, may be crude, but not really that different to the rest of the world's best efforts and, considering his efforts to negotiate Fukushima fallout (spreading it all over the country to "share the burden"), is probably doing the best he can to just keep exports going with the yen pressed low, while generating enough head winds to possibly live up to his inflation target by 2015. I honestly don't think he (or anyone with half a chance at becoming PM in his stead) can do much more without some handy crystal ball in their back pockets.Abe like the rest is behaving like all politicians. Simply extend and pretend. Extend the misery and pretend it all gets better if we pull the blanket over our heads. It's a poor excuse for leadership. He's just another muppet who'll decimate the wealth (or what' s left of it) of the populace to play one more hand.

Quote:interesting times but, for those of us vested in property, Japan's super high yields and the potential for a true revival if the property markets finally bottomed out, coupled with the unbeatable reliable and honest tenant and business environment wins hands down (not over your methods, I know, just for the rest of us RE geeks out there).There will be no true revival of any property market anywhere as long as central banks think they can manipulate and control economies without peripheral damage. The best you can do is understand the dynamics of manipulation and play the game accordingly.

The bottom 90% are trapped. They have insufficient wealth to grow faster than the deflationary (assets wages) inflationary (living costs) squeeze.

One very small glimmer of hope for Japan is the methane gas fields off its coast. The problem may be time. This is a known source of energy but the tech to unlock it is not well developed therefore risky. Japan thinks it maybe able to bring these fields to production in 6 years. Optimistic by all accounts, however, timing aside it still offers huge potential for Japan in two ways. Possible future energy independence (note production cost may be a spoiler here yet) and the IP value involved in this technology could be substantial.

http://news.nationalgeographic.com/news/energy/2013/03/pictures/130328-methane-hydrates-for-energy/

They certainly need a winner from somewhere after virtually destroying their fisheries with radioactive contamination.

Simulated spreading of the contaminated Fukushima waters in summer 2012, 16 months after the nuclear disaster.

A slightly more technical explanation of Japan's predicament but understandable for most people. Take notice where Japan sits on this chart and who its close neighbors are. Reveling to say the least

Why Japan Can’t Fund Itself Any Longer [Global Sectoral Balances Chart] Read more…

QE hasn't worked for 30 years but these muppets are now going to go all in. The JPY has devalued (approx)25% against the USD over the last 7 months and almost 30% against the AUD over 11 months. AUDJPY is currently 101 and the USDJPN 96.86. The target is thought to be USD 120.

To me it feels like I'm watching a ship sink.

If Japan's "Shock And Awe" QE Happened In The US….

Why? Because the just announced "Shock and Awe" expansion of BOJ monetization takes the total monthly gross purchases to a whopping ¥7 trillion per month, or 80x less than Japan's total GDP of $5.9 trillion. Back in the US, the Fed is monetizing "just" $85 billion per month, or 187x less than US GDP of $15.9 trillion. In other words, if one were to pro-rate the latest Japanese monetization effort to the US, one would get a mind-blowing $200 billion per month and $2.4 trillion per year in pro forma QE every month.

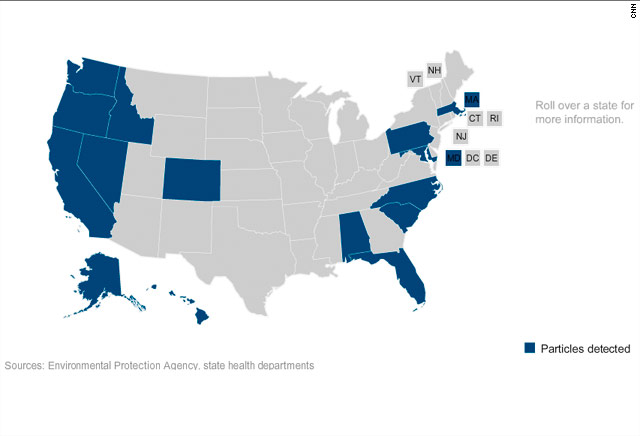

California Slammed With Fukushima Radiation

-

3/30/12 Fukushima Radiation Plume Hit Southern and Central California

The Journal Environmental Science and Technology reports in a new study that the Fukushima radiation plume contacted North America at California “with greatest exposure in central and southern California”, and that Southern California had 2,500 Bq/kg of iodine-131 in seaweed … over 500% higher than other tests in the U.S. and Canada: "Projected paths of the radioactive atmospheric plume emanating from the Fukushima reactors, best described as airborne particles or aerosols for 131I, 137Cs, and 35S, and subsequent atmospheric monitoring showed it coming in contact with the North American continent at California, with greatest exposure in central and southern California. Government monitoring sites in Anaheim (southern California) recorded peak airborne concentrations of 131I at 1.9 pCi m−3. Anaheim is where Disneyland is located.

This graphic produced by Swiss media outlet 20 Minuten Online is aparently based on recordings that

show high levels of radiation had reached Western Europe and Northern Africa by the end of March 2011.

Fukushima contamination yet to reach Chinese mainland.