Forum Replies Created

Here's a little tip. People will react more favorably to polite, respectful, professional type contacts than flyers in the post. It's also an opportunity to gather information about a street or area. Questions like; "Would any of your neighbors be interested in selling?" It's the opposite of referral selling. In this case it's referral buying. You could leave a card if they change their mind or know of someone who might be interested.

Another tactic is to go to a neighbors and indicate you're interest in buying a property in the street or area and mention a few including your primary target. That may provide a lead in to an intro with the target or if people drop their guard provide you with some inside intel to work from.

You'd be surprised what people will tell you if you have the gift of the gab.

If you're going to send letters I'd actually prefer to make approaches in person. You could introduce yourself to the owners and indicate your interest. A face to face encounter will provide you with much more information. A letter is simply sending a message in a bottle. If it fails you have no idea why. The personal approach at least gives you a shot at understanding what's happening which then gives you opportunities to counter objections or motivate the target.

As far as getting to the next phase of possible contracts I would tend to use a buyers agent as a consultant to walk me through the first one or two. They will provide the contract docs (if the seller doesn't engage an agent themselves) and help you navigate the complexities and overcome problems.

Do the initial grunt work yourself then bring in expertise to handle the various components of a transaction.

You should adopt a team approach to buying just as you would if taking on a conventional purchase.

SamDaniels wrote:Kissimmee has realised a reasonable capital gain alreadyYou've sold it then. What did you net out of the deal after all costs and FX exchange variations. Give us some hard data.

Vague claims of profits are just fairy stories one rabbits on about down the pub.

I think you're jumping the gun a bit.

Making an enquiry with someone out of the blue is a fairly common occurrence.

I would never introduce myself in writing. Too scammy. A professional approach is almost always done through a reputable agent.

Anyone could be your agent. Your solicitor, a buyers agent, friend of a friend etc. It should be seen as legitimate or you risk not being taken seriously. You can either have an agent negotiate for you or use the agent to introduce you if the response is positive and you do the negotiating personally.

Whatever you do you must have your ducks well and truly lined up before you initiate contact.

Doc Holliday wrote:I suspect you haven't the vaguest clueHow's that working out Doc?

That bad eh.

Looks like Doc doesn't want to play Moxie.

Holy moly!!

4Sale just jumped to 259 up another 11 in 7 days!!!

Rentals just cracked 200 up 13 in 7 days.

Looks like its all on for young and old.

My guess is that we are now looking at an impending collapse in both prices and rents with absolutely nothing on the horizon that could possibly save this situation.

jmsrachel wrote:Nigel Kibel wrote:Since you are Freckles side kick that's a real surpriseYes I'm the one responsible with providing Freckle with all his data and stats. Your side kicks ain't doing much for you. More interested in attacking the man then answering questions.

Haven't laughed this much in ages…

Joe I'm going to promote you from unofficial Sidekick to Gofor. Sorry but the pay grade is the same. Monies are tight and we all have to make sacrifices especially non executive Gofors. Now go get me a beer this is thirsty work.

speedy gonzales wrote:Cheeves,

speedy gonzales wrote:Cheeves,I'm not looking at Florida but from someone outside looking in….Freckle is presenting the more convincing story….be it right or wrong !!

LOL… for those following the thread I wouldn't suggest taking any information I reveal at face value. It's merely one perspective in a multifaceted world. Hopefully whatever information I do reveal broadens people outlook and illustrates that DD isn't something that can be defined as simply crunching a few numbers and ticking off a few superficial checklists.

40 years ago I wouldn't have bothered with half this stuff but given we're in the midst of global economic melt down investing is a far more complex and difficult exercise. There are far more downside risks now than there were 10 years ago. The old paradigms of investing culture are not as useful as they once were so we need to adapt to a more volatile high risk environment or see our loss rate rise significantly.

Cheeves welcome aboard. I always luv a good debate especially with someone who has a an IQ in the double digits.

Let me phrase the debate thus far. Nigel and Rob like FL. I couldn't care less other than to play devils advocate. I have no skin in this game at all. The current discussion is also oriented around the Aussy investor not your local cowboy so the implications are deeper.

I have a medium to long view of markets so I tend to comment in that context. My comments are primarily focused on investing not speculating which is a whole different ball game. So to summarise I'm commenting in the context of an Aussy investor with limited skill, knowledge and resources looking to invest in a foreign market for at least 5 years and up to 20.

So lets address your first point:

I will say that your posts reflect "Rubbish" charts and spuculative

and you refer to this chart specifically:

Charts with future projections are always problematic for most people. There's a tendency to take them literally and therefore dismiss them as unrealistic. Understanding them requires looking past the superficial data and interpreting what they're trying to convey. In this case Moody's are saying given their research they see those states and muni's as the most likely to be the last to recover and provide a projected timeline that it may or may not occur along.

2030 seems an awful long way away but in reality it's a mere 17 years. The areas indicated were probably the worst hit and given a rough average in property median price drop for FL was around the 50% mark these areas are likely to have seen worse and consequently recovering back to pre crash levels will in all likelihood take some time. If they could average 7%pa over the next 17 years they'll probably meet that projection. But hey 17 years is a long time so anything could happen.

OK next point. Your a main player as well as personally investing so I have to consider anything you say as having an element of industry bias. In saying that though you are least putting your money where your mouth is.. bravo!!

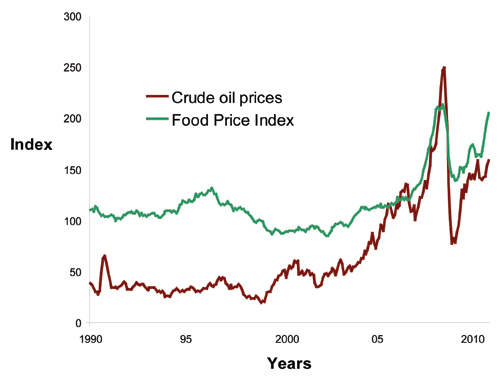

Next point: you've alluded to state initiatives and economic conditions as attractive elements to attract business, increased enquiry rates etc etc. I've already alluded to this up tick in commercial on another post;

You said;

Florida is an area that is in a steep recovery and by the end of the year, you'll see a plateau in my opinion. Maybe Freckle is ignoring the alternative energy companies, and other corporate giants coming to the area. Sure, the economy isn't solely dependent on job growth but it is the leading indicator, isn't it?

I don't necessarily agree with the idea Fl itself is in a steep recovery. There are property hotspots for sure but that makes me even more wary. By the time they've disclosed themselves the immediate opportunity has gone. They're projecting FL GDP at some where around 2 – 3% over the next 12 months. So what's driving this growth now? My analysis indicates it's a combination of states who offer better trading conditions, FED QE and hot money looking for a home. Businesses are gravitating toward economic high ground for self preservation not because they're looking to actually expand their operations as a rule. QE is now an absolutely necessity to just maintain the economy and hot money is fueling bubbles everywhere.

The problem I see with this so called recovery is that it is mainly synthetic and not organic. That lays at the heart of long term investing. So what happens when hot money slows or even stops, when QE is withdrawn (being considered at the moment). Corporate USA has shed jobs, shed inventory and is now moving to economic oasis in an economically growing desert. To me it's like playing poker on the Titanic. It may look and feel like your winning but if(when) the ship goes down you'd better have a lifeboat ready just in case.

In other words there's absolutely nothing underpinning economies other than some CB with their fingers on the CTL+P buttons. God help us when we run out of ink.

You have the benefit of local knowledge, experience and your not a foreign national investing with foreign currency. You have a head start in chasing down the best properties. My guess is that less than 1 in 10 Aussy investors will actually do OK in the US. The vast majority will either scrape buy or cop a flogging. 90% of them don't have the smarts, knowledge, experience, resources etc but most importantly the aggressive motivated approach to be hands on and in the the thick of it to survive.

Sorry Cheeves but I don't own property in the US never have. I don't own property at all these days. I'm working on dying in debt if at all possible. I can't take it with me and I'm sure as hell not leaving any behind if I can help it.

LONG-TERM ECONOMIC IMPACT OF CLIMATE CHANGE

The long-term economic impacts of climate change will be most severe on Florida’s attractiveness as a destination for retirees and seasonal migrants. Second homes for those who winter in Florida constitute roughly eight percent of the state’s housing stock. For decades Florida has also been the favorite destination for retirees who move out of their home states, but that lead is shrinking: Florida was the destination for 26 percent of inter-state retirees in 1980 but only 16 percent in 2008. Still, retirees bring at least $2.2 billion in outside annual income to the state from pensions, social security and other retirement income.

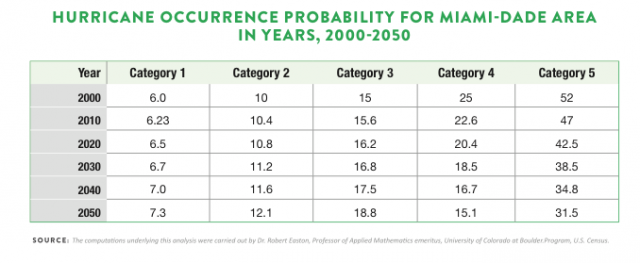

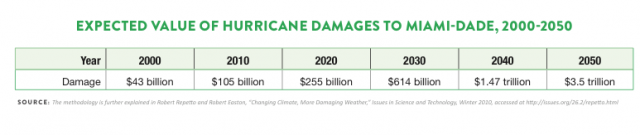

A favorable climate, attractive waterfronts, and affordable housing have been the main draws, but increasing storm surges and hurricanes and rising insurance costs would change all that. Florida’s population is aging: the largest population increase in the coming decade will be people over 65. They are risk-averse. Economic studies estimate that such households would be willing to pay as much as nine percent of their income to reduce the likelihood of a natural disaster with a 50-year return period (currently a Category 5 hurricane) by half. This indicates how unwilling those relocating will be to live in locations where such catastrophic risks are not decreasing but are increasing rapidly.

The graphs suggest don't buy the southern half or in coastal regions. Insurance premiums must be a killer if you can get cover. it seems the NW quadrant is a relatively safe bet on a statistical basis anyway.

Nigel Kibel wrote:FreckleOne of the reason I like Orlando is because it is two hours inland so by the time a hurricane reaches Orlando it has died down so Orlando would never get the full force of the storm

I can only imagine you like shoe leather.

Notable Hurricanes to Have Impacted Orlando

http://www.orlandohurricane.net/History/History.html

San Felipe-Okeechobee Hurricane 1928

Hurricane Donna 1960

Hurricane Charley 2004

Dodged a bullet with Andrew..

Dodged another one with Katrina..

and Ike could have gone anywhere

but ended up going….

Climate Impacts in the Southeast

Over 70 million people live in the Southeast. [1] The region includes many cities with populations over 250,000, including Houston, Jacksonville, Charlotte, Atlanta, Miami, and New Orleans. [1] The region's economy includes forestry, tourism, oil and gas production, and agriculture. The Southeast also includes 29,000 miles of coastline. [2]

The region's climate is generally warm and wet, with mild and humid winters. Since 1970, average annual temperatures in the region have increased by about 2°F. [3] Winters, in particular, are getting warmer. The average number of freezing days has declined by four to seven days per year since the mid-1970s. [3] Most areas, with the exception of southern Florida, are getting wetter. Autumn precipitation has increased by 30% since 1901. The number of heavy downpours has increased in many parts of the region. [3] Despite increases in fall precipitation, the area affected by moderate and severe drought, especially in the spring and summer, has increased since the mid-1970s. [3]

Average annual temperatures in the region are projected to increase by 4 to 9°F by 2080. [3] Hurricane-related rainfall is projected to continue to increase. Precipitation in southern Florida will likely decrease. It is unclear how precipitation will change in the rest of the region. Climate models are currently inconclusive as to whether the net change will be an increase or decrease. Models do suggest that rainfall will arrive in heavier downpours with increased dry periods between storms. These changes would increase the risk of both flooding and drought. [3] The coasts will likely experience stronger hurricanes and sea level rise. Storm surge could present problems for coastal communities and ecosystems.

I was reading something the other week about and background radiation was mentioned. I had always thought background radiation was a naturally occurring event. Not so apparently. Background radiation only came in to being as a result of discharging atmospheric nuclear bombs, the first were in 1945.

The authenticity of pre 1945 wines is tested by looking for the radiation signature of the wine. None means they are authentic pre 45 wines.

I suppose Fukushima and its radiation isotopes will mark another time in our history.

Nigel Kibel wrote:FreckleWhat I would suggest is if you want to have a discussion about the future start a separate post and I will happily join in.

Again you struggle with the sub themes of this thread. Recovery as you like to proclaim as occurring within your chosen locations is a future narrative that requires a modicum of understanding. All investing requires some degree of fortune telling.

Any future recovery has to consider future head winds. Understanding the best case worst case scenarios from whatever cause will or should enable the investor to make sound decisions with concomitant strategies to deal with extreme events.

Food water energy climate are all significant factors that affect Florida's economy YoY. It has a significant agricultural base that employs thousands; it's a transport and export hub for the southeast quadrant, tourism and climate are significant factors in its economy and to top it off that region experiences some of the worst that climate can throw it.

So any long term investor considering the southern states economies would, if they were a serious investor, have to consider the 10 – 20 year time frame in their deliberations.

In a little over 150 years human civilisation has gone from horse drawn carts to running robot probes on mars; from 1 billion people to 7+ billion people.

If you want to be an investor anywhere you'd better start understanding where were going as a race over the next 50 years or you'll be in for some nasty suprises.

Nigel Kibel wrote:If people wanted to follow your rubbish about the world coming to an end they would not do anything.

First lets clarify. I never said the world was coming to an end. I said human civilisation maybe entering a NTE event according to some scientific research.

Again you are intellectually unable to grasp the problem so I'll ilucidate for you. If I put 10 fish in a pond they will eventually die once they've depleted their resources. If I put 20 sheep in a 100 acre paddock they will eventually deplete their resources. The speed will be determined by population growth. It's a simple model. My wife even understands it and she's blonde.

Human civilisation is at the end point of its practical ability to sustain itself without a substantial shift to sustainable lifestyles and economic systems. GDP is simply a measure of our ability to convert living ecosystems to dead material things and the need for perpetual growth ensures we will consume ourselves to death in a finite world. Exponential growth within finite systems is a well proven impossibility yet many persist with this economic model. By around 2050 we will need 3 earth systems to sustain the projected population. Given that we haven't got those resources our demise is a mathematical certainty. The only questions that remain are how and when?

Theoretically there are solutions but they are untenable. We would need to shed 50% of humanity now to even have a hope of getting things back under control. But we are psychologically unable to accept the inevitable. It's in our programming. You are an example of humanities inability to accept its own demise.

There are signs of systemic failure everywhere as a our ecosystems start to labor under the ever increasing load. The US is in the grip of a drought unseen for 800 years. There is concern in the US like there was here in Australia that it may be decades before this drought breaks. Midwest aridation as occurred in the 1930's is a serious concern for them as well as the economic consequences drought brings and the associated spike in food prices.

There is a growing body of opinion that the die is now cast while others still believe we have a chance to correct our current self destructive course. Your response simply reinforces the opinion that the die is most likely cast and that by the time humanity realises the extent of the problem the opportunity to turn things around will have passed.

The difference between you and I is that I accept that we have a problem and choose to take action to mitigate it. You on the other hand belittle the problem in your ignorance and carry on as if the essential resources of life are infinite.

My approach means there's nothing to loose. Yours ensures we eventually loose everything.

A fact is a simple statement that everyone believes. It is innocent, unless found guilty. A hypothesis is a novel suggestion that no one wants to believe. It is guilty, until found effective.

Edward Teller

Nigel Kibel wrote:Finally Joe I am not asking anyone to take my word on anything.

You've lost me?? What's the point of your incessant Florida, Texas, Orlando posts all about then. Just chit chat to pass the time of day?

Quote:I am just saying that this is a market that is worth looking at nothing more nothing lessYou must think we're idiots. Your motives stick out like a sore thumb. You and your associate playing forum tag all based around a pecuniary interest in your own markets. You guys bang on about nothing other than what serves your personal interests.

I could tolerate it better if I thought you two actually new what you were talking about.

Nigel Kibel wrote:Ok I dont know how to respond to thisI'm shocked!!.

Quote:I guess if the world is coming to an end then there is not much we can do about itNot to worry Nigel it's unlikely you'll see it coming.

Quote:However to suggest that the fall has not happened yet is nonsense.Wrong end of the stick as usual. 08 was simply the early phase of the end of this current super cycle. QE initially arrested the descent and afforded limited stability to an abused economic system. QE is a like a blood transfusion. It can give you time to fix the problem but you have to actually fix it not fudge it. QE becomes less effective each time as the patient weakens. There have been many resets in the past. This is no different except that its taking longer and will be far more disruptive and painful than on previous occasions'. Food, water, population, energy and global warming will continue to complicate things and make sustained recovery difficult if not impossible.

.Quote:If a markets falls you have to look at the reasons. No one is arguing about the information that you have put up or the size of the falls. However markets recover

.Quote:If a markets falls you have to look at the reasons. No one is arguing about the information that you have put up or the size of the falls. However markets recoverMarkets may recover but not in my lifetime. And its really simple stuff to understand if you want to.

Populations are growing exponentially..

Energy demand grows along with it… the cost will be crippling financially and devastating from an environmental perspective.

We will need 50% more fresh water by 2050

China, with 1.26 billion people, is "the one area worrying most people most of the time," says Marq de Villiers, author of the recently published "Water " (see bibliography). In dry Northern China, he says, "the water table is dropping one meter per year due to overpumping, and the Chinese admit that 300 cities are running short. They are diverting water from agriculture and farmers are going out of business." Some Chinese rivers are so polluted with heavy metals that they can't be used for irrigation, he adds.

Energy and food costs will cripple poorer economies and constrain modern economies.

This is superficial information. Anyone who wants to can join the dots. It's easy to do hard to execute because most people want to stay ignorant of anything negative that may affect their blinkered lives. If I don't see it it can't hurt me mentality.

jmsrachel wrote:I believe there will be a recovery but 15 years away at best.Hate to shatter the illusion Joe but we haven't had the crash yet. 08GFC was just the first signs the system was breaking. We've done nothing to rectify the causes of that event. On the contrary. Things are now much more fragile and the correction when it comes will be many times more severe. If anything all 08 did was ever so slightly uncover the political, corporate and criminal fraud within the system. As we progress down the timeline more and more of this fraud is being exposed but with a political class entwined in the fraud nothing is improving. If anything it's getting worse.

Europe sinks further into the mire month by month. The US pumps US$'s into Europe's banks trying to keep it afloat because it knows when Europe goes the US will follow shortly after. China's fiscal position is a catch 22 for them. They're only holding on by printing as fast as the US and pouring that into malinvestment that is dragging it under as well. It's QE programs are a zero sum game that will pull us into the mire as well. Japan has just got the green light from the G20 to print to infinity.

We're in a full blown currency war as global economics conditions fail time and again to react to more QE. There is no escape now. It's just a matter of time.

When things finally do go pear shaped for real there'll be no recovery in 15 years. I doubt the world will see a recovery in my sons (30 & 27) lifetimes let alone mine. Over the next 50 years we have to deal with population growth, food production, energy shortages and global climate distress. Even healthy economies would struggle to deal with these events individually but a distressed global economy is somehow expected to mitigate these events as if they're manageable.

This year could see the first time ever we have no Arctic ice. It takes 1 calorie of energy to melt 1ml of ice. That same cal will raise 1 ml of water 80F. The amount of heat energy that is likely to be absorbed from the loss of snow covering is said to be of real concern. Historically 83% of global climate predictions have underestimated the outcomes. A developing consensus amongst some serious researchers is that a 2degC is now backed in. If we stopped all industrial activity today we couldn't prevent that 2degC rise. They are now talking of a NTE. Near Term Extinction

Since 1840 the sea has lost an estimated 90% of fish stocks and is expected to collapse by 2050.

Civilisations have spent the last 4000 years consuming the planet. None more so than recent western civilisations. We can't survive without killing our planet. It's that simple. We are nearing the end now of this earths ability to sustain a growing global population.

The economic reset is one of many that will occur over the next 50 years. The worst will be the population reset. The most pessimistic research that this could occur within 30 years but almost certainly within 100 years.

The only good news is that the northern hemisphere is likely to take the brunt of global warming weather events.