Forum Replies Created

http://www.macrobusiness.com.au/2013/05/arrow-lng-next-to-go/

Arrow LNG has been holding negotiations on potential consolidation with rival LNG ventures in Queensland, raising expectations that owners Shell and PetroChina are moving towards scrapping plans for a $20 billion-plus stand-alone plant to instead join Santos or Origin Energy projects.

Origin chief executive Grant King and Santos boss David Knox on Wednesday both referred to talks with Arrow and held up the possibility of an amalgamation between their respective ventures and the Arrow project.

…Chief financial officer Simon Henry is expected to comment on progress at Arrow at Shell’s first-quarter results in London on Thursday.

A fair chunk of that $65B gets spent offshore. Gladstone may play out sooner than you think. The problem with these large resource projects is they invariably over build accommodation and infrastructure to cope with the high demand during construction. Once the majority of the construction phase is completed you're invariably left with substantial over capacity. Port Hedland housing for sale and rent is ballooning at a phenomenal rate. In the space of 12 months they've gone from houses sold within days to 300 now stagnating on their listings. 12 months ago you had to sell your soul for a place to rent. Now there's 200 vacancies.

Gas demand is not increasing and a gas glut is developing. In Europe they're moth balling gas power generation and going back to coal because it's cheaper.

Proposed projects can be suspended and existing projects wound back. The current pipeline of work wouldn't have to slow down much to see an oversupply develop in the housing market. The risk I see developing is that services/facilities get ahead of demand.

Today there are no fewer than 60 nuclear plants under construction in 14 countries, with another 163 planned and 329 proposed. Gas has some serious competitors.

4Sale – 288 and they still want crazy money

4Rent – 206 eased off a bit

Terryw wrote:Cash basis or accruals? It is generally when you get paid, but not always.Yep. When you set up a set of accounts on MYOB for example it will ask you this when you configure the preferences/settings

jmsrachel wrote:First question – are you a licensed builder and what's your practitioners number. Too many call themselves builders these days when they're just Cowboys.I think what he's asking is if he contracts a builder to price according to a set of plans and specs and then alters the plans or requests add-ons how do you go about pricing it.

Chan when you contract a builder for a fixed price quote based on a set of plans and specifications he will be obliged to honor that agreement. Builders generally have standard rates for work carried out outside of the terms of the contract. So if you want to make a change to something you would request a price for the variation in the contract. Add-ons are the same. he would generally price these at a fixed hourly rate plus expenses.

You would generally describe these things in a contract. That may simply include the wording; Changes to designs and/or specification including add-ons to be negotiated separately as required.

Be careful of Gladston. It's a market at or near it's top with the underlying drivers of value weakening. As I said to someone the other day. When a market is significantly above trend and the drivers of value are diminishing the likely direction of value is back towards trend not higher. I've always believed in buying assets when they are below trend because the likely direction is up. There's no guarantees but running with probabilities is a safer bet than speculating on increased growth when you know the market is near or at its price potential.

Sellers acquiescing to discounts suggest you're at the top of a market because they're running in to buyer resistance. A sure sign the markets topped given the circumstances.

There are 2 book keeping methods with regard to the ATO. At time of invoice or at time of payment. I've always worked on time of payment. Send your invoice out at the end of Jun for Jul payment.

Negatively geared on finance of 1mil and return on market val is a meager 3.3%. Projected margin is $100k/unit. The strategy is obvious. Build and sell but costs are going to have be carefully managed. I've seen profits disappear when cost analysis and cost control are executed poorly.

You're other risk is that the market could move against your assumptions. Personally I believe the WA market is in for a few shocks. It's definitely not trading on fundamentals at the moment. The risk is that resource contraction and other economic head winds changes market sentiment faster than your ability to adapt.

I live (rental) in Mandurah in a modern 4/2/2 in a relatively new subdivision (6 years). When it first opened people camped outside the sellers offices to be able to buy a block. Each release saw increased demand until the developers sold by ballot. Those who missed out twice where given multiple ballot chances at each successive ballot. This property has dropped around $80-100k over the last few years. It's been listed now for 5 weeks – not a peep. It's listed $55k under purchase value.

To me it signals the end of WA's RE boom. I expect to see the economy contract hard over the next 12 months. Property prices will follow in due course as unemployment rises and everyone realises the resource boom is really really over.

When a developer offers a 25k discount to market that screams red flags to me. That indicates a soft market and/or a developer on the ropes. If you're getting discounts in what was once a buoyant market you have to ask your self if you're simply buying into a falling market.

Ziv you might think I'm a bit over the top with the Japan bashing thing but I have a simple philosophy; if you see a fire yell fire.

zmagen wrote:Freckle, I've yet to see you address even one of the news items mentioned above – would you care to, or is MSM, as you like to abbreviate the worlds media channels, and just about everybody they're reporting is active in this space, just so full of gunk and inferior to your superior analysis capabilities that you just can't be bothered?You realise I don't do this for just anybody.

Maca's

“Our pricing policy is demand-based and not cost-based, so it’s not because of increasing material price,” he said.

Yeah right.

Property demand in Japan heats up

Written by CRE investment firm!!! An article based on wishful thinking and hopium.

Weak Yen Helps Push High-End Real Estate Sales

So demand is being driven by a price crash in foreign currency terms. Quote; “For outside investors, these properties have essentially become 30% cheaper,” said Mr. Mochizuki, referring to the 27% drop of the yen versus the dollar since November last year.

Locally it's seeing a 10% increase but in comparative currency terms it's crashed. The stupidity I see here is the foreign investors must think the yen depreciation has bottomed. When in fact there are predictions that the yen will continue on to US1.45 at least and if things get away from the BOJ we could see US1.90

Canada Pension Plan teams up with GE Capital on Japan real estate

Same as above. More muppets playing with OPM but collecting huge fees regardless of how this works out.

Nippon Prologis Jumps in Debut After $1 Billion IPO: Tokyo Mover

A REIT play based on an assumption BOJ QE will stimulate the economy. Didn't work for the US, hasn't worked for Europe. But of course it will work in Japan. Not.

A reality check.

ToT continues to deteriorate even with massive QE and currency manipulation. Export volumes are up but so are import volumes. Next 2 graphs.

Japan posted a trade deficit of 364 billion yen in March, falling into the red for the eighth consecutive month

Production is still contracting even with a weakening yen.

GDP still remains below trend and is only marginally positive.

Inventories continue to contract. Where is all this demand for logistics warehouses going to come from??

Deflation still remains entrenched and has actually worsened.

Capacity utilisation is improving albeit still struggling to surpass 2002 levels. Pre GFC!!!

Global demand continues to contract.

BoT remains negative along with ToT.

A current account surplus is just managing to keep Japan's head above water.

Do the work but start your tax records from a fresh new tax year and bill it out in the new tax year.

Terryw wrote:Interesting about the vacant houses. My mother in law owns a terrace in Osaka and its been vacant for 7 years. 10min from Osaka station. MIL's sister also owns a terrace next door vacant for 10 years +. I ask them why not renovated and lease out and they say it would cost to much for the little return. Not worth it.Interesting. My Apologies to Ziv.

That however concerns me even more. One of the primary assets (wealth classes) of a nation is its property. What you're saying is that property is virtually worthless apart from its utility value. Given that property has been deflating for decades and the true savings rate is negative I tend to see a nation with its back to wall financially.

Quote:However, in general I think things are beginning to pick up in Japan. The main problem was a lack of confidence I think. But now people are starting to see some economic hope again. This may lead to move spending and this would stimulate the economy…I watched a doco the other night on Madagascar's poor. There was a single mother with 5 kids living on an outer city street corner. She'd been there for a few years and it was her bit of security. Beside it was a skip bin which was her sole source of income. Scavenging from the bin produced enough 'stuff' to sell at the semi clandestine night markets. She got 0.01 for 8 plastic bottles and 0.01 for 5 cans. She had an odd assortment of just about everything which she sold for whatever pennies she could get. Interestingly she was very upbeat and optimistic about her future prospects for herself and children.

CheevesFinancial wrote:Freck: Your charts are misleading because it doesn't show annual improvements. Lastly, when does a Fortune 300 firm Headquarter relocation happen on an "everyday basis" as you say? You're a jokester and in my professional opinion can't be taken seriously here.

Your charts are misleading because it doesn't show annual improvements

Do you have some kind of problem interpreting charts. Both show an improving statistical trend. And you call me a jokester!!

.

Keep it in context Cheeves. Business (of all types) coming and going is an every day occurrence. Ask any CRE guy. Where's Rob when you need him.

The bankruptcy data is to balance the recovery euphoria. The other side of the coin so to speak. For a so called boom state it still has its GFC detritus to clean up yet. The incoming businesses are in a significant way filling the vacuum of those that failed.

I'm wondering if new business is exceeding the rate of bankruptcy even if bankruptcies as a whole are trending down currently. That may reverse to an upward trend (nationally). It'll be interesting to see how that affects FL if at all.

Rick sta wrote:Freckle- What the heck is going on with the silver spot price? Can you see Ishares dumping big time and sub $20 prices? I'm waiting to pounce but these guys are making me nervous!

Rick sta wrote:Freckle- What the heck is going on with the silver spot price? Can you see Ishares dumping big time and sub $20 prices? I'm waiting to pounce but these guys are making me nervous!FED's talking up it's wind back of QE but the realists out there don't believe it. The markets of course do the opposite even though all news is effectively bad and globally PM mints can't keep with demand.

I'm just watching and waiting.

touch107fm wrote:So if you where in our shoes what would you do.

Perth market is a little warm at the moment with the odd hotspot but that's about to come to a screaming halt.

Resource wind down is happening much faster than many realise. By the end of this month we're going over a resource cliff. There are already a number of major players in the resource sector warning of impending earnings downgrades and deteriorating resource pricing is squeezing that even harder.

WA's economy is 75% dependent on resources. A pull back is going to hurt big time.

To make matters worse you will almost certainly see an Lib party in power by the end of the year. Abbot is signaling austerity and budget cuts. It isn't going to be pretty as far as the Australian economy is concerned.

I wouldn't advise shares or property for a young inexperienced investor at this time. Park your coin in a term deposit and spend some time learning about where you can invest and how. Too many young investors jump in boots and all without understanding what they're getting themselves into. Even experienced investors are finding this market challenging.

Japan holds the largest pool of USD foreign currency reserves. That enables it to exert some control over it own currency relative to others.

Russia making public its intention to see the USD reserve status dismantled was a clear indication of their frustration with US control and influence in international markets. It's not new but a public announcement signals to all the other countries suffering under US financial dominance that their tolerance level has been exceeded.

Chavez tried to organise the Sth Americans into a monetary bloc, Gaddafi did the same with Africa, Saddam Hussien tried to beat UN sanctions and and trade oil outside the petro dollar, China has quietly been moving to direct currency transactions that circumvent the expensive and bureaucratic cost of USD based transactions and so it goes. 40% of international transactions that were completed in USD's are now done outside the USD. That's a growing trend.

When (not if) the USD looses its reserve status then Japan will have to rejig its foreign currency holdings. That's likely to affect its ability to control its own currency to a certain extent. Given the parlous state of the Japanese economy the degree of control they could exert in a crises may or may not be a good thing.

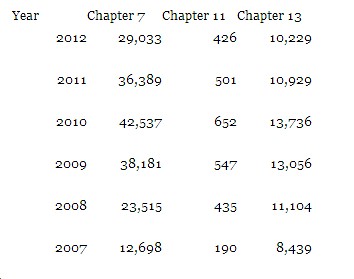

Bankruptcy update.

The Latest Bankruptcy Filing Statistics for March 2013

Within the top four circuit courts, the following districts had the most filings:

Jeez you guys go on about this stuff like it just saved the world. This stuff is an every day occurrence.

Hertz is a service company that bought out another service company and will consolidate the two for business synergies. That means the total jobs will decrease across the board as efficiencies are implemented between the two. It's not a gain for the US. Florida has what, a population of 20+ mil. A few hundred jobs means didly in the scheme of things. A big deal for one tiny little county among hundreds. Hardly gets me dancing in the street.

This link provides a list of bankruptcy filings by state up to 3Q 2012. Florida is only beaten by California (who are in a world of hurt)

http://www.abiworld.org/AM/Template.cfm?Section=Home&TEMPLATE=/CM/ContentDisplay.cfm&CONTENTID=66160

That follows on from a trend evident in this graphic for 2009 where Florida sits 15th on that list (per capita basis)

Bankruptcies in the main are dropping off of their 2009 highs howvever Chap 11 bankruptcies

still have some way to go before we're back at pre GFC levels. (Click graphic for more)

Will Bankruptcy Filings Increase in 2013?

I've never had a problem with Florida's growth/recovery story. While large brand name international businesses may settle in Florida there is still a long road to hoe before FL is back on an even keel. Things look rosey at the moment because FL was literally flattened economically. That vulnerability to economic downturn still remains. Nothing in the US or global economy suggests a sustainable recovery. Quite the contrary. Economic indicators are flat or declining again. Florida is one of several economic islands companies are migrating to looking for safety and growth. Florida is highly dependent on external drivers for its long term sustainability and they don't look promising at all.

The US will continue to shuffle the deck chairs. When that's finished there'd better be something more tangible or we're all back to square one again.

zmagen wrote:Freckle wrote:…That makes so much sense now you've clarified that for me…no, you're right, it's all the evil Russians and braillizans' fault. How could I have been so blind. Come on, man, you used to do better than that.

Now you're mismatching my quotes. My quote (above) was in reference to JGB's but you've aligned it to Russia's attempt to usurp the US dollar reserve status. If your defense is to misquote me then I can't be bothered.

Hertz Announces Corporate Headquarters Relocation