Forum Replies Created

Cost of doing business is how I look at this stuff.

If you've set up multiple layers of protection namely; active management, bond and insurance then what's left over is usually rather minor in the scheme of things.

If you have comprehensive insurance cover you may find the insurance company compensates you and then pursues the tenant for compensation. For the most part pursuing a tenant would be an exercise in futility. You may however get some value in stressing them out as some compensation for all the agro.

zmagen wrote:1. "people borrow in yen, then invest elsewhere, where the currency will go up". Really? I wonder where that might be and how these magical clairvoyants that the world seems to be full of predict that. Utter bollocks, as the last five years have shown time and time again.Ziv you really need to study your carry trade options. The yen borrow rate is has always been cheap as chips. For 20 years its been a textbook FX play. Borrow yen invest somewhere else bank the difference. The yen debasement is just a double bonus.

Quote:2. "I'm a big believer in gold". No, really? You mean like the rest of the panic mongers that fill her ranks? What a surprise. It's amazing, isn't it, how the vast majority of doomsday predictors are somehow invested in precious metals and their derivatives (yourself included, on a smaller scale).Yep Gold's a bad bad investment because it has no yield. Jeez Ziv you can be a muppet sometimes. Try Gold verses the S&P500, BWP(AU CRE REIT) and USDJPY

Quote:3. "Japan doesn't like immigrants, therefore they'll never break out of the ageing population trap". We already discussed this one to death – Japan's already performing a major overhaul of its immigration laws, and this is one of the best bullets in their arsenal – make that a few truckloads of magazines' worth – that they haven't even slightly began to tap – and believe you me, tap it they will.

Quote:3. "Japan doesn't like immigrants, therefore they'll never break out of the ageing population trap". We already discussed this one to death – Japan's already performing a major overhaul of its immigration laws, and this is one of the best bullets in their arsenal – make that a few truckloads of magazines' worth – that they haven't even slightly began to tap – and believe you me, tap it they will.Abe can change all the laws he likes. Waffle all the non xenophobic rhetoric he likes but he sure as hell isn't going to induce a wave of migrants who will receive a rapturous welcome to the few miserable jobs on offer. Xenophobia is cultural. They've been anti immigration since the year dot. You won't change that mindset in a hurry. In reality the xenophobia discussion is a diversion to the real issues facing Japan.

Quote:4. "We will see money fleeing to the safer countries, like the US…" That's when I pulled the plug – didn't wait for the end of it. Give me a break. And pardon me for not continuing to comment on the other thread, too – your last post in that one was so full of speculation and so completely blind to the slight possibility that what happens in the rest of the world may have some effect on your crystalballing, that I didn't even know how to start addrsesing it.Mate you really need to catch up on this one. BOJ is displacing current local JGB investors. It's driving them out of bonds and forcing them to look for yield and opportunity somewhere else. The Nikkei and the overseas markets are stated preferences the BOJ wants to see this money flow to. The Nikkei to make them feel rich effect. Replicating the FED's strategy but magnitudes larger and pushing investment to better yielding assets in the international market so that returns can convert back to even more devalued yen and help create inflation.

Those are all straw man arguments anyway. You avoid the thrust of the presentation and seek to dilute the reality of Japan's situation in a mixed bag of nonsense misdirection.

Maths Maths Maths

….Debt increasing exponentially

….Costs increasing exponentially (compound interest working against you)

….Income (taxes) falling on reduced income and shrinking population

= FINANCIAL COLLAPSE

IT IS NOT AN OPINION OR PREDICTION. ………………IT IS A MATHEMATICAL CERTAINTY

The sub theme to that presentation was that the current Abe initiative is simply bringing forward the inevitable at an accelerated rate.

zmagen wrote:That's cool, oh-mighty-Freck-of-graphsYeah but they look good eh?

Quote:Take a chill pill

Can you imagine Chicken Little taking a chill pill??

Nigel Kibel wrote:lol

Nigel Kibel wrote:lolI will take the sink holes over Tornadoes any day of the week.

r

A tornado you loose the house. A sink hole you loose the house and land!

kochy1983 wrote:Somehow I have even actually managed to save around a grand since I was last on here, for any unexpected costs which may occur!

So thanks guys, your help was much appreciated.

Kirsty

That's huge girl. You've gone from someone drowning in financial quick sand to a grand ahead in the space of 2 months.

Every Oak tree started off as an acorn. Well done!!

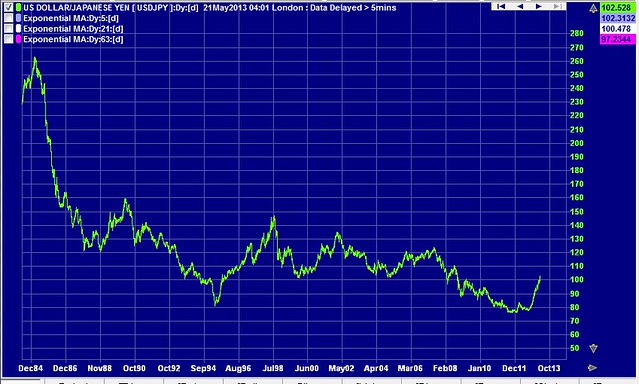

The image below shows a 30 yr tend of a strengthening JPY against the USD. While that trend remained intact it supported to some extent the Japanese standard of living and foreign investors could in the main pick up currency gains even if deflation eroded the value of assets. I could go with what your saying up to recent times. Now that Abe is determined to create inflation and devalue the currency the risk now is the BOJ looses control of the currency and JGB market. A managed depreciation over time would at least allow business and the consumer to adjust but the speed of this experiment in economic policy is unprecedented as is the level of QE. This is a go hard or go home moment. Japan has been loosing at the roulette table for 20 years. It owes the house 1 quadrillion yen. Abe's solution is to double down. Your future rides on the betting skills of a once failed politician with no credibility in one of the biggest economic experiments of all time.

Japan has decades of economic policy failure. If this attempt goes where I think it'll go (and the odds of that are extremely high) then they'll be selling yen by the bog roll. Your Japanese assets won't be worth diddly and the standard of living in Japan (already in decline) will effectively plummet for the bottom 70%.

- Yokohama-based Nissan has gradually shifted more production away from Japan over the last decade

- Nissan has also aggressively increased the use of components made elsewhere in Asia to lower yen-based costs…Nissan now sources more than 40% of its auto parts from overseas, up from 10% to 20% several years ago. Nissan's best-selling domestic car, the compact Note car, imports about 45% to 50% of the parts used to build the vehicle at its factory in southern Japan.

- Nissan says a bigger shift is on the horizon: it plans to move production of its two popular sport-utility vehicles to the U.S.

- Japan’s largest paper companies have also cited the yen’s fall as part of their decision to raise prices by 10% to 15%

- the biggest sesame oil retailer by sales in Japan, has also raised prices on sesame oil 10% from May.

- The price of the oilseed crop has risen over 40% since October, according to trade statistics.

- The government also estimated that consumers will have to fork over about one yen more for a bowl of udon noodles after it raised the price of wheat it sells to millers by 9.7% in April. That’s the biggest price hike since April 2011.

- …small companies say they are also holding out as long as they can before raising prices.

- Yutaka Ishikawa, who runs a small public bath in western Tokyo with his family, said he’s also not thinking of increasing the 450 yen (about $4.50) he charges adults, despite having to use more firewood and dim lights to offset the burden of higher fuel oil costs. What I’d like the government to know is that because the economy isn’t that good yet, yen weakening is just costing money.”

- Yet much of corporate Japan is seeing only muted benefits from the current bout of weakening.

- Semiconductor equipment maker Tokyo Electron Ltd said currency depreciation affects its results in complex ways. “It’s hard to judge, but considering the operations abroad, and local currency, we are moving in a slightly bad direction,”

- Toyota says 70.4% of the 2.08 million vehicles sold in North America in 2012 were also made there, versus just 54.9% of 2.21 million vehicles in 2008. The auto giant just last month announced plans to shift more production to the U.S.

- A weakening yen boosts such import costs more than it helps exports, economists say. The 26.5% appreciation of the dollar versus the yen that has taken place under Abenomics would have increased the value of last year’s exports by around ¥10 trillion, but also raised import costs by a bigger ¥14.5 trillion

- The average price of liquefied natural gas, a mainstay for power utilities, jumped 26% from November to February, while the price for coal used in power plants was up 13%, according to government data. Those higher costs are piling onto a power industry already awash in red ink.

- Five other major utilities have announced plans to raise rates for corporate customers by 12%-18%.

- The petrochemical industry, a big user of oil products as the raw material for plastics, hopes it can come out on top through increased demand from the automotive and electronics sectors, two of their biggest customers.

- For small businesses that don't have the pricing power of big companies, passing on the higher costs may not be possible. Consumers faced with higher energy bills could also wind up with less money to spend elsewhere, blunting efforts to use new demand to create inflation.

- In southern Japan, a recent survey by an association of small businesses on the island of Kyushu showed that 56% of respondents said they expect a negative impact on their businesses from higher electricity prices.

- A public-bath owner in Tokyo said the costs of heating water have nearly doubled from a few years ago. "Some places are unable to earn their daily utility costs," he said.

Yes its all going swimmingly.

McDonalds – lets see. My guess is that a substantial portion of its food products are either imported or have imported content regardless of corporate marketing hype. Brand fees and franchise fees will almost certainly be paid in US dollars. It's energy costs are definitely a function of energy import costs. My guess is that costs have jumped substantially in the past 6 months given McD left prices alone for five years then out of the blue goes with a 20% price hike when any halfwit with his eyes and ears open understands the consuming public is under more pressure than ever before.

The idea that this price increase was simply because they believed the market could take it is absolute BS. Sales have dropped 3.7% in Apr alone.

US$3B per week is now flowing out of JGB's to overseas as bond purchases by investors looking to escape yen deflation and chase yield. It's a trickle at the moment but some analysts suggest this could turn into a flood if the yen continues it's decent. Any capital flight will simply accelerate yen depreciation. JGB's are loosing value. At some point investors will say we've had enough and look to get out of them.

You can be as one eyed and parochial as you like but willful ignorance wasn't something I thought you were capable of. You may be getting 10 – 15% on property but in the last 6 months any foreign investor is sitting on 30% losses with the high probability of more to come. Why any foreign investor wants to chase Japanese assets down the rabbit hole is beyond me. Foreign capital is chasing the Nikkei but only as long as its bubble fantastic climb to the moon outpaces the near vertical plunge of the yen. When the Yen beats the Nikkei expect to see the Nikkei take a hit.

JGB's in a vertical descent again today. Waiting for BOJ intervention (trading halt) to arrest the plummet.

If you think this is normal or safe your on drugs.

You might look at a joint venture. You supply the land they develop and build.

Vendor financed sale.

SeanWilson wrote:What happened in the US was driven by bad government policy and horrendous regulations.

In Australia, I believe we do not have this. So yes, even if the market was overpriced (an argument can be made either way) it does NOT mean that we will see massive collapses like what we saw in the US.

Denise Brailey would disagree with you.

Fish farming? aquatic center?

TheFinanceShop wrote:I think it will hit 90 sooner than later? Keen to hear everyone else thoughts?There's strong support between 0.967 and 0.957. There's also up coming weakness predicted around the US$. If it goes to 90 then that signals a lack of confidence in Australia and could mean a resistance to further investment. IMF have the AU$ as one of their reserve currencies. This will be a test of that status.

If it breaks 0.955 it could go to 0.85 but I think that's a remote possibility. If the US$ doesn't weaken then the AU$ could track around the mid 90's with a slow drift down.

If the US$ does weaken and we go back above par that could be interesting because it would reinforce to markets that its safe haven status is still largely intact.

Hard to say one way or the other what will happen to rates. The AU economy is headed into trouble waters and the RBA will probably look at further cuts but CB cuts aren't indicative of bank funding costs so they bottom at some point regardless of what CB's do. The US market has retail rates around 4.5% while the FED rate is 0.25%. Banks here have indicated their funding costs have dropped and signaled possible out of cycle drops in retail rates.

The flip side is recent strong deposit growth may evaporate and push bank costs back up again. The falling AU$ will also have some impact on consumer inflation so that may pressure the RBA to hold or even raise rates if they see inflation getting away from them. The RBA would likely see a falling dollar as beneficial for the economy so further interest rate cuts would be a waste of bullets so to speak. If the dollar goes to 90 I think the probability of a rate increase is high. Below 90 almost a certainty. The only question would be timing.

Something else I was reading a while ago and came across again just recently that set off a red flag. Australia tends think of its debt profile as fairly benign but that's far from the case. A relatively mild decline in economic conditions could generate negative occurrences within our economy that many would not think possible. Our potential Achilles heel is private debt.

Argus warns on Australia’s private debt load

- The gross national debt of households, businesses and governments had roughly doubled since 2005, with federal and state gross debt now at $500bn, consumer debt at $1.6 trillion and business debt at about $800bn.

- While Australia’s high private debt has not posed a major issue during the biggest commodity price and mining investment boom in the nation’s history, it leaves Australia vulnerable as commodity prices (national incomes) decline, mining capex falls, and unemployment rises.

Personal loan secured or unsecured??

With 300 properties listed for sale and 200 rental vacancies I wish you luck.

Because I really see the future upswing for this property

I admire your optimism in the face of a declining market.

I'm not sure where you get your info from but it reflects a lot of the misinformation and hype I've been hearing for the past few years.

Once the mining expansion is complete about mid 2014 capacity in the Pilbara alone will reach around 800mt. The total global seaborn market peaked at 650mt. Throw in other global suppliers and you have in excess of 1000mt in capacity. So volume has to be rationalised somewhere and prices will invariably reflect the oversupply.

China takes 60% of seaborn cargos. In the last economic quarter China pumped US$1T into it's economy. 50% to stimulate and 50% to roll over NPL's (non performing loans). Japan and S Korea are other major consumers of ore but have economies on the ropes.

I don't think you need to be a rocket scientist to understand that this is not going to end well.

Oil and Gas. There is no follow on boom coming. The gas boom is over. Significant future projects have been canned or suspended indefinitely. Gas and oil represents little more than 30% of WA's resource economy. Iron Ore is the main game. Globally we have a gas glut and there are still some very big fields yet to come on line even though we are currently building 7 of the 12 global gas projects.

There is no CSG in WA it's a shale gas resource here and I just don't see that getting any legs as the US shale gas experiment is looking like a disaster in the making for them. CSG on the east coast only has to put one foot wrong and that'll be the end of that industry here.

Shell is trying to master offshore processing so I'm dubious about any foreshore talk.

I come from the logistics side of the industry. I saw the writing on the wall 2 years ago and last year thought it was time to bale before it was too late. A mate didn't agree and wanted to buy my gear. I told him he was crazy and should sell his own gear and downsize. I forward sold my gear to him at a good price. That was the end of last year. All that gear and his is now up for sale either on consignment or at the auctions. The sales yards are full of trucks, trailers and machinery. They're at the point of turning gear away because the volumes are difficult to move. My friend is chasing 3 companies for outstanding debt from last year.

When I say there's going to be a 10% contraction in resource activity I'm being very conservative.

Mining canaries dropping like flies

Garnaut warns, BHP and Rio cut

China is in the middle of an economic transformation that will result in less infrastructure investment and much lower growth in imports of iron ore, other metals and energy, he says.

Australian policymakers need to make an “immense adjustment” if the country is to avoid a deep recession brought on by the end of the China resources boom, according to prominent economist Ross Garnaut.

“It’s going to be very tough and Australia will only get through that with a radically lower real exchange rate…Monetary policy is critical to this…

.

The ANZ has produced the latest gloomy report into the approaching mining investment cliff in its semi-regular major projects report. This one is a doozy, more bearish than any before it:

Woodside Petroleum has ended talks with other owners of gas fields that could supply gas for an expansion of its $15 billion Pluto LNG venture in Western Australia, signaling another potential growth venture is on indefinite hold.

Woodside had gone quiet in recent months on prospects for a deal on third-party gas supplies. But the formal advice on Thursday that talks have ceased confirms that the possibility of an expansion of Pluto has faded and is now several years away.

“At present, there are no active discussions with other resource owners with regard to Pluto expansion,” Woodside said in its quarterly report on Thursday, which showed a 55 per cent leap in March quarter production from a year earlier.

.

NAB's report: Will mining investment fall off a cliff?

http://www.scribd.com/doc/129026790/2013-03-07-Mining-investment-pdf

- Mining in Western Australia, together with the petroleum industry in the state, accounted for almost 90 per cent of the State’s income from total merchandise exports in 2008-09

- Western Australia’s mineral and petroleum industry, in 2009, had a value of A$61 billion, of which 48.2 billion were created by the mining industry.

Many expected the mining/resource boom to wind down to more sustainable levels however few really understand what this means. The info above merely talks about construction but there is another side to the contraction most aren't talking about and that's the cut backs to operational expenditure as revenues begin to fall.

- Rio Tinto is also in the middle of a belt-tightening exercise, looking to cut $5 billion in costs, including $1 billion from its exploration budget, by the end of next year.

- BHP Billiton boss Andrew Mackenzie used his first major investor presentation as chief executive this week to flag severe cuts to capital spending. He said the miner would cut capital and exploration expenditure by 18 per cent. Ominously for contractors banking on a recovery in mining investment, Mackenzie said BHP's spending would continue to ''decline substantially'' in subsequent years.

There are 3 dimensions to this contraction;

- falling state revenues as ore volumes and prices decline

- project cancelation or suspension and

- expenditure cutbacks in the face of falling revenues.

So for anyone who thinks things will muddle along ok and that any correction will be modest and manageable I say good luck to you but I'm cashed up and cashed out and heading for more secure pastures.

Corie wrote:In case you hadnt noticed the WA RE boom ended a long time ago.I'm not sure what you define as a long time but Perths market has been fairly robust over the last few years. Basically the WA boom (although off its highs) was still intact in most places up until mid 2012.

Perth is now clearly out of its correction phase as the impact of the resources boom has started to cause housing need imbalances (shortages). The graph ‘Monthly Trend Houses and Units – Perth’ presents the current position.

The growth now being exhibited in this market is very respectable and we should expect the rate to slow a little.

I've been in the resource sector here for the last 6 years. The last 3 running my own gear. I've sold up and cashed out. I have friends with businesses hitched to the resource sector and several friends and family employed across the sector here. I can tell you quite categorically that the resources are contracting at a rate I didn't expect until later next year. The big service sector companies are warning of a 25% fall in earnings, unemployment is rising and businesses are grinding to halt as work volumes decline.

Mandurah may simply be the canary in the coal mine. It was actually quite buoyant here until about 4 months ago. Perth has its mini boom based on what? When reality sets in Perth will go flat then I believe it could decline by as much as 10%.

Resources constitute 75% of this states economy. It doesn't have to contract much to start hurting. Iron ore is slipping again. Now $126/dmt for FE62. Chinese buyers are reselling loads back into the market because of oversupply. Mines are starting to close and the budget puts exploration companies under the pump. There is absolutely nothing optimistic happening in the resource sector here in WA.

Get your accountant to get an ATO ruling. It's a grey area and there's so many variations it can make your head spin. I had a contract arrangement with a mob in WA. Their accountant tried to put the mockers on it and pay me as an employee. There had been rulings in the past where contractor status had been declined by the ATO who then demanded that the business pay out super, tax and insurances on top of the gross contract amount.