Forum Replies Created

- Ziv wrote:…The figures showed industrial production jumped two per cent in May from a month earlier and add to an improving trade picture as exports to the US and China surge on the back of a weaker yen.

An improving trade picture……you gotta be kidding me..

Japan on Thursday released trade data for the fiscal year through March, which showed that exports to the US rose 10 per cent from a year earlier to Y11.4tn ($116bn), while shipments to China slipped 9 per cent to Y11.3tn.

If that's surging (China) I'll eat my hat. But wait what's that about the US you say… oh no!!! their Durable goods PMI is crashing… oh wo is me…

Moments ago the Commerce Department reported the latest Durable Goods numbers which were a total disaster: the headline print plunged by 7.3% on expectations of a -4.0% decline driven by a drop in Airplane orders (to be expected following last month's noted bumper Paris Air show spike as Boeing reported only 90 new plane orders compared to 273 in June). Well, airplanes orders did indeed slide by 52.3%, but it was weakness in Transportation (-19.4%) and Computer (-19.9%) orders as well as Manufacturing (-9.8%) that took the market by surprise. This was the biggest miss to expectations since August 2012.

So let me see if I've got this right. Japan is going great guns even though it 2 largest markets are tanking. Sounds about right in this BS world.

Ziv wrote:.A rising number of Japanese firms are expecting profit growth this business year on a weaker yenWho'da thunk it.

Jeez man. Japanese companies with off shore production and earnings in foreign currency look like their profits are better because they convert it to a debased yen. Problem is their export prices are up, volumes down and foreign currency earning decreasing on tighter markets.

Balance of trade is a dog…

So we now have an economy that will become dependent on the CB tit (Y70 trillion/yr) to survive.

Economic reality has been turned on its head where MOAR debt somehow translates into a path to financial success and freedom. Japan's economy is an overburdened mule with ever more debt loaded onto her. The only way she can keep on going is to give her a periodic steroid shot in the arse to keep her going. Sooner or later though she'll drop to her knees.

Ziv wrote:…The figures showed industrial production jumped two per cent in May from a month earlier and add to an improving trade picture as exports to the US and China surge on the back of a weaker yen. The rise was the best since December 2011 and beat expectations of a 0.2pc uptick…How about we try some real information rather than the MSM BS you dredge up.

NOTE THE SOURCE!!!! Japans own government data doesn't support your story.

Go to their stats page and you see their forecasts for the remainder of this year are negative.

Wolf Richter writes some interesting stuff re Japan. He's considerably more objective and realistic than you Ziv even though he is married to a local girl, has family there and speaks the lingo.

His Blog at Testosterone Pit makes for interesting reading.

“Limited Freedom Of Speech” For Japanese Bureaucrats To Cover Up The “Dire Fiscal Condition”

He came out and said what no one in the Japanese power structure is allowed to say. It was outright blasphemy against the new religion of Abenomics that rules the Japanese media and governmental thinking, and even the foreign mainstream media. Abenomics wouldn’t solve Japan’s fiscal and economic problems, he said. And the recent governmental outlook to that effect was way too rosy.

That man is Kazumasa Oguro, formerly Senior Economist at the Ministry of Finance’s Policy Research Institute. He’d joined the MOF in 1997, but apparently, he is a free spirit that didn’t want to be reined in, and so he quit in 2008 and moved on to the Institute for International Policy Studies. He is now an Associate Professor of Economics at the Hosei University and a consulting fellow at the Research Institute of Economy, Trade & Industry.

engelorumora wrote:Do you think the market will start to move North more once the US banks lending criteria loosens?

Credit doesn't drive the property markets these days. Cashed up foreign buyers initially drove prices after the GFC followed in recent times by hedge funds. That momentum is almost gone and given current moves by Funds to try and monetise portfolios through derivatives there is every chance that we will see property retrace in the next few years if not crash once again. My bet is on a crash worse than 08 with no recovery for decades.

Your market in KC is particularly vulnerable to recessions. Unemployment has started to head back up since Jan13 and everything I see in the US economy says recession.

The US economy has literally stalled if M2 is anything to go by. 10 year treasuries are rising and the FED is struggling to retain control of the bond market. It's buying everything trying to prevent interest rates from rising.

Not long now I think. A year until this thing goes pear shaped would be optimistic.

Putting all your eggs in the US market is financially suicidal. The smart money has been leaving for the past 12 months or more.

Nigel Kibel wrote:What I am suggesting is that b providing farmers with grants it allows us to develop new crops that can be sold to the worldThe world has been doing this for 50 years and AU already invests heavily in ag sciences through the CSRIO.

Quote:There is a real risk that within 20 years we could become a net importer of foodInevitable if our current rate of population growth is allowed to continue (one of the highest) We currently export around 50% of production, however, food imports will exceed food exports within 15 years based on current predictions.

Quote:We could become the food bowl of asia.Global warming is set to create massive problems in food production over the coming decades. The govt already has a strategy in place that addresses many of these concerns.

http://www.daff.gov.au/natural-resources/soils/working-group-on-water-soil-and-food/final-report

Quote:The difference is it does not matter how much money we pore into the car industry it will go.True.

Support is about helping an industry transition. When that turns into an ongoing subsidy it's time to pull the pin and redeploy your resources more efficiently. We live in a globalised economy and that throws up pro's and con's. We win in some areas and lose in others. Rigging the game has never worked long term.

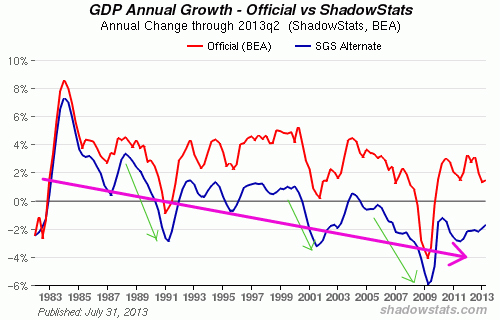

Picking when the US economy tanks will always be difficult but tank it will….

Each successive correction is worse than the last and the causalities of these corrections take out an even greater proportion of the populace. Every recovery has been predicated on CB support that simply sets the US up for the next wave of Wall Street induced chaos. Meanwhile the economies ability to recover reduces with each cycle. My instincts tell me that the next crash will be the clincher mainly because past recoveries have been able to utilise remaining system capacity both locally and internationally. The effort gone into preventing total collapse this time around has largely exhausted remaining global capacity.

jayhinrichs wrote:The Hedge funds Have CASH there is no leverage or fixed bank debt on any of these properties… So the only obligation to keep the property is pay property tax.s they could board the houses up if they wanted to and still not loose them….Blackstone has been on the forefront in the housing market, gobbling up 32,000 single-family homes for $5.5 billion, helter-skelter, at foreclosure auctions on courthouse steps scattered around the country, hoping for capital appreciation and rental income. Deutsche Bank has been on the forefront funding this binge and leading the issuance of $3.6 billion in loans.

jayhinrichs wrote:Freckle, I think there could be another correction but no way worse than the last one. Houses dropped 80% in some markets and too many houses have been paid for in cash… Even if the market dropped 100% those that payed cash would just hold they would not give the houses away, at least thats my experince. I think the bigger issue is those that are in Aligator houses IE ones that eat you alive every month some of those folks could just take a walkabout.I tend to think a correction regardless of how severe (and that will vary from area to area) will be more profound this time coming on the back of a mini boom straight after a bust. The large institutional players will change how this plays this time. It looks like risk is about to get offloaded to the market in the form of derivatives. That's ominous and doesn't bode well for the average Joe who doesn't have that ability. Lot's of variables though so things could or will play out in unforeseen ways.

There are those now who are entering at what is virtually the top of the market with lots of downside risk. I see nothing in the US economy or global for that matter that could even remotely be construed as positive for the US market. Quite the contrary. If the property market retraces like I think it will it could signal a tipping point in the US economy that triggers a negative feedback loop.

Your decision to exit will prove correct and none too soon I think. Better a year early than a day late as they say.

jayhinrichs wrote:We are looking to move the rest of our 250 house's this year as well and go ahead and cash out and wait for the next opportunity..Yep. There's going to be a few foreign investors with big holes in their pockets in around 18 months. I suspect you have less than 6 months before you see a reversal in the US property markets. There is real potential for this to be even worse than the last property correction.

Wall Street Engineers New Frankenstein’s Monster For Housing

So do you have a detailed investment proposal with examples of your work, costings, projections, etc etc that potential investors can look at.

Wouldn't touch them with a barge pole. They're flooded with houses for sale (453). It's your typical boom bust scenario. House construction is over shooting demand. Vacancy rates aren't bad yet but my bet is that will change to the downside over the next 18 months or so. All those properties for sale are in the main rentals. With vacancies in the 70's that can only get worse.

Not worth the effort – way to much risk.

filminvestment wrote:Given there are no pathways to finding investors for film productions in Australia, I thought I would post in a property investment forum to see if there were any investors out there who were interested in investing in a film.

Crowd funding is your best route. A lot of small first time type film makers get started this way.

http://www.crowdfundinsider.com/2013/05/15046-9-australian-crowdfunding-web-sites

The above should get you started.

Good luck.

Personally i think it's time to either get out of the US market or reduce exposure at the least. Take the gains and capitalise on the exchange rate shift to bank some gains while the goings good. The risk is that the market corrects badly again, the FED pushes more QE out the door which could see the AU strengthen against the US even though the AU has its own troubles.

The big funds are setting themselves up to exit and that doesn't suggest anything good for the investor.

Another interesting read on the US housing market

There is a counter to populations moving to the fringes in search of cheaper accommodation and that's the cost of transport. Sydney's a bitch of a place to commute around at the best of times let alone rush hour. One of the reasons I left in 06.

This report on Australia's energy profile might interest a few. It's easy to see from the table below that AU's reliance on imported oil has only increased. Energy costs are rising fast and set to go much higher over the next decade. That's going to affect the population dynamic when its likely the economic situation is only set to deteriorate over the next decade and beyond. Understanding the financial pressures on the population should help the canny investor make the most of it.

Your in the wrong forum Possum. You need to be talking to users in the MGS forums.

Personally though I wouldn't go the sport route. Too few trading opportunities. Forex offers far more trades and given FX volatility possibly a better margin on average. You have to be wary though. Platform and trading costs can easily eat up 50% of your trading profit. You might have to be willing to forgo as much as $20k just to get the experience and education until you could develop enough skill to get up to pro status.

If you're just going to tinker with it my guess is you'll do your doe in the end. Remember though that less than 10% who give it go actually make real money. That holds true in just about all financial endeavors.

Jamie M wrote:Sydney is hot at the moment – especially out west.West Sydney like many fringe areas tends to run hot and cold. A few years back they couldn't give them away after the initial FHB grants sucked many a newbie west only to find the living/commute costs where worse than living closer in and paying higher rents or mortgages.

I would expect to see the outer Sydney become attractive again as economic conditions tighten.

The following link gives some interesting property and rental data for Sydney and regional NSW

(January 2013)

Juichi wrote:I have decided to stick with basically one data provider.You need two at least to confirm the data, assumptions used etc corroborate each other. There is very little time taken in collecting and assessing this sort of industry stats so you should make use of what's available.

Minimal stats amongst other things might lead you to prospects with potential. You need to use everything available to you when making a final analysis. You learn over time what is reliable and what is not. Experience will also help reduce the amount of information you need to filter in order to arrive at a decision.

Sounds like a tile roof…most of this stuff is not difficult to fix. Almost impossible to replace ceiling batons without taking out the interior ceilings, rebattoning and then regibbing though. It comes down to the extent of the work, cost, time etc as to how you might revalue a property if you still want to take it on. You could end of with a better valuation if you can get the property at a discount and complete a reno on it for a reasonable price.

You could see a few more of these over the next few years. Corporate AU is up to its eyeballs in hock.