Forum Replies Created

Get a detailed written fixed price quote before work starts and a warranty.

Ilovehouses wrote:I would stay well away from Kyler Rice. His way of "helping" me was to place a squatter in a home that I foreclosed on and that was the last I heard of him. Similarly, Alex Franks from Charlotte, South Carolina. I lent this guy money and finally had to foreclose on him when he couldn't sell the property. Not an apology, email or word from him since. Has taken off to NY now. Probably has a lot of investors chasing him. The only one I would trust would be Jay Hinrichs whom I have met personally and have a lot of respect for.It's the American way of doing business unfortunately. US business is renowned for its aggressiveness and uncompromising tactics. If you want to do business there you need to be hard headed and unemotional about any relationships.

Wages;

Monthly wages are down… 14 straight months. Beware of nominal Vs real wage growth. Bonus payments are up but regular monthly payments are down. Negative wage growth is not reversing. Total wages paid out are also trending down due to a shrinking work force.

GDP:

GDP is up more than expected. Go look at any country who plans to raise consumption taxes and see what happens to GDP. You get a positive spike on pull frward spending by consumers to save on the new tax. You get a recession afterwards.

Olympics:

Too far away to have any immediate affect but expect to see property speculation ramp up going forward. Fukushima is the fly in the ointment. Things don't get sorted there the Olympics could be a disaster. Economically it may actually produce very little.

Dr. Allison Stewart, who has conducted exhaustive economic research on the Games since 1960 for Oxford University’s Saïd Business School, said there was no evidence to suggest any Olympics had ever resulted in a positive cost benefit.

Koll:

Koll conveniently ignores who will hold JGB's when inflation is 2% and bonds are paying sub 0.8%. He assumes the BOJ will be the buyer of last resort and will soak up surplus bonds. Good luck with that. He also fails to explain how lower bond prices impact on bank reserves.

Significant increases in productivity could fully mitigate inflationary pressures –

There is no "significant" potential remaining in the productivity stakes. Since the 90's Japan has rung more productivity out of the system than anyone else. There is a point where no more or little productivity remains to be realised.

Keep looking for someone credible enough to counter Bass's arguement.

BS MSM:

When I pull from the MSM I try to refer to actuall facts in an article as opposed to editorial or opinion pieces. It's relatively easy these days to discern industry or politically motivated opinion peices masquerading as ligitimate information.

Bass puts his money and reputation where his mouth is. Koll doesn't. I don't necessarily agree with everything Bass says. No one is right all the time about everything.

This debate is fairly simple. Can you expand debt faster than income indefinitely and still survive. We all know how Ponzi schemes work and consequently know the answer to that.

Ziv wrote:When Abe wants to create inflation and growth, corporations comply and raise employee wages IN ADVANCE of such occurrences,Huh???????? Who's kidding who here?

The problem with this so called wage growth is that total wages are falling with a shrinking work force…

Self explanatory….

On the Bass thing how about finding something that is up to date. Those comments are over 12 months old. The situation is considerably different and still fluid at this point. Bass has something like $1.5B under management. He has more trades going than you can poke a stick at. Some are up some are down. In two months things could be completely different again. Simply because Bass' Japan trades are or were underwater at one point in time indicates nothing. His past blockbuster trades went through the same process so excuse me if I don't slash my wrists just yet. My guess is that given the yen has moved considerably since then and interest rates and JGB's have headed south then it's quite possible Bass is sitting on a win at this point. Still a long way to go on this play yet.

Ziv wrote:Your point? Incidentally, when did you move from "Japan is doomed" to "Asia is doomed"? Or is this part of the general "the world is doomed" theme?Busted!!

Iceland

Greece

Spain

Portugal

Ireland

Argentina

Venezuela

Italy

France

descending into the economic meat grinder..

India

Indonesia

Philippines

Brazil

China

Japan

Russia

UK

US

Euroarea: 92.2%, up from 88.2% a year ago

Greece: 160.5%, up from 136.5% a year ago

Italy: 130.3%; up from 123.8% a year ago

Portugal: 127.2%, up from 112.3% a year ago

Ireland: 125.1%, up from 106.8% a year ago

Spain: 88.2%, up from 73.0% a year ago

Netherlands: 72.0%, up from 66.7% a year ago

Total debt % GDP

Yep it's all good. Nothing bads going to happen here. Carry on as usual. I must remember to tell my kids that debt is good.

Contradictions? I've always had a consistent view of India and never been that enthusiastic about the "emerging markets will provide a growth engine to support the global economy" meme. Especially the muppets who thought India was the next big thing after China. The hot FED money that provided access to cheap credit that fueled EM growth is now flowing the other way leaving EM economies with a Current Account problem. India's political machine coupled with it's insane bureaucracy were always going to be impediments to progress. Couple that with an insatiable demand for gold leaves India with some serious economic headaches to sort out.

However, India is but one economy amongst many in Asia facing these problems. A point you seem to have ignored in our recent debate. The Asian crises will still linger in the memories of many Japanese I suspect.

As far as the Japan 4th comment I was surprised to run across that little snippet. Does this mean Japan is falling behind or others surging ahead. For a country that was not so long ago number 2 forth represents a mighty fall.

As sure as God made little green apples Japan is slipping. Using PPP and comparing Japan from the 1990's it's fairly obvious Japan is loosing the battle to get it's economy under control and moving in line with other comparable countries.

Now who'd a thunk it.

World's 10 biggest economies, India at No 3

Japan 4th!!!

Things are going well what with a potential rerun of the Asian Crises just around the corner.

engelorumora wrote:HI Freckle,Thanks for that. I get you. Very intersting stuff. I guess the solution would be not to keep large funds in a their bank account then lol

Thanks.

You don't keep large amounts of funds anywhere these days. Todays investing environment is completely different compared to when I was your age. I didn't have to watch my back as much as I do now and you have to be much more aware of the wider implications around you. DD requires far more in depth research incorporating both national and global economics than it ever did in the past.

You might want to do some research on tax havens given your a US investor. There are legitimate uses for them within the US IRS system especially for non US citizens

Ran across this at TP but reposted from here…http://the-japan-news.com/news/article/0000506686

Land prices in Japan rose at 66% of the 150 locations surveyed as of July 1, compared to April 1, reported the Land, Infrastructure, Transport, and Tourism Ministry, the first time since the financial crisis that over 60% of the locations had price increases. Prices remained flat at 27% of the locations and fell at 7%. The report fingered jumping real estate investment, fueled by the flood of money from the Bank of Japan. As we have seen for months, Japanese REITs, private equity funds, and foreign funds have jumped into the game and are driving up prices in the three largest metro areas: in Tokyo prices rose at 69% of the locations, in Osaka at 64%, and in Nagoya at 100%. Outside of the top three metro areas, it didn't look so rosy: land prices rose at 46% of the locations, remained flat at 34%, and dropped at 25% – thus the majority outside the metro areas were flat or down.

There's a push by investigative journalists to expose tax havens that shield the rich and wealthy.

Trillions hidden in tax havens by super-rich, corporations

That's pushing the wealthy to move their wealth and hide it somewhere else.

Billionaires Flee Havens as Trillions Pursued Offshore

The long and short of it is that while places like the Bahamas may seem like nice places to settle down and raise a family that might all change in the blink of an eye if some insolvent government looking for their next penny decides we want your money.

Global Property Guide – Cyprus

The problem with places like the Bahamas is they took a pounding during the last GFC. That suggests another financial event will invariably hurt the property market again. I suppose do you feel lucky

The shadow of the global recession hasn’t left the Bahamas. Though there are no official house price figures, house prices dropped by an estimated 30% to 40% from 2007 to 2010, and haven’t recovered yet, according to Treasure Cay Real Estate agent Everett Pinder.

http://www.globalpropertyguide.com/Caribbean/Bahamas/Price-History

Cyprus was a tax haven that got caught in the cross hairs of some greedy sovereigns. EU/ECB made Cyprus take a significant haircut on Greece. A little over 12 months later it's broke and in need of help itself. The ECB and other EU countries (namely Germany) made their (Cyprus) banking system divy up much of its depositors hard earned in what was an uncharacteristic attack on depositor funds. A bit murky with Russian oligarchs and secret bank accounts etc but the lesson was in don't mess with the big boys.

Since then tax havens have moved into the cross hairs of sovereigns as potential honey pots to keep the global charade going. The Bahamas and surrounding tax havens are coming under more and more scrutiny as hideouts for dodgy money. Govt's globally are scratching for revenues and given most large corporates shield their earnings from sovereign tax regimes to minimise their tax burden they are increasingly being targeted to minimise this practice. There are trillions at stake.

The problem for tax havens like the Bahama's is that their economies are tiny in comparison to their banking system. France is already targeting several tax havens in the big money grab. Other's will almost certainly follow suit.

France steps up assault on tax havens

The risk is could the Bahamas become another Cyprus as desperate sovereigns chase shielded corporate tax profits and undeclared income.

Watch out for tax havens. They're on a few hit lists of late. Another Cyprus is not out of the question.

walk away. you're being bid up. serious investors never buy this way.

32-Year-Old Homeless Man Found Dead Outside Japanese Arcade

Japan does have a large homeless population—something that visitors are surprised to discover. South Osaka and parts of Tokyo, for example, is populated with cardboard and blue-tarp covered shanty towns (see above). Generally speaking, the country's homeless, however, do not beg for spare change as it's not only considered degrading. Moreover, many Japanese people seem unwilling to spare a few yen

Yep Japan is really good at looking after one another…. not!

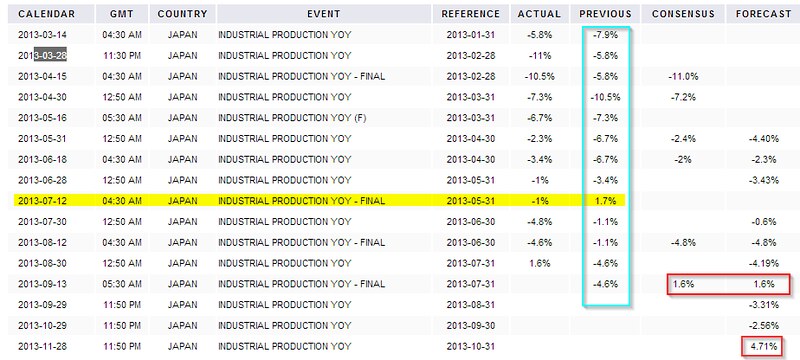

The YoY vs MoM is simply semantics in the scope of this discussion. There's quite clear evidence that Japans industrial base is under substantial stress.

Bass and hedge funds. I think something like only 5% of HF's have beaten the market to date this year. Something like 80% have not beaten inflation or lost. Bass like other HF's have their irons in many fires and use complex hedging mechanisms that don't always tell the whole story. You'll have to point to a reference re Bass's fund down 29%. He runs 11 at last count. He's said for some time they're reducing risk and positioning for a downturn so I'm not sure where this 29% report comes from or what it refers to.

The Japanese culturally stoic characteristic is, during good times, an advantage but in tough times it's their Achilles heel. It served them badly at the end of WW2. They took far more damage than was necessary and they'll grin and bear it again this time around as things literally fall to pieces around them. The idea that business is lifting wages on a broad front is a myth. Token at best.

We've covered this aspect of Japanese culture before. Their propensity to cover over the cracks in society and carry on as if things are all well is a character flaw that will only see unnecessary misery for those in need of help. A growing mental health problem and one of the highest suicide rates in the world does not suggest a society any better able to deal with its problems than anyone else. The Japanese are simply better at pretending all is well and putting a smiley face on things.

Interesting to note Asian emerging economies are crashing at the moment. India and Indonesia are in big trouble. The last time we saw a crises in Asia Japan struggled to cope.

I expect to see economic conditions worsen in Japan in the last quarter but I'm sure the MSM will somehow put a positive spin on things. MOAR QE on the way by the bucket load.

Yep this all going to end well.

nicpascal wrote:To date, what has been achieved besides stroking your own ego's?I use to stroke my ego quite a bit when I was younger then I got married and left that to the missus. As we get older I find I have to do more of the ego stroking of late.

As to what has been achieved well how's Ziv going to become rich and famous if I don't help him improve his search engine rankings and general industry exposure?

Dumps release fumes for decades. Good luck.

Re post 81

Can't say I agree on the timing thing although I think we are on the same wavelength to a degree with everything else. They didn't muck around when it came to debasing the yen or shoving truck loads of QE into the system to juice the markets. The reality though is time regardless of cultural norms. They can't do another 30 years of jigging around with things hoping the big fix will somehow fall into place. Their growing debt burden has to be addressed in the very near future or this thing will rotate out of their hands and that won't be pretty.