Forum Replies Created

I've talked about this many times before but it looks like the US market is about to take a hit. Jay's already seen the writing on the wall and moved to protect his equity and gains from the last few years. I suspect those who invested over the last 3-5 years are at risk of losing all or part of their current valuations if this thing goes where I think it will go.

Centennial Hut – Franz Joseph Glacier… no explanation required.

camforum wrote:

camforum wrote:I would appreciate your thoughts and feedback,

Cam

8 pages of mostly superficial advertorials. It's not a magazine it's a junk mail flyer amongst a sea of similar junk mail.

JacM wrote:Annoying isn't it!I find I have that problem in Internet Explorer but not Firefox,…..

…or Chrome

This text box isn't a patch on the previous version. It reminds me of the old days when TV was black and white.

What are you trying to achieve Johnno?

engelorumora wrote:I just dont know how much higher can the market keep going in Australia.

Don't think of any national market as a whole. It's a collection of segments, some rising some falling some going sideways. It helps if you look at where a suburb is in relation to its cycle. New, established, maturing, decay, rejuvenation. Cycles vary in length and intensity from place to place but they invariably follow the same pattern.

Quote:The bubble has to burst eventually.Again part of the cycle. The trick is to figure out duration and strength of each component in the boom bust cycle. How you play it determines your success or not.

Quote:Do you think the market could ever decline as much as it did in the US?Possibly but it will vary from segment to segment. Washington DC didn't miss a beat from memory.

Quote:I hope it does as I know every little town like my back pocket in NSW hahaI know where all my fingers and thumbs are but I still hit them with a hammer from time to time.

Quote:Spent many sleepless nights driving around with Nathan Birch looking at all kinds of properties hahaYour streets ahead of the crowd..

There will be many small booms and busts as volatility increases. The big one will come eventually but calling the timing is almost impossible.

engelorumora wrote:What do you suggest is the best and safest investment in the current climate?

I tend to think more in terms of speculating rather than investing. There are no safe or good places. Much of the sentiment within markets is about chasing what yield can be found with an emphasis on capital preservation.

Quote:Also, your thoughts on the Australian property market. Does it offer good opportunities?I think Abbot will favor the property market in general however Joyce is warning about a bubble forming which is contrary to his commentary over the last few years. In the main I think the unsophisticated investors will loose ground. Gains will be more about luck than anything else. Sydney is the only market worth considering. Has been for a while but that could all change if Australia starts to struggle. There's a huge amount of Chinese money flowing into Sydney and I can't see that changing anytime soon. The Chinese tend to buy where investors don't though and that complicates the decision process if you're trying to chase the segments of the market most likely to appreciate.

Quote:ps. I am not to keen on stacking up on bars of silver hahaThere are pro's and con's to holding PM's or PM miners through shares. It's just another investment that can be used in an overall strategy.

PEACHY wrote:I hope your travels are going well Freckle

Finally got everything through customs and vehicles licensed. The duplicate red tape nearly did my head in.

BNP Warns Only 10% Chance That Abenomics "Ends Well"

Japan’s core CPI (which excludes perishables) surged 0.7% y/y in July, but the upturn is largely due to higher prices for energy that reflect rising import prices due the yen’s weakness. Despite global exuberance at Abe's "progress", BNP notes that there are still no signs of price growth for rent and service prices, factors behind Japan’s protracted deflation. Crucially, BNP believes that Abenomics could lead to four possible medium-term outcomes: (1) Continued deflation (35% probability), (2) Financial repression (40%), (3) High inflation (15%), and (4) Happy end to deflation via revived trend growth (10%).

Via BNP Paribas

Which is really no chance at all truth be told. I thought 10% was optimistic.

engelorumora wrote:if the US collapses the whole world collapses also.What do we do then?

Thanks

Go back and study the 1930's collapse. It will give you an idea if the way things will happen. It won't be exactly the same but you can get some semblance of what and how things will unfold. Also look at post WW2 change in reserve currency from the British Pound to the US dollar. The US dollar will lose its reserve status possibly within 10 years. It's already lost 40% of global exchange transactions over the last decade or so and that trend is continuing as other currencies especially the RNB grow in importance. As the USD diminishes so will American influence. The likely outcome is war. Syria is the current flash point in an attempt to protect the petro dollar and US influence in the region.

We live in interesting times.

engelorumora wrote:Freckle,

I remember you saying last year that there will be another big collapse bigger than the first one. Still hasn't happened my friend in fact the market has started moving up here in the US.

Had a family friend who died of cancer a few years back. Right up to 3 days before he died he believed he was getting better and was making plans for the future.

The collapse is happening as we speak. The reason it doesn't appear to be a collapse is you and many others think it has to happen quickly and all at once. It's also being masked by $85/mth in FED stimulus. Without SNAP cards there'd be 47 million Americans lined up at soup kitchens.

+10 Ziv. You're the most subtle spruiker on here…

Your article was a luvly shepherding piece to guide the punter into your neck of the woods and lo and behold they'll find a jolly good fellow who'll look after all their investing needs in the land of deflation, crazy politicians and an unfolding nuclear disaster.

It's one of the better shmooze jobs I've seen in a while.

Looking forward to Pt 2 & 3 if only for the entertainment value.

Dominica …. US$100k + exp. A little piece of paradise.

Mikand wrote:Unfortunately, I think I need to be a bit more patient, and wait until my PPOR value increases or pay off more of the principal.

You have a $400k property with only $60k of equity after 8 years. If you took entry costs, holding costs and exit costs (if sold) then you are probably underwater on this place

If you're going to go for an IP you definitely do not want to repeat that performance or you're on a hiding to nowhere.

You might find this interesting..

Moxi wrote:there will be immediate policy changes which will be beneficial to increased investment in mining.Code for basically negating any and all road blocks that slow the approval process down. Land ownership, environment, labor unions etc will be given up or targeted as bargaining chips. I expect Abbot to sell AU down the river to achieve his political aims. It'll be interesting to see what sort of debacle the resource tax's will end up in.

Door step interview 5 Apr 13

Tony Abbott plans on removing the mining tax, but is considering extending another (petroleum) tax.

I expect to see Tony back flip, spin around and do summersaults like never before over the next 12 months. I also expect that Hockey will fall out with Abbot during this term in office. Howard and Costello all over again.

My problem is NZ relies on a strong AU economy… I don't think we're going to get it. God help us if we have another GFC on their watch. I don't have any faith at all in those two clowns.

Chinese money is flowing into property markets especially Sydney. It has been for a while but appears to be picking up of late. It's probably the single biggest force driving the market at the moment. Where the Chinese go is where you are likely to see the biggest gains. But beware. Capital flows go both ways.

Foreign investors are virtually ignoring FIRB requirements and agents aren't interested in highlighting the abuses. If the govt ever decides to clamp down in this area (unlikely but not impossible) then valuations may take a hit. There is very little underpinning markets at the moment aside from foreign capital. Inflows may increase if international conditions worsen as capital flight looks for safety. The down side is that once that cycle is over there is a high probability of a market(s) retracing.

That in mind suggests PI's should have a speculative facet to their investing mindset and strategies.

Ziv wrote:As demonstrated above, the total average PER PERSON is up – they're simply doing it via irregular payments, to prevent a non-reversible premature raise – cautious, but works.- In 2013 nearly 40% of employees received a larger bonuses than in 2012, according to a survey by Nippon Life Insurance Insurance Company. 48.8% said their bonus was the same, and 11% said that it decreased. The average bonus size was ¥559,000 up ¥64,000 from 2012.

- In the June 2012 bonus period, according to a survey of wives, their husbands' average after-tax summer bonus fell 65,000 yen from a year earlier to 611,000 yen, the lowest since the survey began in 2003, according to Sompo Japan DIY Insurance Company.[4] According to a Japanese Business Federation (Keidanren) survey of summer bonuses, summer bonuses at 160 companies fell by 2.55 to 771,040. Summer bonuses fell in 12 industries, including steel (12.48%), electronics (5.35%), and the auto industry (3.15%).

Trend is pretty obvious

Had to laugh when I read this

BIS veteran says global credit excess worse than pre-Lehman

(Mr White, chairman of the OECD’s Economic Development and Review Committee.)

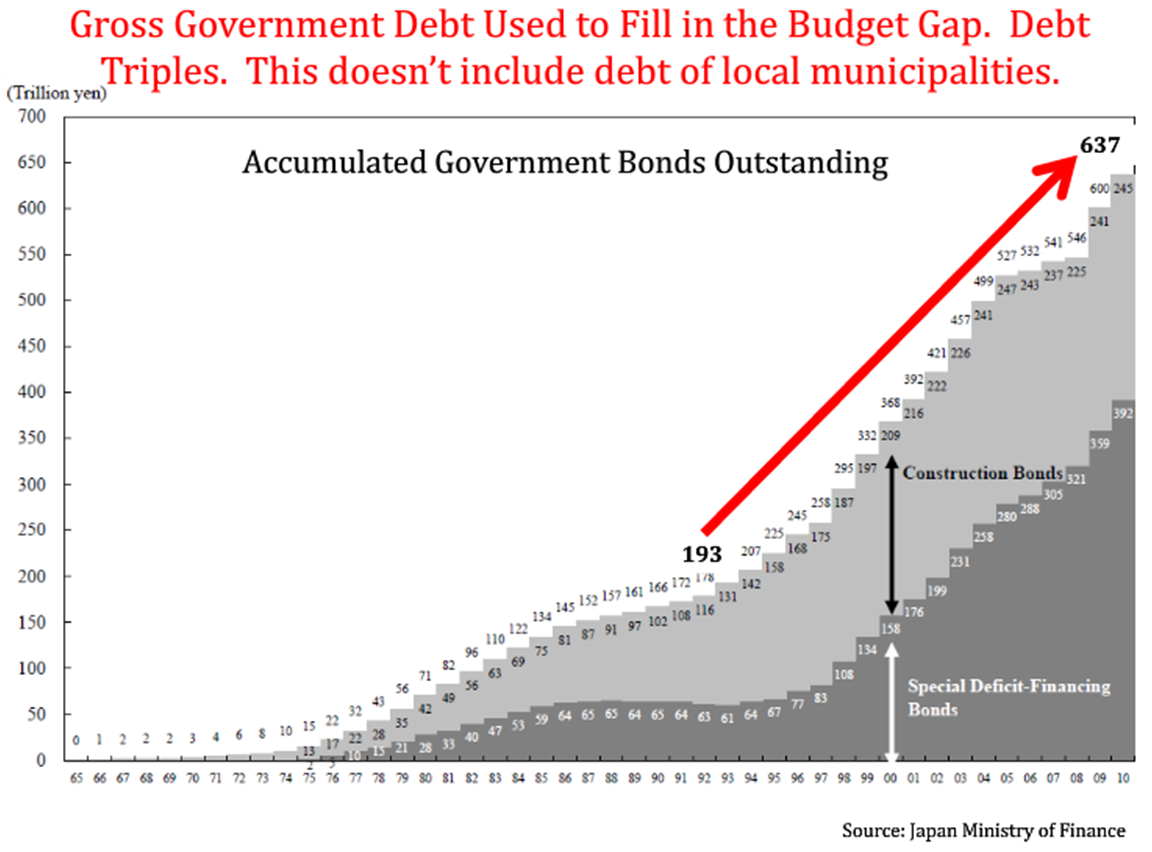

Ziv wrote:No, that's not what the debate's about at all, since no one's trying to "expand debt faster than income" – what Japan's administration is doing is attempting to INVEST in its growth and kick-start an economy that's been dormant for two decadesROFL…said like a true Keynesian Krugmanite.. opinion and rhetoric override empirical data.

Quote:

Quote:no one's trying to "expand debt faster than income"

Yep somebody's making all this up to make them look bad LOL