Forum Replies Created

I doubt you'll see anything spectacular. A rising dollar will keep a lid on the ASX is my guess. What are you chasing JP?

tommytucker wrote:the deal of a lifetime comes along every week.Which is actually BS. Good deals come along all the time if you're looking. The deal of a lifetime sets you up for the rest of your natural and they are rare events.

The burb you are looking in has an average growth rate over the last 5 of 2.08%. It did all its growing in the preceding 5. It's a relatively good suburb location wise, Uni, large shopping centers, rail, freeway, beaches, schools etc. All within a five minute drive.

Perth is cooking off for no real reason other than a supply shortage. The risk is economic for WA as a whole but I don't see it falling into the sea anytime soon. It's times like these you need to keep your head on. Any big growth is likely to be short and sharp in a few select areas. Mid 2014 could prove to be the point where WA starts to do a Melbourne. Business in WA is doing it tough and a rising dollar isn't going to help WA's cause given it lives mainly on exports and servicing the resource sector.

Resource sector momentum built up over the last 5 years is keeping things going but that momentum will cease about mid 2014. What's not know yet is will there be a vacuum after wards that pulls prices back. My guess is that norther coastal suburbs will fair better than most but your likely to see them stay around trend for some time.

Tell them you are happy to look at any claim they may present. Tell them to prepare a claim with supporting evidence and costs to support it and you will consider it. Indicate they will have to show this was not pre existing damage from another event.

If a claim is legit and for something like $200 then it's probably not unreasonable given the fault is not theirs. I tend to think maintaining an amicable relationship is worth a few dollars in this case, however, if they try it on with an unreasonable claim it's gloves off.

I had an insurance company come at me 2 years after a small bingle that left a dent in a bonnet. The claim was for like $5k. When I asked for repair statements they were claiming for a whole range of damage on top of the bonnet. The vehicle was a fleet vehicle and the damage was an accumulation of damage over several years. They thought they could load the bill on to sum muggins prior to off loading the vehicle. They got told where to go. Never heard from them again.

Quote:IS there a 'best order' to get things done? Sparky, plumber, carpenter, painter…etc which ones follow the others?!On a reno like yours you'd usually do your strip out then get your plumber and sparky in to do anything needed. Once they're finished it's your chippy, tiler, plaster etc. You would normally organise your subby's in advance and ask them what they need from you and when depending on your reno plan. Most of this stuff you'll realise along the way because it's mostly self evident.

Quote:We are not requiring to restump….but probably need to rewire….(granny at the moment says house often 'shorts out' when too many appliances are on).All houses have multiple circuits, lights, wall, oven, are the common ones. A light circuit can usually carry a certain wattage usually no more than 800w total. Wall plugs you usually have no more than 5 on a circuit. Oven circuits are dedicated and are usually 30amp from memory while the rest are 10amp. The house either has circuit breakers or fuses. If it has fuses you can replace these with plug in circuit breakers.

If the house is shutting down (main breaker) then you probably need a new board not a complete rewire. Talk to a sparky. You want to avoid rewiring if you can. You probably don't need to rewire just run an extra circuit or two and perhaps a new board with breakers at most.

Quote:Then tiling, then grout so this takes a while. Then vanity etc go in.I always tile after cabinets and tops go in. If a wall's not quite straight or room's out of square you can usually hide this with tiling and trims afterwards. Which leads me to another tip. Run a straight edge along where bench tops will go to make sure the wall is straight. Much easier to fix than hide.

If you're going to update switches and plugs be wary of the cheap switches. Some cause arcing at the switch and that can play Mary hell with halogen lighting.

Connolly wrote:what would you suggest if you were in your mid twenties in this current climate?Patience and quality. By that I mean a purchase must allow you to improve equity through improvements and be in a stable lower middle class area. Set minimum equity levels. I would go in with at least 15% and look to reno that up to 30%. I have a minimum rental return of $1.50 rent per $1000 market value. Your initial purchases absolutely have to be quality. It forms the basis or foundation of a portfolio and shields you if the market moves against you. Building a base with high quality takes time and that's where patience is essential. Get the first 5 properties right and that provides momentum to accelerate growth through acquisitions later down the track

The vast majority of newby PI's make poor buying decisions in the early phases because they want to get runs on the board. They lower their standards just to get a foot in the door. There are dozens of PI's on this forum who have gone out and bought 1, 2, 3 dude properties and then find they've backed themselves into a corner with mounting losses. They lowered their standards and convinced themselves that CG growth would get them through.

If things get rough then every one tends to move down a notch so the bottom half of the market is the safer option with the bottom third offering the best growth in a down turn.

I bought a crystal ball years ago but I could never get the damn thing to work. [/sarc]

You can also look at land titles for a whole heap of useful info, easements, leans, mortgages etc

The fees are quite modest.

http://www.dse.vic.gov.au/property-titles-and-maps/land-titles-home

Fees

http://www.dse.vic.gov.au/__data/assets/pdf_file/0017/170315/YGT_Landatafees2013.pdf

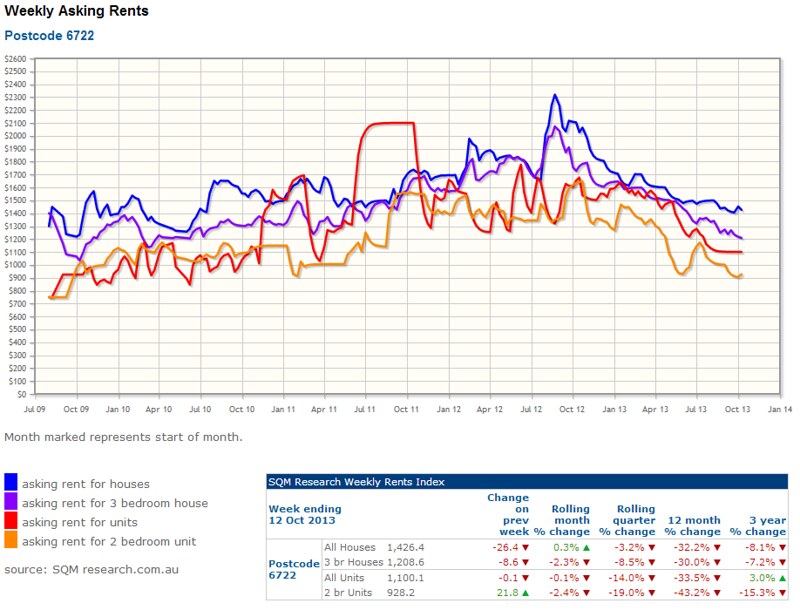

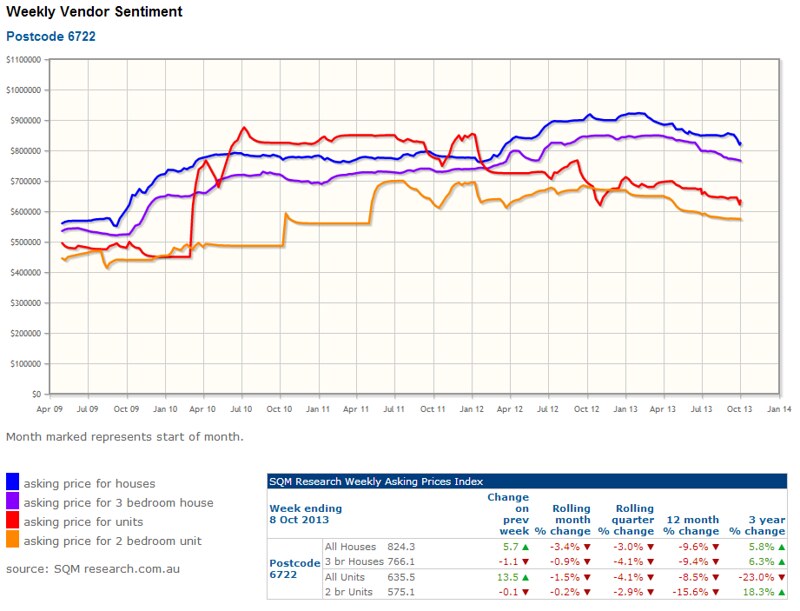

South Hedland (6722)

Source SQM Research

I wouldn't assume this data is absolutely accurate but the trends are noteworthy.

Ok guys… hands up those who have a Swiss banker that invites them to foreign shores to invest their hard earned.

zmagen wrote:

zmagen wrote:the vast majority of our clients are actually hard working or retired mom and dad types, like ourselves…….

…who jet in from foreign shores and who are met by their Swiss banksters. Me… paranoid… never!

zmagen wrote:to meet a Swiss banker who's bringing a group of Singaporean and Thai "filthy rich",Agh! Pandering to the 1%. I'm disappointed Ziv

God no. Flog as much as you can while you can to the foreigners. When Fukushima goes tits up you can buy it back for pennies on the dollar.

zmagen wrote:Aaaawww, touched a sore spot, have we? Grow up, freckle, the world sucks – not everybody thinks you're a genius.

zmagen wrote:Aaaawww, touched a sore spot, have we? Grow up, freckle, the world sucks – not everybody thinks you're a genius.Weather's lousy here and I'm a bit bored truth be told. When you play the man I know I hit the spot LOL. Luv it when you bite

Quote:Love how consumer confidence is a good indication when it slips, but a sows ear when it's high, incidentally. Hypocrite much?

Quote:Love how consumer confidence is a good indication when it slips, but a sows ear when it's high, incidentally. Hypocrite much?

Japanese consumer confidence or more accurately pessimism hasn't actually been in the optimist zone since early 06 and then only briefly. The poor old Japanese consumer has been in pain for decades. From moment to moment it's just a matter of how much. Abe's managed to give the consumer some respite in the form of a psychological lift but that's unlikely to translate into broad tangible benefits for the populace at large but I do hear Lamborghini expect to increase sales by 30% to filthy rich courtesy of Abe and the BOJ.

Iabove 50 indicates optimism, below 50 pessimism)

zmagen wrote:but busy here in the real world, with all the "idiots" who have been netting handsome profits here in JapanI thought it was a bit harsh describing your clients as 'idiots'. Is that all 5 of them or just a few in particular.

zmagen wrote:"Slipped" is the right term indeed – I think it's quite a manageable slip, considering July's numbers –

zmagen wrote:"Slipped" is the right term indeed – I think it's quite a manageable slip, considering July's numbers –JAPAN CONSUMERS HAVEN'T BEEN THIS CONFIDENT IN 7 YEARS

sorry, freckle, doing my best to keep up with your couch commentary, but busy here in the real world, with all the "idiots" who have been netting handsome profits here in Japan while you moan and groan from your precious metals hoard stash

ROFL…. still trying to make a silk purse out of a sows ear Ziv. A quote from the report you provided:

-

Japan's consumer confidence index rose five points to 78, its highest reading since the first quarter of 2006, according to Nielsen's quarterly survey of consumer confidence and spending intentions.

However, that figure still trails behind the global average of 94. Index levels above and below a baseline of 100 indicate degrees of optimism and pessimism.

Interesting what the report says about SEA in general with Indonesia having a very high confidence score. The report suggests a growing middle class is fueling growth. Brazil had a very similar profile over the last decade and is now running into big problems. Consumers simply leveraged up to buy consumer goods. That gave the impression of a buoyant vibrant economy. If SEA doesn't achieve a concomitant increase in productivity it may well find itself in the same boat as Brazil. Throw a FED taper in there (or even the hint of one) and capital flows will reverse faster than you can say Freckles a legend. That indicates how exposed to a crises SEA is.

A BOJ survey now shows consumers are catching on to Abenomics. As I mentioned a while back I expect his popularity to go into terminal decline over time as his policies hit the reality wall.

BOJ Poll: Japan Consumer Confidence Slips on Lower Income

The average household spending fell a real 1.6% on year in August, marking

the first y/y drop in two months after a 0.1% gain in July. The average real

income of salaried workers' households fell a real 0.9% on year in August,

the first fall in six months while their disposable income also posted the first

drop in six months, down 1.4%.

SteveMcKnight wrote:Yes Freckle, followed by Trillionaire, of course.But what would come next?

– Steve

The movie of course!

-

Japan's consumer confidence index rose five points to 78, its highest reading since the first quarter of 2006, according to Nielsen's quarterly survey of consumer confidence and spending intentions.