Forum Replies Created

I' m waiting with baited breath as to how Abe will talk his way out of this one… Abenomics ..pfffff!!

For the 30th consecutive month, Japan ran a trade deficit and this time it was the biggest ever as

imports rose 16.5% YoY (missing the 19.9% YoY expectations by the most in 15 months) and

exports rose 11.5% (missing the 15.6% YoY expectations by the most in 14 months)...

An MSM article I know however some of the statistical information is interesting.

What happens to a country when its young people stop having sex? Japan is finding out

I've always thought Japanese culture had its fair share of idiosyncrasies but these kind of trends presents some serious problems going forward. A century or two from now (given we're still around) the Japanese may well be a case study in extinct ethnic groups.

You get an 'F' for political savvy Ziv.

Melbourne went through a period where Indians where seen to be targeted by racist elements in society. It took a steady stream of government media releases to ease the tensions and send a signal that government took peoples concerns seriously and perpetrators would feel the full force of the law. I somehow think a complaint at the local cop shop would have produced little in the way of reassuring, not only the Indian community, but other ethnic minorities that authorities took the protection of their rights and person seriously.

Abe's reluctance simply implies that his political ambitions are more sensitive to actual voters needs (protestors) than that of non native Japanese who may be the target of prejudice. From an international perspective Abe and by default Japan repeatedly miss the point when it comes to foreign sensibilities.

zmagen wrote:A government doesn't need to respond to loud racist minorities excercising their freedom of speech in JapanMy guess is that if you or your family where the target of this 'freedom of speech' rhetoric you might have a different opinion.

The Only Thing Necessary for the Triumph of Evil is that Good Men Do Nothing

I'm wary of studies like these because they can be constructed to skew results in favor of whoever is running the agenda but lets accept this study for arguments sake anyway.

From your reference supplied above:

Table 2, estimated from the JGSS, contains the percentages of respondents who

are against an increase in immigrants among 20-60 yearolds in selected occupations.

Nearly 60% of the respondents who are in agricultural/forestry/fishery, or are

laborers/operators express anti-immigrant sentiments. Incontrast, more than 60% of

the respondents in service occupations express pro-immigrant sentiments.

So it appears that blue collar and laborers perceive immigration as a threat while white collar doesn't. Antagonists within societies are those who are for whatever reason socio-economically deprived (or threatened by immigrant groups). As the economic landscape deteriorates in Japan I would expect to see this section of society increasingly vocal.

The argument is moot in my mind because even if Japan has the best intentions to make change of this nature it will take decades and will more than likely take a generational change in mind set to be implemented effectively. The reality is that immigration policy such as this has been in motion now for several decades. There's absolutely nothing substantively new about immigration. (Source)

The immigration debate is a red herring. It's a distraction that is designed to placate the populace and suggest to them their government is proactively attacking the problems when in fact it's not. It's simply doing what it's always done and pitched it as some new initiative.

The real debate is the absurd financial policy that simply replicates the failed policies of the past 3 decades.

When the nutters in charge say they will use inflation to reduce debt then increase debt exponentially faster than inflation you know you're on a hiding to nothing.

Ziv wrote:as for the effect of future immigration reforms on current financial conditions – I'll let you know as soon as the details of the reform become clearIn other words you don't have a clue how this will have any impact at all.

It's pretty simple stuff Ziv. Sound immigration policy is usually focused on 4 things;

- those who can bring capital and start businesses

- skill to fill holes in capability

- to create internal demand, and

- maintain a population base capable of growing the population.

While you may not speculate I will.

- even in countries people want to migrate to like Australia the effect is miniscule

- Japan doesn't lack the ability to attract highly skilled individuals where necessary but this again is miniscule

- the most likely target of immigration given Japan's shrinking population

- just to sustain it's population your report suggests according to UN calculations that Japan needs to import 381,000/yr out to 2050.

So to summerise;

– over the last 50 years immigration policy has failed to stabilise population declines or meet the skilled/semi skilled demand for workers.

But of coarse Abe is different and he will be Japan's savior. Good luck with that.

Do you not get it?

We're talking about Abe and his government's reaction.

All countries to some extent or other are xenophobic and racist. Japan just happens to be up there with the worst offenders. How that plays out varies from country to country and minority to minority. What's at issue here is how the establishment deals with this problem within their own borders and what signal that sends to foreigners. Even after a century Japanese Koreans are still no better off than black Americans remaining second class citizens with limited rights. At least the blacks have equal rights under the constitution.

As far as the immigration debate goes I'm yet to see you put up any evidence that might remotely establish how this policy will in any way shape or form contribute to solving Japan's financial problems.

JT7 wrote:I've got a freight train running through my head on account of a date with a bottle of Sailer Jerry last night!I rarely suffer from hangovers thank God but heartburn absolutely kills me on bourbon and coke not to mention it plays Mary hell with old ticker.

moxi10 wrote:Perfect description of a "captive market"

Yep. Captured by big money. The small time PI doesn't realise they have the tiger by the tail.

Some days I wonder if things will last 5 weeks let alone 5 years. God help you if you have all your eggs tucked up in the US market

This says it all:

The Carlyle Group’s Latest Investment… Trailer Parks

- Because the cost of relocating a home is expensive, residents are less likely to move away. “Our customers have no alternative shot at homeownership, nor do they [normally] even have the credit scores and quality to seek anything better,” Mr. Rolfe said. “They never leave the park they are in, and the revenues are unbelievably stable as a result.”

Unwinding of the resource construction boom would make sense. Median house prices (Norman Gardens) dropped with a thump last year (10%) and units are tracking south..

Keep looking I'd say.

I tend to adhere to the KISS principle whenever possible.

The focus should be on;

- accessing funds;

- cash flow to fund full time employee

- minimising taxes

- distribution of income

The most logical approach is however to keep both parties in employment and pay professionals where appropriate and labourers to undertake most of the reno work. The principles can be more effective as employed individuals who can share the project management tasks.

I wouldn't flip these reno's either instead with careful selection the combined buying power of two individuals could enable the growth of foundation properties that have CG unlocked through reno's (enabling further leverage for other properties) and rental income that provides a 10%+ (minimum) as the income source to progressively go fulltime at a future date.

Buy, reno and flip is not a very judicious use of capital or a efficient growth strategy in this circumstance. Income should come indirectly through equity growth enabling further leverage to expand a portfolio and a growing portfolio selected well will underpin growth through cash flows from rental incomes.

zmagen wrote:Freedom of hate speech? Not really. As with all things Japanese, the wheels move slowly, but move nonetheless –You're trying to make Japanese political processes sound different to everyone else when they're not. Difficult policy often takes more than one term in office even in the west.

Blimey that's an old one – 3 to 4 years ago. Nice try to deflect from the real issue and that is if Abe and his ministers give tacit approval through their silence on such issues one cannot take their proposed immigration policies seriously. Any potential immigrant would have to consider a xenophobic environment would or will remain alive and well. I can see them coming in their droves

Quote:Immigration reforms, similarly, are moving, slowly but surely, in a pace well calculated to allow the government to implement them without being thrown out of office – which is exactly the way things should be done here, due to the mentality of the vast majority of the population.So Abe's policies are unlikely to play any real part in the delusional idea that somehow Japan can turn a maths problem into a policy problem and solve it that way. Maybe in a few decades Japan might be able to deliver a cogent immigration policy that overcomes all things xenophobic. Not in my lifetime I think.

Quote:I know the west likes "quick fixes" about as much as you like demagoguery and crisis alerts, freckle, but for better and worse, it doesn't work that way here. Bummer, I know

Still playing the man…

wilko1 wrote:Wouldn't be that worried about it.

wilko1 wrote:Wouldn't be that worried about it.Would only be concerned if it was 10-30mm not 1-3mm

or if it had grown by 1-3mm in a week etc.

Ditto…. Extremely common occurrence.

I would set it up as 2 investors(partnership or company or 2 sole traders in a JV) who buy property and a company that does the reno/project work and bills the investors accordingly.

Lotsa ways you can set this up to take advantage of various aspects. You'll need good legal and accounting advice to take advantage of loopholes etc. Terry's pretty good as this stuff but he requires more than a few cappuccinos I believe

CB's can suppress interest rates, govt's can borrow till the cows come home and banks can push the credit bubble ever bigger but at some point we will have to pay the piper.

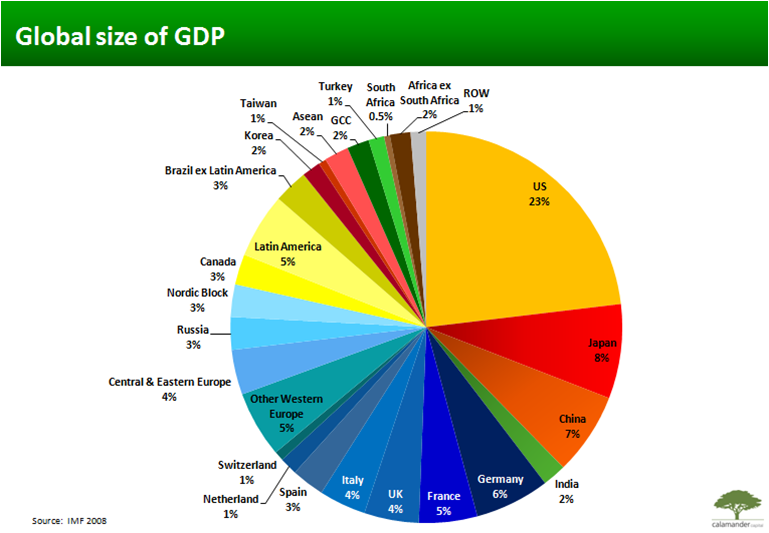

This graphic of global GDP is an eye opener if you look at all the economies that will tank when the US, Japan, EU go tits up.

US + Japan + China + India + France + UK + Spain + Italy + Netherland + Portugal + Ireland + Brazil + Argentina + Greece =>60% of global GDP

All of these countries have high debt that is still growing faster than growth or are already in substantial trouble. This only ends one way. Economies and financial systems are now so intertwined that the collapse of one will drag the others down just like mountain climbers roped together in an avalanche.

This graphic illustrates just how precarious things are becoming. Debt (red) is now growing exponentially faster than growth (blue) and has been since the mid 80's

I will be utterly surprised if we manage to get through the next 5 years without this thing going totally off the wall.

How's Japans immigration policy going? It seems not well if this guys open letter to Abe and his ministers is anything to go by. It would appear Abe says one thing but deep down is just as xenophobic as the rest of Japan.

Abe and his ministers give anti-foreigner rallies tacit green light

Freedom of hate speech: Members of the anti-Korean Zaitokukai rightist group demonstrate in March outside Tsuruhashi Station in Osaka. Tsuruhashi is a largely Korean district that straddles the city's Ikuno and Tennoji wards. | KYODO

JT7 wrote:Yes well…. Gold up $49 over night. I think I might take the goldies out for a run this morning.Anyone care to join me?

Sure beats all in on red on the roulette table!

It's rolling with the USD nothing more. I think you missed the boat. I expect to see a smack down soon, perhaps Fri US markets.

Connolly wrote:Hey Freckle, have already done 2 renos here in Perth- our equity position allows 2 purchases. However one of our rules as we accrue property is not to spend more than 250k per purchase. This excludes pretty well everywhere in Perth (houses only) that has solid growth fundamental backed by positive cashflow.Only place that has legs based on the above is Geraldton.I would drop the 250k limit and substitute it for something like a % gain on CG/equity post reno and cash flow as a cash on cash return. You could also reno and flip the odd property that has CG potential but doesn't meet the cash flow bench mark if you're having problems finding suitable project that tick all the boxes.

Multi state portfolios are over rated and don't compare to home town advantages. You're better offer creating a more flexible and adaptable strategy rather than a narrow restrictive one that pushes you beyond your home advantage zone while your building a stable portfolio base. As you increase your reno skills you might want to also start looking at developing as the next step. There are lots of opportunities in your home state for someone with a creative mind.

Connolly wrote:Hey guys,looking to pick up a couple of IP's over in the eastern states.

It always amazes me that PI's think the grass is greener somewhere else. Why would anyone want to try and reno from one side of the country to another when there's ample opportunity under their feet.

Jpcashflow wrote:Difference between Casino and Shares, if i go to the Casino I cant minimize my risk, because once its land on the opposite color im stuffed

Only for games of chance. Skill based gambling can be very lucrative. Added bonus is your winnings are not taxable. Had a client who was pro gambler. Started when he was 18. By the time he was 28 he was buying million dollars houses for cash. Blackjack (he card counts and reckons it's easy) poker (luvs the tournaments) and sports betting (NRL & AFL mainly) are his primary areas. He was telling me their ROI is around 20%. Can't argue with that.

His worst year he only made $80k (tax free). He averages around $150-200k/yr and his best year was $600k