Forum Replies Created

JT most of the resource build is nearing completion and this mine will have little affect on a state wide basis. It's affects will be felt local to its developments but in the scheme of things $10B over 3-5yrs is peanuts compared to where we've come from.

Coal especially thermal is marginal at best. Many mines have had to reorganise to maintain even thin margins and profitability. The Indian owners face their own problems with a problematic economy and falling currency with commodity prices out of Aus presenting huge problems for them. It's one thing to build billion dollar power stations to increase penetration of the energy grid into India but when consumers can't afford the cost of energy you have a big problem.

GVK could be another major conglomerate that could hit the wall if things get worse globally. Most of these guys are leveraged to gills. A small interest rate rise would just about knock them over or at least mean parking many of its big projects.

engelorumora wrote:What you doing in NZ?

After 15 years in Oz we missed the green stuff, mountains (real ones) , white stuff and recreational opportunities far more varied than Oz has to offer.

Quote:Too many sheep there lollolYou have more. Ours are better looking.

engelorumora wrote:

engelorumora wrote:Your up early lol

Not if you're in NZ…

engelorumora wrote:WOW,There might be some good buying opportunities again if the bottom falls out from all of these funds.

Thanks.

Not in the US and maybe for a long time. The next GFC event will almost certainly hasten a change in the reserve currency from the US$ to a basket of currencies (incl the US$). That creates a huge problems for the US currency.

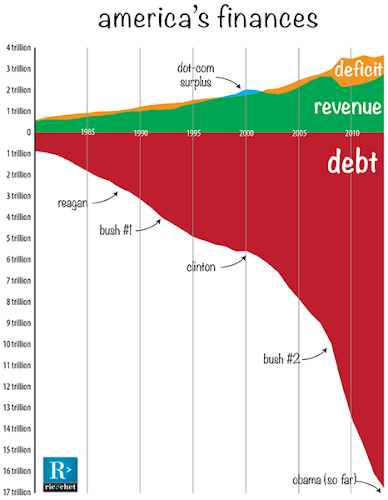

The US currency is seen as a commodity to facility global trade. The US can run deficits into the global system to supply the US$'s countries need to trade effectively. If the US$ is not needed then the trillions of US$ in the system become surplus and essentially worthless. You might get 10 cents on the dollar until the system rebalances … I'm not sure how it's going to work out but it certainly won't be good. Anybody holding US$ or assets in US$ will have a bad day.

If the US$comes under threat in this way then interest rates are likely to rise substantially (think mid 80's @ 22%) to mop up excess US$ liquidity.

Currently inflation is being misreported by the US government because if the true rate were published (in excess of 10%) then interest rates would have to rise substantially to contain inflation. There's no way they raise rates without going belly up.

It is very difficult to envisage any way in which a transition from US$ reserve status to a basket of currencies will play out. I can't see any way in which it will be good for investors. The upside is that the US economy would become more competitive by a significant margin. You might even see the US and China sort of change positions. China becomes a consumer and the US a manufacturer. God knows US manufacturing quality is streets ahead of the Chinese.

Interesting times ahead.

An example of how distortionary and completely counter productive FHOG policy can be on a market is Perth. In the 2013/14 budget the WA govt decided to reduce the FHOG on existing dwellings from $7000 to $3000 by Sep13

That sent a wave of first home buyers into the market who sought to capitalise on the FHOG before it reduced. The resultant surge in demand drove prices much higher as first home buyers paid over the odds for property in fear of missing out. The demand drove prices up and the fear of rising prices reinforced demand in a self perpetuating loop.

In order to save $4000 in grants first home buyers ended up paying 10's of 1000's more than they should have. Since the reduction of the grant came into effect prices have pulled back on average $14,000.

FHOG policy is so distortionary that the affect is usually multiples greater than the actual subsidy. Any benefit is only captured by the very first buyers. The market quickly adapts to additional capital and demand. Those unable to act quickly enough invariably find that price increases have exceeded the value of the subsidy and actually left them in an even more difficult position than before. All those following have an even greater hurdle than if nothing had been done.

FirstHomeOwner wrote:I concede there is an argument that government incentives can (and perhaps in the past have) distorted the market such that any benefits may be wiped out.So you are suggesting we repeat the mistakes of the past for no gain.

Quote:However, and without disrespect to forum members, it seems pretty indisputable that recent record auction clearance rates and significant property value increases have been driven primarily by investor demand.Investor demand is only one component in the matrix. What is often missing is the influence of hot money looking for opportunity from international investors. There is wide scale abuse of the FIRB requirements by international investors and the the FIRB appears to have no interest in correcting the problem. Internationals tend to overpay for property and consequently can have a disproportionate affect on property pricing.

Quote:All I am suggesting is that some form of government assistance (be it grants or stamp duty concessions) may level the playing field since at the moment first home owners simply cannot compete with investorsYou have already acknowledged that in your first sentence that subsidies distort the market for little or no gain so why persist with a flawed strategy? So how about prospective first buyers learn some discipline and skills that will enable them to enter the market on a sound footing. The argument that first home buyers can't save for a deposit because prices rise too fast is frankly BS. What they can't do is save fast enough to buy a new 4 bedroom double garage with 60" plasma type property. If you can't get in at the level you want you lower your standards and buy what and where you can to get runs on the board. The more motivated buyers tend to buy reno jobs and work on developing their equity through this method then move on or use increased equity to leverage into another reno property and so on. This forum offers many strategies to get into and expand ones property portfolio.

Quote:many of whom are in the position they are in today because they benefited from previous government grants.And many aren't which goes to show that it's doable and that subsidies aren't as necessary as some like to make out. There are investors here who bought their first properties when they were 18 or younger and have since built million dollar portfolio's. FHOG weren't first and foremost in their investing strategy.

Quote:I understand that it may be difficult for me to sway investors. I just ask you try and think back to how hard it was for you to put your first foot on the property ladder.What you're looking for is the easy option – get in the door on someone else’s back.

Subsidies only distort markets. A better policy although in reality another subsidy is to incentivise 1st home owners to save for bigger deposits. During the 80's NZ ran such a program. You saved into a designated Home Ownership Savings account. You could claim $0.45 tax rebate for every dollar saved up to $2000/yr over 5 years from memory. I think there was also a minimum hold period of 5 years.

There are far better methods for lowering or containing entry costs for new entrants but that will never be on the table because it means removing distortionary taxes (stamp duty) and supressing RE price growth through interest rates and deposit requirements. That impacts State revenues.

Land banking by large developers who control the supply of land and State imposed development costs are far bigger contributors to RE costs. A petition would be far better off addressing some of the structural issues around RE pricing rather than constantly tapping the tax payer to subsidise others into property

Hey Ziv look at this. Now I know you're a fair way away from that nuclear wasteland they call Fukushima (as if you can eva be far enough away)

I thought you might be interested in some protection tips…

How to Help Protect Yourself from Fukushima Radiation

I thought the lead sumo jock strap could be a winner over there.. trendy huh?

<edited: moderator>

These are the sorts of buffers you need to ensure survival. That doesn't mean I predict any sort of specific effect. No one really knows.

The problem with leverage is you have to service it. You have to have some capacity to soak up interest rate rises and defaulting renters/vacancies. 80% of PI's can't even withstand a mild financial event let alone what's coming. There are many here who are sitting on negative CG and pumping literally 1000's into dud investment properties.

I've said several times I believe the bottom 1/3 of the market offers the safest position simply due to the fact in a crunch many move down a peg or two. Demand focus will shift to the lower end of the market out of pure necessity.

Prices won't change uniformly. Just like the last GFC they will vary across all segments.

jayhinrichs wrote:Freckle.. It is really going to be interesting to see how this all unfolds. Blackstone and other hedge funds could be just like banks where they unload properties at huge loss's.. The Hedge funds were late to the game.. When i bought atlanta I bought my houses with my investors for half of what blackstone paid.. I am not sure they have any huge equity gain.. Now they bought a billion in CA and that market could resuce the whole enchilada ( US term of Mexican origin)Blackstone impress me as fairly switched on cookies. They are pretty good at buying over leveraged businesses, leveraging them up some more (plus a bit of asset stripping on the side I suspect) then repackaging the whole deal a bit down the track and offloading to some dumb as chips super fund or other for exorbitant fees and profits. Unless they get their timing wrong (and I don't think they have at this stage) they'll unload or monitise everything they can before things go pear shaped.

I'm pretty sure these guys have seen the writing on the wall as have you and are positioning themselves to get out of the way of what's surly coming.

What always surprises me is the mutton heads who buy the overpriced junk they're selling. Then again fund managers get paid either way.

The writing on the wall..

jayhinrichs wrote:Freckle its blackSTONE not blackROCK..Drugs where would I be without them

jayhinrichs wrote:We are selling however I do not buy the house is falling down….

jayhinrichs wrote:We are selling however I do not buy the house is falling down….The problem with property markets is that you have HF's mopping up capacity and consequently pushing up asset prices crushing yield. On top of that you have banks leveraging MREIT's to the moon on free FED money(Repo's) to buy MBS's. There have been several upsets that have seen banks dump MBS's to deleverage on MREITS when Repo rates tic'd up.

Things'll get very dodgy if (when) the market destabilises. A GFC like credit freeze will almost ceratinly see rates rise faster than banks can liquidate. That'll signal a potential collapse in property prices if the big guys decide to dump everything and run or the system simply stalls like the last event.

My guess is that the property market will get crushed between rising rates and HF's monetising rentals.

- MREITs are a growing part of the US shadow banking system. When they have to liquidate their holdings of MBS, of which the banks also held $1.3 trillion (as of end of March), they might take some banks down with them. How fast have they grown? Over the last three years, their holdings of MBS have nearly tripled to $460 billion. Fitch had warned about the issue at the end of June: "A repo funding disruption in which leveraged MBS investors need to liquidate some of their holdings could create negative knock-on effects for the $6.7 trillion agency MBS market more broadly." And banks would get hit.

Blackrock unloading their dogs by the looks of things… just before everything turns to custard perhaps.

“It’s a great time to sell,” mused Anthony Breault, senior real estate investment officer at Oregon’s state pension fund.

And Blackstone Group, the world’s largest “alternative investment” firm, is doing exactly that, feverishly, relentlessly, hand over fist, at peak valuations, cashing out, maximizing its profits. That's how capitalism is supposed to work.

jmsrachel wrote:Wouldn't every one just file for bankruptcy and clear the debt? I can't see how my $600k ip 15km to the cbd will only be worth $300?The next event will look much like the GFC in 07/08. However, it will be broader deeper and more pronounced than the last. Any recovery could take decades if ever (in our lifetimes). The problem this time around is that exponential population growth is stripping resources faster than we can replenish them or find substitutes for them. Over the next 30 years energy supply will not meet demand by a significant amount based on current discovery rates verses depletion rates coupled with extraction/supply rates. Most western countries have been bumping up against energy supply limits for a decade or more.

The other obstacle is food production. We haven't progressed food production in line with population growth. The reality is that for all the tech breakthroughs we aren't keeping up and in fact may be boxing ourselves in with mono culture ag practices. It is estimated that the world needs to double food production within 25 years. We've never been able to do that and with an energy and fertiliser shortages on the horizon the outcomes does not look good.

One of the largest sources of protein for many populations is marine. In my lifetime I've personally seen anecdotal evidence of desertification of marine coastlines in NZ. Pollution, over fishing, climate etc are on track to cause a global collapse in marine ecosystems by 2050.

Many people choose to ignore these challenges and problems because they are either ignorant of the facts or simply choose to not see because the consequences are too dire to cope with emotionally. The ostrich syndrome. If I don't know about it, can't see it or simply ignore it it will somehow go away.

The reality is that these problems are coming and the cause is population nothing else.

These challenges are bad enough but while some wonder about asteroid impacts causing problems we have our own lethal problem brewing under our noses, nuclear waste. People should educate themselves about Fukushima to get their head around that problem. What most people don't realise is that Fukushima has the potential, if it goes wrong, to destroy virtually all life on this planet. Currently we a have waste storage pool (reactor 4) containing several hundred tonnes of spent fuel rods sitting in damaged cradles suspended under water in a building that has been partially destroyed by earthquake, tsunami and hydrogen gas explosions. This pool of waste fuel rods is suspended 3 floors up and is held in place by a series of jack studs to prevent the pool from collapsing and spreading spent fuel rods all over the place. Just this pool alone has the potential to release radioactive contamination equivalent to 14,000 Hiroshima's. That pool of fuel rods will start cooking off the second they are exposed to air. It will take down its neighboring reactor which has roughly the same amount of fuel rods. They will in turn start cooking off and then we have the remainder of the site that has literally another 1500+ tonnes of spent fuel rods stored on site.

One expert described the problem in fixing this as almost impossible. The fuel rods are stacked in cradles underwater and where positioned by computer controlled cranes that work to tolerances of a mm. Those cranes (30t) are currently sitting in the pools in a tangled mess with half the building collapse in on them. The expert described extracting these fuel rods for safe storage like pulling wet cigarettes out of a crushed packet without breaking them – good luck with that. So while everyone tries to figure out how to make Fukushima safe without destroying the world the rest pray that another earthquake won't finish the job off in the meantime.

If Fukushima goes off it's basically game over. It isn't stoppable. It would be so bad they're even talking about basically evacuating the northern hemisphere. Impossible I know but people will flee none the less. The estimates are that the southern hemisphere will last around 10 years before it too succumbs.

Fukushima aside we have the problem of another 400+ reactors around the world plus another 400 on the drawing boards that produce huge quantities of fuel waste that has to be contained in water pools to prevent them going off. We only have to do this for 100, 000 years. No problem I'm sure they're all stored in safe locations away from earthquakes, floods and highly skilled tech's watch over them day and night with upto date monitoring systems.

Bonham wrote:Are you just talking about shares or property or BOTH?

Property.

jmsrachel wrote:Well I guess all we can do now is sit and wait. Reminds me a bit of that movie deep impact.AU is likely to take the least damage and should recover faster than others due to much smaller debt load and economy that is at least partially supported by stuff others want.

As long as you keep your leverage below 60% and can take a 50% asset depreciation hit while still retaining positive cash flow you should be alright in even the worst of situations.

If your even close to negative gearing you're a goner.

jmsrachel wrote:When and if the world packs in, what's more likely to suffer the most, shares or property?Both but for different reasons and as a market corrects that doesn't mean all assets correct equally. Systemic and/or strategically important assets will decline the least if at all. Some may in fact appreciate. The next phase is how asset classes recover. Some will continue to decline others will bottom out and drift sideways and others still will rebound to some extent as the system rebalances and finds its new equilibrium.

In terms of property if a correction were to hit then how much a particular property class/region/area/suburb might correct would reflect it's current distance from trend and how much leverage owners/investors have relative to that category.

It's pretty obvious where this is going… not too long now I'm thinking

Something that is rarely discussed in a direct sense but none the less should be considered in the scheme of things. While GFC08 was widely considered to be a 'Financial System Gone Wrong' kind of thing it is quite likely something more complex and sinister than simply a few greedy banksters and a corrupted system. Corrupt systems and banksters may simply be an opportunity waiting to be captured by others intend on shifting the balance of power.

Economic Warfare: Risks and Responses

-

Serious risks to the global economic system were exposed by the crisis of 2008,

raising legitimate questions regarding the cause of the turmoil. An estimated $50

trillion of global wealth evaporated in the crisis with more than a quarter of that

loss suffered by the United States and her citizens.

-

A number of potential causative factors exist, including sub-prime real estate loans, a

housing bubble, excessive leverage, and a failed regulatory system. Beyond these,

however, the risks of financial terrorism and/or economic warfare also must be

considered. The stakes are simply too high for these potential triggers to be ignored.

Phase 1/3

-

The first phase was a speculative run-up in oil prices that generated as much

as $2 trillion of excess wealth for oil-producing nations, filling the coffers of

Sovereign Wealth Funds, especially those that follow Shariah Compliant

Finance.

This phase appears to have begun in 2007 and lasted through June 2008.

Phase 2/3

-

The second phase appears to have begun in 2008 with a series of bear raids

targeting U.S. financial services firms that appeared to be systemically

significant.

Phase 3/3 (yet to come or is it already underway?)

-

The risk of a Phase Three has quickly emerged, suggesting a potential direct

economic attack on the U.S. Treasury and U.S. dollar.

But, we remain left with the critical unanswered questions of who and how?

The recent seizure of $134 billion face value in supposedly counterfeit U.S. Federal

Reserve bonds underscores the reality of the economic threat.

-

"According to economic analysis the severe financial crisis ravaging the US and

hitting the international community on all continents has its economic roots in

two major realms: One was the overbearing political pressure put on Wall Street

to release loans into unprepared sectors of society and two, was the

miscalculation – some say the drunkenness- of Wall Street in accepting these

immense risks. But according to Political Economy assessment, there may havebeen a third player in the crisis: OPEC, or more precisely, radical circles within

oil Producing regimes in the Peninsula. The thesis argue that combined Salafist

Wahabi and Muslim Brotherhood circles in the Gulf -with consent from the

Iranian side on this particular issue, used the escalating pricing of Oil over the

past year to push the financial crisis in the US over the cliff. The high point‘ in

his analysis is the timing between the skyrocketing of the prices at the pumps and

the widening of the real estate crisis. In short the ―Oil-push put the market out

of balance hitting back at Wall Street. Basically, there was certainly a crisis in

mismanagement domestically (with its two above mentioned roots), but the possible

OPEC economic offensive‘ crumbled the defenses of US economy in few months."

Jeez Ziv he's been singing that song for a year or more… where ya been son?

The scary thing is your BOJ heros are starting to echo his opinion…