Forum Replies Created

You've been told wrong. Australia does not impose estate, inheritance or gift taxes.

http://comparativetaxation.treasury.gov.au/content/report/html/11_Chapter_9-07.asp

Matt_Arnold wrote:Eg. A $300,000 loan over 30 years at 5.98% paid fortnightly with an avetage of $10,000 in the offset account for the life of the loan will reduce the total interest payable by $45,575 !Jeez I hate these BS examples. The true power of Offset accounts are not in the piddley amounts of small change you might save over a time period but the ability to keep capital unencumbered so it can be deployed quickly with sensible amounts of leverage to generate a return.

The above example is nominal not real because it fails to include the lost tax deductability which in effect reduces the end result considerably. Scale for inflation and the savings wouldn’t buy a coffee once a week.

People also need to realise that banks offer products usually in conjunction with other products. Mortgages that allow offset accounts can incurr higher rates, fees and other charges which can further erode the nominal offset rates.

If things weren’t bad enough in the land of the rising sun now we have a push to make secrete anything that doesn’t jive with the “Don’t worry. Everything is under control”, meme.

Japan Reacts to Fukushima Crisis By Banning Journalism

Japanese Prime Minister Shinzo Abe’s government is planning a state secrets act that critics say could curtail public access to information on a wide range of issues, including tensions with China and the Fukushima nuclear crisis.

The new law would dramatically expand the definition of official secrets and journalists convicted under it could be jailed for up to five years.

Japan moves closer to a failed democracy.

“A democracy cannot exist as a permanent form of government. It can only exist until the voters discover they can vote themselves largess from the public treasury.

“From that moment on, the majority always votes for the candidates promising them the most benefits from the public treasury, with the result that a democracy always collapses over loose fiscal policy, always followed by a dictatorship.

“The average age of the world’s greatest civilizations has been 200 years.

These nations have progressed through this sequence:

“From bondage to spiritual faith;

from spiritual faith to great courage;

from courage to liberty;

from liberty to abundance;

from abundance to selfishness;

from selfishness to apathy;

from apathy to dependence;

from dependency back again into bondage.”cbarry wrote:I need to really define what my goal is, but I suppose it is to build wealth, so when I am old and grey I have financial security and also a home that is paid off to live in, and possibly a nice little holiday house somewhere. Is that a realistic goal?That is not a goal. It’s just a wish. A goal has to be specific. Non specif goals engender non specif plans which almost always mean you fail to achieve your goal.

A goal might look like:

I want to achieve a net income from property assets that provides a minimum annual gross income of $250K by year 10.

Once you have a clear goal you then set objectives that are subsets of the goal:

I need 20 properties that average 15kpa net of expenses.

and so on.

Once you have a goal and stepping stone objectives you can then turn your attention to an over arching strategy. After that you develop tactical plays to accomplish your strategy.

Strategy: I will shoot for 3 positively geared properties within the first 5 years and 7 in the remaining 5 years

Tactics: I will look for properties that have unrealised CG that can be realised through renovationYou can have multiple strategies. Goals, objectives, strategies and tactics are never fixed. You change them when you need to. For example you might hit your objectives ahead of schedule or behind schedule. That will necessitate some alteration to scheduling and/or a revamp of strategy to accelerate if you get on a role or completely alter a strategy if you run into a wall

It helps to build timelines and schedules into everything. This keeps you focused, on track and provides milestones to evaluate your progress.

You might want to include personal goals like; I want to be conversant in option plays by year 2 and conclude an option deal by year 3.

You could do a SWOT analysis on yourself. Strengths, Weaknesses, Opportunities and Threats. Work to your strengths and develop strategies and goals around those. Identify your weaknesses and work to redress them. Opportunities might be relationships that already exist that you can leverage. Threats might be personal debt, employment etc.

The better you understand your abilities and limitations the better you can effectively develop a plan that has a statistically much better chance of success.

Kade wrote:Is his type of structure common in property investing?It is THE method. Build equity then leverage up, wash rinse repeat.

Here we go

Tepco Successfully Removes First Nuclear Fuel Rods at Fukushima

Tepco planned to remove 22 assemblies from the pool, which contains 1,331 spent fuel assemblies and 202 unused assemblies, by the end of tomorrow, the company said. Crews are beginning with the unused assemblies because they are less fragile, spokesman Yusuke Kunikage said by phone.

A gimmicky loan term taken from the commercial sector to baffle the newbies. Your just using existing equity to finance another purchase.

Leveraged loans in the commercial sector where LVR's of 60% are common was/is often used to releverage up to even higher levels with concomitant higher rates that would then be onsold into the loan market. These types of loans are common in the M&A and Leveraged Buy Out (LBO) commercial world.

Do you guys not read the date on these threads and posts? 2004 !!!

Interesting article at MB today. Seems like CSG could be in trouble.

QLD gas wells falling short of forecasts?

DOUBTS about the ability of Queensland’s coal seams to produce enough gas to feed Gladstone’s LNG export plants are growing, with claims that many wells are not producing as expected and that more gas could be needed.

The concerns, which have been rejected by the three proponents spending $70 billion on projects to export gas through Gladstone’s Curtis Island, have now been backed up by Houston-based drilling supplier Superior Energy Services.

SES, which has turnover of more than $US4bn ($4.2bn) and employs more than 14,000 people around the globe, says its foresees growth in its eastern Australian business because poor well performance means more drilling in Queensland and South Australia.

“When we are talking to the operators in Queensland, we hear from them that the coal-seam gas (wells) that currently have been drilled are actually not meeting the production expectations,” SES head of Asia Pacific, Ruud Boendermaker, told investors in Houston last week.

“So what they have to do is to drill a lot more CSG wells in the next few years because of the commitments to the LNG trains that they are currently building in the north of Queensland.”

Failure rate in these types of commission based occupations is fairly high. Less than 5% after 5 years on average.

If you look at lost earnings comparatively over that period you're looking at around $250k plus opportunity cost. Together that could amount to around $500k.

Business consultancy/advisory is far more lucrative and with lots of upside potential. FP/MB is a slow grind and growth is glacial by comparison. You can buy into business advisory consultancy types of businesses on a franchise basis. Do your DD as you would with anything though. You should be able to start at around $150k and work up to around $500kpa within 5 years. Depends on what level/size of business you work with.

This one screwed up but i can't delete it…

VF Calais wrote:For some reason the computer wouldn`t let me use paragraphs.You're forgiven. I have an Android smart phone and tablet as well as 2 top end laptops all running various browsers. They all have issues with this dog of platform. What should be a relatively easy task but takes twice as long and requires a few additional skills to be competent at working with this dog of a… I mean text box.

Rental market in resource areas weaker than rest of state

Gladstone, Mackay, Rockhampton and Townsville, where the resources sector plays an important role in local economies, continued to exhibit relatively weak rental market conditions with vacancy rates of 3.5 per cent and above recorded.

Rental price drops by up to $120 a week in Gladstone

THE median rental price in Gladstone has dropped by up to $120 a week despite ongoing employment opportunities in the mining and construction industries, according to PRDnationwide's latest report on the region.

75% of AU's wealth is held by 45 year olds and upwards with a fairly equitable distribution across the ages. AU has one of the better wealth distribution profiles in the world and a GDP per capita ranking that understates this distribution. It makes AU attractive as a middle class paradise that has few equals.

The down side is that an economic crises in all likelihood would substantially debilitate the middle classes for some time. Given the middle classes hold mostly property and stocks(through super funds) a market correction coupled with a property market correction could be devastating to a degree that it would be decades before that lost wealth could be recouped.

This should present food for thought on how a property portfolio might be structured. There is unlikely to be a right or wrong answer but diversification and minimising leverage are obvious tactics that could mitigate any impact.

.

With a high dollar wage growth at this pace will kill competitiveness faster than macro prudential policy can respond. It will invariably decline as growth hits greater resistance. If it declines that could be problematic for rents and market values.

This is a serious problem for young people.

Unemployment rates are so massaged these days as to be totally useless. Labor participation rates are a better indicator of labor market stressors. And we're not looking too sharp. Things have taken a distinct turn for the worse since late 2012. The trend is a concern and not dissimilar to what other countries are facing.

If you think AU banks hold the moral high ground compared to their international bretheren you'll be disappointed. If you you think AU banks are somehow capable of withstanding another GFC event think again.

When you read this article you start to get the picture on how integrated into the international banking ponzi scheme AU banks are. CBA for example is controlled by none other than HSBC and JP Morgan who combined hold around 30-35% of CBA stock. They are the 11th largest bank and 5th most profitable globally. The FED quietly back handed them a few Billion to tide them over last time. I seriously doubt there's a banker in AU that could lie straight in bed.

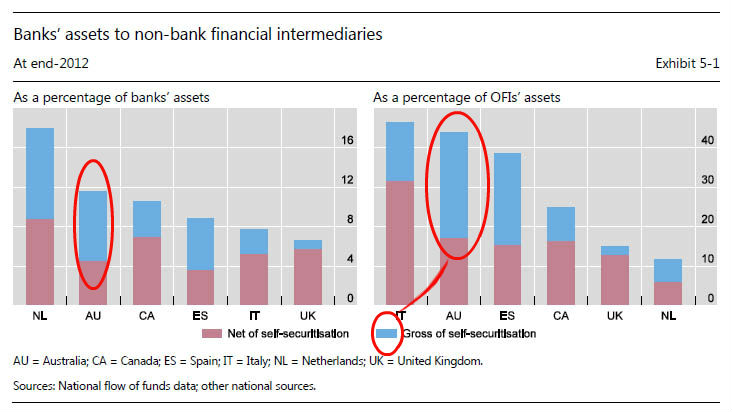

For those who have difficulty understanding what 'self securitisation' (SS) is – the layman's version;

You take a bunch of mortgages and package them into a security called a Mortgage Backed Security (MBS). You then offer that to the CB as collateral for a loan. Now in normal accounting terms the MBS moves from the banks balance sheet to the CB's balance sheet.

Not when you SS. The MBS stays on your balance sheet and with the loan you can wash rinse and repeat to infinity. Basically a circle jerk.

Rick sta wrote:Any thoughts or charts on Purchasing Power Parity? Totally new to me.In what context?

Rick sta wrote:Freckle if you're not already a part of silverstackers, you should be.It's part of an overall strategy. PM's are useful as a store of value but little else. PM's are your seed capital to start again when a recovery is in progress. Up to that point toothbrushes and toilet paper have more value. Ask the Venezuelans.