Forum Replies Created

Freckle, When you go to dinner at a friend’s house, to you comment about how much you dislike the new decor? Why not apply that genius brain of yours and come up with some constructive criticism? I for one would like to know: a. What specifically you don’t like; and b. What specifically we could do to improve; and c. What specifically would you like to see by way of improved functionality? Maybe you’ll find the world a better place if you are more helpful. – Steve

We went through this the last time you dropped a new forum on everyone without consultation or even a polite warning. Suggestion after suggestion was made that time with little or no change. I gave up last time why should anyone bother this time. This forum has been around since Adam and is in its whatever iteration, 3rd that I know of. If you haven’t got it right by now I doubt anything anyone says will get this site any further ahead. You’ve chosen not to listen in the past so why would I think you’ll listen now.

It isn’t rocket science.

I thought the last one was bad and barely functional. This one is another level lower again.

For a guy who is supposedly a property guru the IT side leaves a lot to be desired. Considering this site gets milked for all its worth I would think throwing some real dollars at this revenue stream and fixing it once an for all would be money well spent.

It’s time you got your mate Gehl onto it… after all he’s supposed to be the go to man on all things net related. Maybe he could give you a few tips.

Let me guess, east coast mining area/town???

Pretty obvious where this is going …..

HSBC China Composite PMI Tumbles To 28-Month Lows As Services Fell (& Rose)

I use XE

Been using them for years. AU -> NZ, NZ ->China, NZ/AU -> Malta

Hey you're not conning me… I'm no April fool

I know

Googled it 2 sec's (sigh)

When brokers are working on a 'co-broke' basis, they are sharing exclusive listings with each other. In a co-broke transaction, one broker will represent the buyer or renter, while the other will represent the owner of the property. The commission is usually split 50/50.

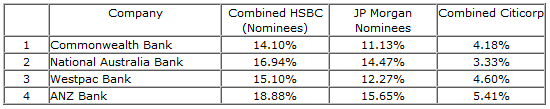

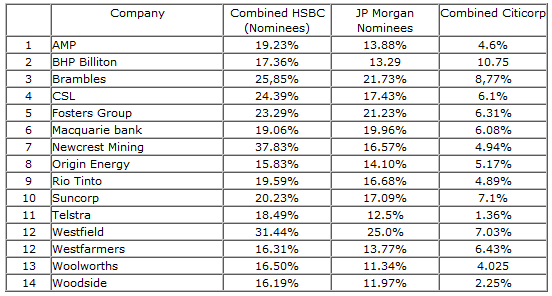

They're all tarred with the same brush and have the same puppeteers namely JPM and HSBC

and who owns corporate Australia and pulls their strings..

You dig deeper into these companies and you find a lot of cross ownership in that most have shares in each other through diverse conduits. On the face of it it looks like JPM and HSBC have around 25%+ in most companies but when you realise some of the other shareholders are also controlled by JPM and HSBC the degree of control is far more extensive and pervasive.

The big four banks for example control through various outlets in the financial industry around 90% of transactions and by default exert enormous influence over the remaining players. Current court cases are merely nuisance value to banks and government has no control over what they do or how they act. The banking sector controls the government not the other way around.

News Corp controls 80% of media in AU and has vast holding internationally that spread the gospel according to Rupert on a global scale. If you look at who the top ten voting shareholders are on that company low behold who do you find;

3.) Invesco – 1.8pc

4.) Bank of New York Mellon – 1.19pc

7.) JP Morgan Chase – 0.41pc

8.) Blackrock Group – 0.35pc

9.) MFC Global Investment management – 0.35pc

10.) Goldman Sachs Group 0.35pc

The money guys control the FIAT and they also control the message. Any wonder the world is full of sheeple.

Nigel Kibel wrote:However I still believe there is more upside in the US markets.And let me guess they'd be…. don't tell me … don't tell me… Florida and Texas ….right!!……jeez I'm good

It's not unusual for the big guys to grab all the limelight in good times and bad but in their shadow stand many smaller countries who will add to the mayhem should things go tits up.

Hong Kong banks have loaned 165% of the territory’s GDP to China

Nigel Kibel wrote:If any of the Doomsday predictions of your happen I guess we are all screwed.

Nigel Kibel wrote:If any of the Doomsday predictions of your happen I guess we are all screwed.Seems McKnight is alluding to the same kinds of things I am …….particularly the Aussie market…

**********************************************************************************************************************************

Hi Freckle,

Glenn Stevens, RBA Governor, has given this timely warning to property investors:

"It is important for both investors and owner-occupiers to understand that a cyclical upswing in housing prices when interest rates are low cannot continue indefinitely."

Paraphrasing – if you're investing for speculative market-driven growth don't be fooled into thinking the current increase in house prices can continue indefinitely.

I certainly agree. The research I revealed at my recent market update points to the Aussie property market being close to, or just past, the cyclical peak of the current cycle.

So what about a property crash (prices falling by 50%+)? This has been raised in the press recently by visiting US demographer Harry Dent, and has long been floated by Aussie economist Steve Keen.

Yesterday, Glenn Stevens had this to say on the matter:

"You can never be 100 per cent sure. But the price to income ratio has been around four times … for about 10 years, so a very long-running bubble, if it is a bubble. Most do not last that long."

Freckle, the takeaway here is that risk has noticeably increased for property investors in respect to price growth / stability and interest rates. You should be reassessing your investing strategy and property portfolios accordingly.

*********************************************************************************************************************

I've alluded to on other threads that the smart money has been consolidating their positions and scaling leverage accordingly in anticipation of a possible/probable correction. Meanwhile many of those whose livelihoods hinge on property services continue to talk the market up on little else other than industry and MSM sponsored hype.

I can't be absolutely sure in this upside down world of finance but my gut tells me China may just have had an uh-oh! moment…

China's Credit Pipeline Slams Shut: Companies Scramble For The Last Drops Of Liquidity

…where $1 trillion in credit was created in the fourth quarter alone, that is clearly unsustainable for the simple reasons that i) China will quickly run out of encumbrable assets and ii) the bad, non-performing loan accumulation has hit an exponential phase, which incidentally is why Beijing is scrambling to slow down the "flow" from the current unprecedented pace of $3.5 trillion per year.

Boy this is going to hurt…

Nigel Kibel wrote:Its alright freckle I expected your comments I notice in another post you are predicting that China will disappear off the face of the earth as well. If any of the Doomsday predictions of your happen I guess we are all screwed.How does exaggeration help your argument? Diverting attention to other discussions doesn't help your cause much either.

The reality is that the US economy is not recovering by any metric and that the FEDs seemingly serious attempt to taper is starting to bite. There are pockets of the US that are surviving for the time being but only because the economically desperate are migrating to better off states. This can last only so long before even those states are exposed to the challenges in a deleveraging world.

I would be more optimistic if there was something tangible and sustainable driving economies but a tapped out middle class underpinned by prolific printing and surviving on debt creation aka subprime student and auto loans to the moon isn't giving me any hope to say the least. To add to its problems there's a very good chance the US will get its clock cleaned over the Ukraine debacle.

Anyone who thinks the US economy is recovering and will strengthen over the coming years is in lala land.

Nigel Kibel wrote:I believe that it is a great time to buy in the United States. The economy is recovering and there is no doubt that both prices and rental demand are on the rise.You have to stop reading the "Onion" Nigel. All publicly released data is really satire to amuse the masses. When politicians and their agents tell you the economy is recovering they're not serious. We all know its not recovering but conning ourselves makes us feel better.

Stevie2013 wrote:I'm very curious to know what you believe will happen to the Aussie dollar as a resultThe AU$ is a tough one. Logic says it wall fall against all currencies if China folds but if China folds then many other countries are also in the crapper as well. The US$ is looking like it could take a hiding over the next decade. The Ukraine debacle has pushed Russia and China closer and that's bad for the US and to a lesser extent Europe. If Putin puts the screws on Europe via the energy lever then the Euro economy could tank spectacularly.

Ask me something simple like what are the lotto numbers for this week.

underdev wrote:China is the richest country in the world, guess who the western world owes all its debt to?

China isn't rich. It's one of the most indebted countries in the world. It prints 200+ billion per month trying to keep the ship afloat. Without cheap labor it falls flat on its face.

Bank runs in China?? No way… get outa here…

What A Bank Run In China Looks Like: Hundreds Rush To Banks Following Solvency Rumors

Curious what the real, and not pre-spun for public consumption, sentiment on the ground is in a China (where the housing bubble has already popped and the severe contraction in credit is forcing the ultra wealthy to luxury real estate in places like Hong Kong) from the perspective of the common man? The photo below, which shows hundreds of people rushing today to withdraw money from branches of two small Chinese banks after rumors spread about solvency at one of them, are sufficiently informative about just how jittery ordinary Chinese have become in recent days, and reflect the growing anxiety among investors as regulators signal greater tolerance for credit defaults.

The average Chinaman knows implicitly that the system is built like a house of cards and could collapse at any minute hence the race to withdraw one's funds at the merest rumor. The West hasn't yet figured this out but soon will is my guess and when that days comes……

It's just not fair….

Furious Chinese Demand Money Back As Housing Bubble Pops

With new project prices down over 20%, 'homeowners' exclaim "return our hard-earned money" and "this is very unfair" – who could have seen this coming… "We aren't speculators. We just want an explanation from the developer," said one 35-year-old home buyer, who said he had bought an apartment and gave his surname as Wu. "This is very unfair." Unfair indeed.