Forum Replies Created

Yes perhaps a more interesting graph, how would we tell?

A snapshot in time of the QLD (Brisbane) market is a fair comment and that's all the data is showing, booming isn't the word I would use to describe our market over the last four years, no attempt to describe the larger economy or make any prediction apart from 2012 looking better than 2011. If you think you can do better than a buy and hold investor then prove it.

Not sure how proficient you are with Excel Tiger but I've found making a spreadsheet can be an excellent way to understand the numbers for any calculation or project. There are spreadsheets you can borrow to begin with and use them as a complete product or modify yourself.

Derek wrote:Andrew, Thanks for you valued feedback. Michael seemed to think there was a lot of song and dance about not much.

I would expect there might be local benefits in terms of infrastructure perhaps, on a suburb level, but wonder about the impact on a more general level for a city of half a million+ people.

The Gold Coast has been having this debate about 'Indy' for years in terms of is it worth it.

Would expect like the last boom the Goldy will begin to look very interesting once fundamentals start looking compelling, need look no further than 'yield' as your one proxy for total market indicators here I think. I remember buying in 2001 on the coast when prices had been flat for a decade and getting +ve cashflow yields.. those were the days

Hi Elizabeth,

Here's one for Brisbane that does qualify! Free on first visit and not generating commission income from selling product.

http://www.meetup.com/brisbanepropertygroup/Good luck with your site.

Andrew

Michael Matusik's latest thoughts

Quote:Brisbane is at the bottom of the cycle and is set to improve. Three things drive a property cycle north – confidence, supply/demand and jobs. Confidence is on the mend, the Brisbane new housing market remains undersupplied and a plethora of new resource and infrastructure projects will help drive future job growth.http://matusikmissive.wordpress.com/2012/02/17/missive-extra-next-stop-brisbane/

An example of the kind of event that is out there, low key promotion, no upsell and real investors to network with. The most popular segments always are the 'real deals' where investors show the details of their latest project.

http://www.meetup.com/BrisbanePropertyGroup/events/50335982/

In greater Brisbane if you are talking about the 250 level and houses in good condition then you are looking 20k+ from the CBD, areas like Logan City Council and Redcliffe to Caboolture on the northside

Good idea about talking to a valuer. Sounds unlikely as a plan though.

When we have bought flats on the one title the valuer has looked at a per flat comparison, so 2×2 flats they can even look at single 2 bed flats in the suburb as a comparison.

Derek I have no reason to disagree with Matusik on this one about the Gold Coast, seems reasonable.

As well as asking agents check carefully with council or a trusted source. The idea being agents often know but you should always trust but verify!

Paullie wrote:Interesting, so they are anticipating rate rises.A sign of increased cost of funding and likely not related to any view about which way the cash rate will go.

http://www.alankohler.com.au/graphs/wholesale-bank-funding-costs

Terryw wrote:Sounds like you need a lawyer first. Many issues to considerAgreed, first point of call if you are clear on the 'why' and are just working on the 'how'

I know something about this subject

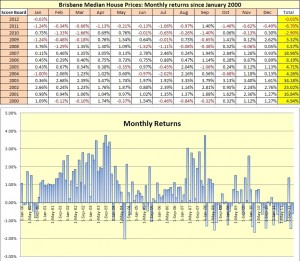

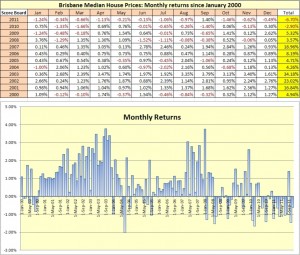

Generally been quiet since 2007, I have some detailed charts and percentage returns on here to look at in terms of Brisbane specifically.

https://www.propertyinvesting.com/forums/property-investing/general-property/43429362012, Looks like being a good year! It might seem strange to get excited about a month that recorded a -0.03% capital loss until you understand what type of year 2011 was. I was predicting a flat January and my prediction has proven to be somewhat accurate. The increase in buyer activity was first noticed mid December and has continued right through January resulting in more healthy price action for our market.

There are still plenty of people sitting on the fence and watching the Brisbane market carefully, waiting for signs of positive momentum, fair enough, just keep in mind that if you are one of the people on this fence you need only glance around to see all of the people you will be competing against when the market turns. It’s really crowded on that fence presently.

Houses: $427,134

Units: $348,900Not all seminars and property evenings are teasers, plenty are though and aren't worth your time attending. As long as you keep the credit card at home and don't pay anything more than a few hundred dollars (at most) then it's not a bad way to learn and make up your own mind on what's out there. If the seminar motivates you to take calculated action then it's likely worth it, otherwise it probably isn't!

I consider negative gearing is a tool rather than a strategy and therefore neither good or bad in itself but to be carefully weighed up as part of your investing. Blanket statements such as 'avoid negative gearing' or 'only buy positive cash-flow properties' are at best not helpful and at worst plain wrong in my opinion.

The latest Brisbane property data current till the end of December 2011. Eleven out of twelve months recorded a capital loss in 2011 and only three of the last nineteen months have recorded gains. If you are looking to ‘buy the dip’ in Brisbane property there is a healthy chance that this might be the time!

With a capital loss of 6.7% for the calendar year 2011 it was most welcome to usher in 2012 and a chance for a stronger show! January 2012 has shown healthy turnover and renewed buyer interest so it will be interesting to see how well this reflects in the January data.

Houses: $427,253

Units: $352,943Fantastic question!

There's so much toxic prediction out there and precious little concrete suggestions to pin down. There are good legal reasons why a person might not want to be specific but most predictors aren't specific for other reasons including they don't know any better.

Three important questions you need to answer for any trade:

1) What to I buy

2) How much

3) When do I sellIf a person opines that residential real estate is not a good investment then so what? Steve Keen sold his apartment and values are up significantly in the area since he sold, doesn't mean anything other than prediction and profiting from market timing that prediction can pass by each other quietly in the night without ever meeting. If a person then opines that a fixed term deposit is a good alternative then we have something to test, great.. we can measure our total and risk adjusted returns and build a track record.

Applying the Jan Somers recipe to our three questions we have:

1) Residential property!

2) When you can afford it

3) NeverNot a perfect recipe by any means as Jan admits herself but one that will continue to perform well (even if under longer term trend) with a few assumptions.

1) Take Residex 5yr forward predicted returns

2) Favourable tax, leverage and government support continue to exist

3) We aren't invaded or something equally disastrous, there's always a possible scenario to cancel all betsThis is just for buy and hold investors, those who are actively adding value are doing great in this market and will continue to make money but they can reasonably be viewed as operating a business rather than being purely investors.

Also back on track… offset accounts set a high benchmark to beat when you take into account tax considerations

Not kidding and nothing that surprising about my comments unless you are seeking to jump on anything positive about the Brisbane market. Yes, plenty of noise to filter or ignore always!

The last couple of interest rate cuts have really buoyed the Brisbane market, I suspect the Dec-Jan figures will reveal that though it takes some time for the data to filter through.

I personally know investors who have got rich from property in the 50's,60's,70's,80's,90's and 00's.. Now it's time to step up to the plate for the 10's!

There are always angles to be played and strategies that are working well.