If Only “The Block” Was Reality TV

Australian Property Market Update

6 November, 2018

Last Sunday night, the final episode of The Block aired. The winning couple sold their renovated unit for more than $3 million, over a half million above their reserve.

Viewing the clip felt a little like going back in time to 2016. Hordes of people were crowded in a room, with emotional buyers going to war to secure a winning bid.

Unfortunately, that’s not reality for the majority of sellers at the moment. According to CoreLogic’s latest figures, auction clearance rates have reached their lowest point since June 2012 when only 43.5 percent were successful.

The Auction Market

The Melbourne Cup put a big damper on auction volume in Victoria this weekend, dragging the the number of auction listings nationwide down to 1516.

Going back to the previous week, however, sellers offered up a total of 2,928, with a nationwide weighted average clearance rate of 47 percent. That marked the fifth week in a row where buyers failed to clear even half of all properties brought to auction. By the time all of this week’s results are counted, we’ll likely see an even lower result.

The downward trend continues.

Keep in mind, these auction clearance rates in the 40s include those properties sold both prior to and after the auction date. At the moment, we’re only seeing about one in three listings successfully drawing a winning bid through the auction itself.

Here are the latest preliminary auction results from CoreLogic:

Source: CoreLogic

The Bigger They Are the Harder They Fall

Auction clearance rates below 50 percent are generally consistent with falling home prices, so it’s no surprise to see the downward trend in prices continue.

According to the latest official data from CoreLogic, Sydney’s rolling twelve month decline is pushing 7.5 percent, and Melbourne is down almost 5 percent. Keep in mind that dwelling values have been falling for over twelve months now, so the year-on-year data will no longer reflect falls from the peak back in early-spring 2017.

The greatest fall in prices have been in the more expensive segment of the market. The top 25 percent in terms of price have seen falls of around 9 percent for the year in both Sydney and Melbourne. Interestingly, in the bottom segment of Melbourne’s market, prices have actually risen nearly 3 percent, while in Sydney, the least expensive homes have still fallen about 4 percent.

Of course, there are some suburbs where the declines have been much greater than the metro average.

if this downward trend continues, Strathfield has likely crashed well below the $2m mark for a median priced property by now which is roughly a 25%+ fall in just 1 year. Dec and Jan had just 2 sales I think each of those months. 1 big and 1 small house. pic.twitter.com/zcw6CsopZ4

— Lindsay David (@linzcom) November 2, 2018

On the bright side, Hobart continues to boom, up nearly 10 percent over the past twelve months, and still rising. Canberra and Adelaide are also looking solid, while Brisbane seems to be flattening out.

Here’s snapshot of CoreLogic’s latest median house price data from across the country:

Source: CoreLogic

In the News…

RBA Still on Hold, But Is a Rate-Cut Looming?

The race that stops the nation didn’t stop the RBA Board from meeting today. They decided to leave the cash rate on hold at 1.50 percent for a 27th consecutive month.

The race that stops the nation didn’t stop the RBA Board from meeting today. They decided to leave the cash rate on hold at 1.50 percent for a 27th consecutive month.

Our central bank’s primary stated goal is to keep the inflation rate somewhere between 2 to 3 percent per annum, and ideally at this time on the upper end of that range.

The latest Consumer Price Index data (September quarter) showed headline inflation of 0.4% quarter on quarter or 1.9% year on year. Retail sales tumbled sharply in the third quarter, likely in response to falling house prices as Australians feel less wealthy and choose to save rather than spend. With our economy limping along and real wage growth stagnant, the likelihood of an RBA rate hike anytime in the next two years is extremely low.

If house prices fall far enough, the next move from the RBA may very well be to cut the target cash rate. At 1.5 percent, our central bank’s overnight lending rate is one of the lowest of developed countries. Philip Lowe has said he doesn’t believe a cash rate below 1 percent would be helpful for the Australian economy, so that leaves perhaps two more moves down on the cards.

The FED Squeeze on Aussie Property Investors

The Fed raised borrowing costs in September for a third time this year, and thanks to a booming US economy, another rate-rise in December is likely. The US economy added 250,000 jobs in October, year-on-year wage growth is higher than it’s been in almost a decade, and the unemployment rate is holding steady at a 49-year low of 3.7 percent.

The Fed raised borrowing costs in September for a third time this year, and thanks to a booming US economy, another rate-rise in December is likely. The US economy added 250,000 jobs in October, year-on-year wage growth is higher than it’s been in almost a decade, and the unemployment rate is holding steady at a 49-year low of 3.7 percent.

The Fed committee will meet later this week, and although they are likely to keep their funds rate on hold, investors will be looking for clues to whether the most powerful central bank in the world may be raising rates faster than expected. If with the expected Fed rate rises on the cards for 2019, higher borrowing costs will put Aussie lenders (and borrowers) in a precarious place.

Unless the RBA intervenes, expect variable mortgage rates here in Australia to rise in pace with higher interest rates overseas.

Morgan Stanley Sounds the Alarm

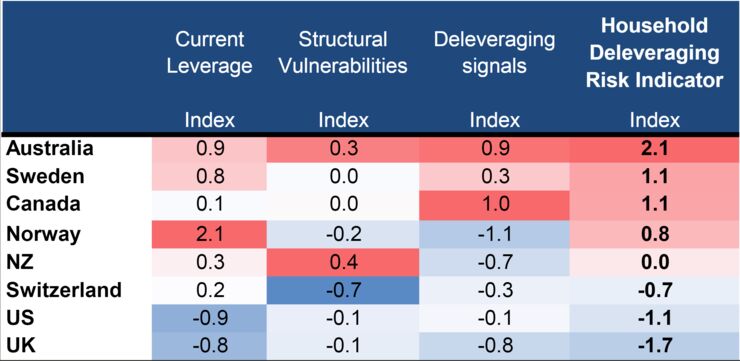

American investment bank Morgan Stanley has placed Australia at the top of a list of developed countries most at risk of an economic downturn. Falling house prices, potential tax changes diminishing the attractiveness of property investment, tightening credit conditions, and a decrease in spending due to the burdens of debt repayment are all reasons the bank cited for giving Australia the top honour.

AMP Forecasting 20 Percent Falls in Sydney and Melbourne

AMP Capital recently revised down its forecasts for the Australian property market from 15 percent to 20 percent price falls by 2020. Here’s what AMP’s chief economist wrote in a note to clients:

AMP Capital recently revised down its forecasts for the Australian property market from 15 percent to 20 percent price falls by 2020. Here’s what AMP’s chief economist wrote in a note to clients:

“The risks are starting to skew to the downside — particularly around tighter credit and falling capital growth expectations made worse by fears of a change in tax arrangements… Auction clearances in recent weeks have been running around levels roughly consistent with 7-8 per cent per annum price declines.”

Twenty percent falls would be a rough outcome for those who happen to buy twelve months ago. That would mean that those buyers who borrowed 80 percent would have zero equity in their homes. Their entire deposit, not to mention stamp duty, would be gone.

The News Isn’t All Bad!

Let’s keep in mind, things aren’t looking bad at all in Tassie, Regional Victoria, Canberra, Adelaide and Brisbane. Several of my clients are finding great deals and making money in these markets.

Source: CoreLogic

What’s your strategy for securing property investing profits in the current market?

Comments

Got something to say? Post a comment...

You must be logged in to post a comment.

Great info Jason!

Thank you!

Thanks Juerg for stopping by :)

Awesome and insightful article, may I ask what % chance you think that there will 1 be a drop in interest rates some time next year? and 2 what % chance you think they will be left on hold till near the end of 2020, I personally think they will almost definitely be on hold till mid 2019 with the current state of economy and household debt but haven’t thought much further ahead than that.

That’s a good question Sam, but timing is anyone’s guess. I personally don’t expect an RBA rate cut before 2020, unless the Fed suddenly changes course and cuts rates next year. If Philip Lowe is honest in his assessment that inflation will rise in 2020, then he would need to be proven wrong before cutting the cash rate.

Thanks for reply, I agree, that could definitely be a catalyst for a rate cut if other factors like debt have little change.

The banks move their rates independent of the RBA so even if the RBA doesn’t raise rates next year, the banks still might, especially on interest only loans. Your thoughts Jason?

Hi Shirley. I definitely agree with you on that. The RBA can try to keep interest rates low, but there are other factors that impact bank decisions, like profitability (wholesale lending costs), bond prices overseas (Federal Reserve decisions), and regulators here at home (mainly APRA).

Yeah that could happen for sure, the final report and findings from the royal commission will play a part in the decision no doubt, even if the banks raise them independently they surely won’t be 25 basis points I feel, we’ll have to see what happens with other factors too. Many dodgy practices etc have already been revealed from the banking royal commission and who knows what more will be revealed in the report when it gets released.

Hi Sam, you’re right, the findings of the Royal Commission will play a part. Some banks have already tightened lending criteria and procedures eg. looking into estimated living expenses in more detail etc. That also means it’ll be harder for some people to shop around for better interest rates and refinance in the future.

Absolutely will, very true, they will have to be much more stringent with their lending practices and criteria that lenders need to adhere to, yes receiving credit and having loans approved will be much harder, I had a pretty good lender when I got my loan, let’s see what happens when report gets released.