All Topics / Opinionated! / Oh O'… Houston we have a problem

International trade is in bit of a hole I think.

Baltic Dry 10yr

Baltic Dry 1yr

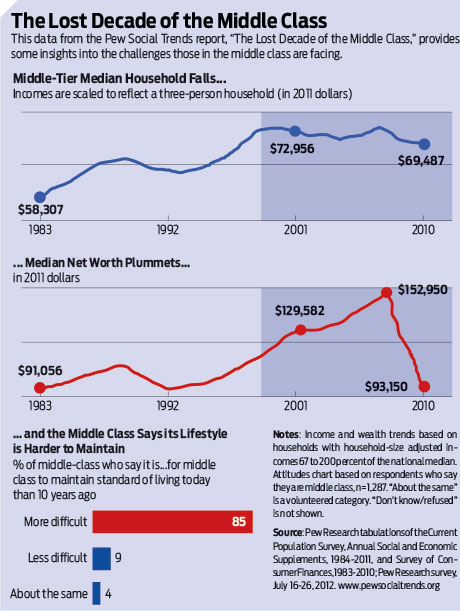

From the end of the war until the early 80's the US enjoyed a period of prosperity. Note how evenly wealth was distributed.

However shortly after the 80's this new found wealth started to migrate upwards.

The problem now is that the everage American is actually poorer now than he was a decade ago and getting poorer.

Well then there's employment. Note the trend started on 00 and was slam dunked 08. And then even after trillions in extra deficit spending, stimulus and rerigging of the CPI inflater GDP is still a sick puppy

Hell even an education is no good. Tens of 000's in student debt and a suck job!

Housing… nothing much happening here…

Who's gonna buy houses?…no saving and huge debts…subprime anyone?

[image no longer available]

Print more… borrow more… that'll fix it…yeah..

Yep a recovery is on the way……

MISH'S

Global Economic

Trend Analysis

Does anyone out there possibly believe price inflation is a mere .60%?

- With the GDP deflator (the official measure), the reported GDP was -.14%

- Using PCE (personal consumption expenditures) as a deflator, GDP would have been -.77%

- Using CPI (the consumer price index) as a deflator, GDP would have been -1.56%

- Using ShadowStats CPI as a deflator, GDP would have been -4.3%

The US already had a substantial trade deficit prior to the GFC and that trend was a divergence between export vs imports. Post GFC that trend has quickly re-established itself. Note: if you compare trade export falls with unemployment above you get a fairly good correlation. Note the tail of 2012 and the down trend in exports.

A micro view of the trade balance..

If you look at the last column (2012) you see a reduction in the deficit but that it reverts fairly quickly heading toward that continued growth trend in the export deficit

Freckle what does this means for Australians in plain english? Should I start building the bunker?

Why is the above is this forum?

cheers

Rick

Here's my analogy.

We're all on the Titanic. In 2008 we hit an iceberg and now we're settling in the water. The pumps aren't keeping up. Meanwhile the crew are still shagging around rearranging the deck chairs in the belief that the engineers can patch her up.

There are those who do not know the ship is even sinking. There are those that believe we will be saved somehow before we go under. There are those that still hang onto the belief that she is unsinkable.

The smart money has found/bought a lifeboat and left. Lifeboats are expensive and most won't get a ride. They will have to take their chances in the water and hopefully be picked up before exposure gets them.

So get a flotation device ready and do what you can to insulate yourself from the coming cold.

Since the USA took the dollar off the gold standard the dollar has been eroded by almost 96%. I just find a bit staggering. No wonder the poor and middle class say they are struggling.

On another rant. Pies in service stations. $5 Unbelievable. 10 years from now ill be paying $10 bucks for a crappy pie.

Freckle, hate to Say it but I think your on to something. One thing I am getting sick of is the media saying 2013 is the year of the recovery. What Bullocks! It’s pretty bad out there.

Mainstream Media massage the employment data to try and convince the masses their government is on to it. I think this guy is more on to it than most.

David Rosenberg and 16 Reasons I'm Not Buying The Employment Report

I work for myself and i am already predicting this year to be a bad year. The trend this year for me has been customers wanting gold but only prepared to pay for silver. They really don't want to part with their cash.

Most tradies i speak to are pretty quiet for work and the ones that are actually busy are doing work from last year.

All my suppliers are very quiet. One in particular had to ask some employees to go on annual leave.

Just had a friend stay a few days while doing business in Perth. She runs a med screening service in the Pilbara. The same stories are starting to filter through from there too. Work groups are being dropped back to 8hr days, some are being warned that they may need to take holidays soon, employment is on hold and some mobs are shuffling workers around various jobs to keep them busy. There's a kind of hope that activity will pick up as major works projects come up for final approval. The general consensus I see is that at least 90% won't get across the line.

There's a strong possibility that iron ore will drop back 2H 2013 and with the wind down occurring at the same time I see a confidence issue developing in WA.

It'll be an interesting time I'm sure.

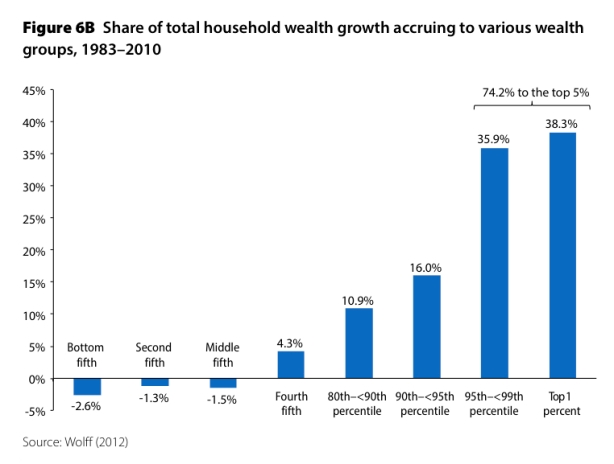

There will be no recovery. That's an illusion. The top 10% have been mining the wealth of the bottom 90% since the mid 80's. You get a recovery when wealth is evenly distributed across a population.

Some interesting graphs on wealth distribution.

Note USA, Europe & Asia Pacific. The majority of the wealth resides at the top

Worse is that these countries/regions control the majority (80%+) of global wealth.

The Fed is absolutely paranoid about the EU going under and you can see why. It's economy is bigger than the US and they are inextricably linked. One falls they both fall. A crises in one area is automatically a crises in the other. The Fed has been pumping as much dosh into local foreign banks as it does its own trying to underwrite their solvency while juicing the markets.

http://www.zerohedge.com/news/2013-02-02/how-feds-latest-qe-just-another-european-bailout-vehicle

The fact that wealth is migrating to the top is the single biggest obstacle to a recovery. The biggest consumer blocks in the world are becoming poorer and QE is accelerating that fact through inflation which is simply a wealth transfer mechanism.

There are people out there who think that because you control your own currency and can print that you can manage this when in fact all you're doing is exacerbating the problem. There are those who believe in US omnipotence because they've been the top guy for so long. There are those who read the Saturday paper and see an article pumping the local markets and somehow discern from that the next property boom is just around the corner.

People see what they want to see because reality is just too scary for most or simply hold the blaise attitude' She'll be right mate' . Cognitive dissonance.

I couldn't have said it better myself.

From Jim Quinn

http://www.theburningplatform.com/?p=48749

-

We’ve got $1 trillion annual deficits locked in for the next decade. We’ve got total credit market debt at 350% of GDP. We’ve got true unemployment exceeding 20%. We’ve had declining real wages for thirty years and no change in that trend. We’ve got an aging, savings poor, debt rich, obese, materialistic, iGadget distracted, proudly ignorant, delusional populace that prefer lies to truth and fantasy to reality. We’ve got 20% of households on food stamps. We’ve got food pantries, thrift stores and payday loan companies doing a booming business. We’ve got millions of people occupying underwater McMansions in picturesque suburban paradises that can’t make their mortgage payments or pay their utility bills, awaiting their imminent eviction notice from one of the Wall Street banks that created this societal catastrophe.

We’ve got a government further enslaving the middle class in student loan debt with the false hope of new jobs that aren’t being created. We’ve got a shadowy unaccountable organization, owned and controlled by the biggest banks in the world, that has run a Ponzi scheme called a fractional reserve lending system for 100 years, and inflated away 96% of the purchasing power of the U.S. dollar. We’ve got a self-proclaimed Ivy League academic expert on the Great Depression (created by the Federal Reserve) who has tripled the Federal Reserve balance sheet on his way to quadrupling it by year end, who has promised QE to eternity with the sole purpose of enriching his benefactors while impoverishing senior citizens and the middle class. He will ultimately be credited in history books as the creator of the Greater Depression that destroyed the worldwide financial system and resulted in death, destruction, chaos, starvation, mayhem and ultimately war on a grand scale. But in the meantime, he serves the purposes of the financial ruling class as a useful idiot and will continue to spew gibberish and propaganda to obscure their true agenda.

If you read Quinn's article from end to end and the tail piece in italics from George Carlin you can feel the undercurrent of frustration and anger. I see it and feel it in more and more articles written by people who in ordinary times are quite peaceable. Something's coming in the years ahead and it's going to end badly.

Hey Freckle

Sometimes I avoid reading your posts because they tend to be a bit depressing. Reality doesn't paint a rosy picture. There's no denying that the Global economy is in trouble, and that huge debts have caused major imbalances. It seems everybody owes countless billions to everyone else. The U.S. and most of Europe have huge deficits. China also has huge debts. Who holds all the IOU's?

"Something's coming in the years ahead and it's going to end badly" On the other hand, these issues have been building for years, even decades, which I suppose makes an even bigger bubble, But somehow the day of reckoning has not arrived yet, and the world goes on.

"He will ultimately be credited in history books as the creator of the Greater Depression that destroyed the worldwide financial system and resulted in death, destruction, chaos, starvation, mayhem and ultimately war on a grand scale." Now there's a cheery statement. Sounds like he's referring to Satan

moxi10 wrote:Hey FreckleSometimes I avoid reading your posts because they tend to be a bit depressing. Reality doesn't paint a rosy picture. There's no denying that the Global economy is in trouble,

LOL.. It's getting harder and harder to be optimistic that's for sure.

Over the last week or so I've been scratching my head over a potential deal with a NYC based business. The Yanks are very parochial and have a narrow view of anything not American. I'm trying to get these guys to see the value of international markets but they're very fixated on their local market. I tend to get this from most of the US business people I talk to. It's almost a she'll be right kind of attitude. They have an ingrained belief that they're big bad and powerful and that somehow that will protect them.

Then again most people haven't got a clue as to what is actually going on beyond what they see on TV or read in the papers. MSM does a good job at hiding or obfuscating reality.

You must be logged in to reply to this topic. If you don't have an account, you can register here.